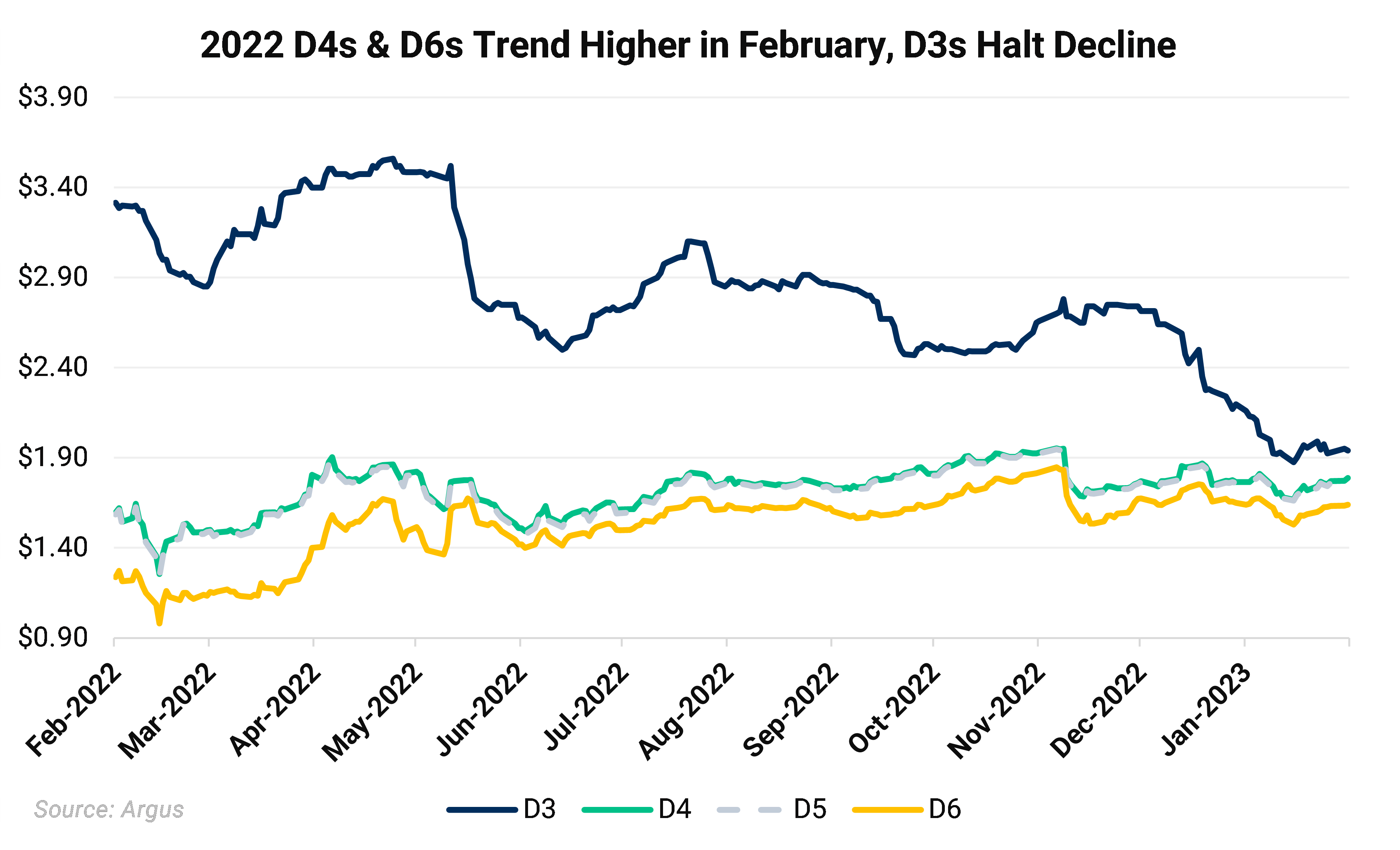

RIN prices trended higher over the course of February yet were lower on a month-over-month basis as a court ruling halting two Small Refinery Exemption (SRE) petitions saw markets take a consistently bearish tack. Revisions to 2022 RIN generation showed a tighter 2022 supply for D4 credits, rattling inter-vintage biomass-based diesel RIN spreads. January 2023 RIN output showed the highest D6 RIN generation since 2020, while January D4 production came in at an all-time, seasonal high.

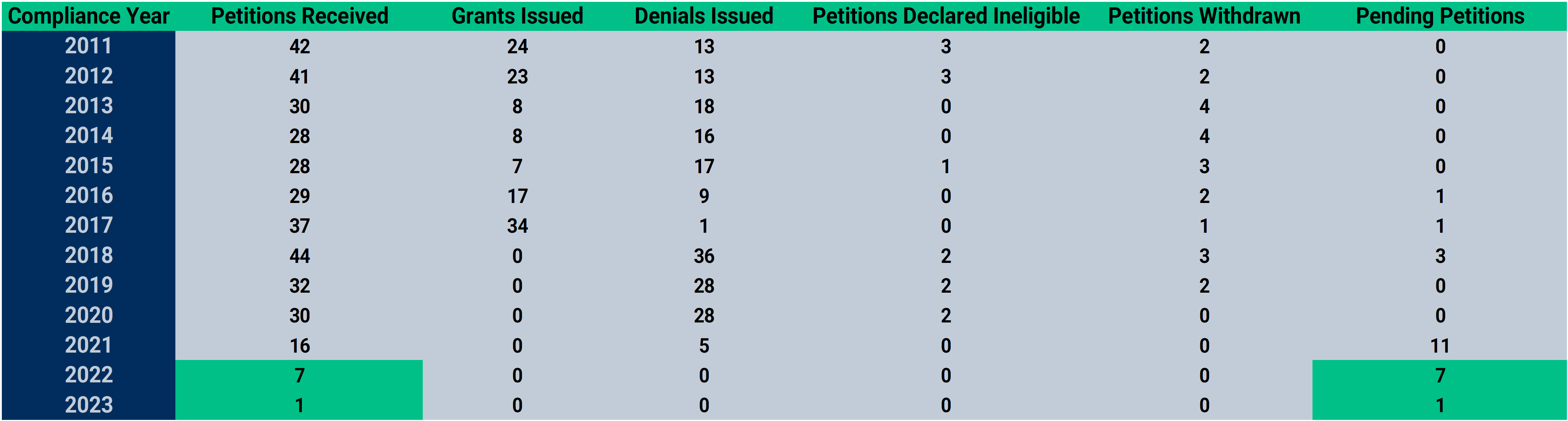

- A court ruling halting compliance obligations for two refineries with Small Refinery Exemption (SRE) petitions weighed on credit markets as the chance for a pivot in the EPA’s approach on SREs could prove materially bearish for RIN prices.

- Notes from the court were strongly in favor of granting the SREs, as the court made it clear it intends to handle SREs as originally intended by the RFS—i.e. waive RFS compliance if undue hardship can be demonstrated—and to allow waivers which were issued in an “unlawful retroactive application.”

- The EPA retroactively overturned 69 Trump-Era SREs starting in April of last year by denying 31 SRE waivers for 2018 and then denying all SRE petitions for 2016 through 2020. Denying SREs is bullish for RINs markets as refiners must enter the marketplace to purchase RINs to cover compliance obligations which were originally waived.

- The EPA’s proposed ‘Set Rule’ came under fire from the advanced biofuels industry urging the agency to lift advanced mandates for 2023-2025 to reflect the volumes of fuel available to the marketplace. The EPA decided to focus on feedstock availability limitations when originally laying out the proposal.

- The eRIN remained contested in comments. At the center of the issue is who earns the credit. By allowing only auto manufacturers to earn the eRIN, the EPA is choosing to promote one technology which contravenes the statutory purpose of the Renewable Fuel Standard (RFS), which is to boost renewable fuel use.

