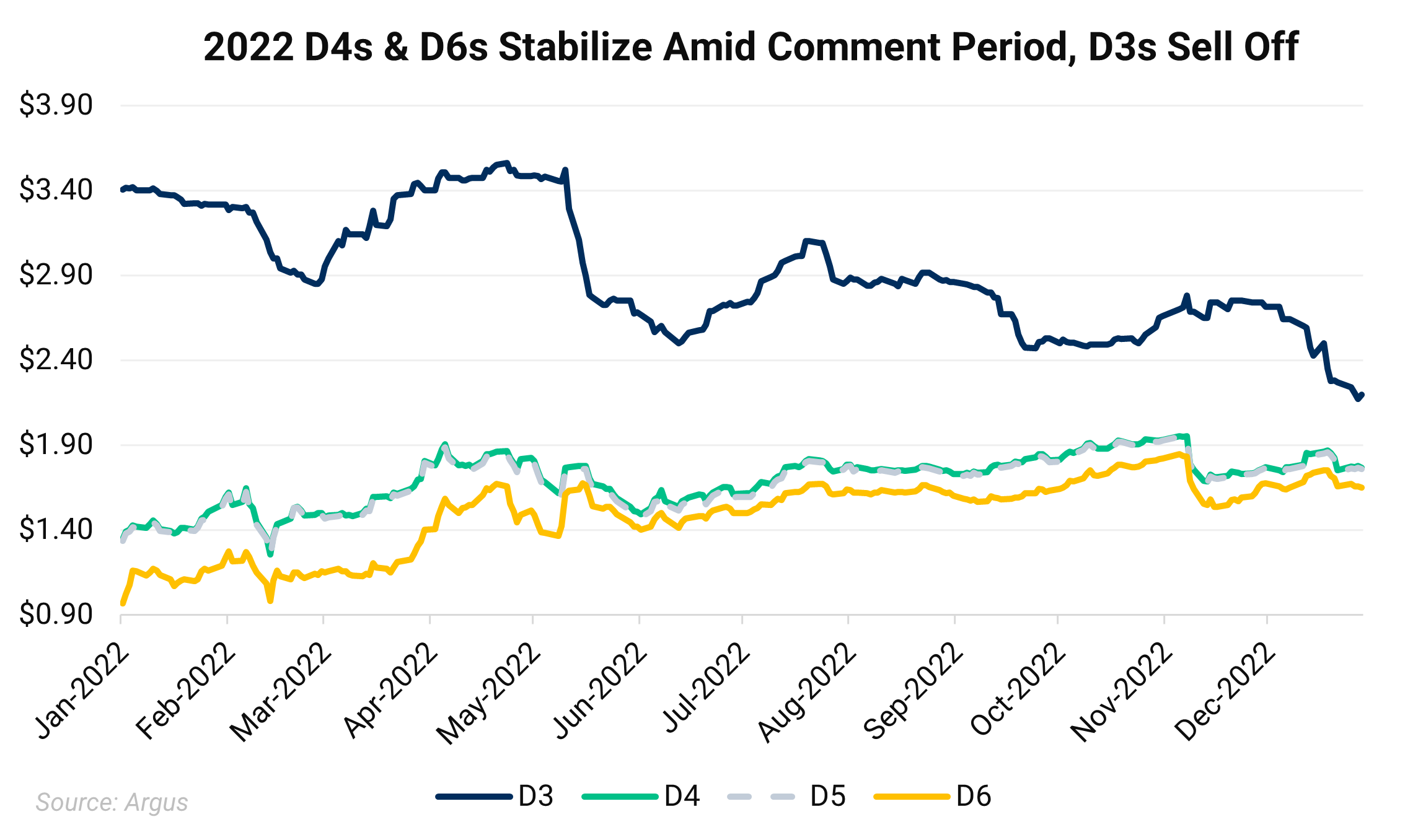

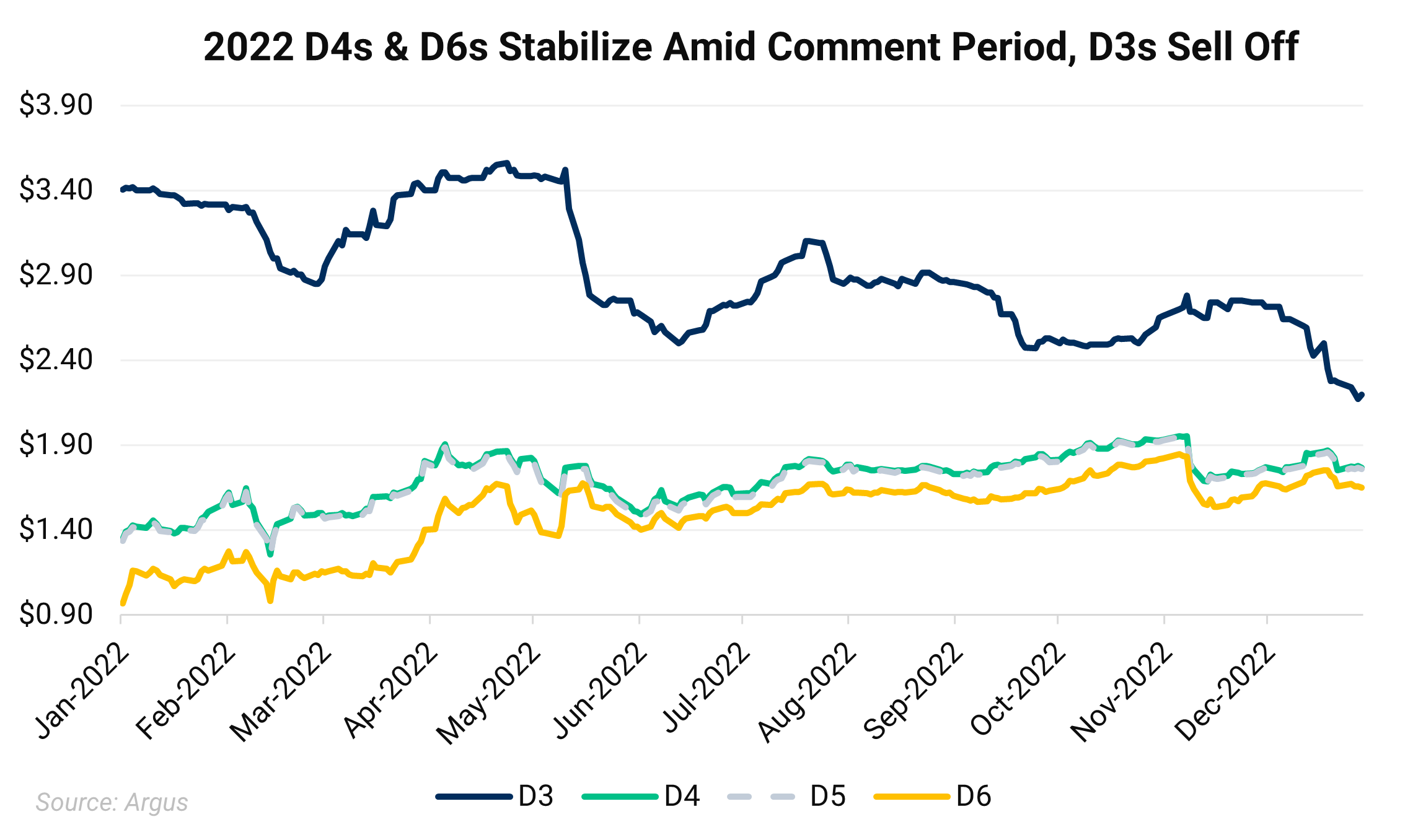

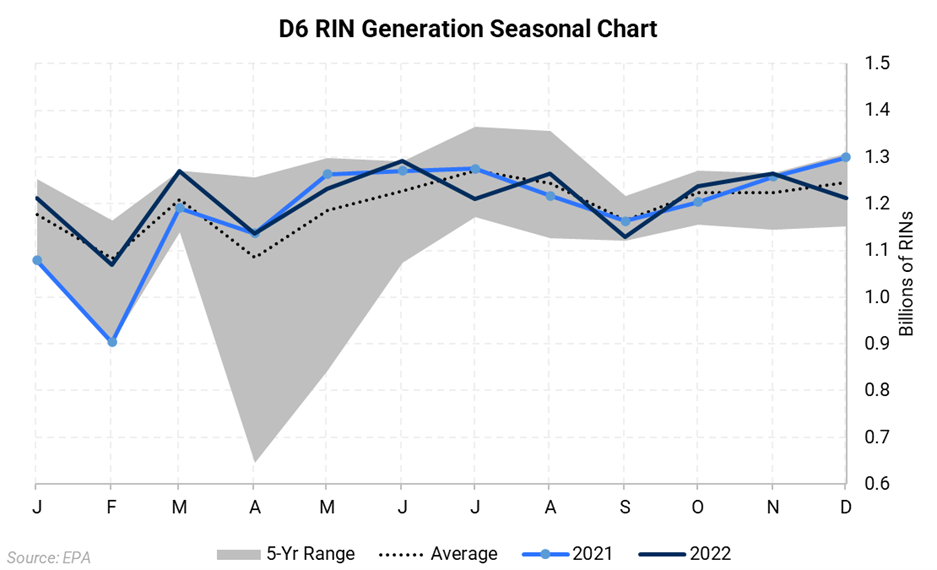

Total 2022 D6 RIN generation came in relatively tight to mandated levels, while excess advanced credits left breathing room for obligated parties. The public comment period for the ‘Set Rule’ lifted RIN prices briefly, while regulatory uncertainty saw both prices and spreads sink into rangebound trade.

- The EPA’s proposed ‘Set Rule’ entered a one-month public comment period on January 10, with nearly every stakeholder opposed to the introduction of the electric RIN (eRIN) except for the sole beneficiary—automakers.

- At the center of the issue is who earns the credit. By allowing only auto manufacturers to earn the eRIN, the EPA is choosing to promote one technology which contravenes the statutory purpose of the Renewable Fuel Standard (RFS), which is to boost renewable fuel use.

