The future of the RINs market changed in December, as the EPA issued the long-awaited ‘Set Rule’ which laid out proposed renewable mandates for 2023-2025, while carving out space for the new eRIN. While these new price and regulatory risks will permeate many industries we posit the largest risks moving forward will likely be borne by biofuels producers and renewable feedstock producers.

- The EPA launched its proposed renewable-fuel volume mandates for 2023-2025 on December 1

- Blending requirements for the overall advanced-biofuels category, including biodiesel, renewable diesel, and Sustainable Aviation Fuel (SAF), were smaller than many analysts expected.

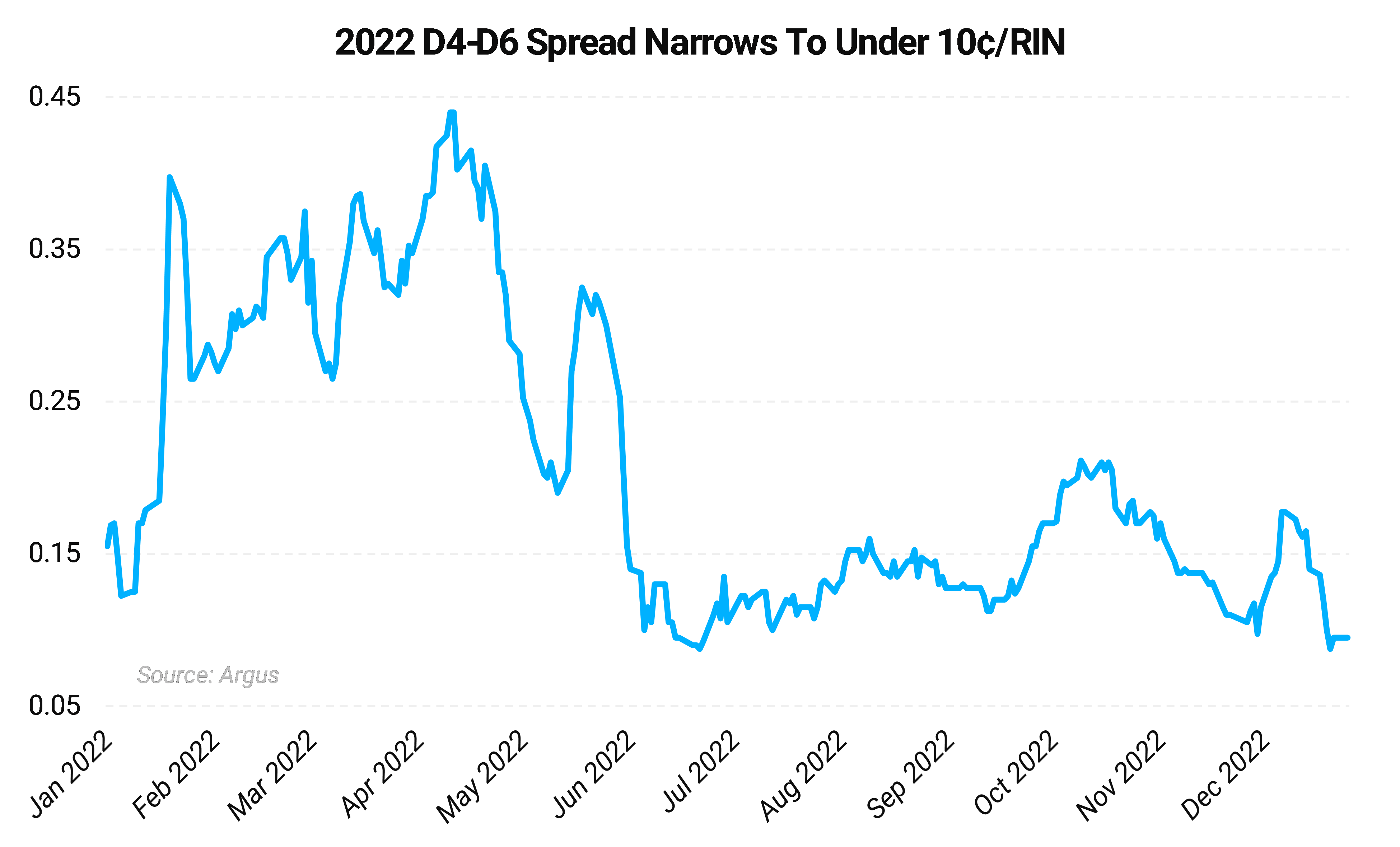

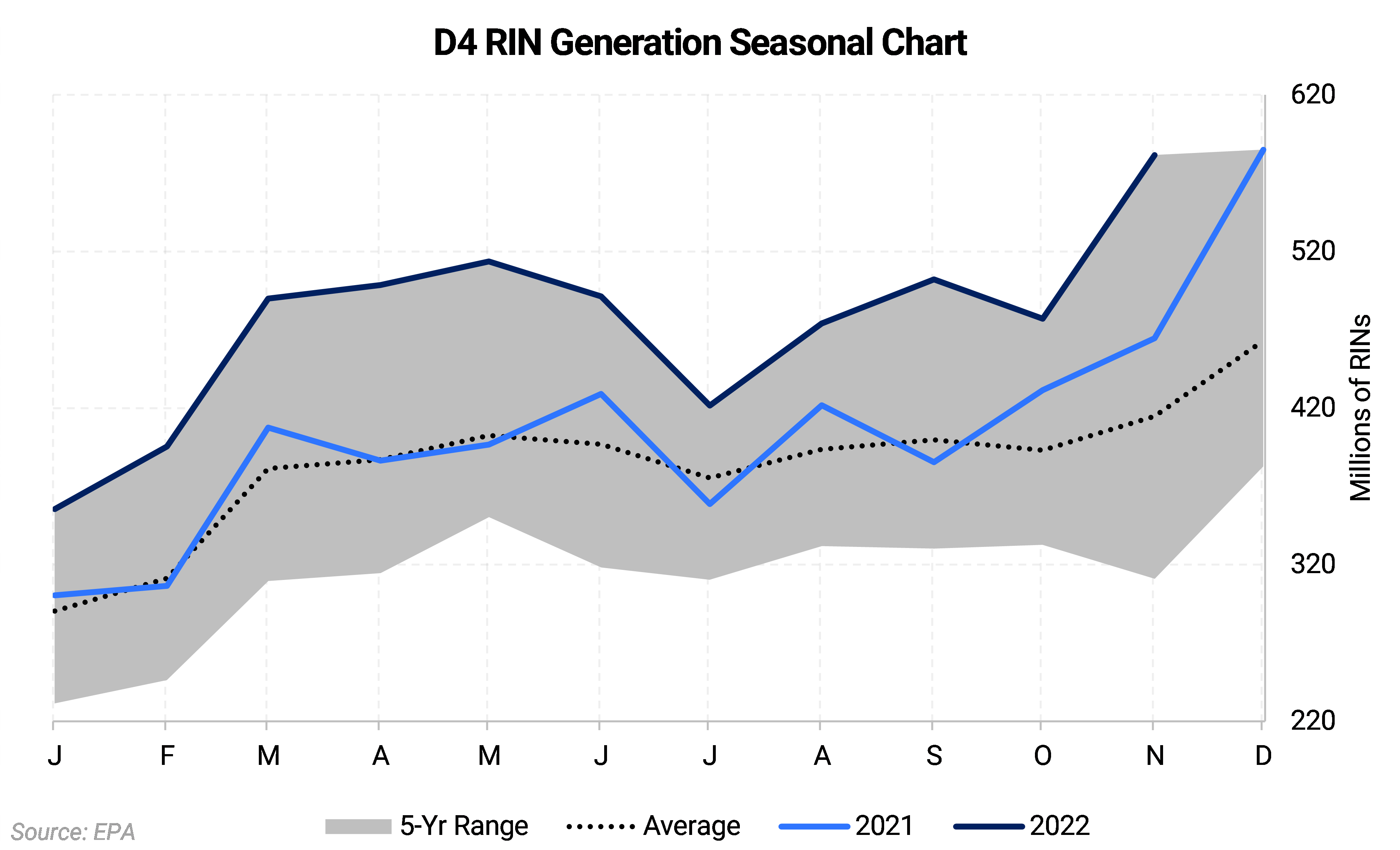

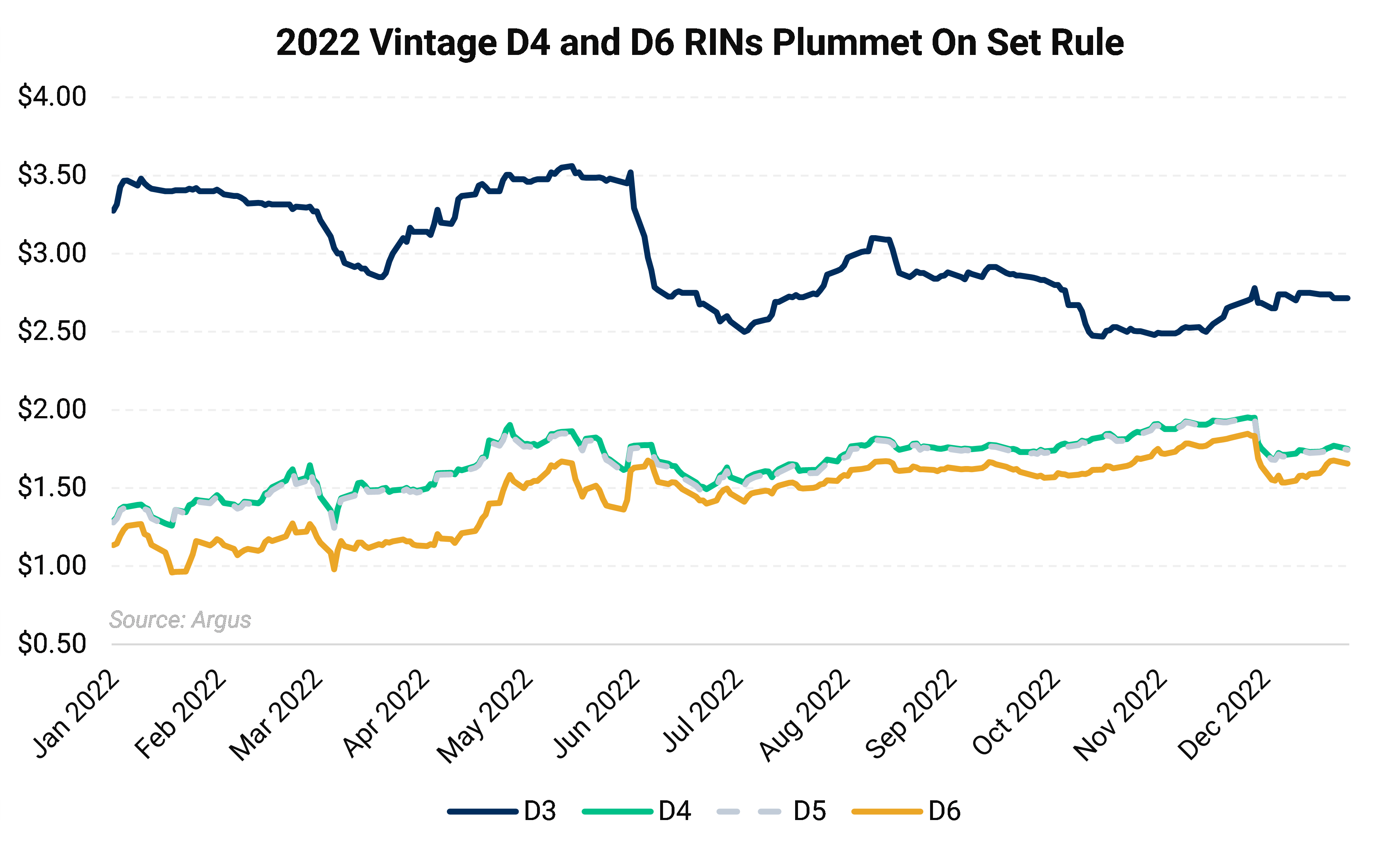

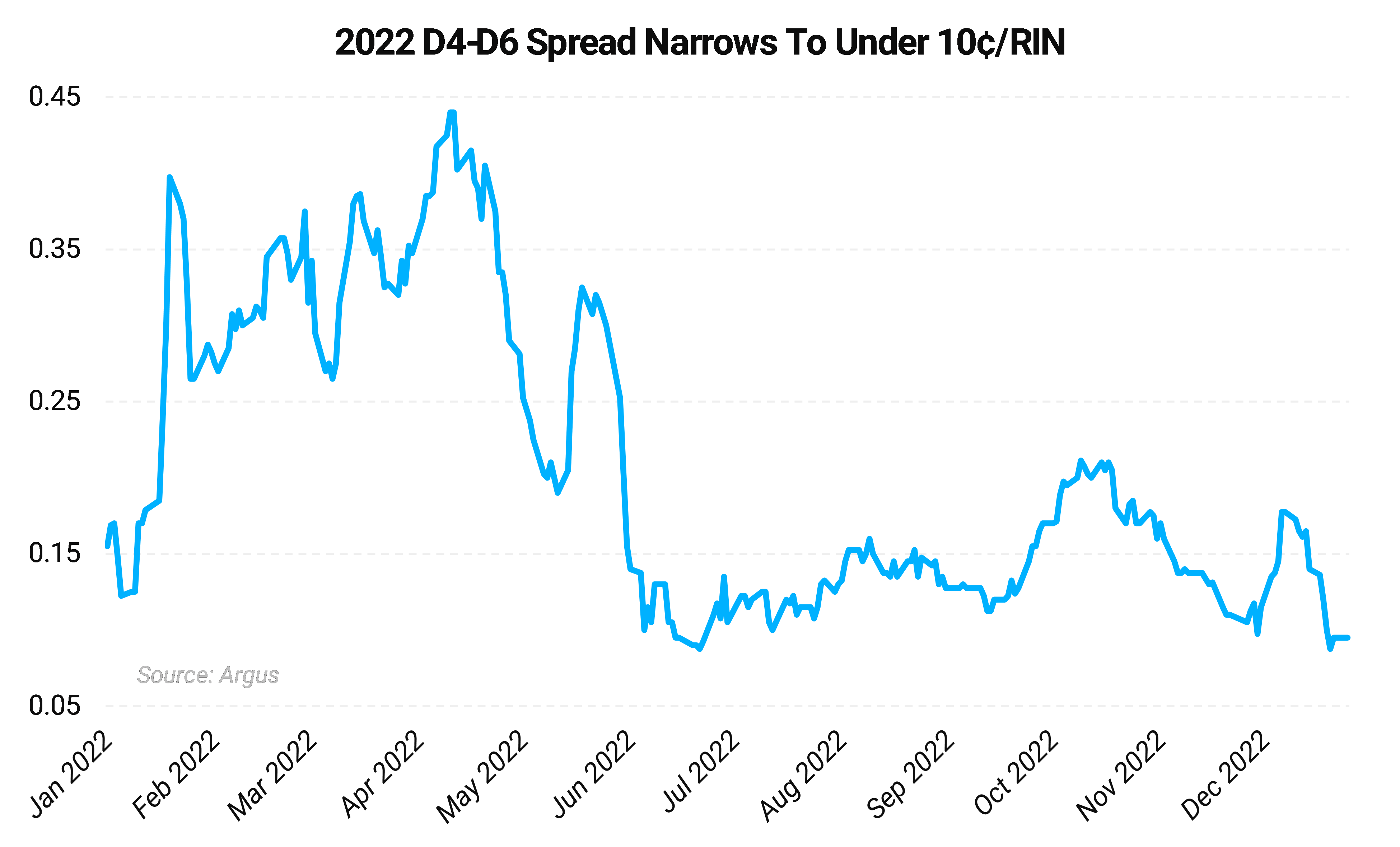

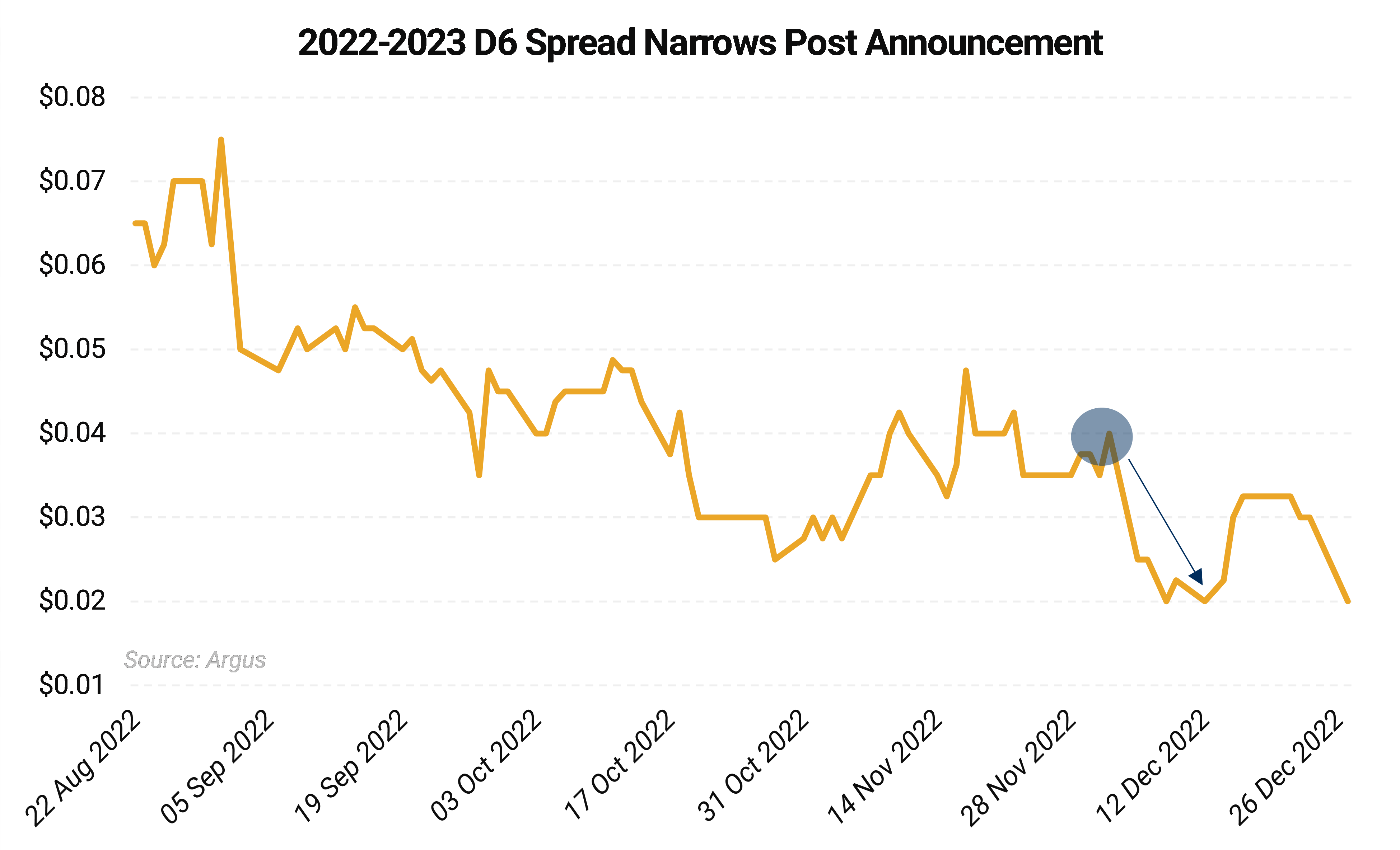

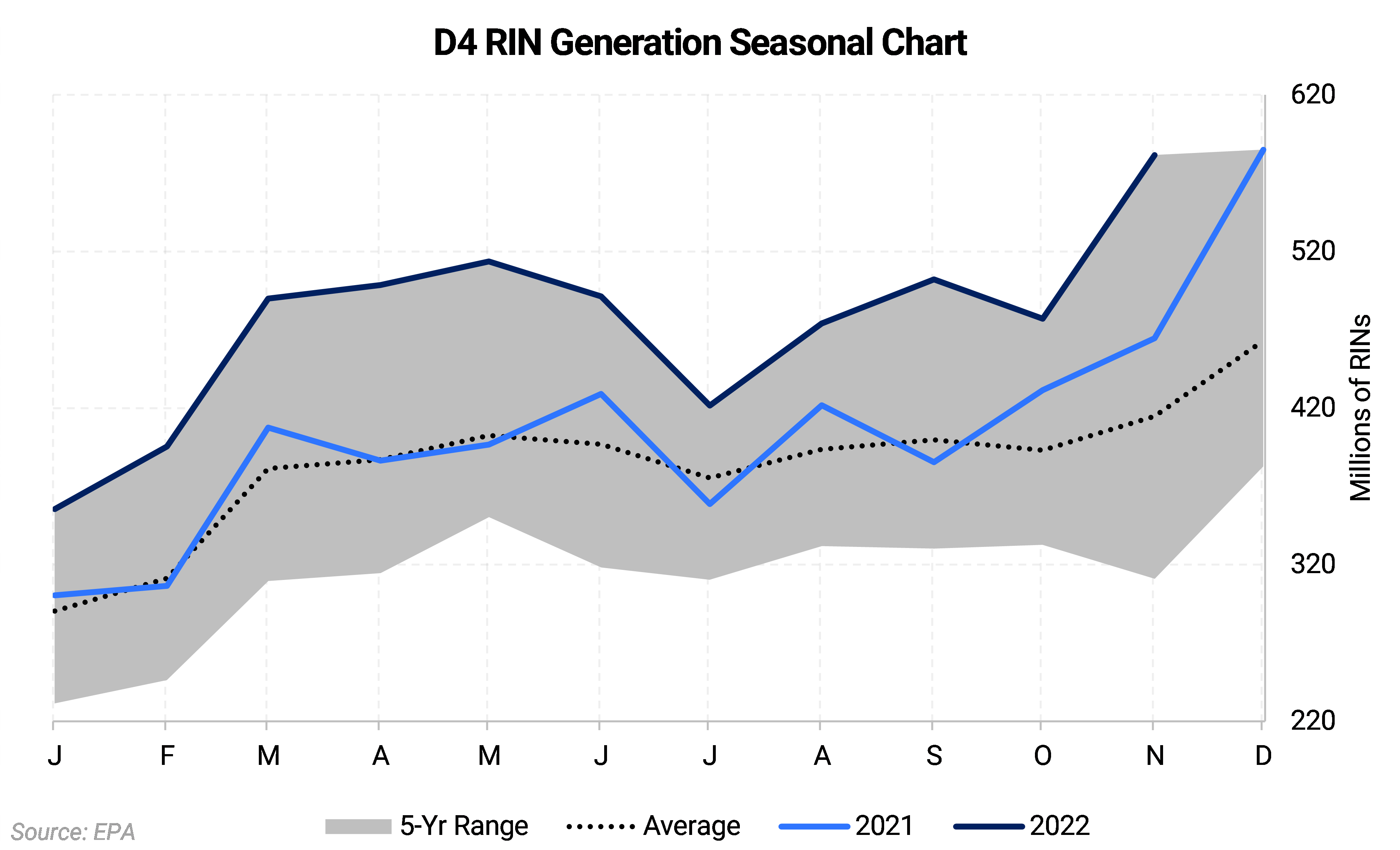

- The proposal or ‘Set Rule’ led to a rapid decline in D4 credits and tightening of the current year D4/D6 spread—the spread between 2022 vintage biomass-based diesel credits and conventional ethanol credits.

