Hedging behavior is an interesting science to us. Our advisory discipline considers each individual company’s corporate objectives, risk tolerance and current portfolio composition as well as the current economic environment when making hedge recommendations, but there is a behavioural component to hedging as well.

Recently we did an analysis of producer hedging as WTI moved from $60+ to below zero and back again. Our goal was to see if producers generally stuck to their hedging programs even as volatility and uncertainty skyrocketed. Our analysis focused on 1) overall hedge activity 2) the types of structures producers chose at any given time and price, and 3) tenor of hedges.

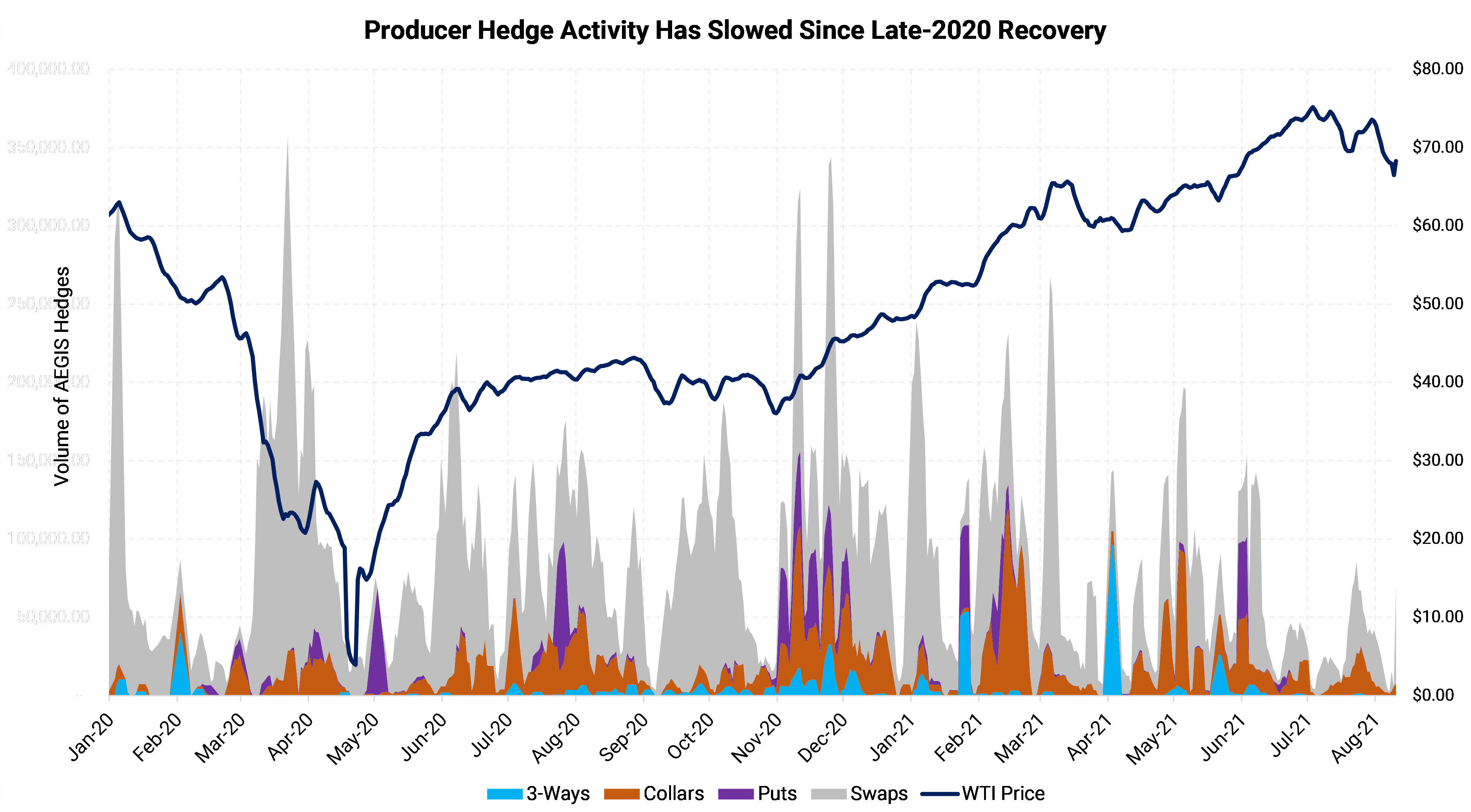

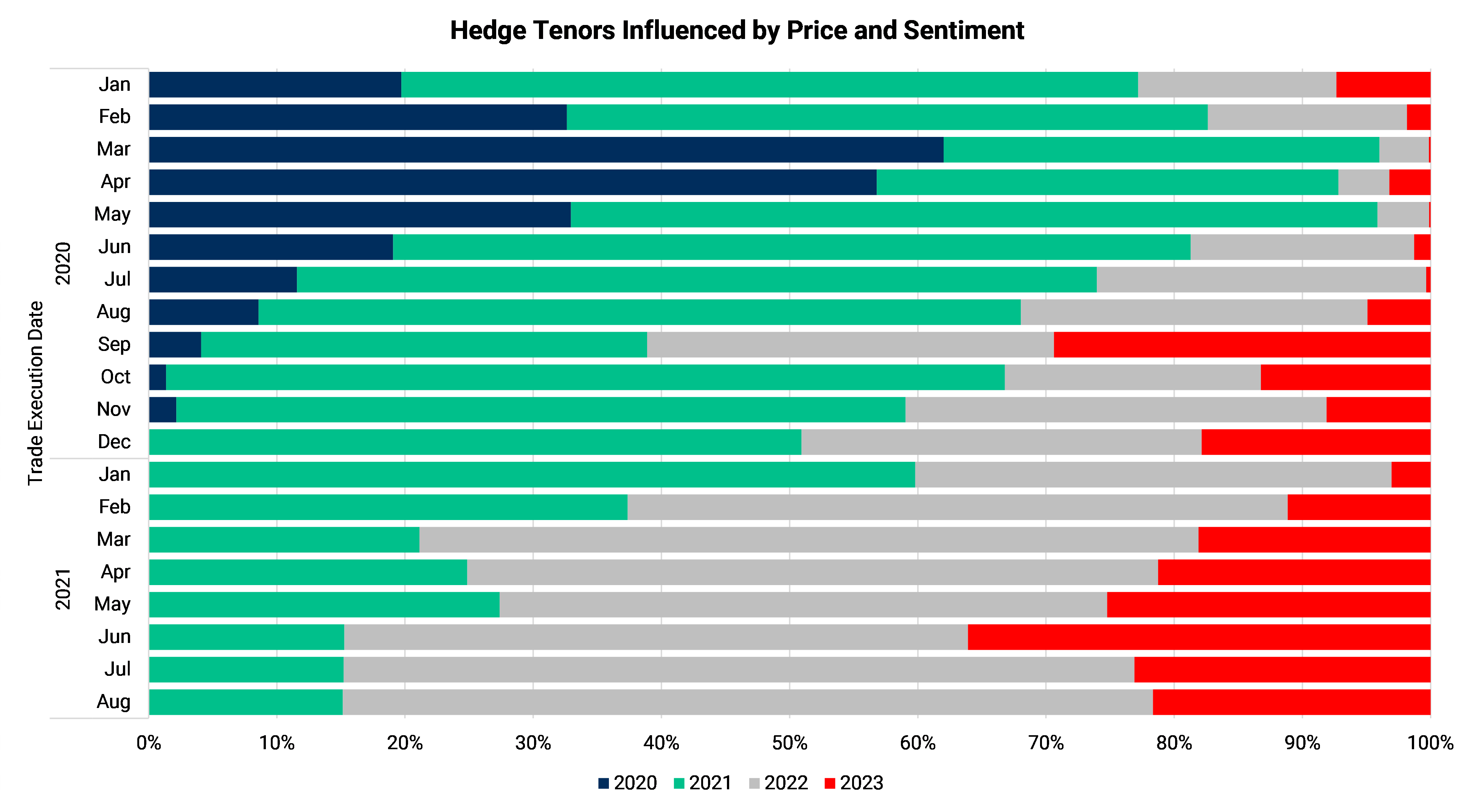

We observed that producer hedge activity increased beyond normal patterns in March-April 2020 as Covid-19 gripped the globe and the demand outlook looked bleak. Not surprisingly, swaps were the most popular structures and primarily for the balance of 2020. While the forward curve was steeply contango during this time period, forward swaps still remained well below producer budgets and breakevens, which raised questions of whether there was more to the story.

Because AEGIS executed nearly all these hedges, we know that in March-April 2020 producers took the opportunity to monetize the value out of some hedges by unwinding in-the-money swaps and using the proceeds to enhance new swaps at higher than market prices. Our data show that producers primarily added enhanced swaps, but a small number of collars and puts were added as well for the balance of 2020 and 2021.

As prices recovered somewhat into the summer, swaps continued to rule, but structures that allowed upside participation also gained traction. The forward curve remained slightly contango, but prices still remained relatively low with the front 3 years still firmly under $50. Producers were mostly adding 2021 hedges, but 2022 coverage wasn’t far behind. While hedging was a bitter pill to swallow, producers seem to remain dedicated to their hedge strategies and continued to add coverage even at these lower levels.

