|

Surging demand has led to low stockpiles, all the while, oil refining capacity constraints have become apparent. The long lead time required to supplement U.S. refining capacity means prices could stay elevated for awhile, years even.

|

||

|

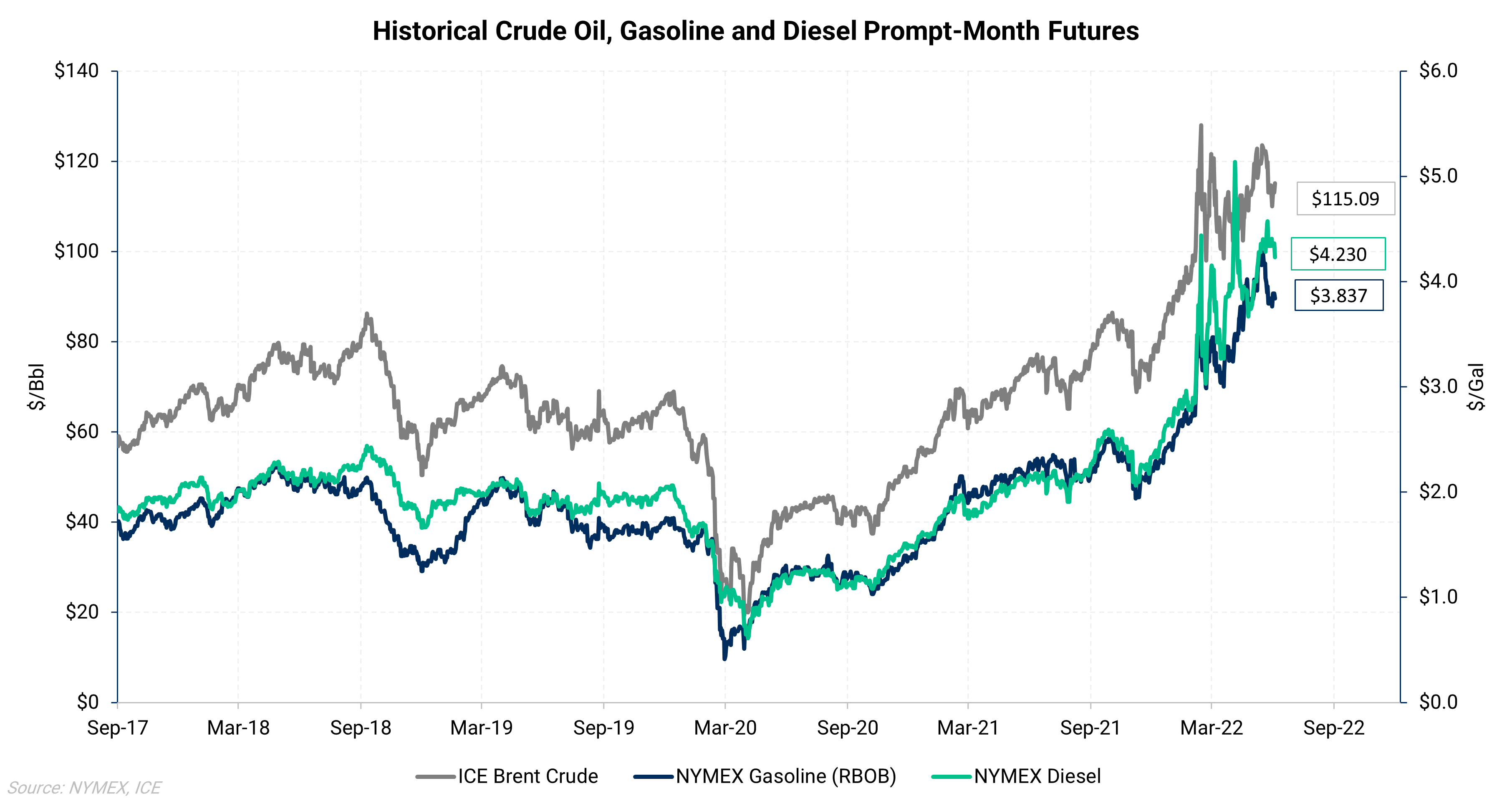

June 28, 2022 – Oil has largely traded above $100 since Russia invaded Ukraine and sent already high fuel prices surging even higher. Crude benchmarks jumped nearly 50% since the invasion and the price of retail gasoline and diesel hit record highs of $5.006/gal and $5.718/gal respectively. On Monday, March 7, oil prices soared to their highest levels since 2008, as the U.S. and its European allies discussed banning Russian oil imports, and hopes for a quick return of Iranian crude to global markets faded. Russia's invasion of Ukraine raised concerns that the price of oil might shoot up even more as the U.S. and the U.K have banned Russian oil, and the European Union plans to end its reliance on Russian gas and accelerate its economic response to Russia's aggression. The rise in crude oil prices sparked a rally in the price of refined products, which is now being sustained by a lack of supply in the fuel markets and refinery capacity issues. According to the EIA, the national average cost of retail gasoline is $5.718/gal as of June 13, and it cost $3.286/gal on average a year ago. The figure below illustrates the trends in petroleum products following Brent and geopolitical issues that are affecting the global economy.  |

||

|

||

|

The chart below displays the correlation between the monthly settlement price of diesel futures and the monthly average of Brent crude. It is clear from the blue dots (Monthly average price of the last 90 days) that the relationship between NY Harbor ULSD and Brent crude has recently deviated from the historical correlation. This can be first seen after the Russian invasion of Ukraine. In addition, a return to pre-pandemic levels of demand, a lack of refinery capacity, and low stockpiles have all contributed to the rise of diesel over crude, and the difference (depicted by the dotted red lines) is the diesel crack. |

||

|

|

One of the reasons for the elevated prices is the shortage of inventories of both gasoline and diesel in the U.S. On June 10, distillate fuel oil inventories were 26 MMBbls (19%) lower than the seasonal average for 2015–2019, which put significant upward pressure on distillate pricing and margins. According to the EIA’s Weekly petroleum status report, on June 15, gasoline stocks in the United States were 16 MMBbls (7%) lower than the pre-pandemic five-year seasonal average.

The lack of refinery capacity is a second major factor contributing to the price rally. Since the beginning of the pandemic, the U.S. has lost about 1 MMBbl/d of oil refining capacity, and more refineries are anticipated to close in the upcoming years, outpacing the construction of new refineries. Furthermore, even if capacity per refinery has increased, most U.S. refineries are already operating above 90% capacity and EIA estimates them to run at 95% for the rest of the summer. Refinery capacity hasn't kept up with the demand for more refined oil, which has essentially reached pre-pandemic levels.

Although the prices of oil and refined products seem to move in tandem, there is some variability in how quickly changes in the upstream price of oil affect the downstream price of gasoline. Still-high refined product prices indicate that demand is still strong and that the resolution for the primary supply issue facing the oil industry, which is a lack of capacity to produce refined fuels, is demand destruction. However, for the time being, refineries are having difficulty producing as much gasoline and diesel as is anticipated, despite the government's efforts to boost consumption through tax cuts.

Our hedge recommendations differ by desired outcomes and risk tolerance. Given the liquidity in these markets, popular structures such as the costless collar, three-way collar, and swaps can be executed with a minimal amount of credit. Reach out to an AEGIS advisor today to discuss the best way to protect cash flow and costs during this period of surging prices.