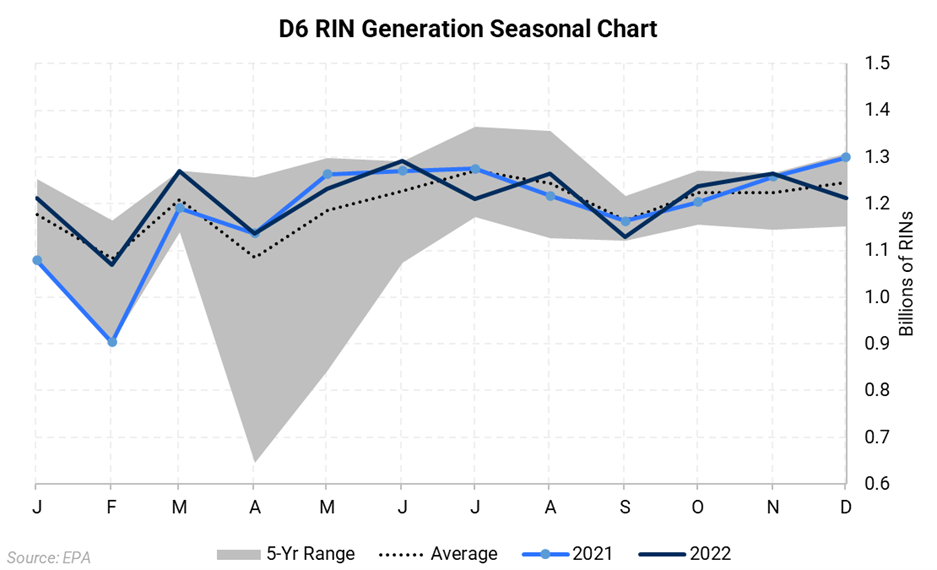

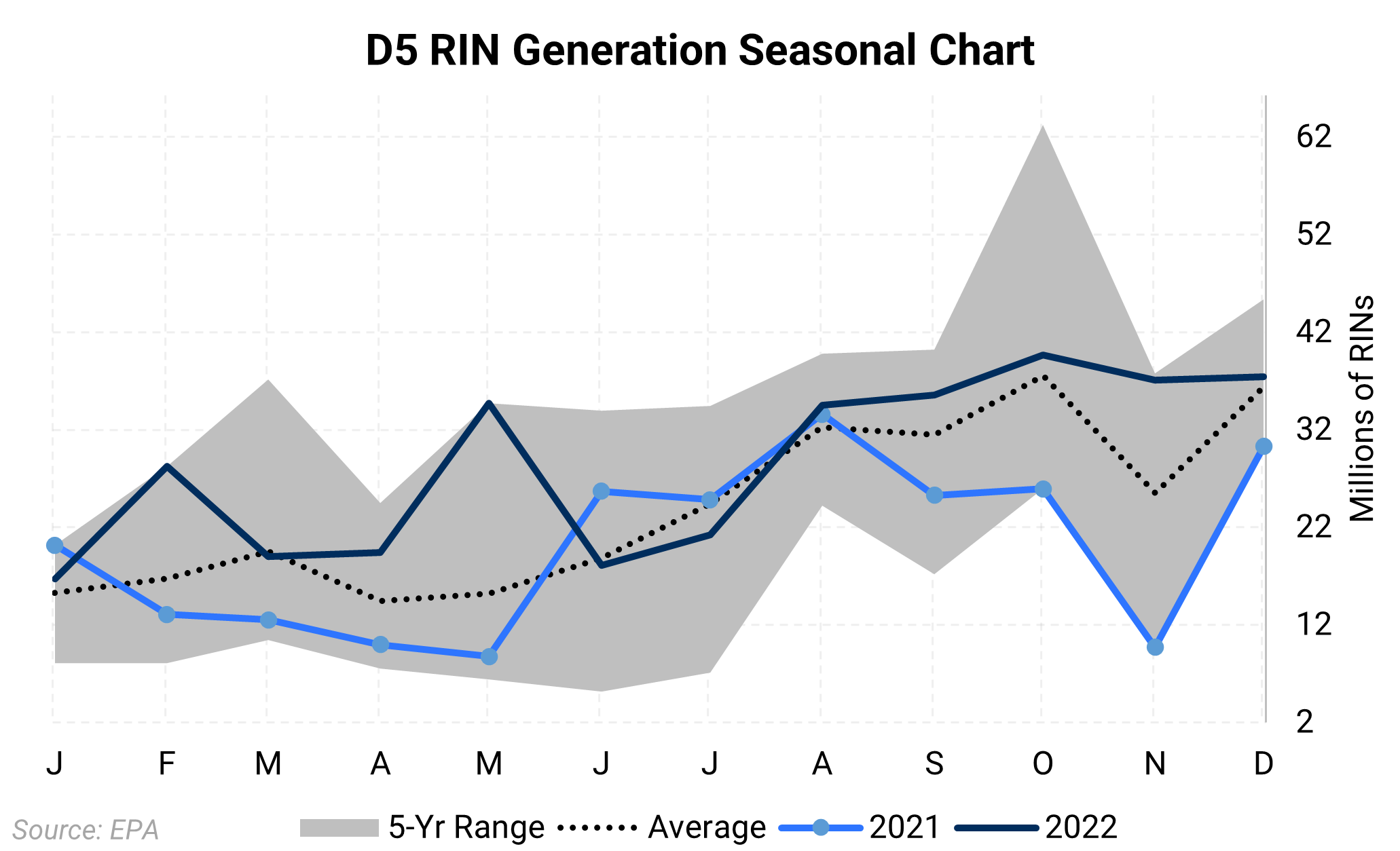

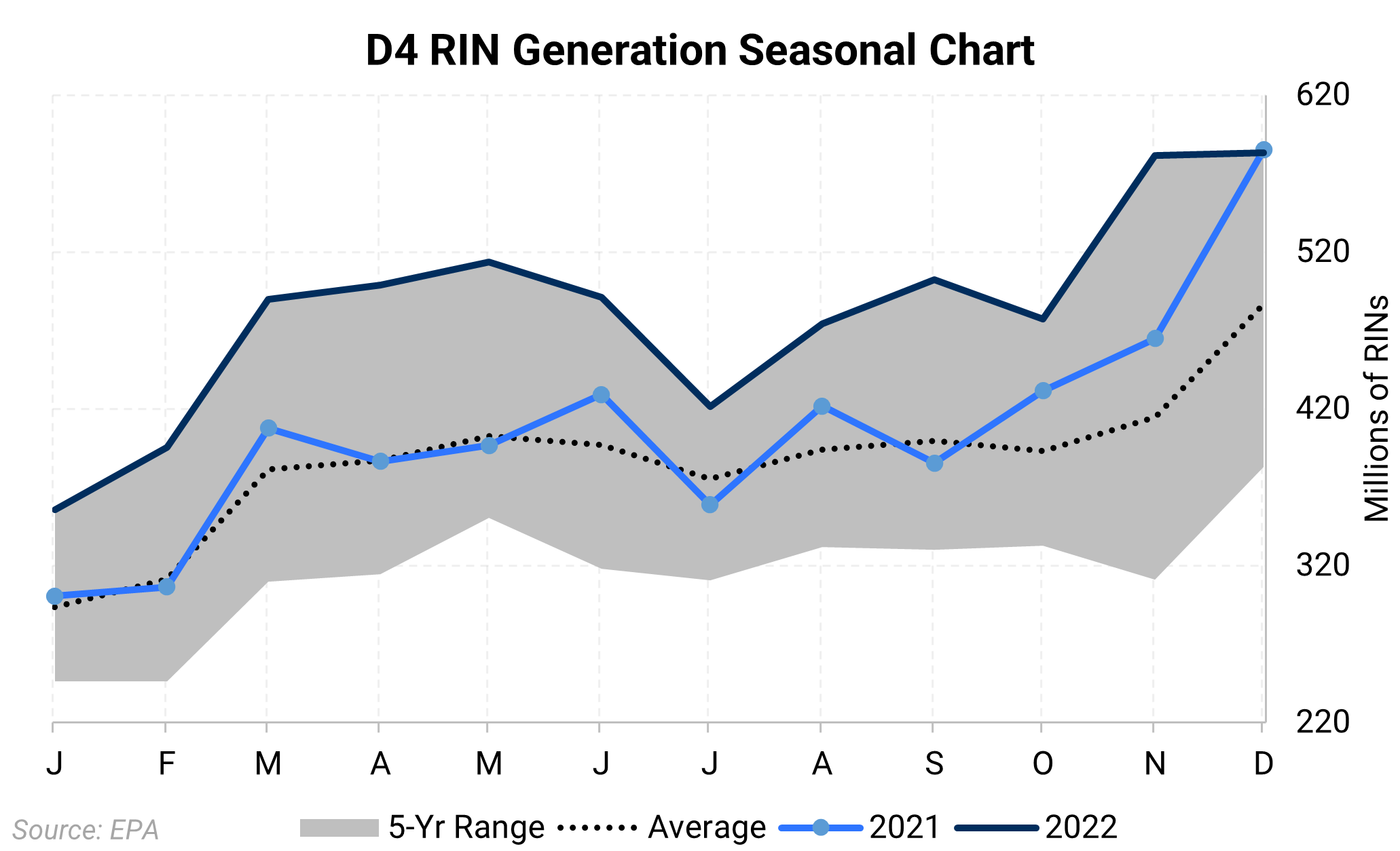

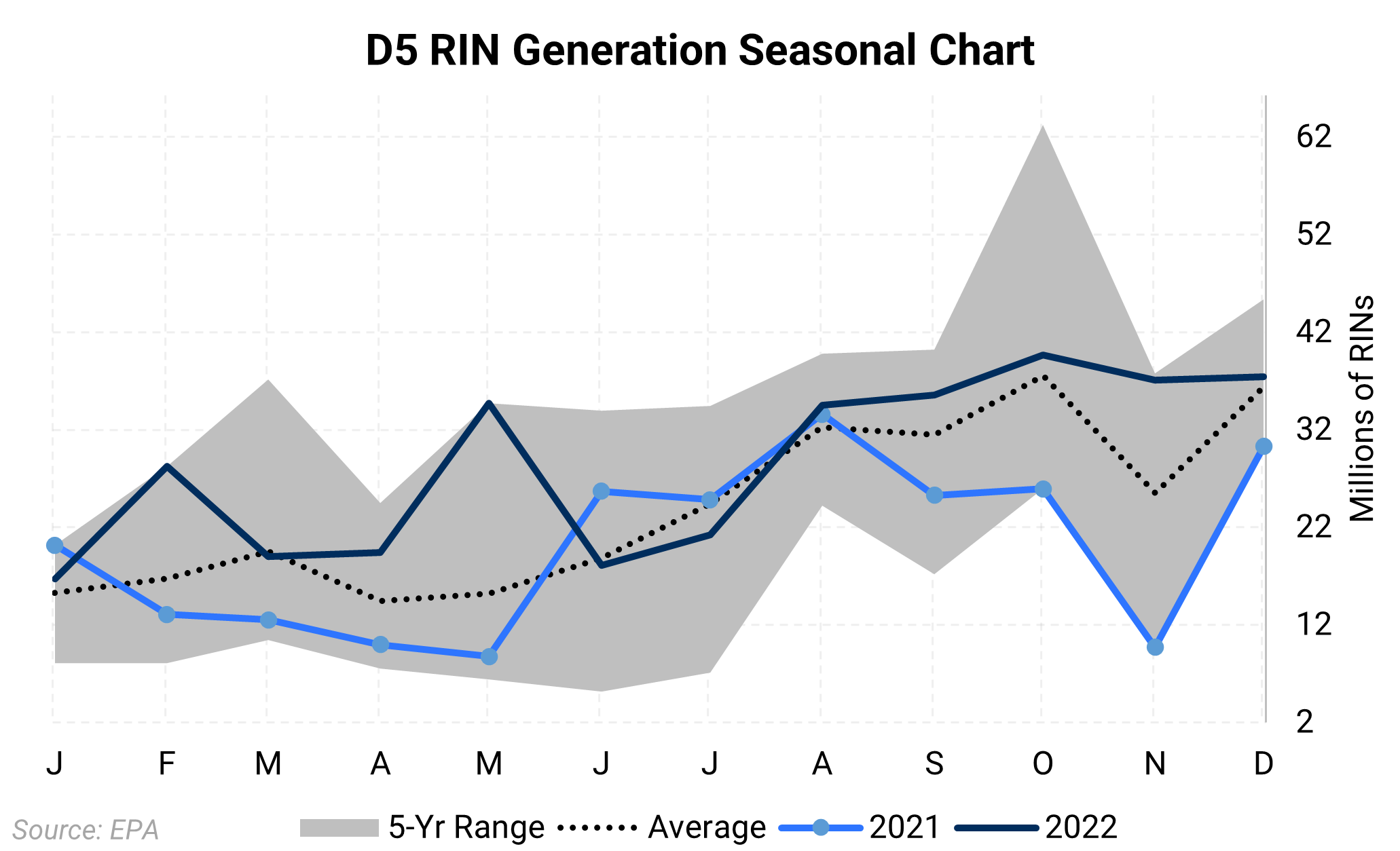

- December RIN generation data showed total D6 RIN generation falling roughly 1 billion credits short of the mandated 15.25 billion gallons under the final 2022 standards. Excess D4 and D5 credits can easily make up the shortfall, alongside obligated parties (OPs) using banked prior year credits to meet compliance.