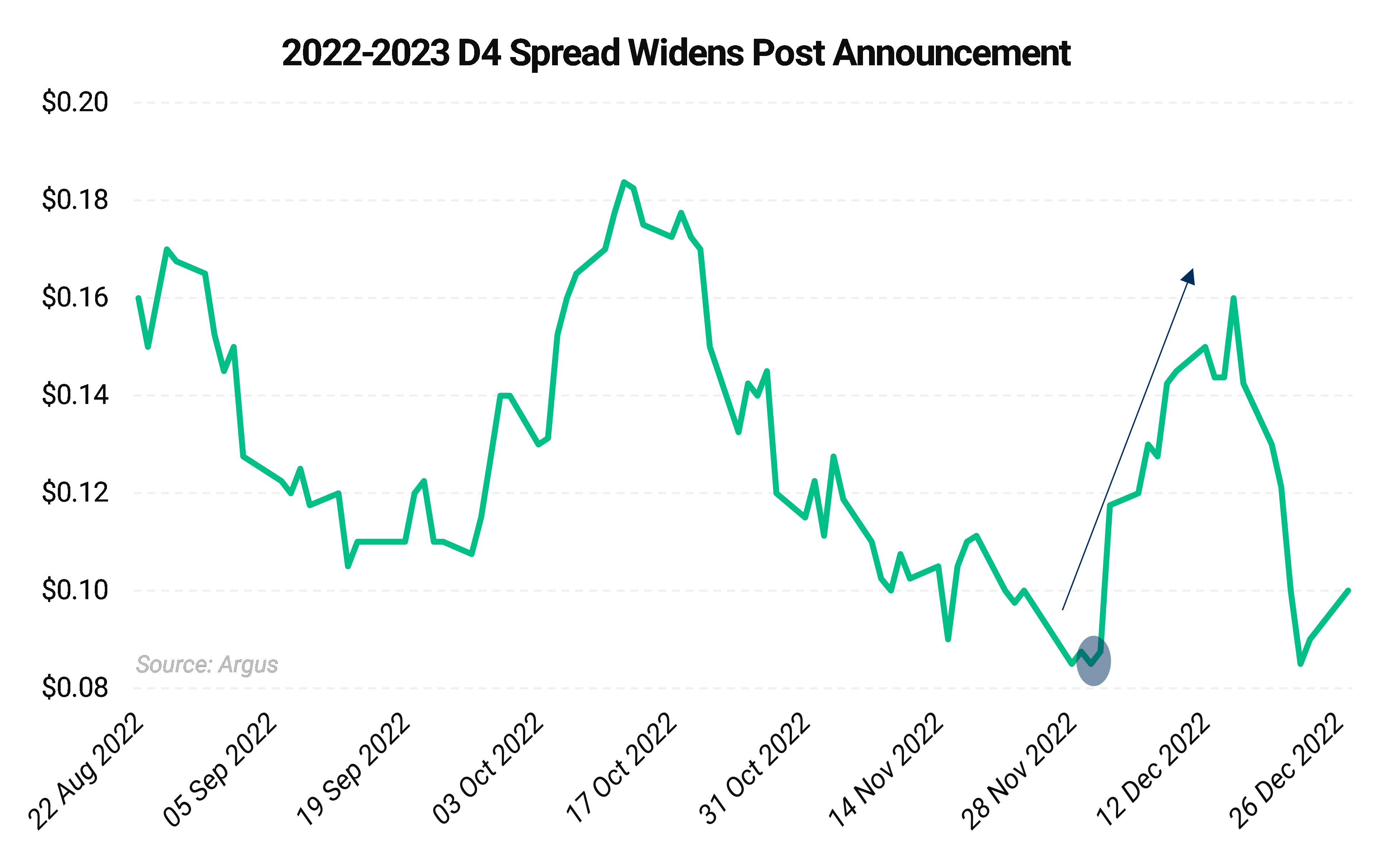

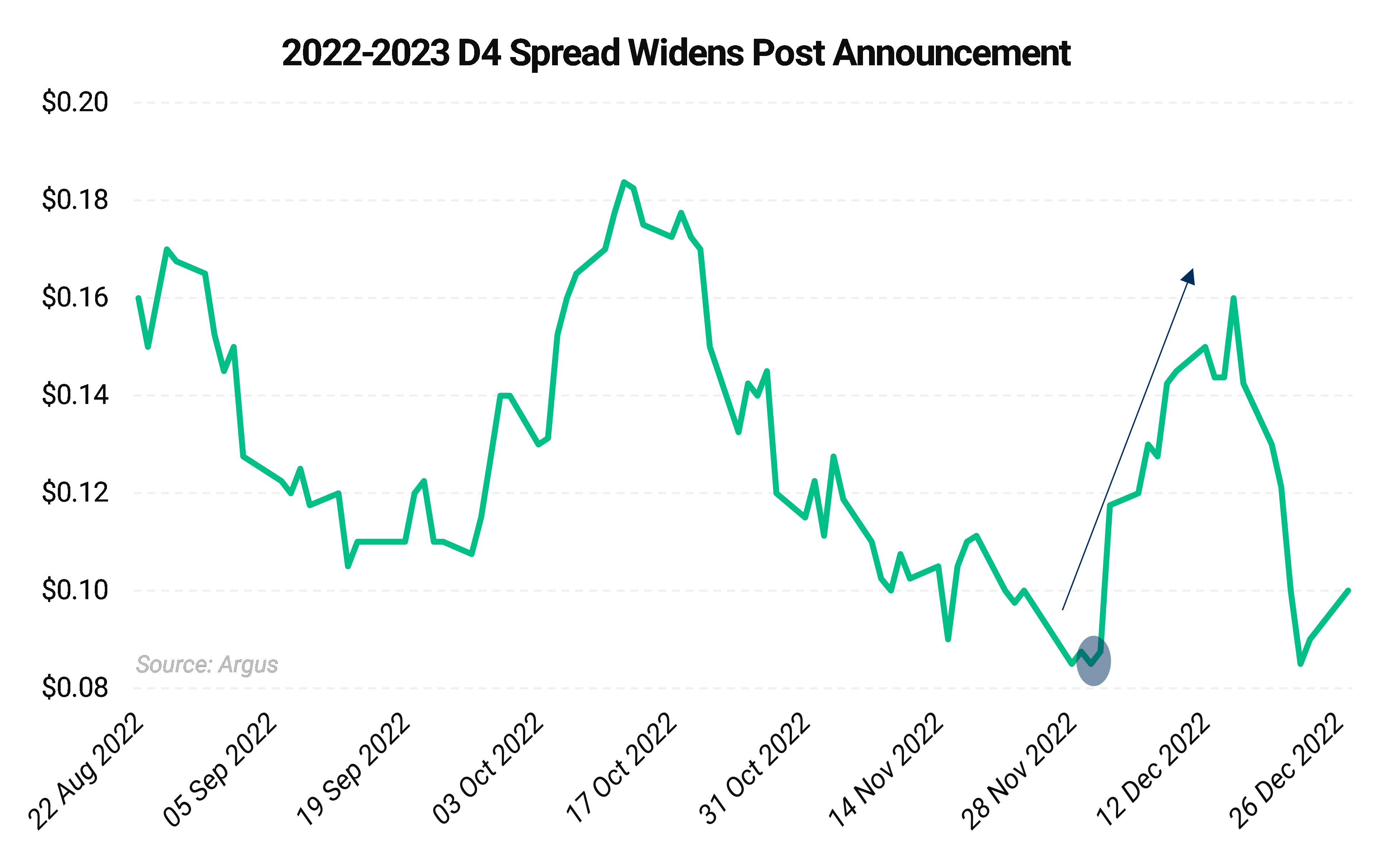

- D4 RINs for 2023 tumbled to as low as a $0.16/RIN discount to the 2022 vintage, indicating the market viewed future mandates as easier to achieve than current.

- The announcement led to a rout in CBOT soybean oil—the main feedstock for biodiesel and renewable diesel production—while additional corrections in the RIN market led to high volatility for biodiesel and renewable diesel margins.

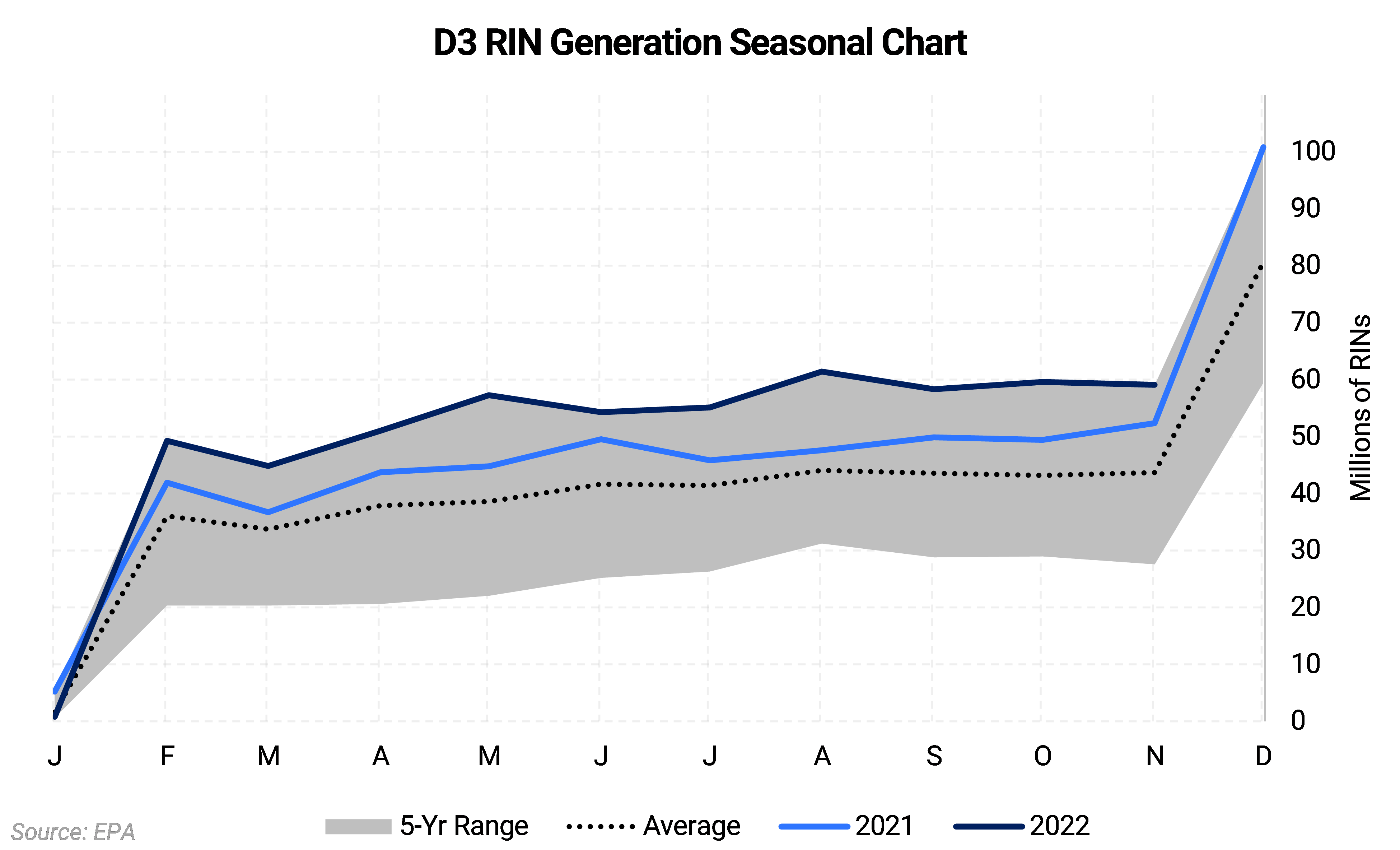

- The EPA has proposed removing the cellulosic waiver authority under the ‘Set Rule’—a key blowoff valve for the D3/D7 cellulosic RIN market.

- The ‘Set Rule’ also laid out regulatory guidance for the use of electricity in transport to generate eRINs, lining up producer offtakes with OEMs. The main source for the electricity would be biogas. eRINs with fall under the cellulosic category which will double between 2023 and 2024 to 0.82% of the fuel pool from 0.41%.

