|

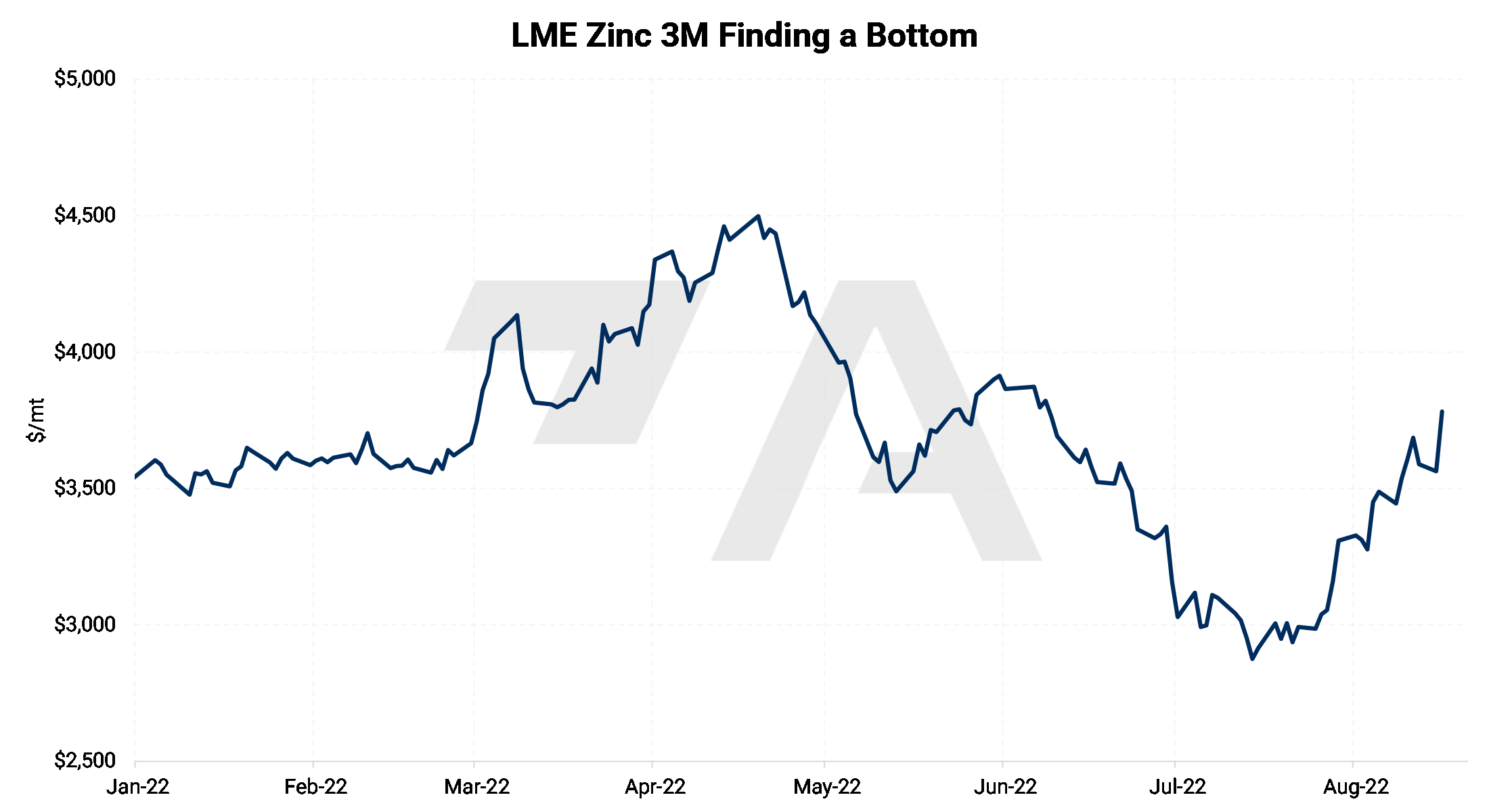

Earlier this week, Citigroup predicted that despite falling demand, further smelter curtailments in Europe due to an ongoing power crunch could lead to a rebound in zinc prices over the next 12 months. The bank has thus raised its three-month price target to $3,200/mt, and its six-to-twelve-month target to $3,400/mt. Both targets are up $400/mt from their prior forecast. However, the bank remains “marginally bearish,” as the power crisis in Europe could also suppress demand. Zinc prices have already bounced over 20% since mid-July due in part to smelter shutdowns and could rally further if more curtailments occur. |