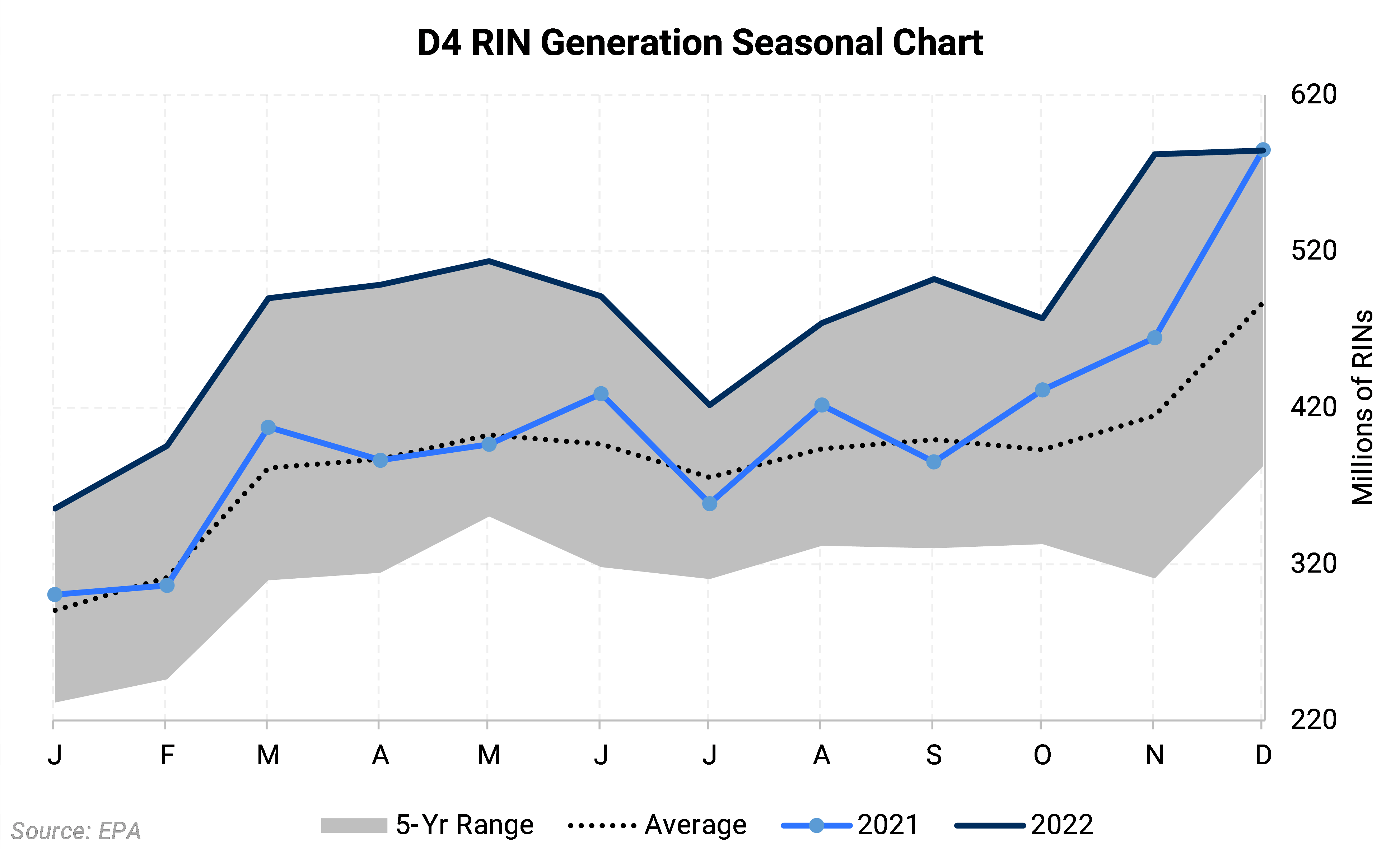

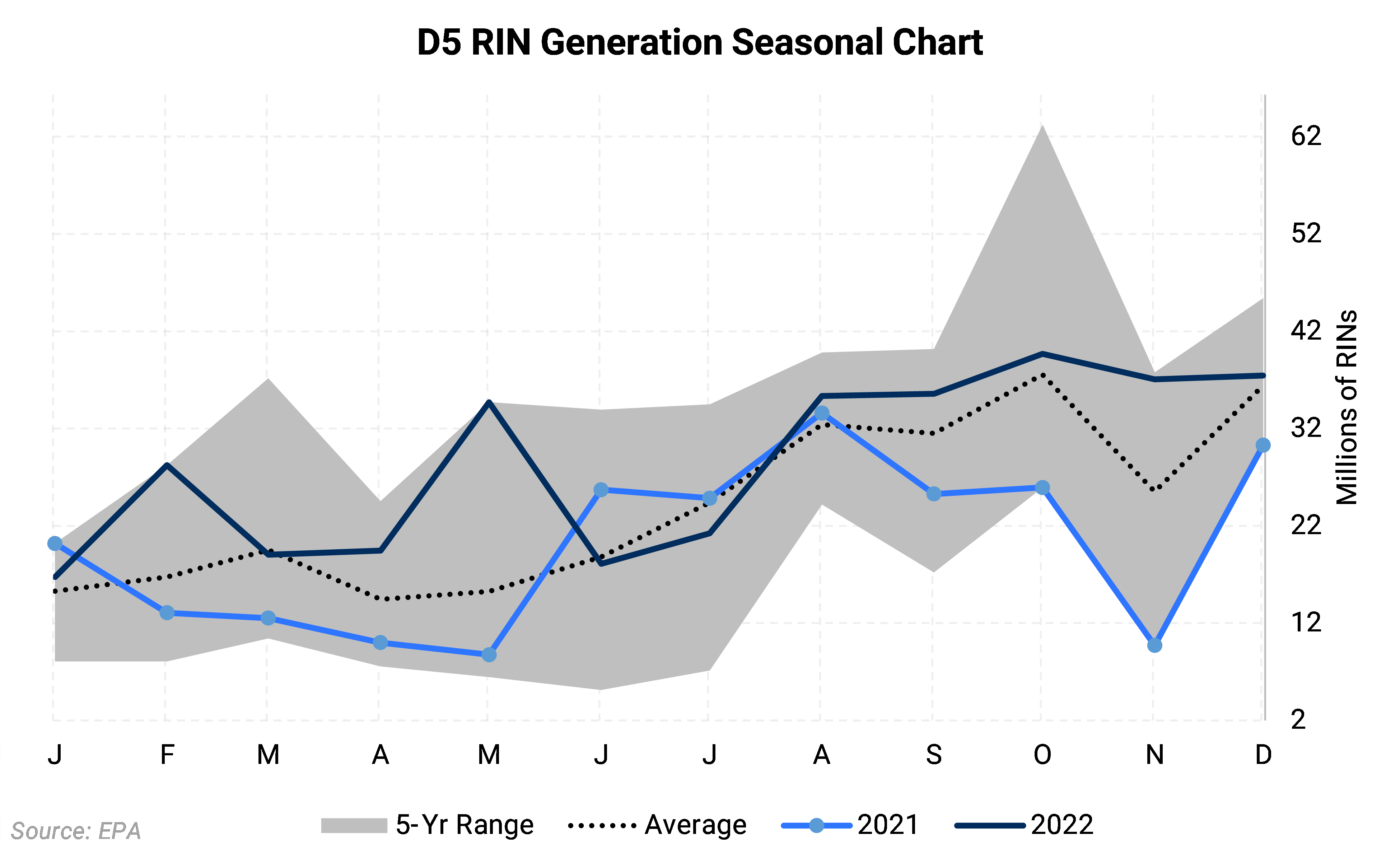

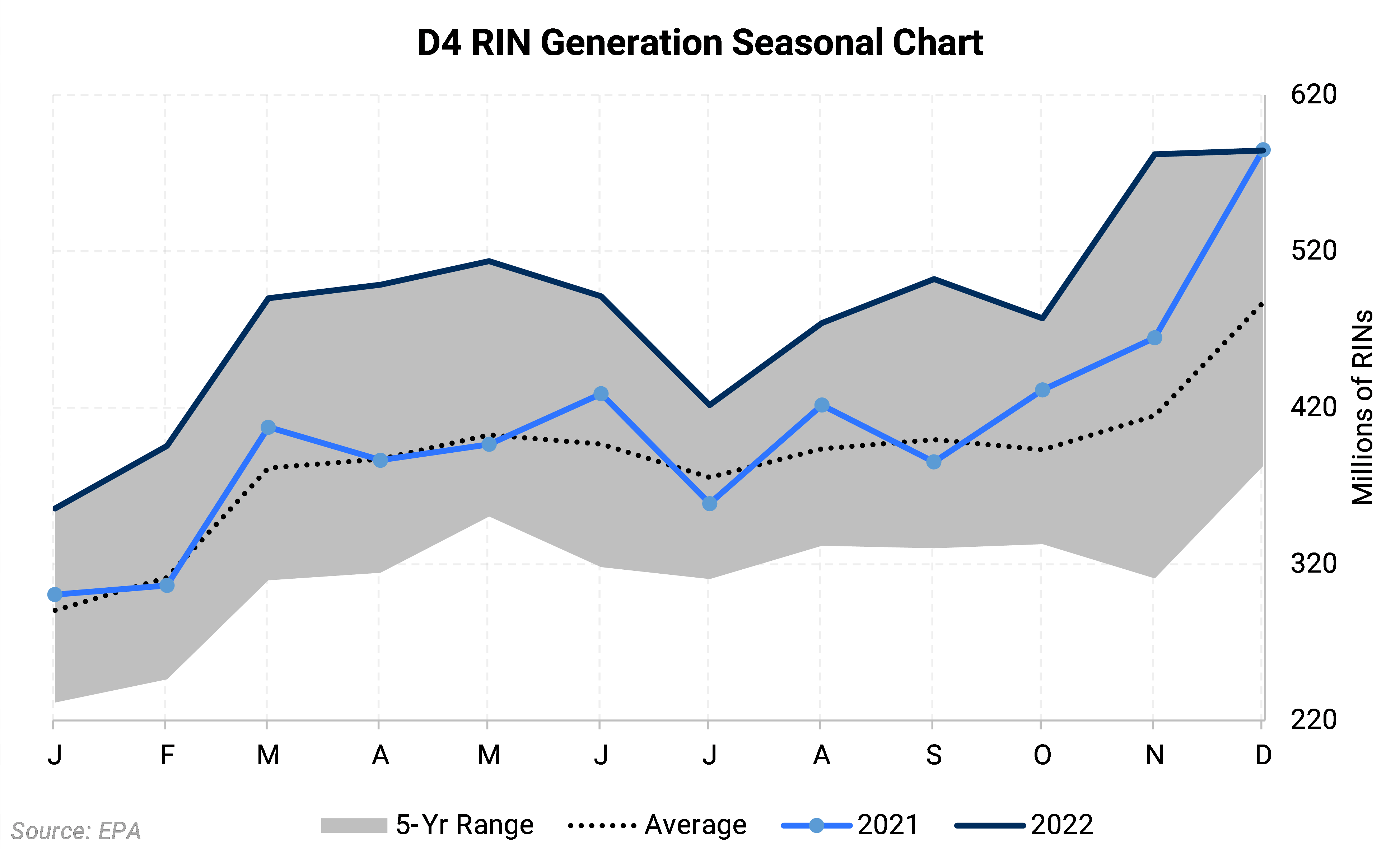

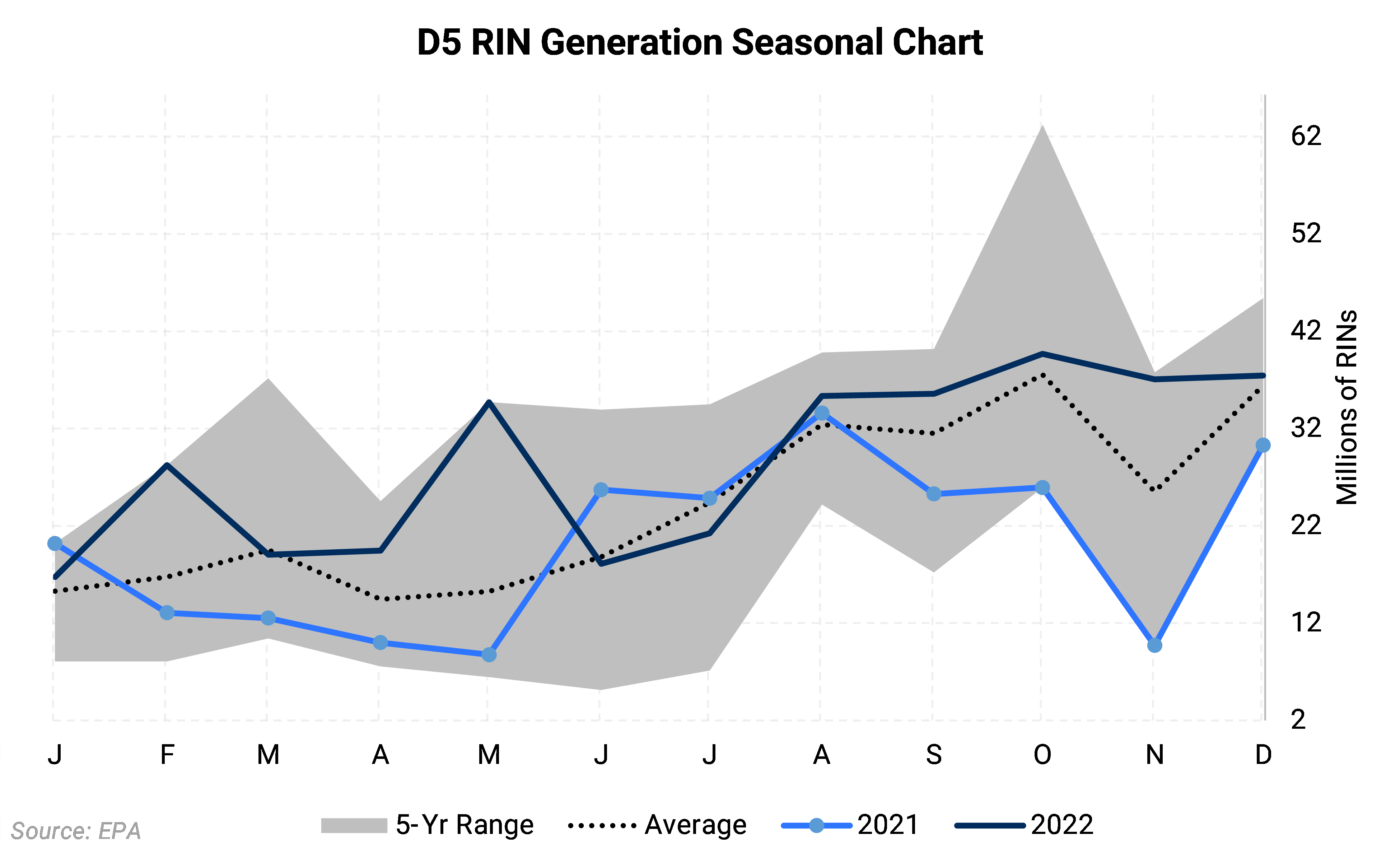

- After revisions, December RIN generation data showed total D6 RIN generation falling roughly 720 million credits short of the mandated 15.25 billion gallons under the final 2022 standards. Excess D4 and D5 credits can easily make up the shortfall, though there were some downward revisions in 2022 D4 data.