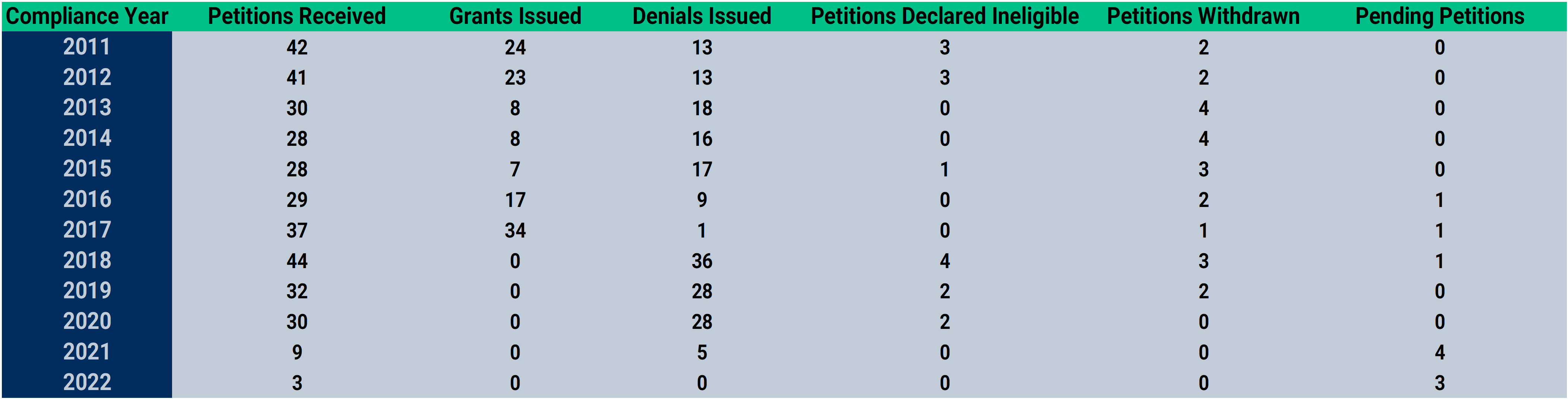

- The EPA responded to a Government Accountability Office report critical of the agency’s handling of Small Refinery Exemptions (SREs), which waive RIN requirements for refiners producing 75,000 Bbl/d or less and can demonstrate economic hardship from compliance with the RFS. The EPA analysis concluded that small refineries recover their compliance costs in the price for the fuels sold, yet at the same time showed small refiners pay more for RINs than large refiners—1.2 cents on average.

Calendar:

- January 10, 2023: EPA’s virtual public comment period commences

- February 10, 2023: EPA comment period closes

- June 14, 2023: EPA deadline to finalize 2023-2025 volumes

Relevant News:

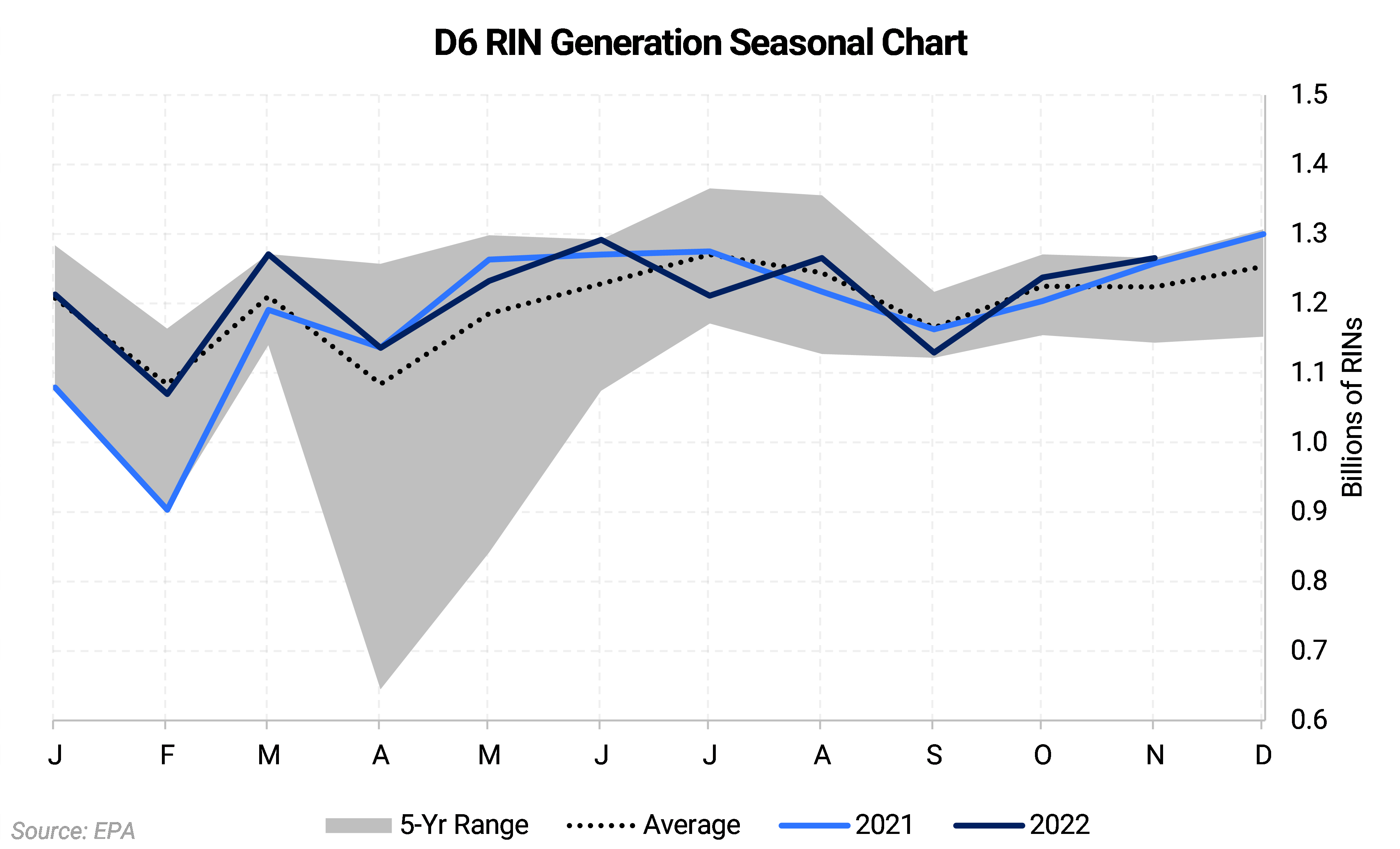

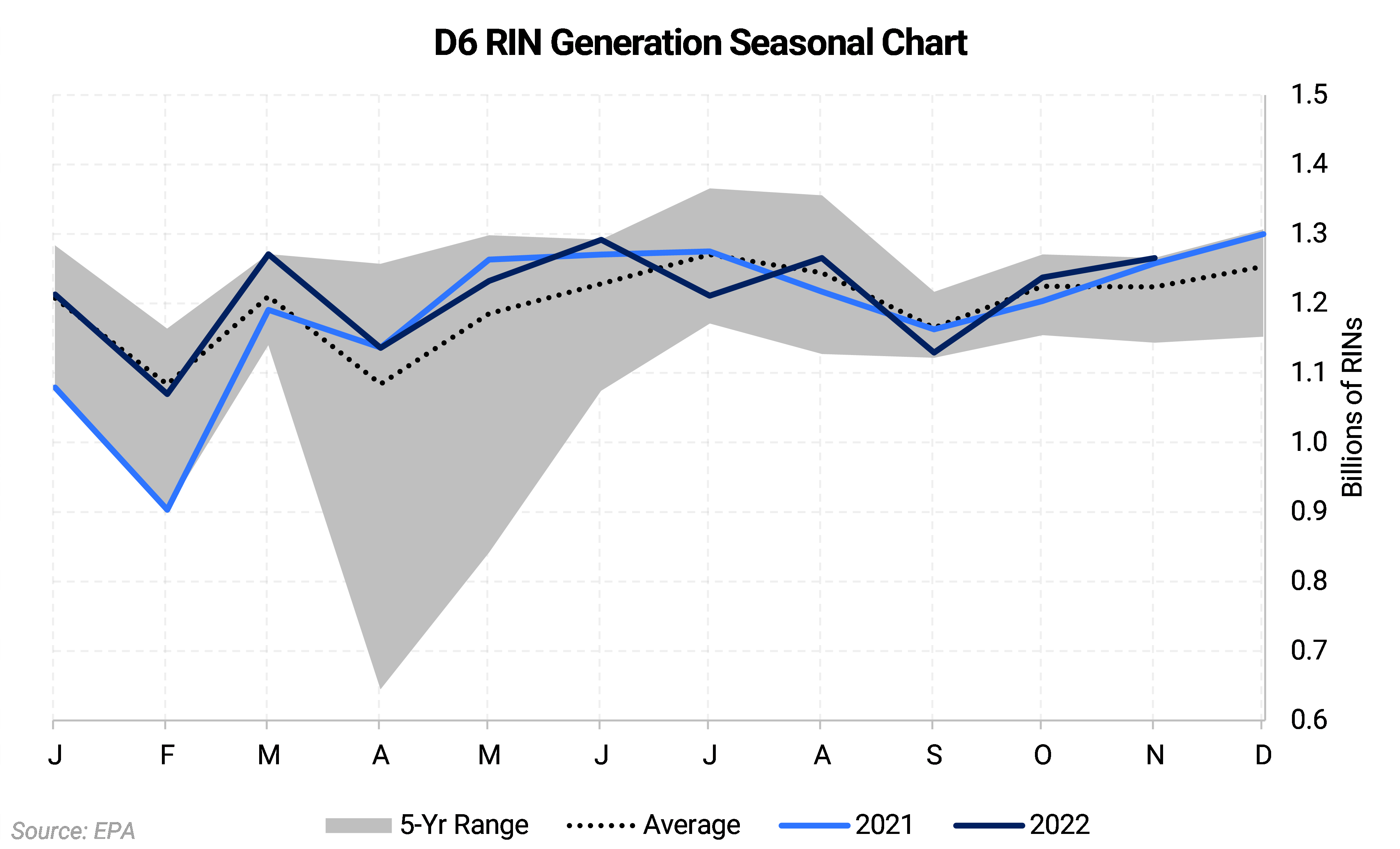

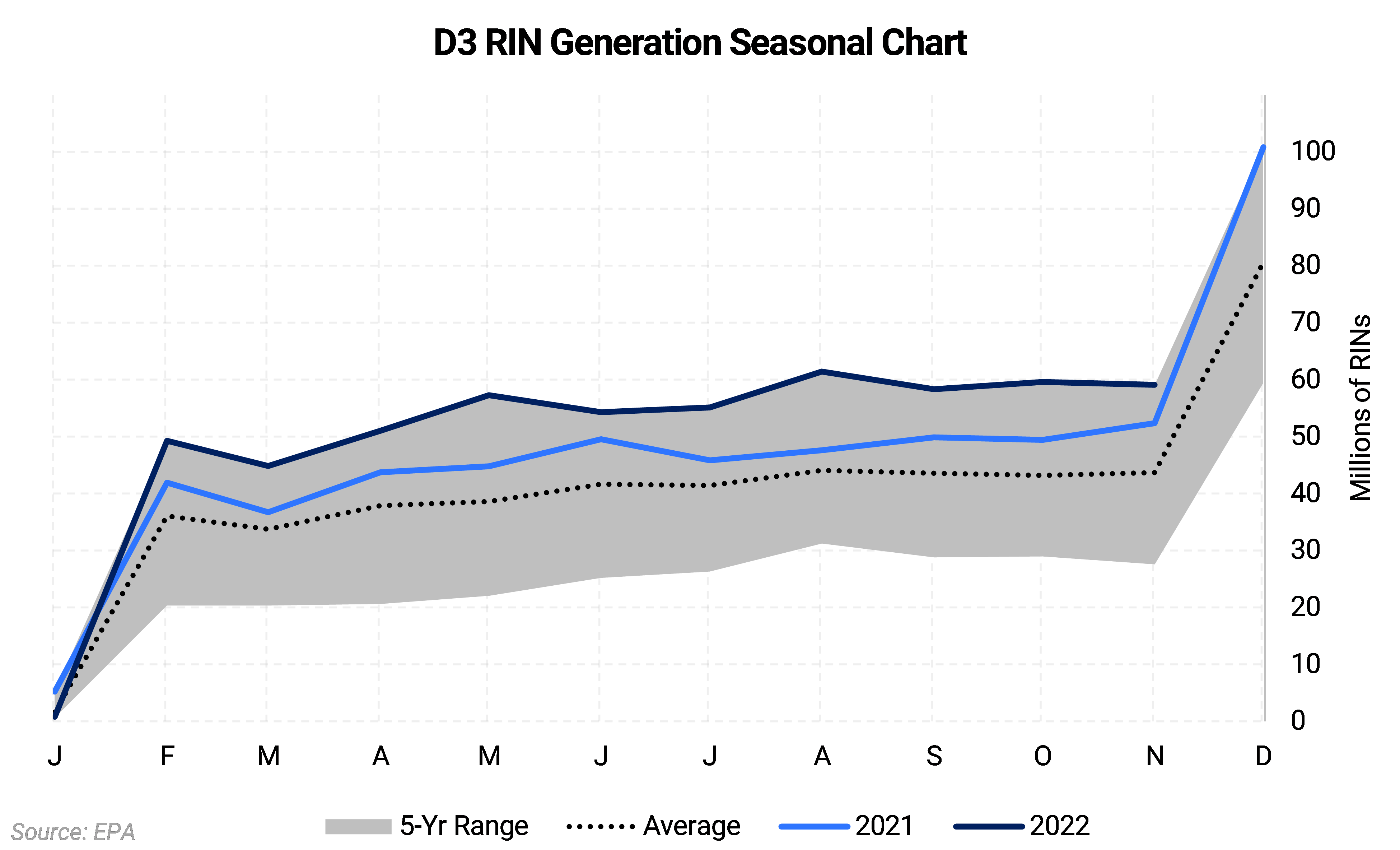

- November RIN generation came in at 1.94 billion credits, up 9% from year-ago levels. Compliance with the advanced category has already surpassed the annual mandate for 2022, though the cellulosic category is less than 1 million credits short heading into December. Markets will need to generate 1.93 billion D6 credits in December to meet compliance, or obligated parties will have to turn to banked 2021 D6 credits. Some obligated parties are allowed to use up to 20% of prior-year credits to meet current-year compliance, though not in consecutive compliance years. Under the RFS, obligated parties include refiners of refined products such as gasoline and diesel, importers and on-road fuels, and blenders of on-road fuels for use in the US. Jet is exempt under the RFS but can be used to generated RINs through the blending of SAF.

- The IRS issued guidance on the SAF credit in its Notice 2023-06. The base SAF credit of $1.25 per gallon is eligible to any SAF which reduces lifecycle greenhouse gas (GHG) emissions by 50% with an additional $0.01 per gallon for each percentage point reduction