|

|

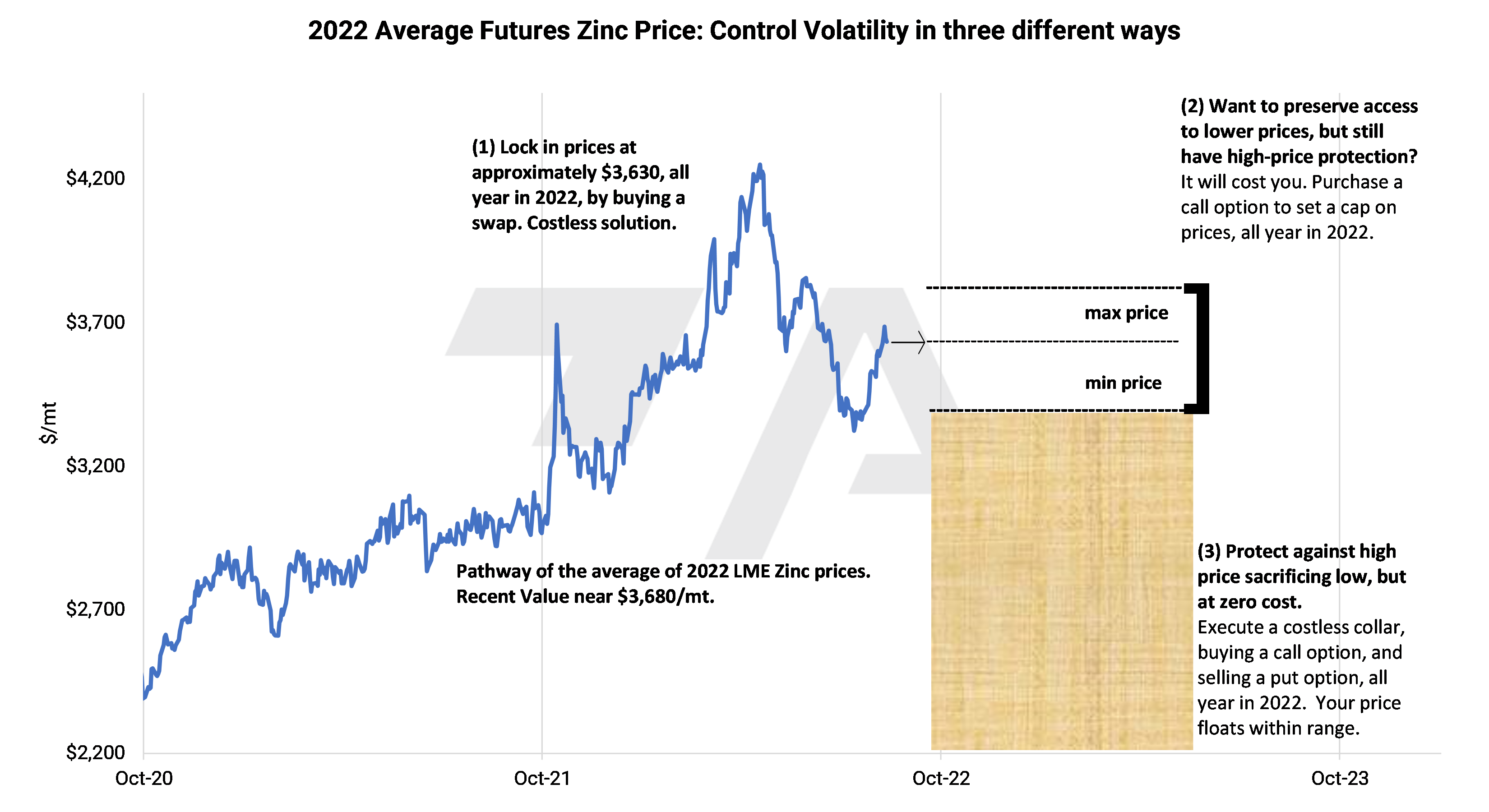

Zinc’s forward curve has also shifted vertically higher and is severely backwardated. This allows a zinc end-user such as a galvanizer to hedge future purchases at prices lower than the current spot market. |

|

|

|

Worried that zinc prices could see more upside? End users such as galvanizers can hedge zinc in a variety of ways, as we detail below. Buying swaps or call options are viable strategies, as either would establish a maximum zinc price. Such positions are basic for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. |

|

Important Disclosure: Indicative prices are provided for information purposes only and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as "edge," "advantage," "opportunity," "believe," or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.