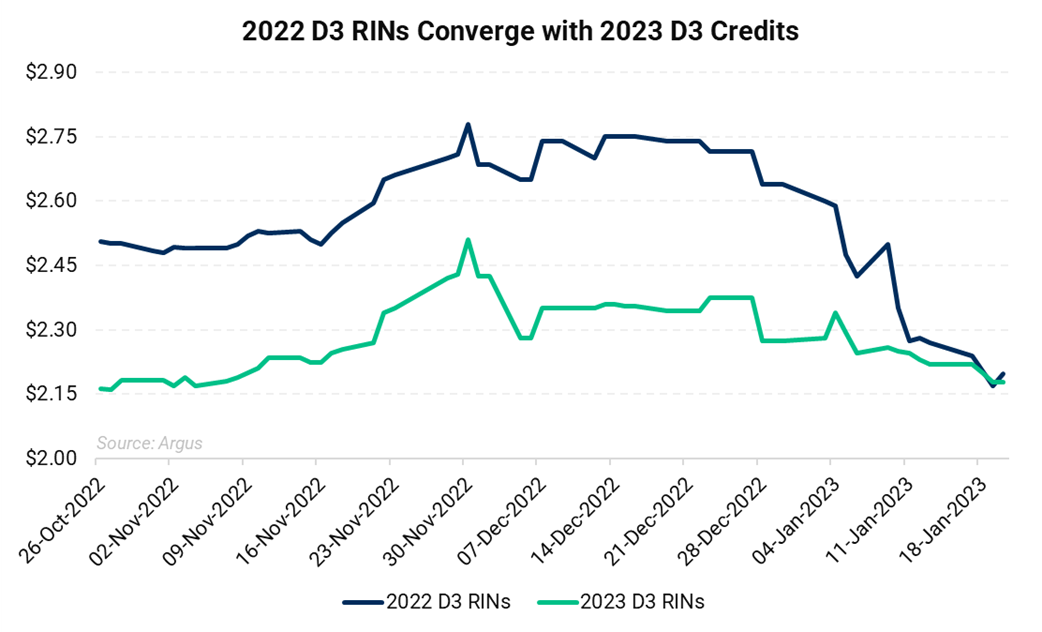

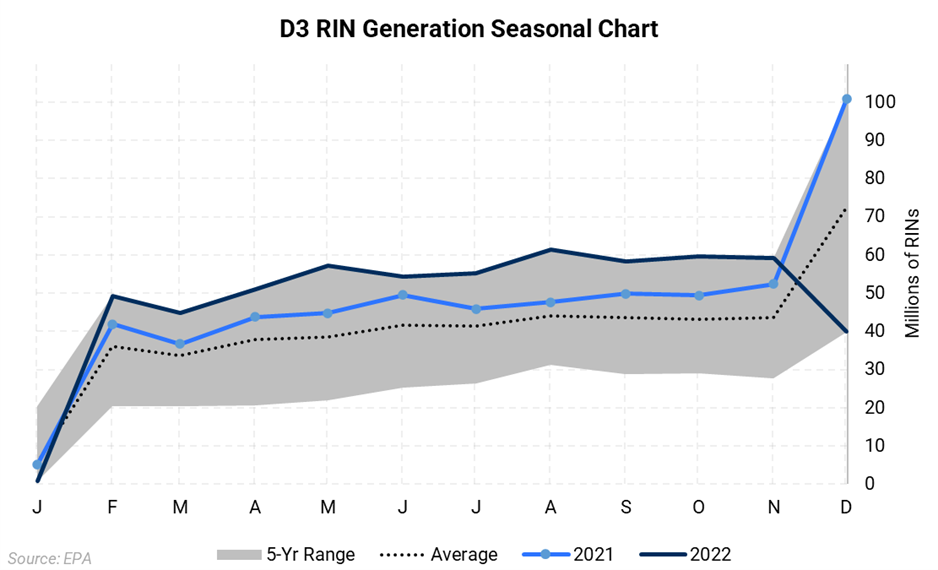

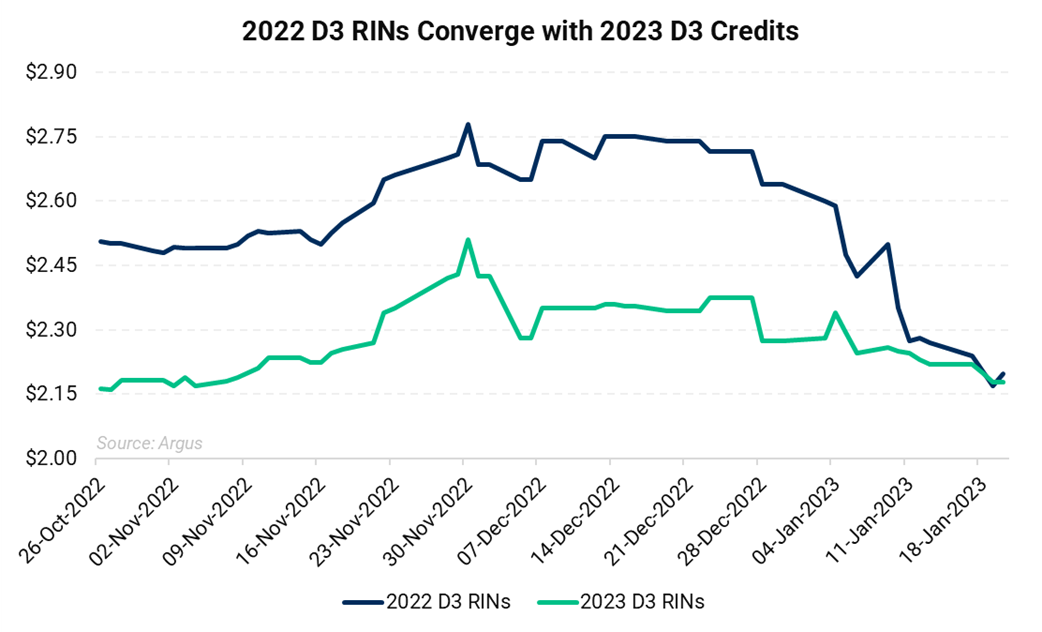

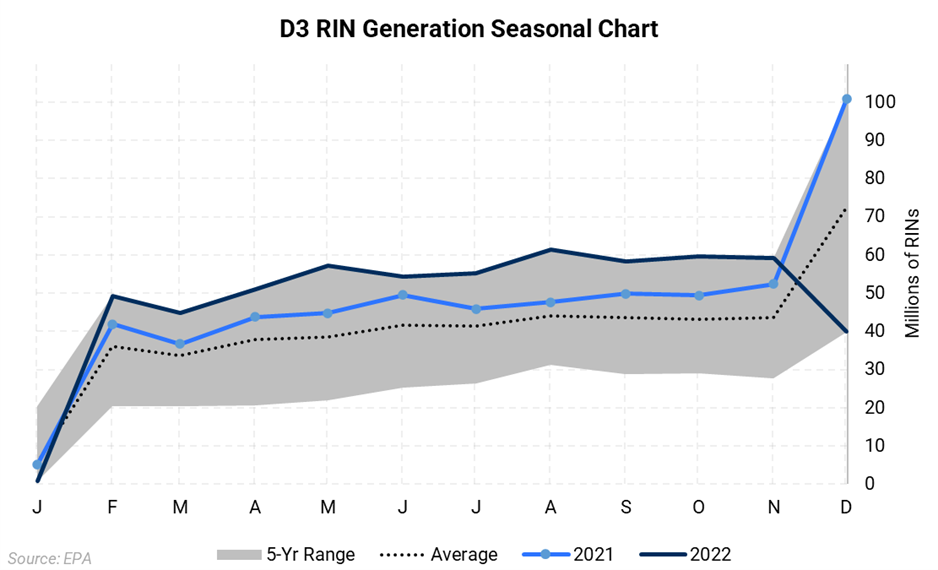

- D3 generation proved underwhelming last month as well, yet OPs seemed unconcerned given the 2024 standard as well as challenges to the eRIN pathway all of which led 2022 D3 RINs to converge with the 2023 vintage D3 market. Low December generation suggests a large January production number is likely on the way. The proposed removal of the cellulosic waiver authority under the ‘Set Rule’ could also be weighing on pricing; at least now.

Calendar:

- January 10, 2023: EPA’s virtual public comment period commences.

- February 10, 2023: EPA comment period closes.

- June 14, 2023: EPA deadline to finalize 2023-2025 volumes.

Relevant News:

- Seven Midwest states are pushing to remove the 1.0 Reid Vapor Pressure (RVP) waiver for E10 sales to promote year-round sales of E15. The move is a gamble to bring only incremental volumes of ethanol into the marketplace, yet would severely disrupt the operations of refiners, pipelines, and storage facilities, in turn raising fuel costs and leaving the region prone to more frequent and longer-lasting gasoline supply shocks. The EPA can block the measures for up to two years.

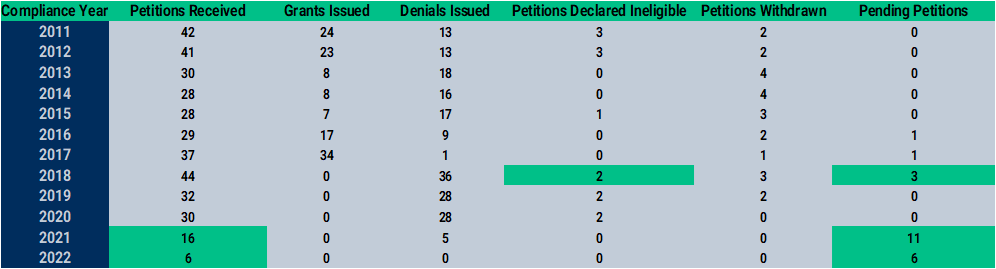

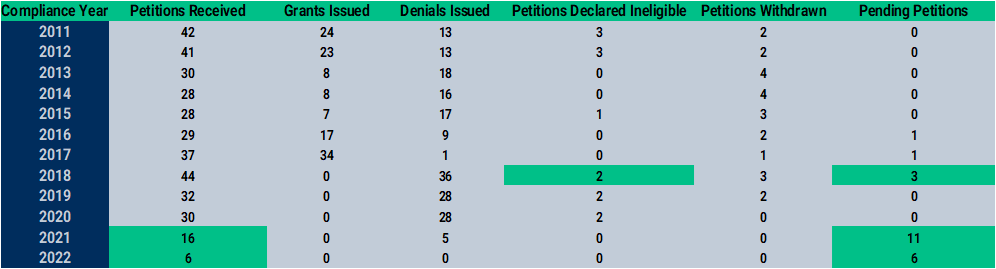

- Ten new small refinery exemptions (SREs) were filed as of January 19, leaving 22 pending petitions. Seven of the newly filed petitions were for the 2021 compliance year, with three for the 2022 compliance year. Two 2018 SREs were changed to pending from ineligible.