past 50%. The IRS sets the baseline for petroleum-derived GHG emissions at 89 gCOE2/MJ, the same set by the International Civil Aviation Organization (ICAO). The credit is available to fuel used during the 2023 and 2024 calendar year and excludes co-processed SAF, SAF produced using palm oil, and fuel produced outside the US.

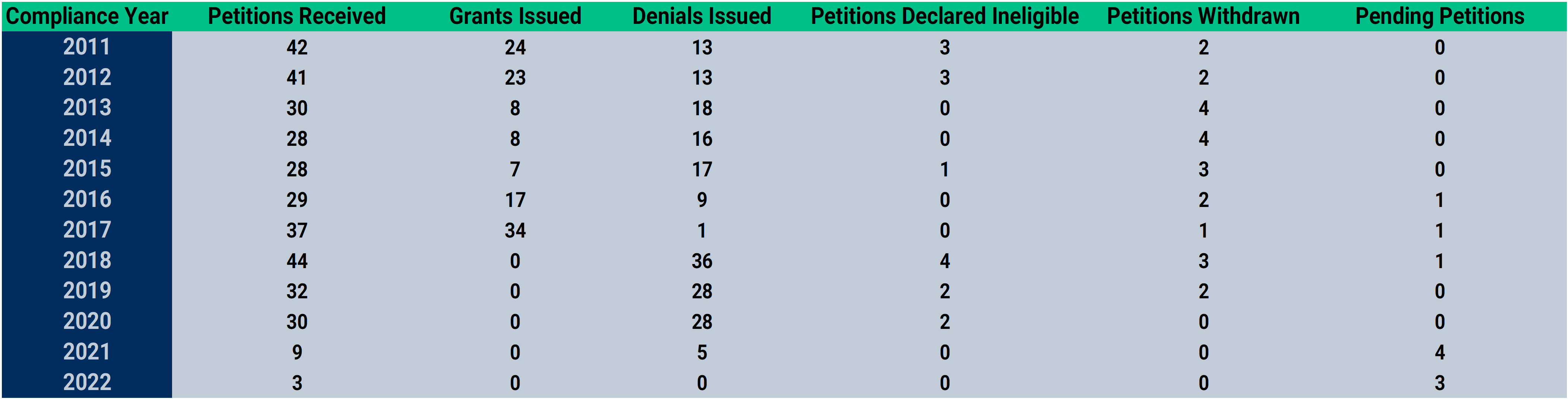

- The EPA released updated SRE data showing one new SRE petition was filed making for a total of 10 pending petitions. The new petition is for the 2021 compliance year. The Biden administration has thus far denied all SRE requests.

- A bipartisan year-round E15 bill, the Consumer and Fuel Retailer Act, was introduced into the House of Representatives on December 8, with wide support from farming, biofuels, and oil companies. The E15 fuel—a blend of 85% gasoline and 15% ethanol—cannot be sold during the summer months—June 1 through September 15—as the fuel’s higher RVP causes the fuel to evaporate. The Trump administration lifted the restriction on year-round E15 sales in 2019, yet sales were limited due to poor consumer education, lack of infrastructure and the lower energy density of ethanol. These same constraints still face the marketplace.

