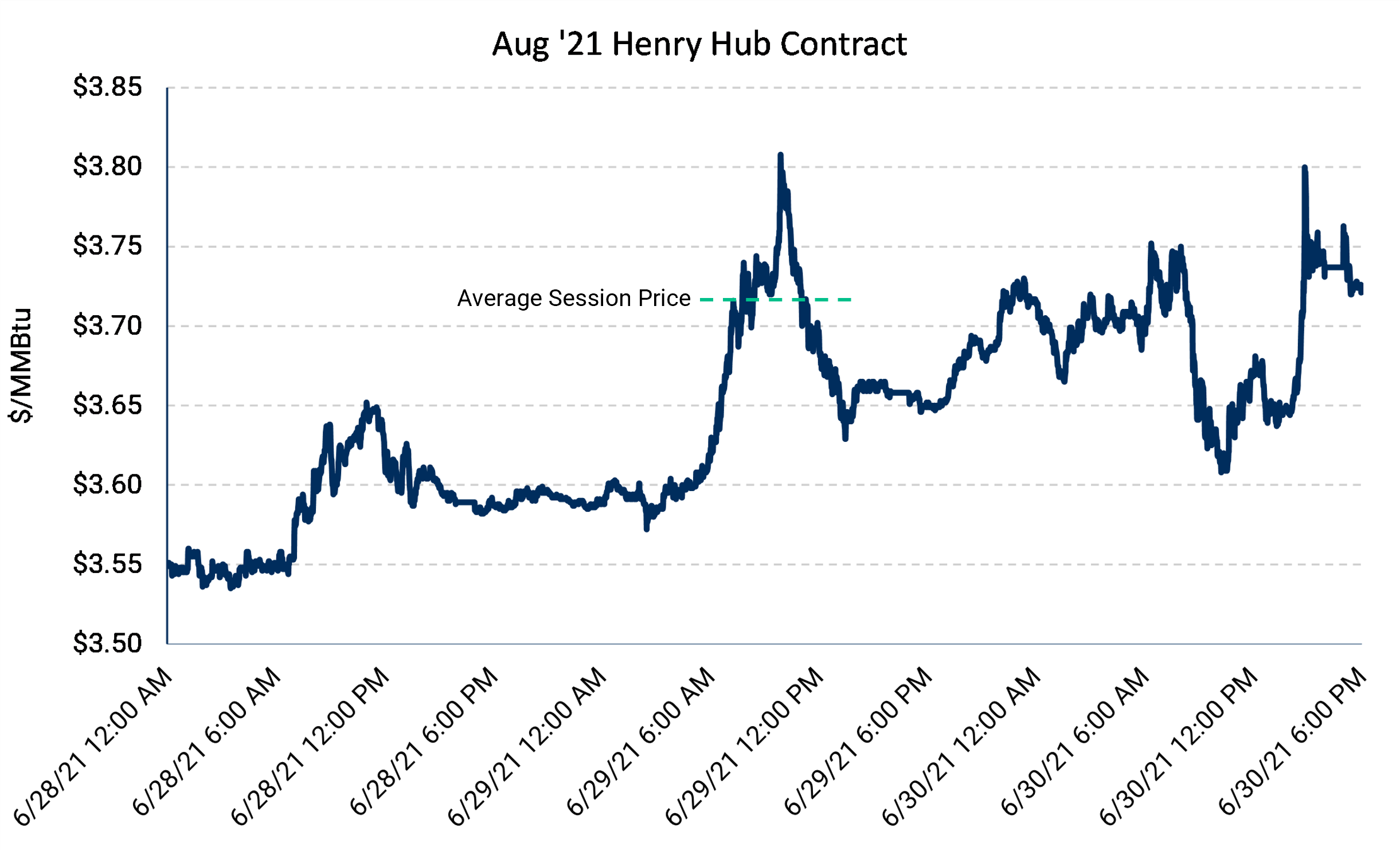

For many seeking to hedge, but not already working an order with AEGIS, the quick up-and-down move would have made it difficult to execute the trade near the highs. In contrast, the average swap executed by AEGIS on June 29 was within $0.02 of the average* price.

|

|

This wild day highlighted the importance of working with AEGIS to establish price targets, in advance, for these potential short-term opportunities.

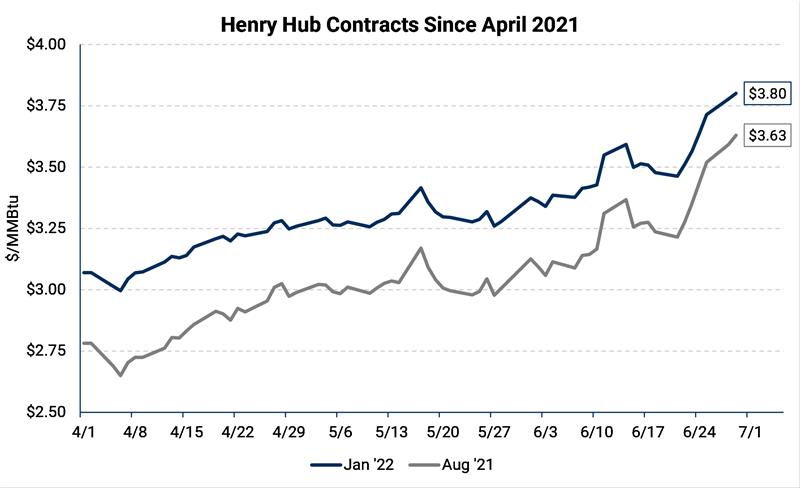

Again, late on Wednesday (June 30), it happened again! What are some good actions to take to be ready next time?

But before all that, there’s some homework to do, if not done already:

On days like June 29, there is no guarantee you can execute a hedge at an attractive price. If you do execute, there is no certainty that there will be a gain on the position. But being ready means giving yourself a chance to take advantage of short-term volatility where your competitors may not.

* “Average” here refers to a time-weighted mean of mid prices during 7:30-1:30 pm Central.

Commodity Interest Trading involves risk and, therefore, is not appropriate for all persons; failure to manage commercial risk by engaging in some form of hedging also involves risk. Past performance is not necessarily indicative of future results. There is no guarantee that hedge program objectives will be achieved. Certain information contained in this research may constitute forward-looking terminology, such as "edge," "advantage," 'opportunity," "believe," or other variations thereon or comparable terminology. Such statements and opinions are not guarantees of future performance or activities. Neither this trading advisor nor any of its trading principals offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.