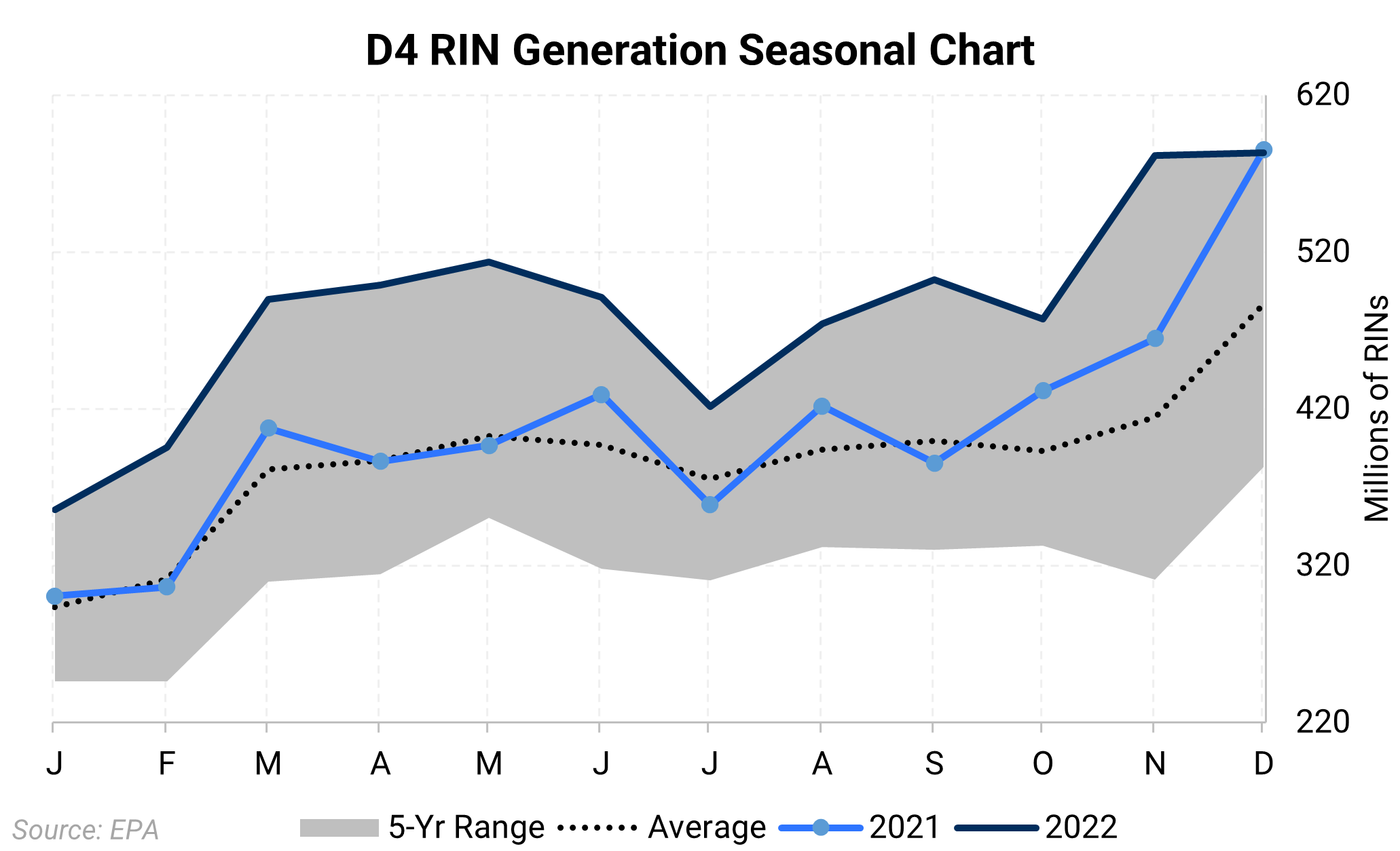

- LanzaJet received EPA approval to generate D4 RINs for sustainable aviation fuel (SAF) and renewable diesel produced from sugarcane ethanol at the company’s Freedom Pines Fuel Facility in Soperton, Georgia. This marks the first time ethanol has been approved by the EPA as a feedstock to produce other fuels under the Renewable Fuel Standard. The company plans to produce 10 million gallons of SAF and renewable diesel annually using the ethanol pathway along with waste-based feedstocks.

- An EIA analysis showed the US achieved 10.5% ethanol blending on average last summer, the highest on record. The creeping adoption of higher blends like E15 and E85 saw the agency nudge up its forecast average ethanol blend rate for 2022 to a record 10.4%.

2022 D6 RINs gained $0.03/RIN, or 1.8%, over the course of the month, with strength seen during the lead up to comment period before prices retreated to as low as $1.65/RIN. The 2022 D4 credits rose $0.02/RIN, settling in around the $1.77/RIN mark in choppy, thin trade driven by the comment period. The 2022 D3 RINs plummeted $0.40/RIN, or 15.5%, to converge with the 2023 D3 market as the comment period prompted heavy selling (see below).