Calendar:

- February 10, 2023: EPA comment period closes.

- June 14, 2023: EPA deadline to finalize 2023-2025 volumes.

- Pending: Final court ruling on SRE stays for 2021 & 2022

Relevant News:

- The EPA heard comments from the Advanced Biofuels Association urging the agency to lift the advanced mandates in the proposed ‘Set Rule’ to reflect the volumes of fuel available to the market. The EPA decided to focus on feedstock availability when originally laying out the 2023-2025 proposal.

- The National Fuels Institute, urged the Biden administration to not limit biodiesel blends in heating oil and diesel fuel to 20%, a prohibition buried in the new ‘Set Rule.’ A cap on biodiesel blending would prove supportive of D4 biomass-based RINs and would be particularly disruptive to New England heating oil markets.

- A wider effort by Congress to overturn all existing 69 SREs through a Congressional Review Act was quickly quashed by the Government Accountability Office in the first week of the month.

- Seven Midwest states are pushing to remove the 1.0 Reid Vapor Pressure (RVP) waiver for E10 sales to promote year-round sales of E15. The move is a gamble to bring only incremental volumes of ethanol into the marketplace, yet would severely disrupt the operations of refiners, pipelines, and storage facilities, in turn raising fuel costs and leaving the region prone to more frequent and longer-lasting gasoline supply shocks. The EPA can block the measures for up to two years.

- Two new SRE petitions were filed as of February 16, leaving a total of 24 pending petitions. The petitions include one for the 2022 compliance year and one for 2023.

- Neste completed its 440 million gallons/yr expansion of its Singapore Renewable Diesel (RD) and Sustainable Aviation Fuel (SAF) facility on February 10. The expansion takes the plant’s total capacity to 880 million gallons/yr. The Finnish company aims to produce 340 million gallons/yr of SAF by the end of March, making it the largest SAF production facility in the world.

- PBF and ENI announced a 50/50 joint venture, St. Bernard Renewables LLC, to run a new RD plant in Chalmette, Louisiana. The 360mn gallons/yr facility is expected to come online during the first half of 2023 and will include full pretreatment allowing the consumption of 1.1mn t/yr of feedstock consumption.

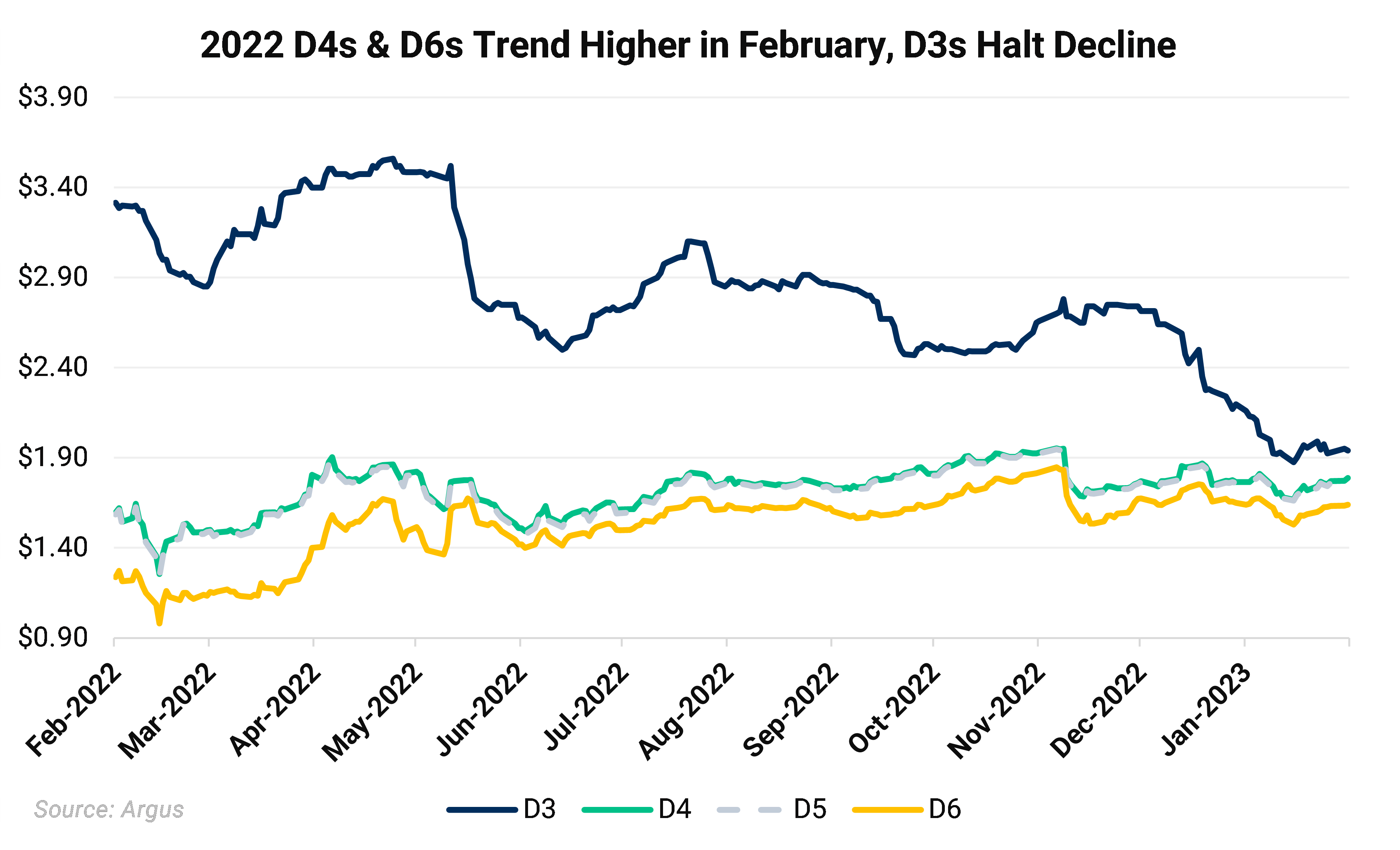

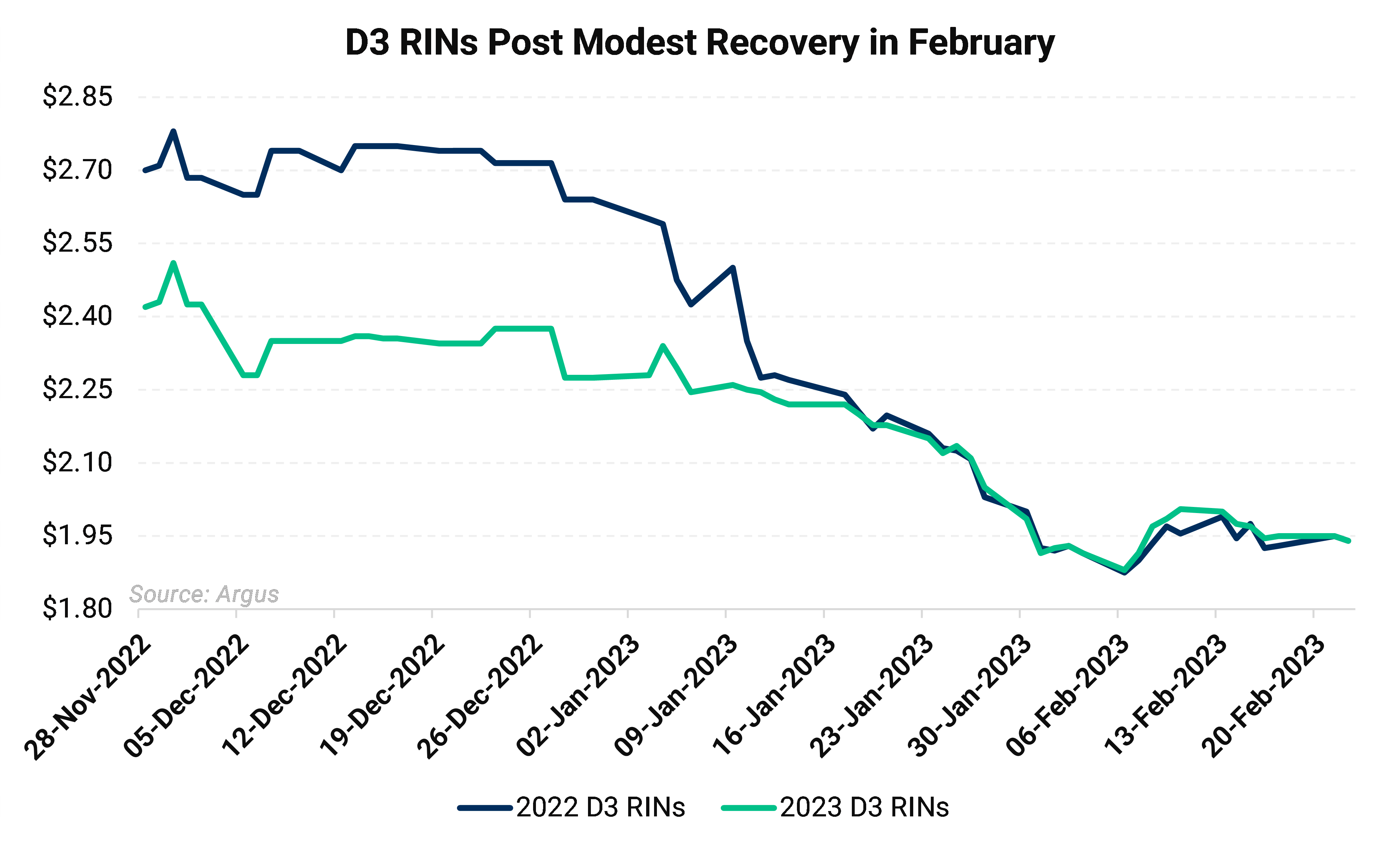

RIN markets bottomed out in the first week of February as a court ruling halting two SREs weighed on the wider marketplace. The chance for a pivot on the EPA’s SRE policy could prove materially bearish for RINs if the court sides with the small refiners which comments showed is likely. Yet strength returned to market as the advanced biofuel industry issued comments urging for higher advanced requirements given available production capacity. This saw RIN markets trend higher over the course of February, yet were lower on an average, month-over-month basis.