The Covid uncertainty remained headline news and as kids went back to school, case counts rose. As oil prices became more volatile, producers reverted back to swaps indicating that sentiment was more skewed to the downside than up. One significant development that we noticed was that producers began adding 2023 in earnest in the fall of 2020. September 2020 hedging activity was fairly evenly split between 2021, 2022 and 2023.

Finally in the last two months of the year, positive vaccine news gave oil demand new legs and thus began the steady march higher. Pharmaceutical companies reported results showing >90% effectiveness in protecting against Covid-19 early November, and FDA emergency use approval was announced in early December. Producer hedge structure choice immediately shifted to structures allowing some upside to market prices. Hedging activity materially increased again, with a noticeable uptick in puts, 2 way collars and even 3 way collars.

In general, prompt and forward prices remained tethered to a pretty tight range for 2020 following the blip to negative territory in April. Producers, however seemed to maintain their baseline hedging plans but shifted structures based on sentiment.

WTI has risen ~$20 since the beginning of 2021, and while the pandemic is still the source of the lion’s share of volatility, additional focus has been placed on other dynamics of supply and demand such as OPEC, the environment of capital discipline, ESG commitments, and geopolitics. Producer hedging activity has slowed even as forward market price through 2023 have moved to $60+. Hedge structure are noticeably skewed to structures allowing upside participation. Producers seem to look further out the curve to 2023 in times of consolidation while 2022 hedges remain most popular in steady front month price increases.

Our overall conclusion of this analysis is that producers have indeed stuck to planned hedging programs, but have carefully adjusted structures and tenors based on market pricing and conditions.