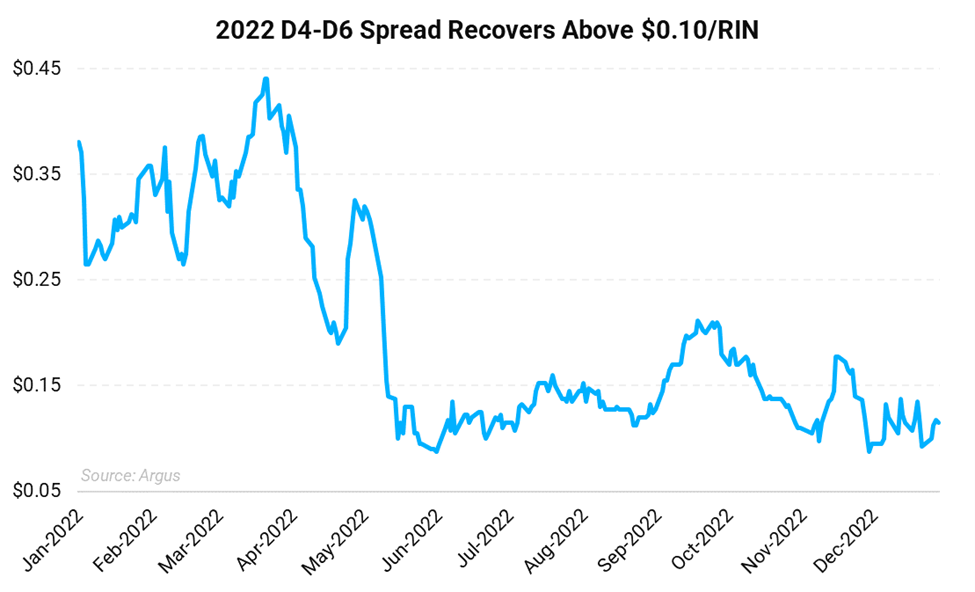

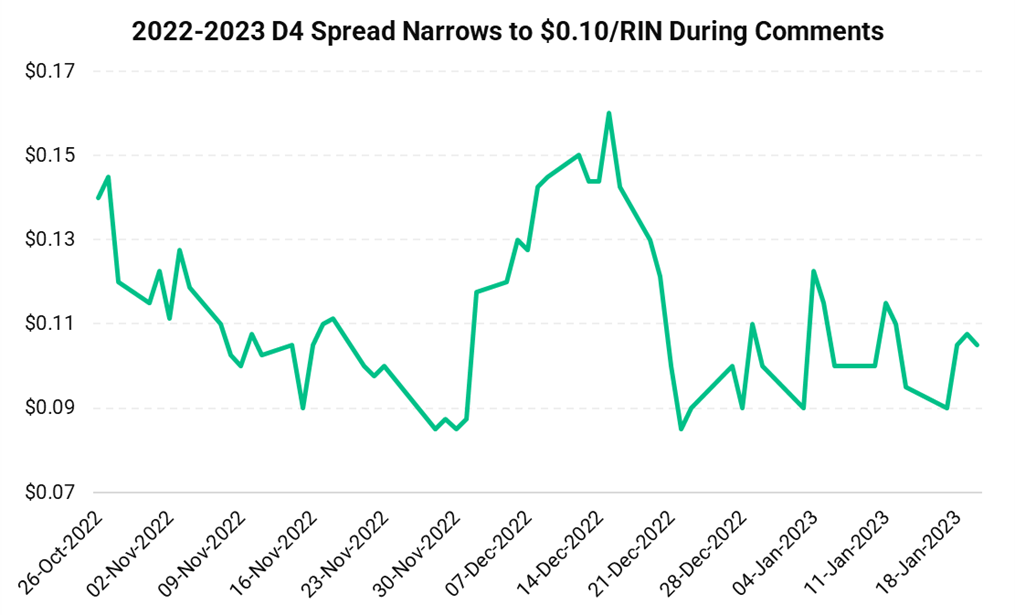

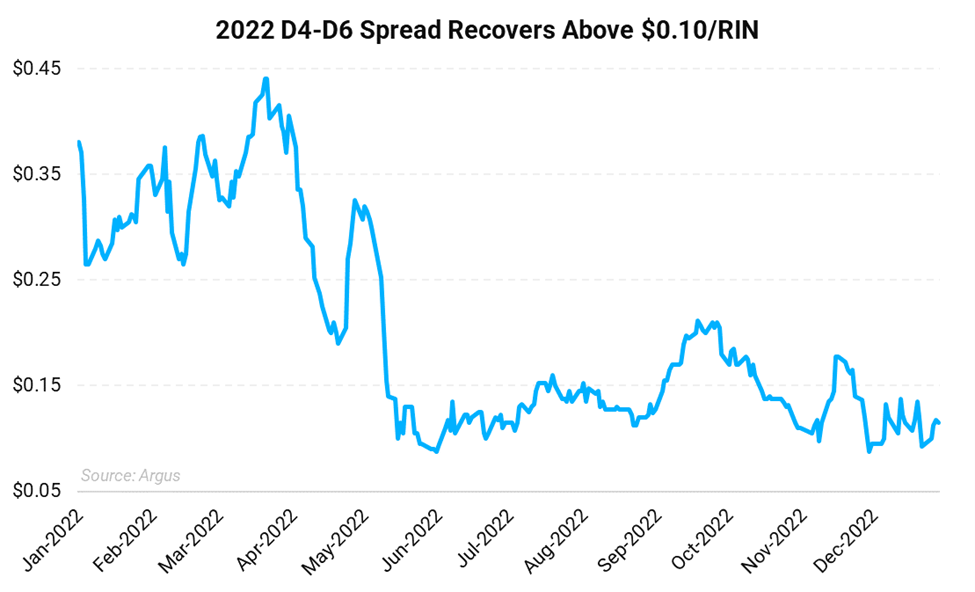

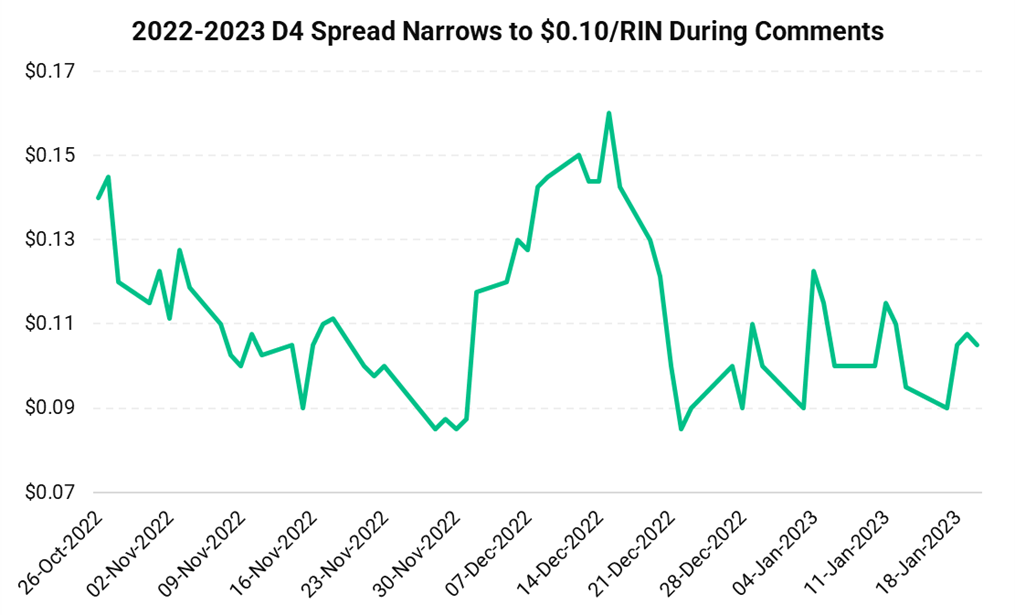

The 2022 D4-D6 spread recovered above the $0.10/RIN mark after narrowing to as low as $0.087/RIN last month. The move came as diesel prices rebounded more than 10% adding modest support to the D4 RIN market, while government data showed the US blended in excess of the 10% ‘blendwall’ last year reaching as high as 10.5% during the summer season when ethanol blending is constrained by RVP.

A wider D4-D6 spread implies a looser D6 supply as the D4 credit is the next vehicle of compliance in the absence of sufficient D6 RINs or the ability to use carryover credits. Conversely, a narrow D4-D6 spread implies a tight supply of D6 RINs. The theoretical cap on the spread is parity, though D6s have traded at modest premiums to D4 credits in extreme circumstances (note 2013).