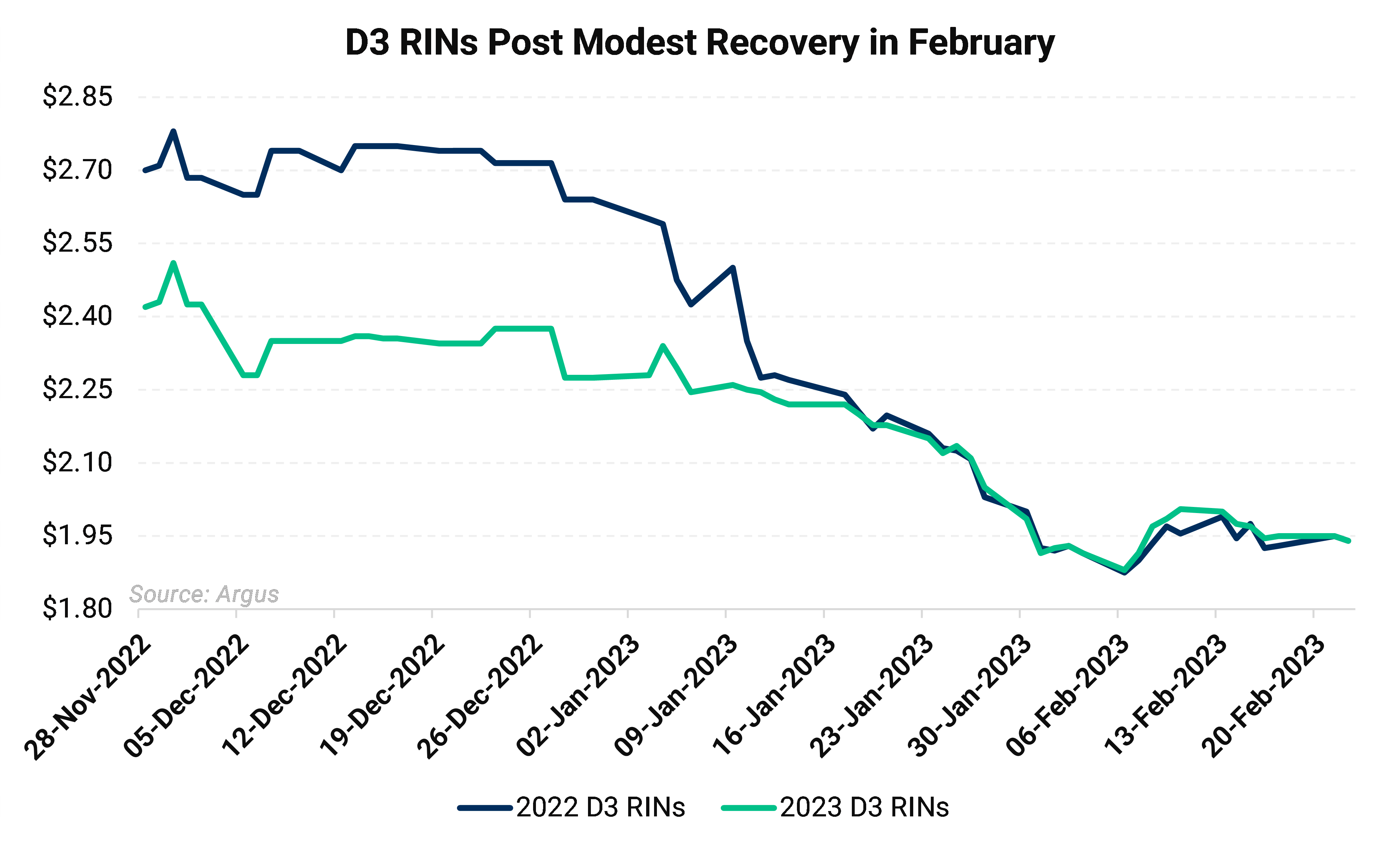

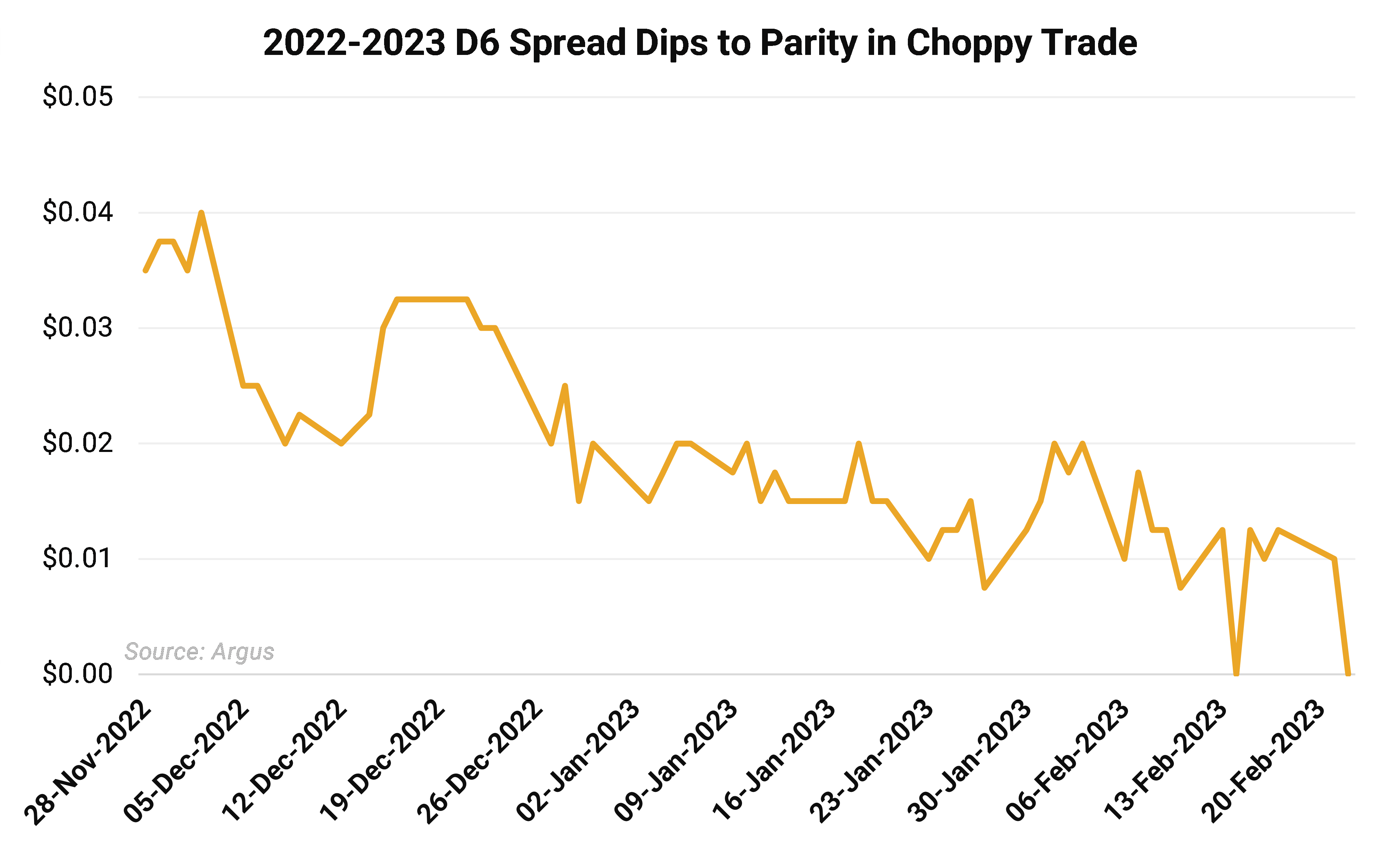

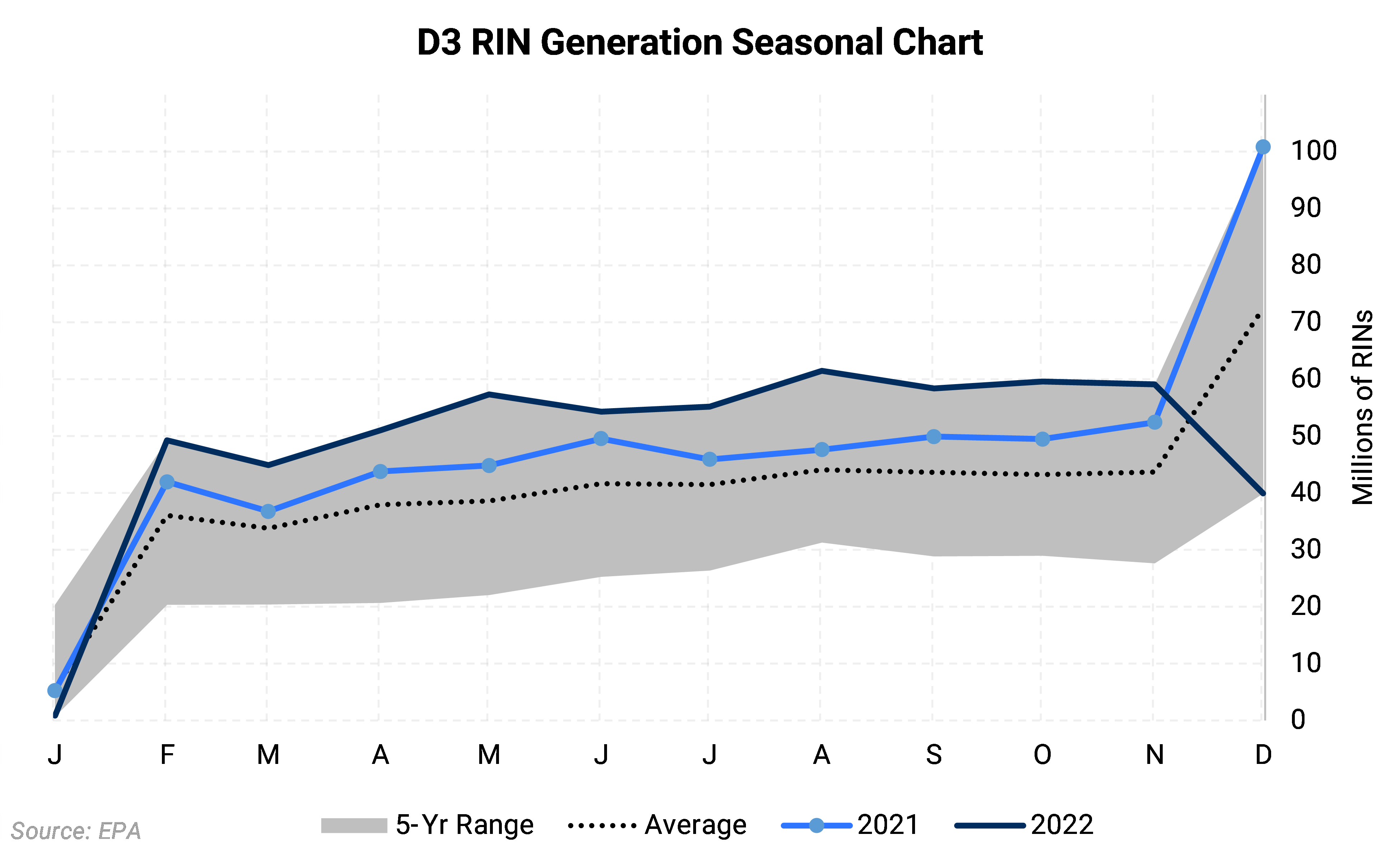

2022 D6 RINs shed nearly $0.09/RIN, or 5.2% on a monthly basis to average $1.59/RIN so far this month, while D4 losses were more muted at $0.07/RIN, or 3.7%. D3 RINs tumbled $0.32/RIN, or 14%, to average $1.94/RIN. Losses were more pronounced for 2022 vintage D3 credits relative to 2023 D3s, narrowing the inter-vintage spread to parity as February draws to a close (see below).