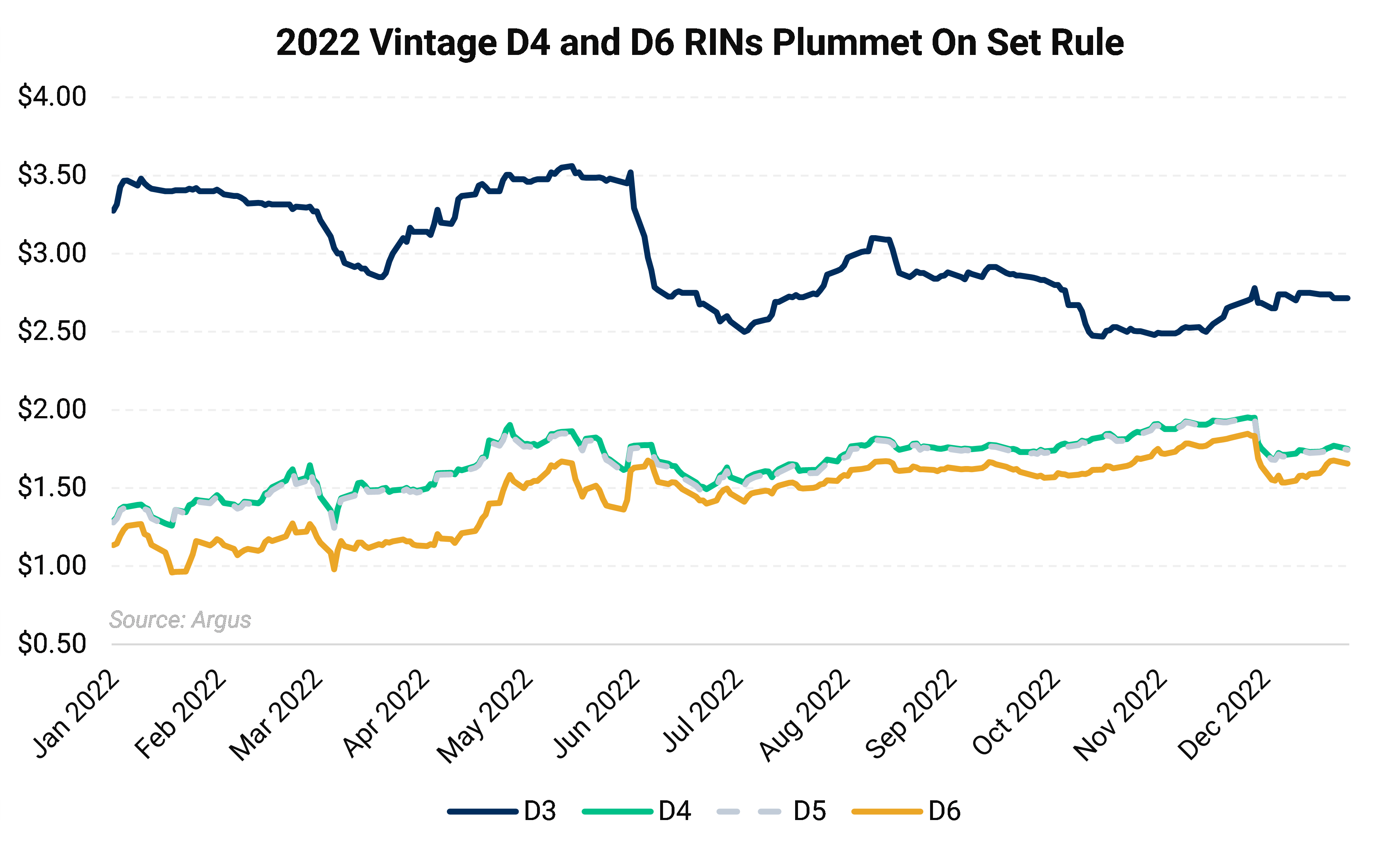

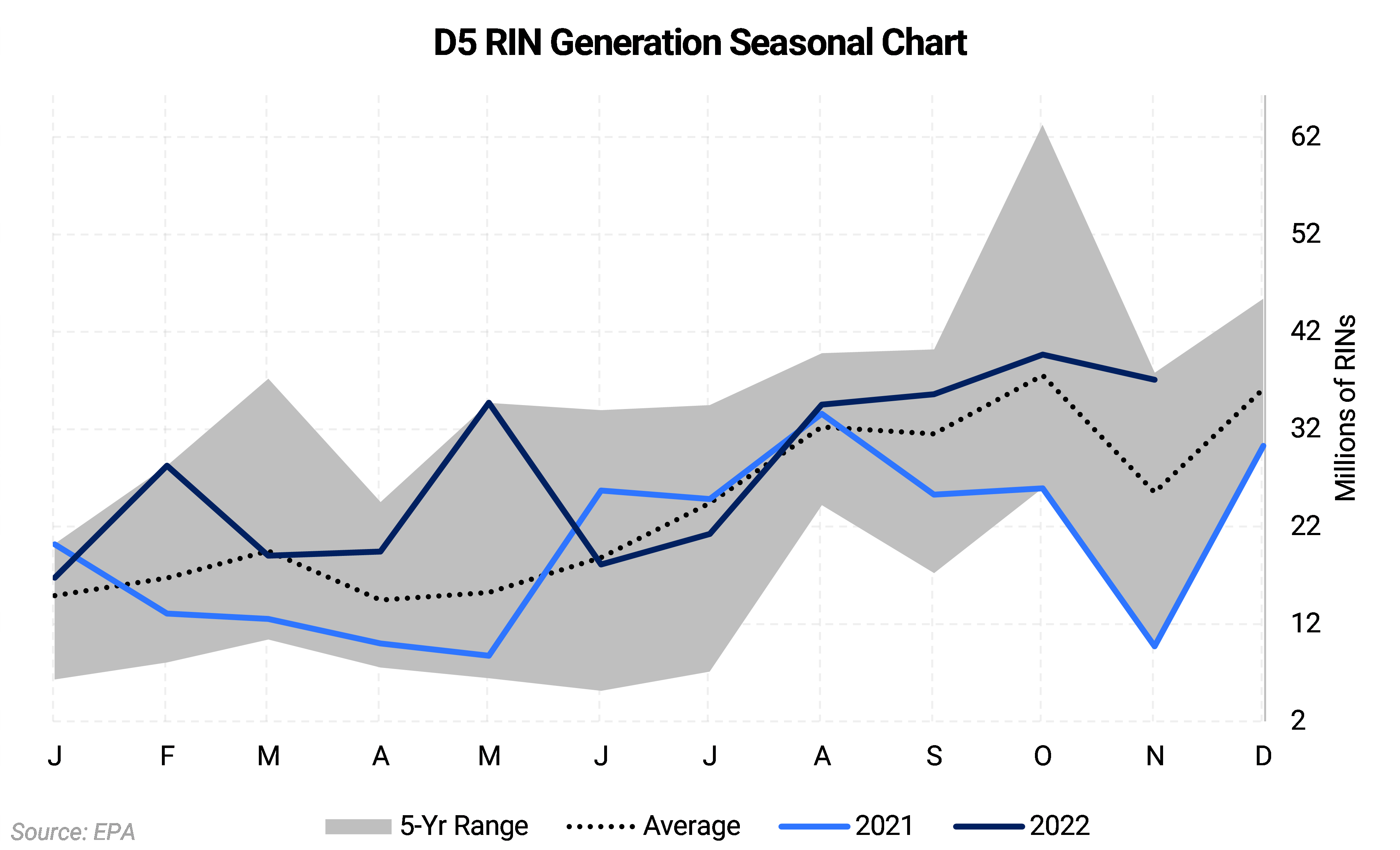

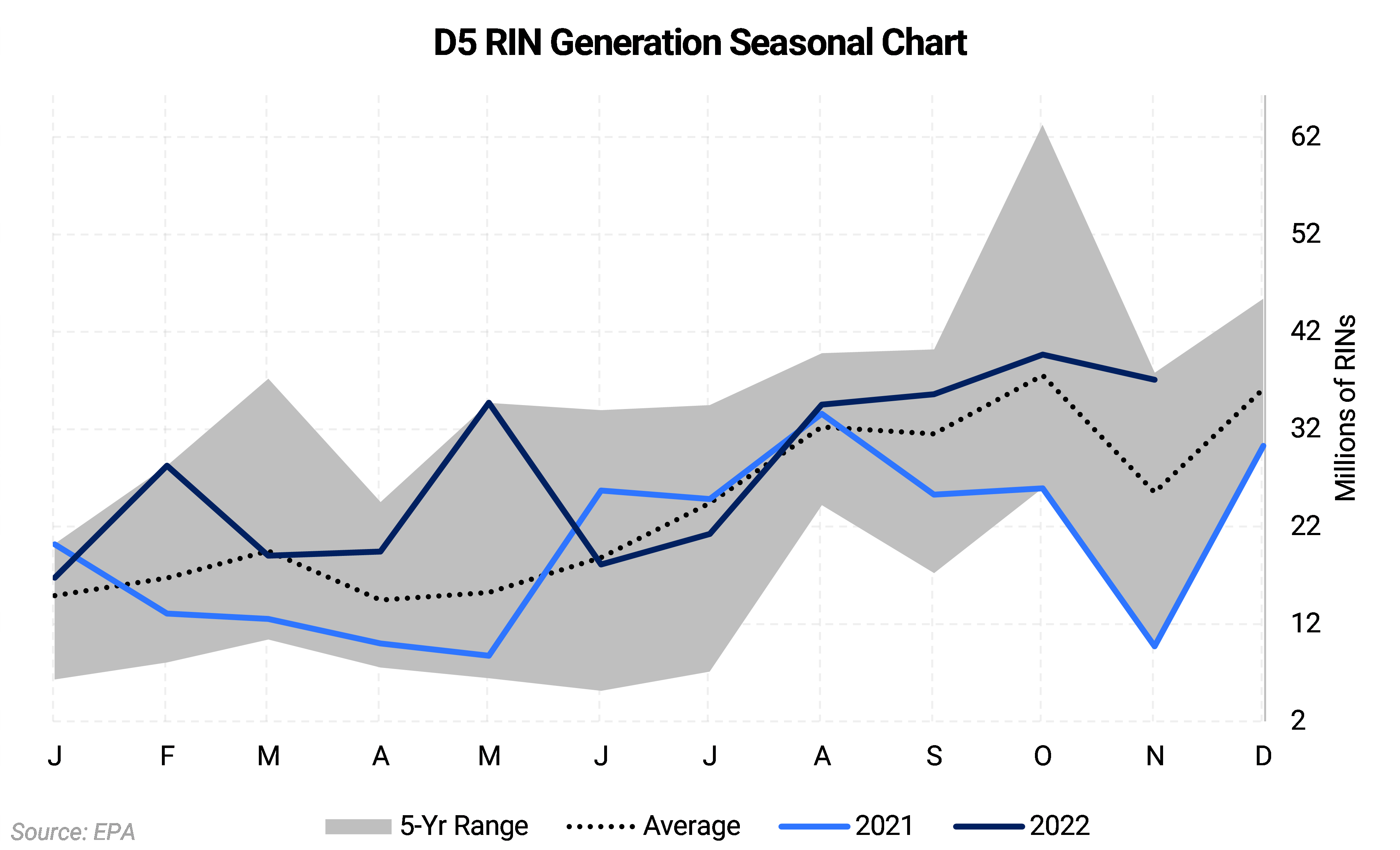

Current-year vintage D4 and D6 RINs posted losses of $0.20/RIN, or 10%, and $0.18/RIN, or nearly 10%, over the course of the month. The 2022 D3 cellulosic RINs shed $0.07/RIN, or 2.3%, as current-year supply is still short of meeting compliance requirements, while the ‘Set Rule’ calls for higher mandates moving forward.

The D4-D6 spread narrowed sharply, indicating a tight D6 supply with the ethanol mandate set at 15.25 billion gallons for the next three years. The mandate is already over the blendwall, meaning that there may not be enough gasoline consumed to blend the mandated levels of ethanol. Future mandates likely will need to account for a probable pullback in gasoline demand over the course of the ‘Set Rule.’ While nearly a dozen states primarily in the Midwest are pushing for year-round sales of E15, the RIN market convergence of D4 and D6 RINs demonstrates that the marketplace believes D6 supply will be tight, nonetheless. As the advanced mandates in the “Set Rule’ fell short of expectations, D4 RINs were quick to shed value, yet a faster downward correction in renewable feedstock markets coupled with ULSD losses saw D4 credits recover some value as the month ended. Stronger D4 credit prices are not needed to support biodiesel and renewable diesel margins when the Nymex ULSD basis is posting losses, and vice versa.

The 2022-2023 D4 spread widened $0.07/RIN following the announcement to as wide as $0.16/RIN as the market priced in lower advanced mandates given the rapid pace of development in the renewable diesel industry projected for the next 4-5 years. The spread corrected downward to $0.10/RIN by months’ end as feedstock prices slumped, Nymex ULSD shed value and the market priced in the likelihood of the need for D4s to cover D6 shortfalls.