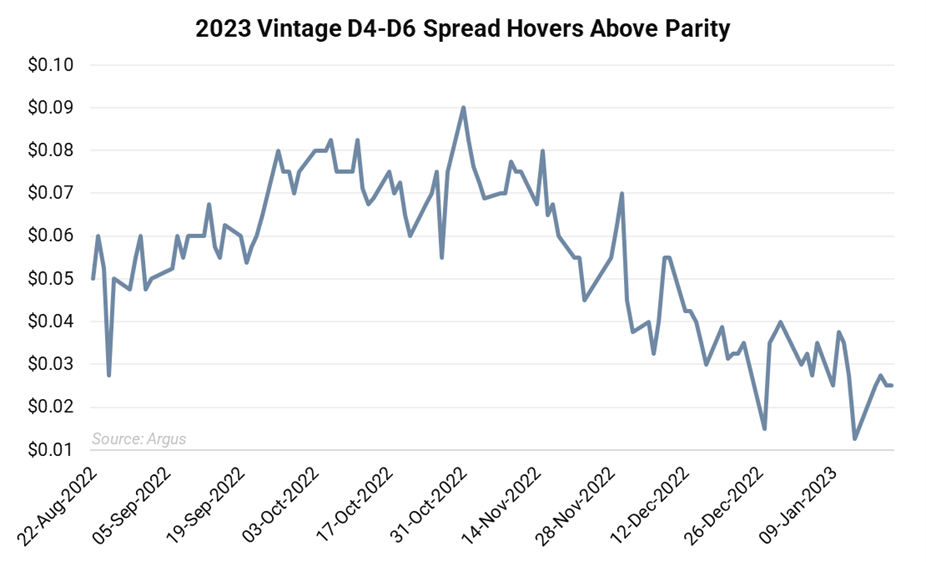

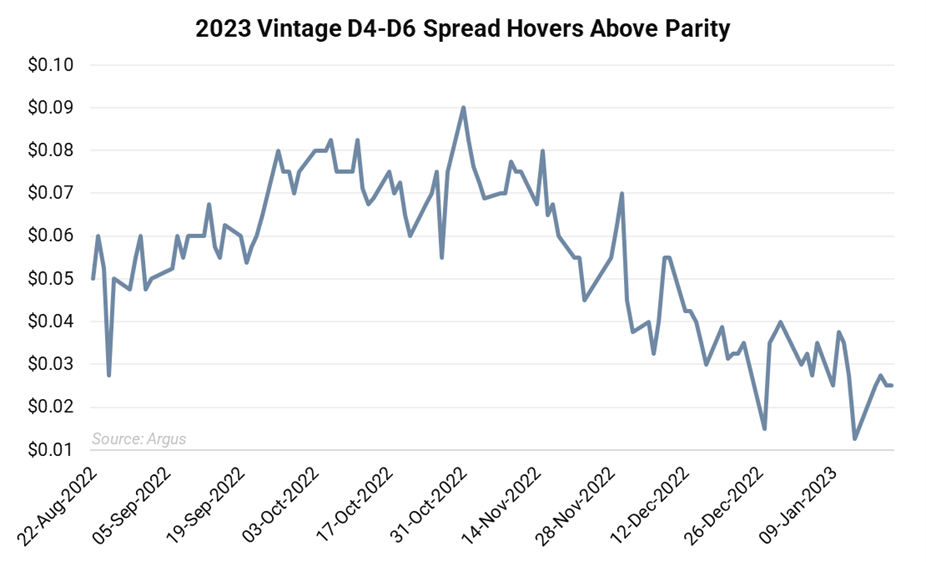

The 2023 D4-D6 spread stands in stark contrast to the 2022 supply balance. With the spread averaging $0.028/RIN over the course of the month, the market views a much tighter D6 market relative to the advance credit market. This is in line with the more stringent ethanol targets in the proposed ‘Set Rule’ alongside more achievable advanced compliance. The bulk of this narrower spread relationship is driven by lower priced 2023 vintage D4 credits.

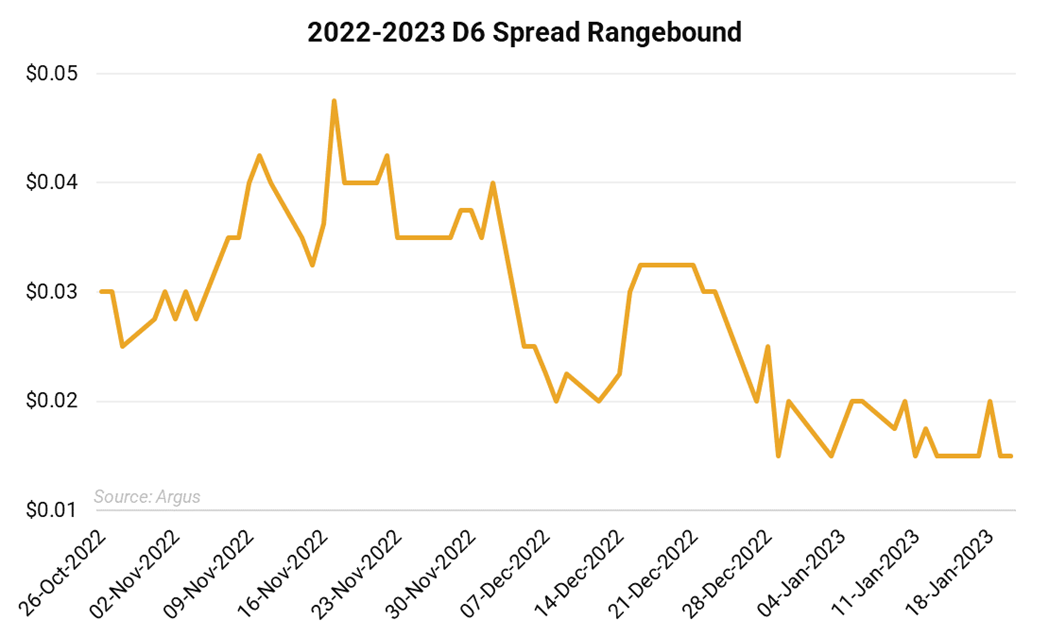

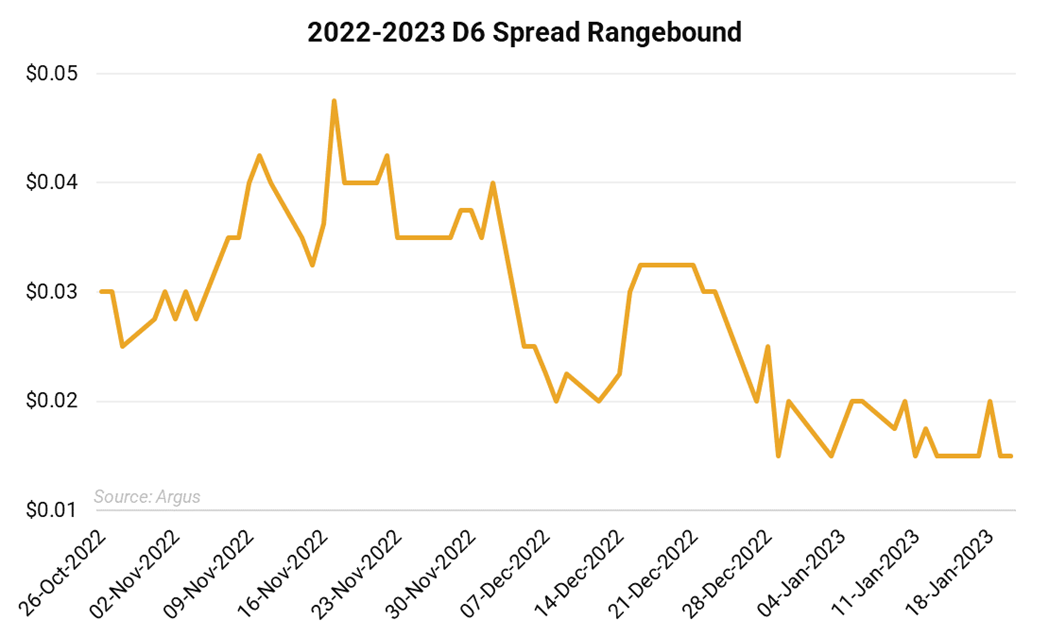

The remainder key RIN spreads have been in a choppy holding pattern throughout the EPA’s public comment period. The 2022-2023 D6 spread has ranged between the $0.015/RIN to $0.02/RIN mark. Current year vintage D6 RINs have climbed nearly $0.09/RIN since November in response to D6 tightness and more stringent compliance targets through 2025.

The inter-vintage D4 RIN spread narrowed considerably from its $0.16/RIN mid-December peak to hold just over $0.10/RIN throughout January. The 2023 vintage D4 credits have risen faster than the 2022 D4s since mid-December, narrowing the spread.

EPA RIN Generation Data as of January 19:

EPA Small Refinery Exemption (SRE) Data as of January 19:

Some of the price and regulatory risk in the development of the renewable fuels markets is controllable through hedging or pre-selling. Other risks require constant monitoring of pending changes to regulations and programs. AEGIS can help with both.

Our environmental experts are here to help you. If you’re facing price or regulatory risk, reach out today.