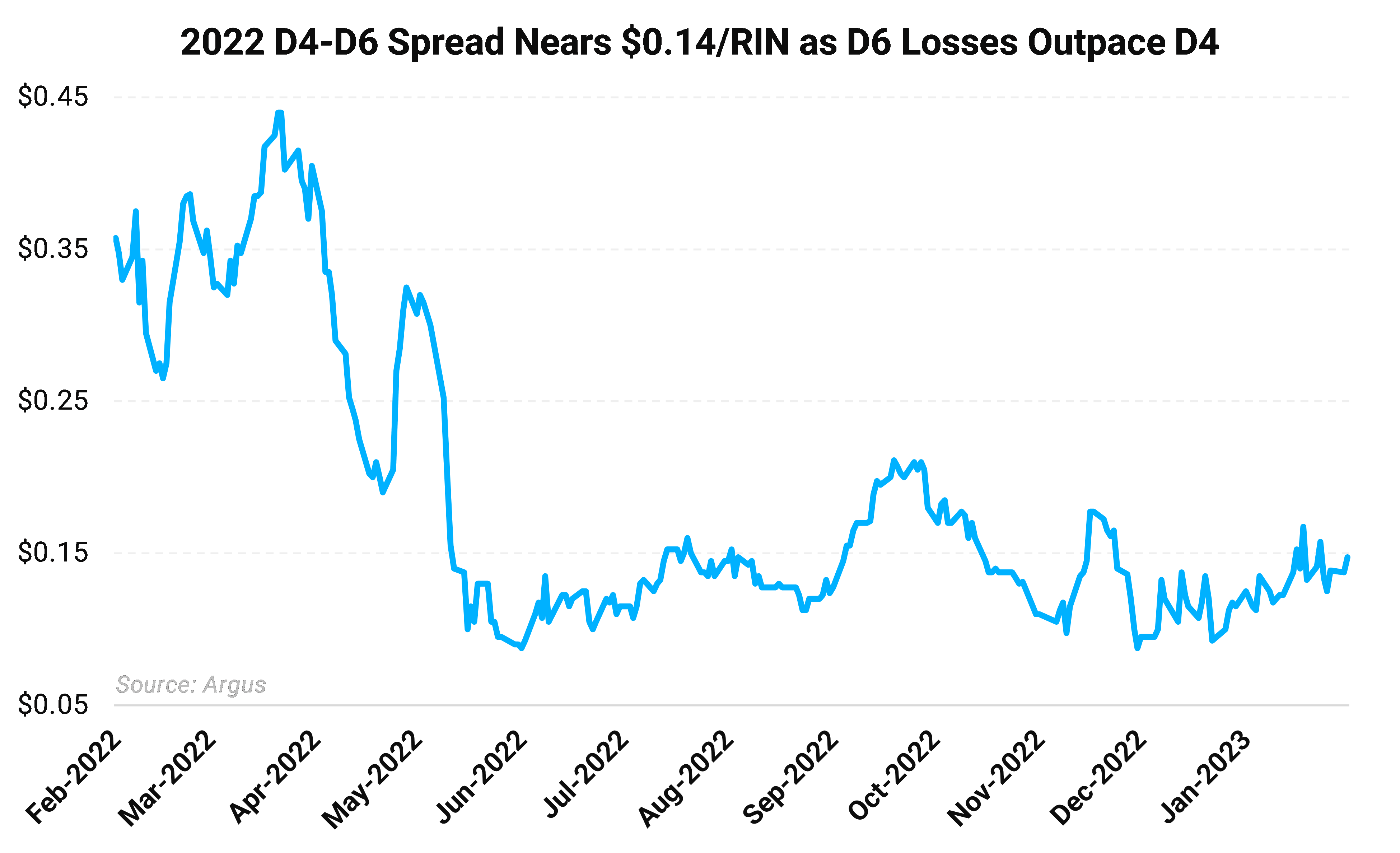

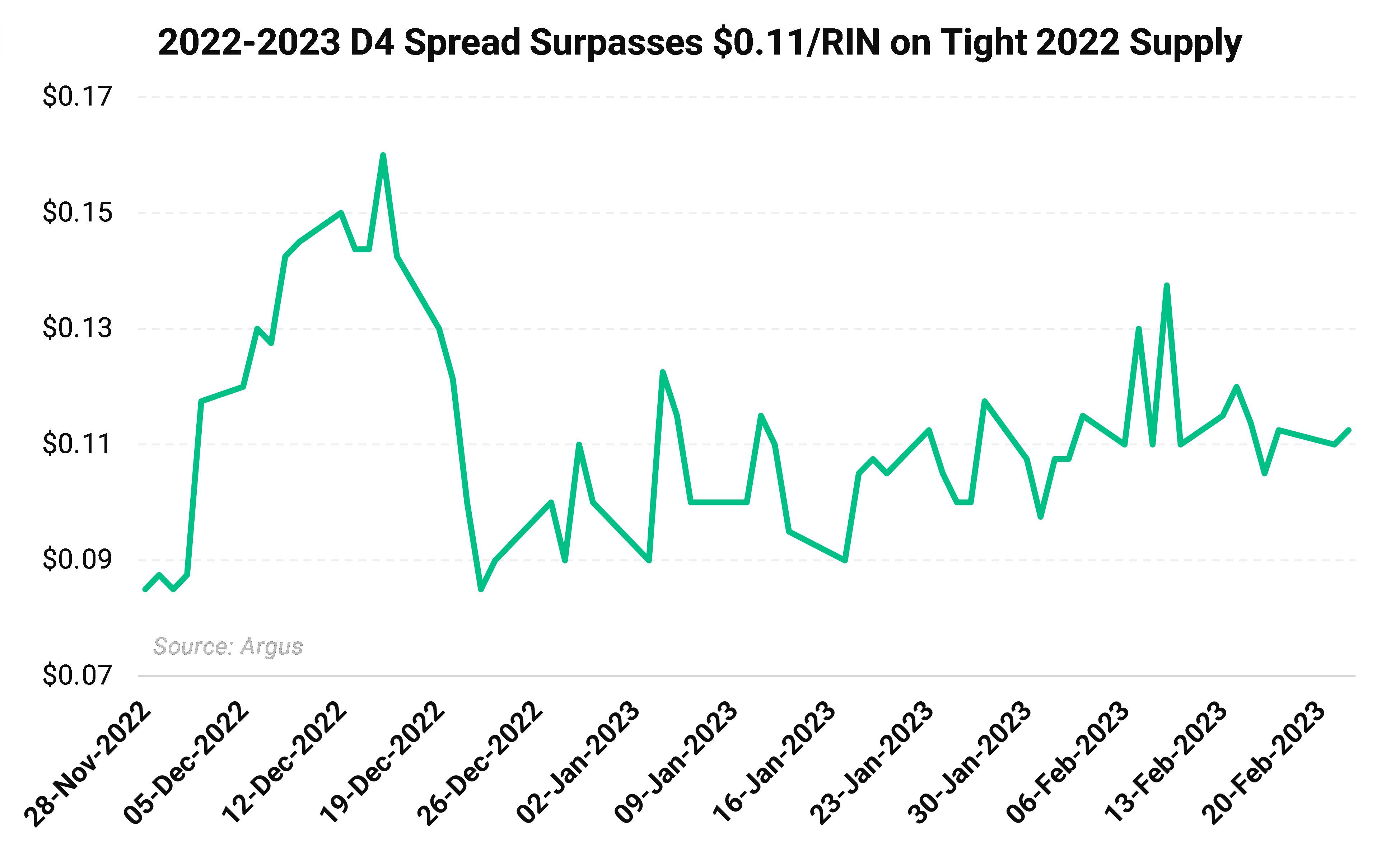

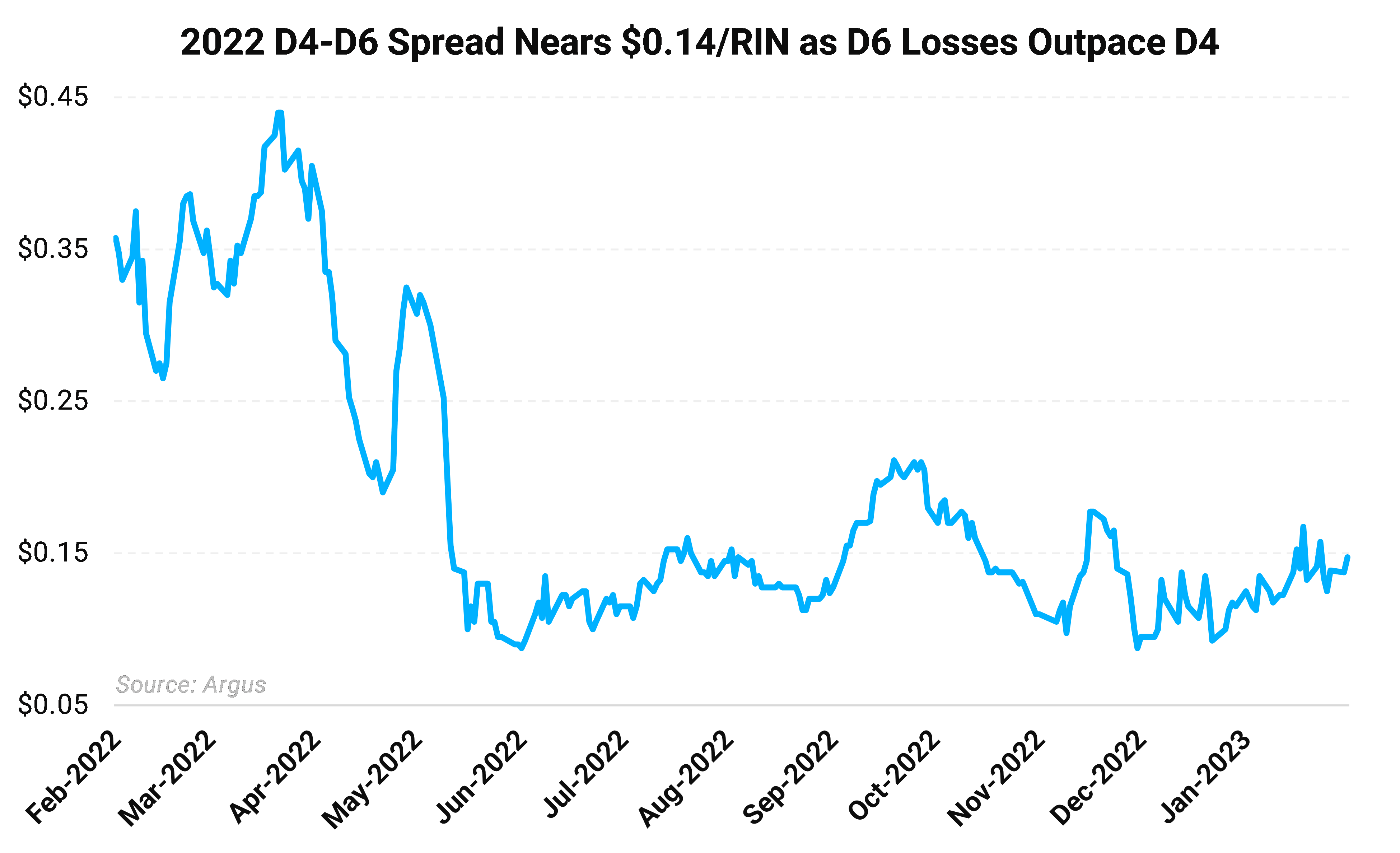

The 2022 D4-D6 spread hit the $0.14/RIN mark on average, reaching nearly $0.17/RIN on February 9, the day before the EPA comment period closed. The move came as the advanced biofuel industry issued comments requesting higher advanced blend mandates for the 2023-2025 ‘Set Rule.’

A wider D4-D6 spread implies a looser D6 supply as the D4 credit is the next vehicle of compliance in the absence of sufficient D6 RINs or the ability to use carryover credits. Conversely, a narrow D4-D6 spread implies a tight supply of D6 RINs. The theoretical cap on the spread is parity though D6s have traded at modest premiums to D4 credits in extreme circumstances.