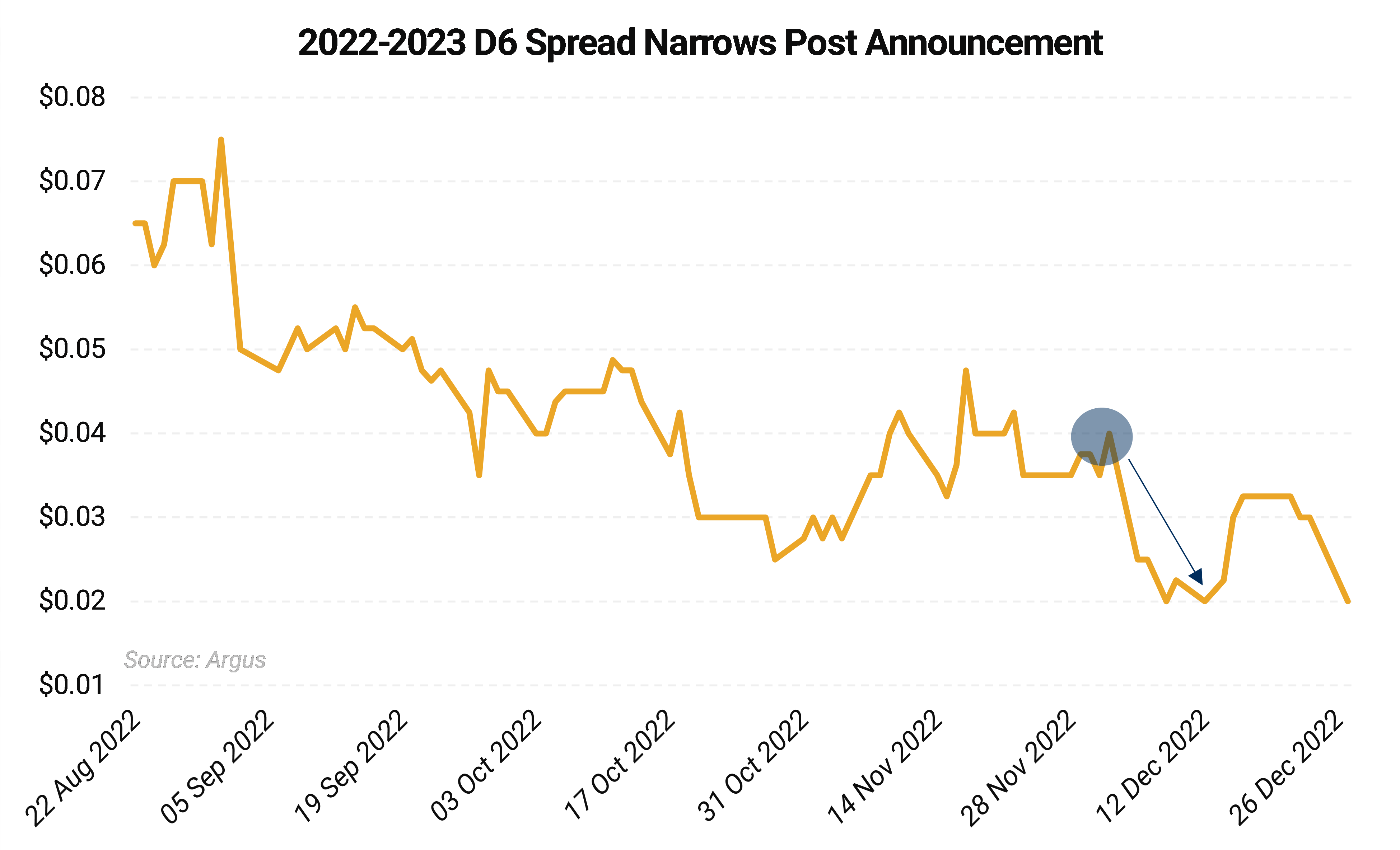

The 2022-2023 D6 RIN spread narrowed to around $0.02/RIN over the course of December as supply of 2022 vintage D6s are running short, and the market priced in blendwall concerns. The spread reached as low as $1.5/RIN in the final days of the month. While we do see the possibility for this spread to reach parity, we do not see prices holding at that level as the 2022 shortfall is much more acute and thus the 2022 vintage D6 should carry a premium.

The complex will need to generate 1.93 billion 2022 vintage D6 RINs in December alone to meet the 15.25 billion requirement. That is too large of a shortfall to blend in one month. The alternatives are to draw down banked D6 RINs or opt to cover using more expensive D4 credits. Obligated parties are allowed to use 20% of their prior year credits to meet current year compliance, though this option cannot be used in consecutive compliance years. In our view, using D4 (or D5) credits is the likely solution.

To learn more about “de-nesting” RINs to optimize compliance with RFS, read our market primer here: https://aegis-hedging.com/insights/aegis-on-rins

EPA RIN Generation Data as of December 15:

EPA Small Refinery Exemption (SRE) Data as of December 15:

Some of the price and regulatory risk in the development of the renewable fuels markets is controllable through hedging or pre-selling. Other risks require constant monitoring of pending changes to regulations and programs.

Our environmental experts are here to help you. If you’re facing price or regulatory risk, reach out today.