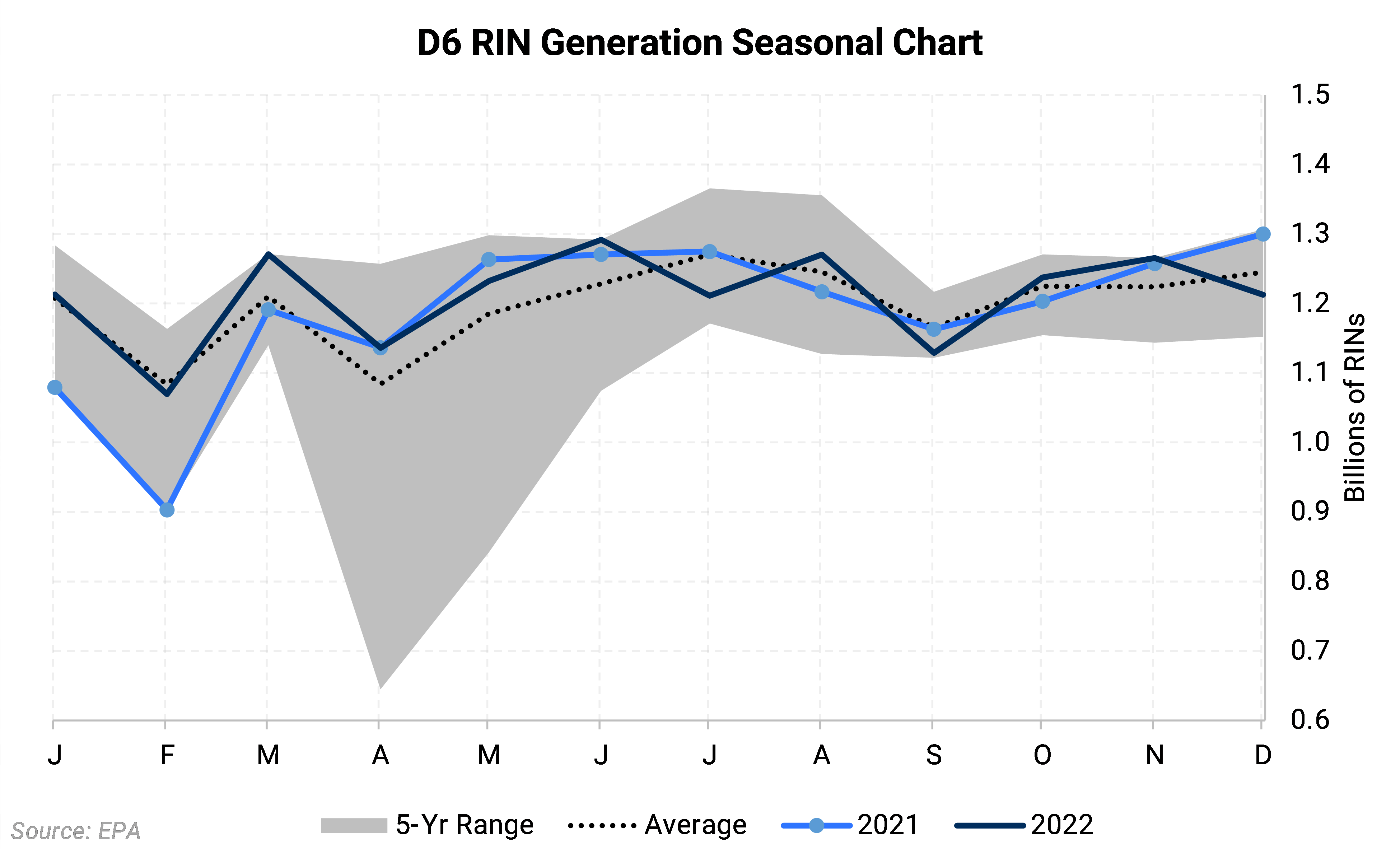

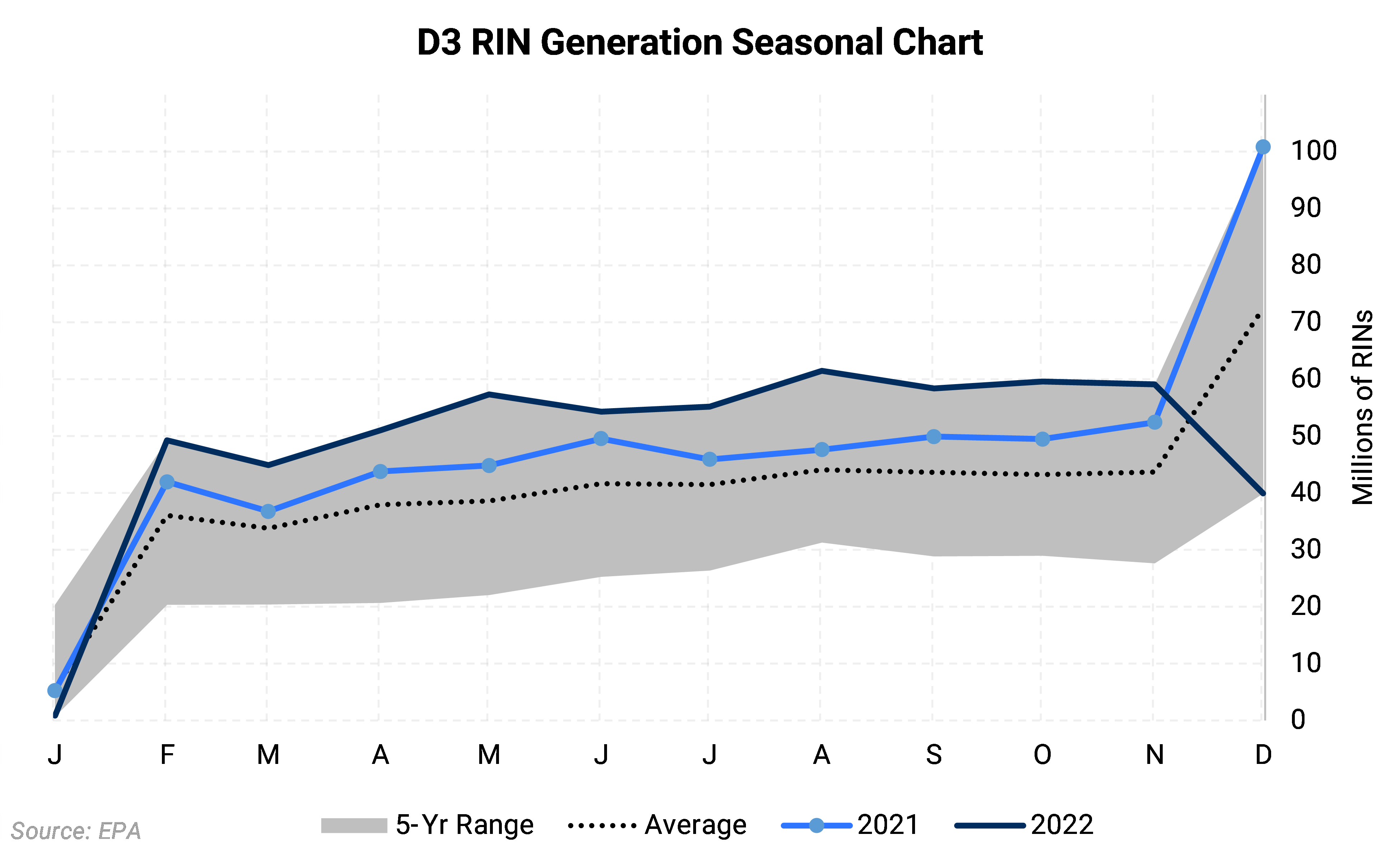

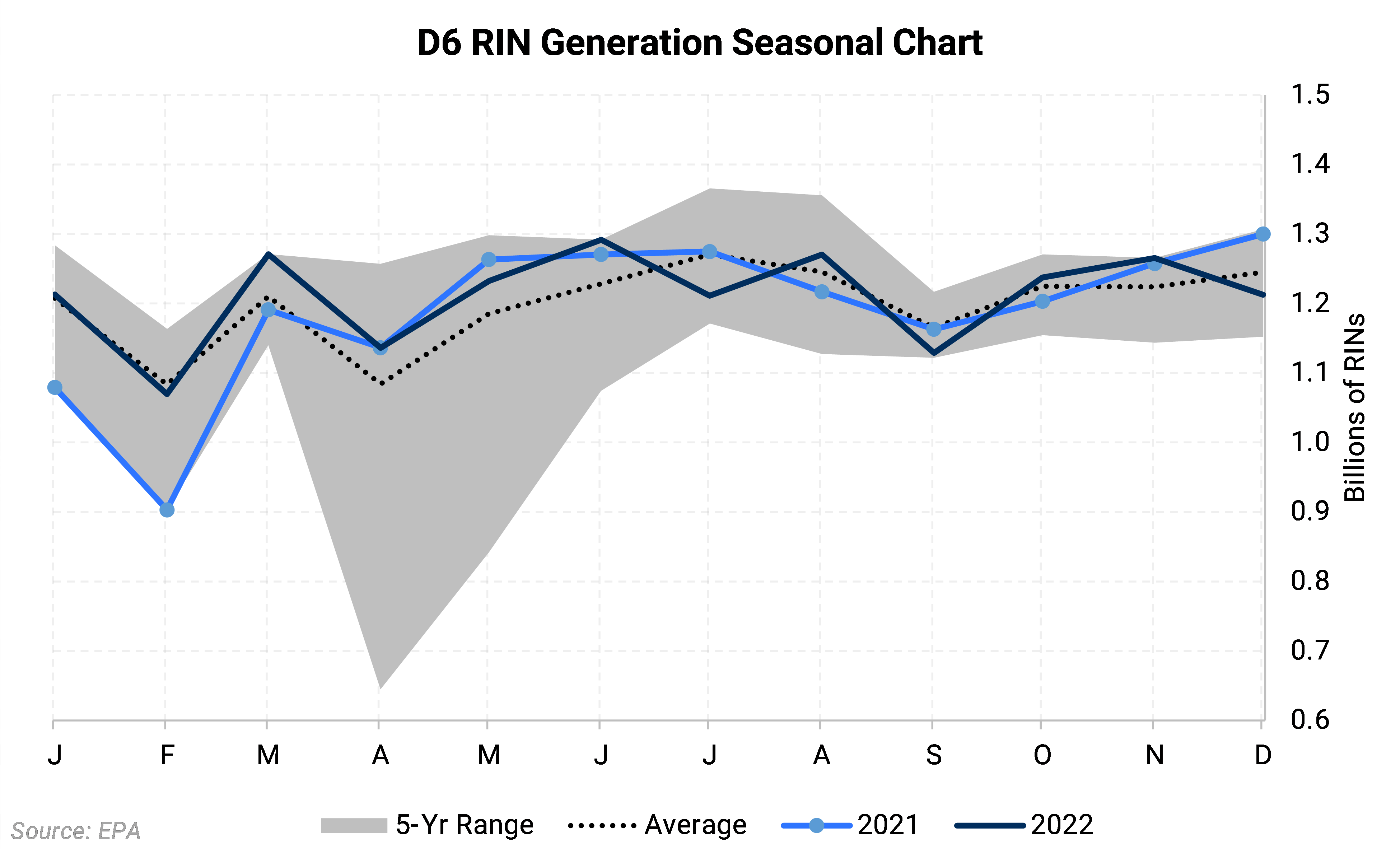

D6 RINs took the brunt of the bearish SRE news as any granted SRE petitions will free up more D6 RINs than any other D-category. January D6 RIN generation marked the highest monthly level since 2020, a month that typically is marred by lower blending. Recent government data confirmed the US is consistently able to blend in excess of the 10% blendwall even during the summer season when ethanol blending is constrained by RVP.

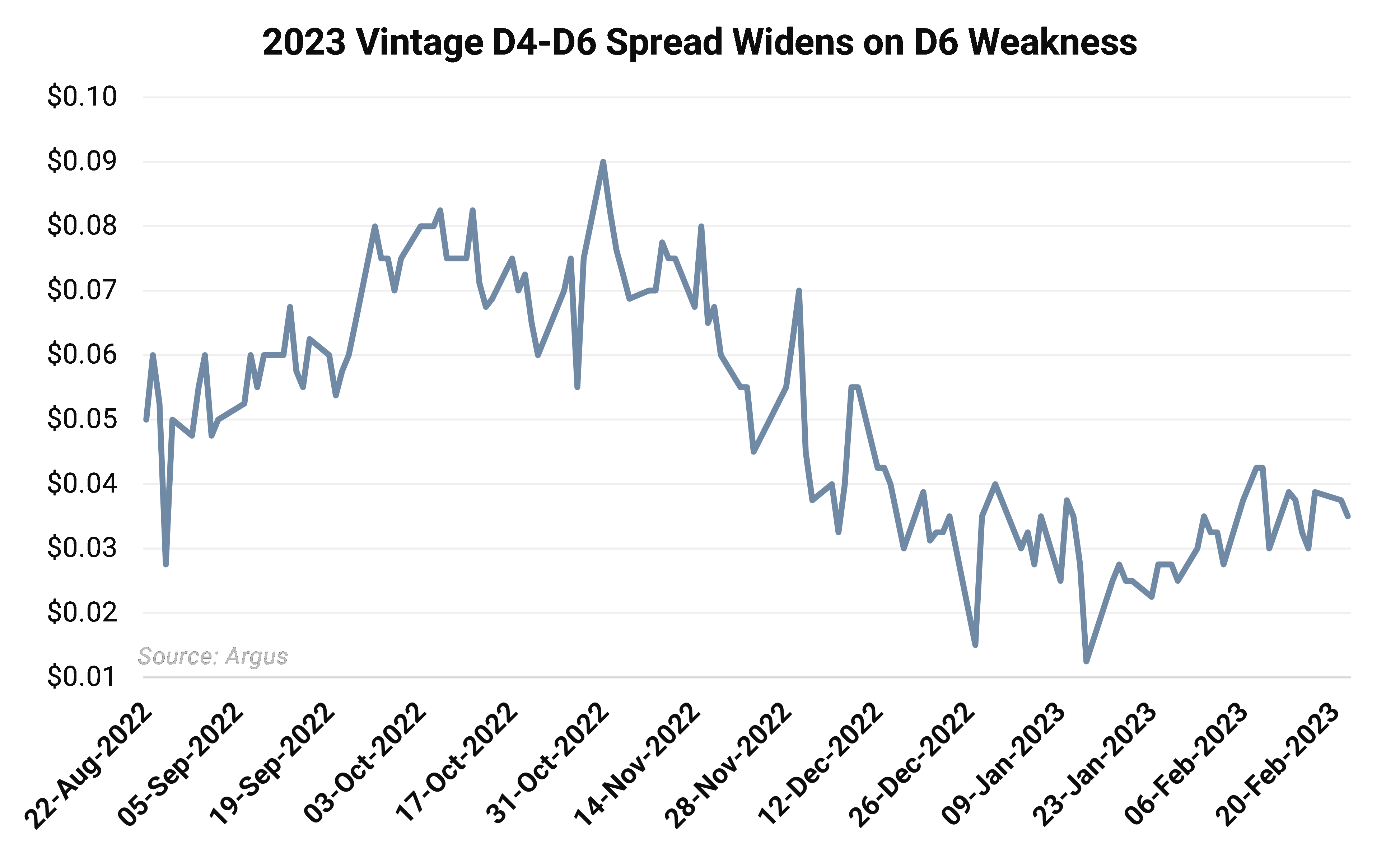

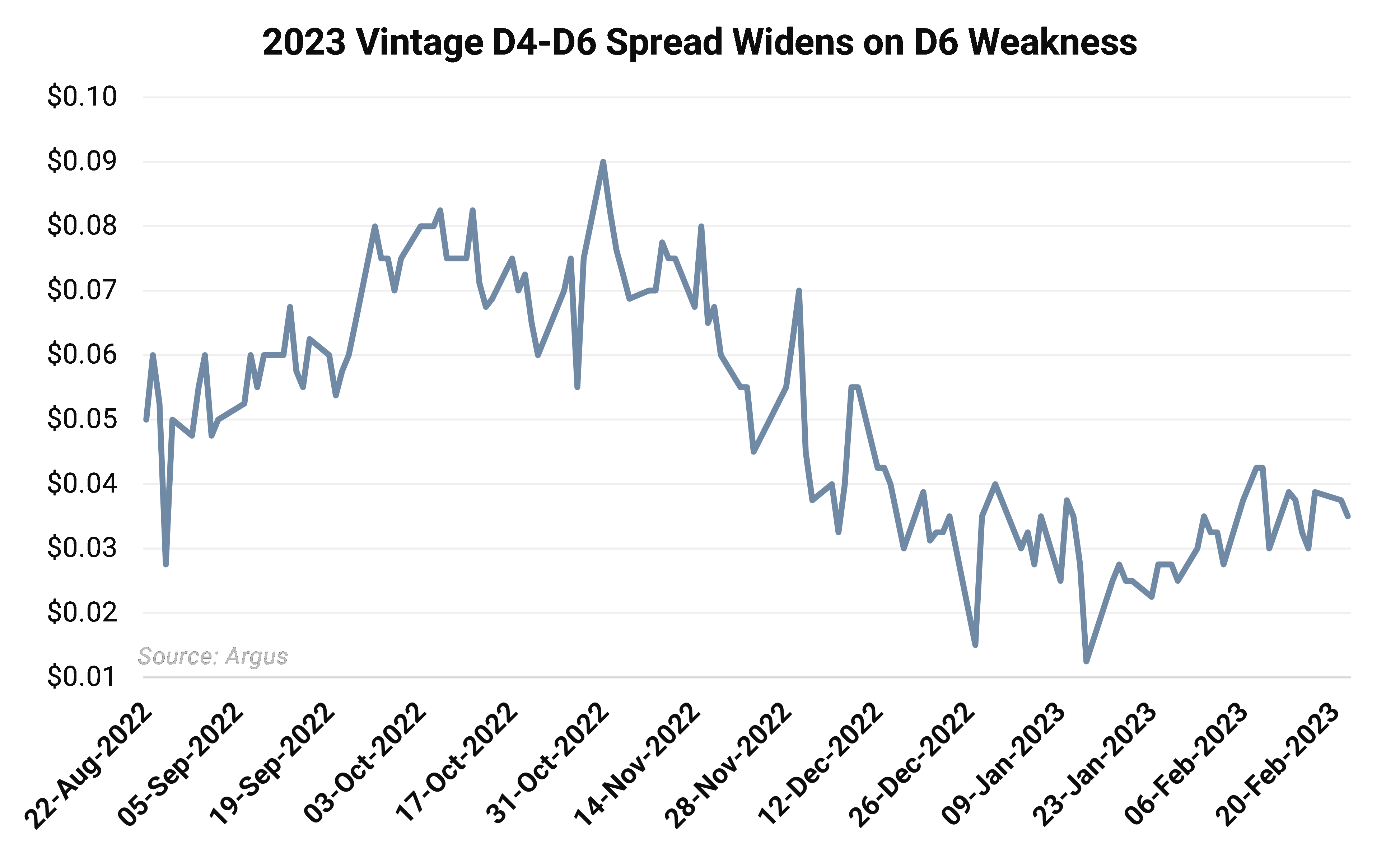

The 2023 D4-D6 spread also widened over the course of the month averaging $0.036/RIN over the course of the month, as the D6 market loosened up relative to D4 credits. As mentioned, robust January D6 generation showed healthy seasonal blending, while the specter of SREs clouded D6 credits of all vintages.

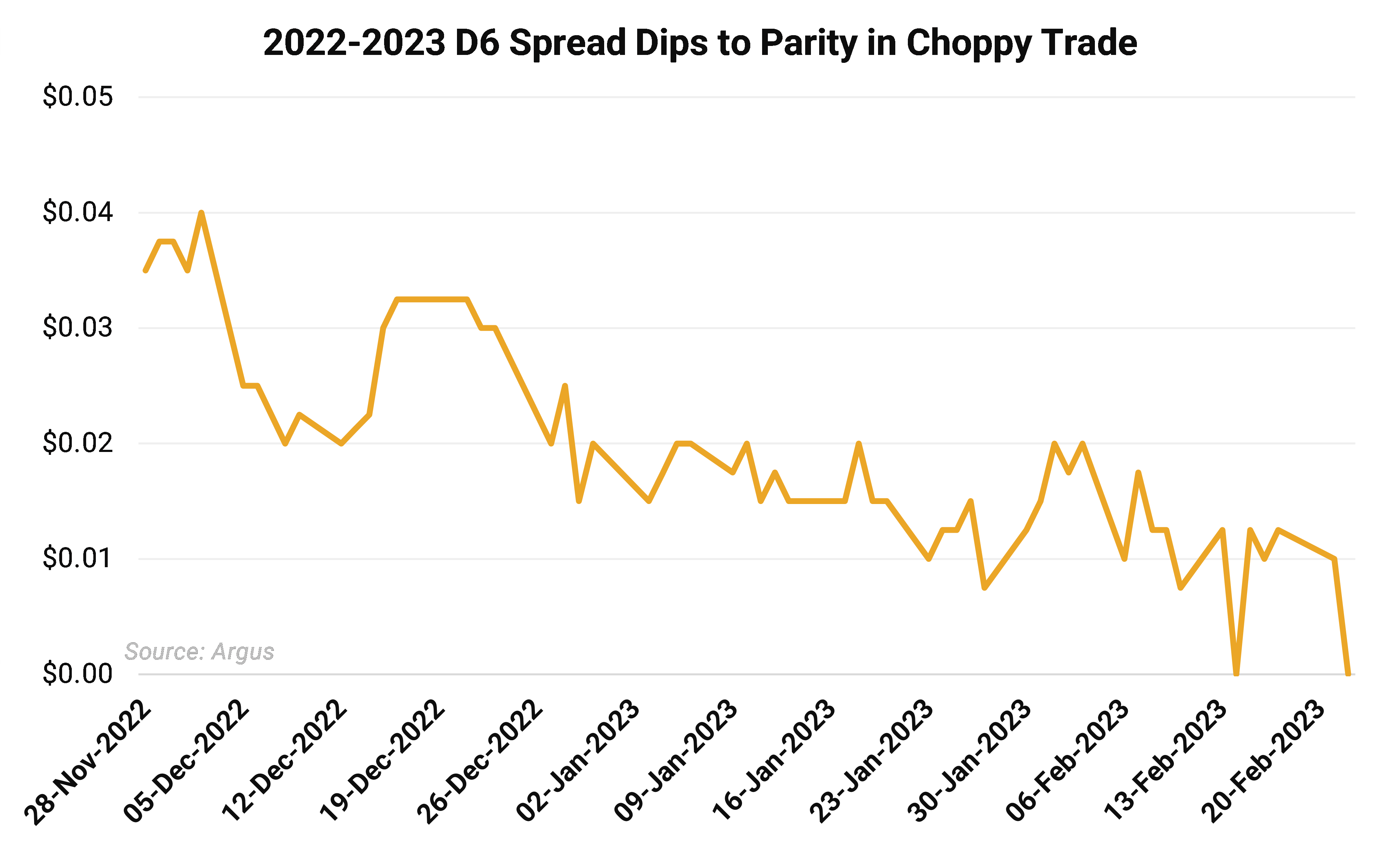

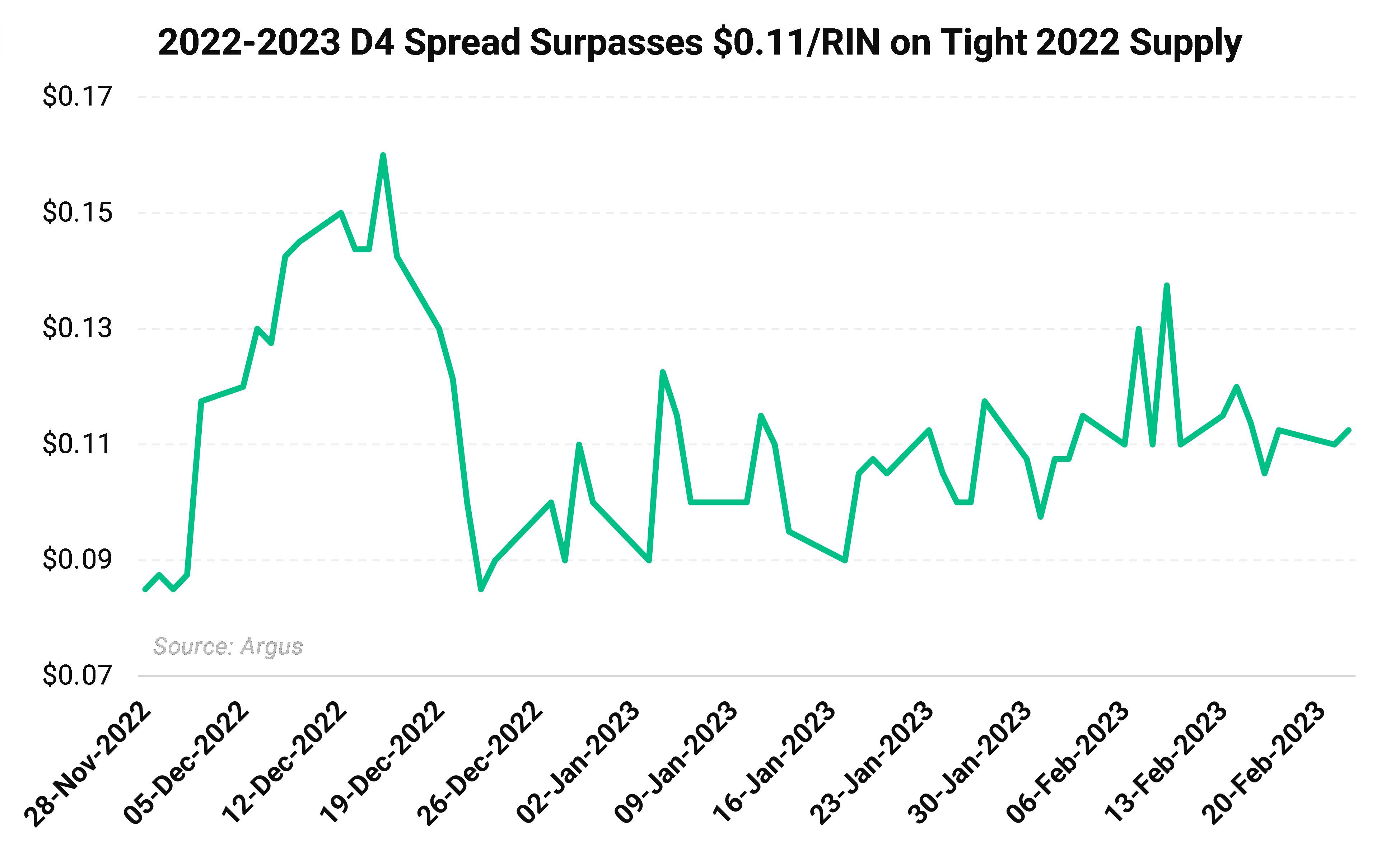

The remainder key RIN spreads saw increased volatility this month as the market grappled with the competing variables of the EPA comment period, the SRE court ruling and mixed RIN generation data. The 2022-2023 D6 spread, which has generally been trending lower since late-November of last year, finally touched parity twice during February. The spread only reached as wide as $0.02/RIN twice throughout the month. This convergence was likely spurred by SRE concerns and near-record high January D6 RIN generation.

The inter-vintage D4 RIN widened to average over $0.11/RIN throughout February. D4 credits trended higher over the course of the month. Yet losses in 2023 vintage RINs slightly outpaced 2022 D6s on a month-over-month basis as it is now clear to obligated parties that 2022 vintage D4 RINs will be needed for compliance with the Renewable Fuel, or D6, obligation given a 720 million RIN shortfall.

EPA RIN Generation Data as of February 16:

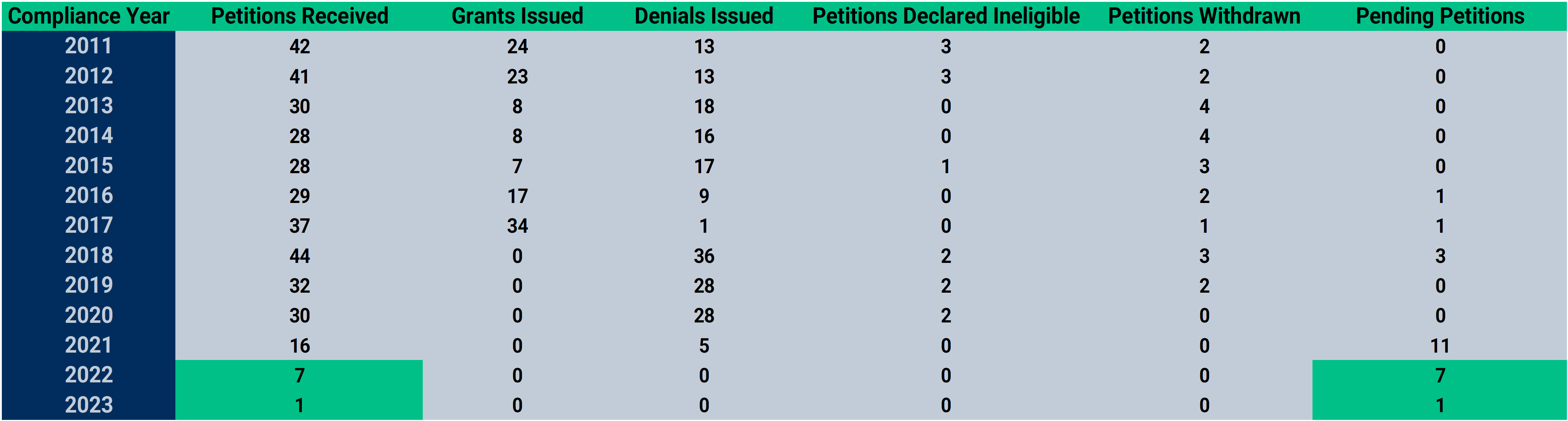

EPA Small Refinery Exemption (SRE) Data as of February 16:

Some of the price and regulatory risk in the development of the renewable fuels markets is controllable through hedging or pre-selling. Other risks require constant monitoring of pending changes to regulations and programs. AEGIS can help with both.

Our environmental experts are here to help you. If you’re facing price or regulatory risk, reach out today.