|

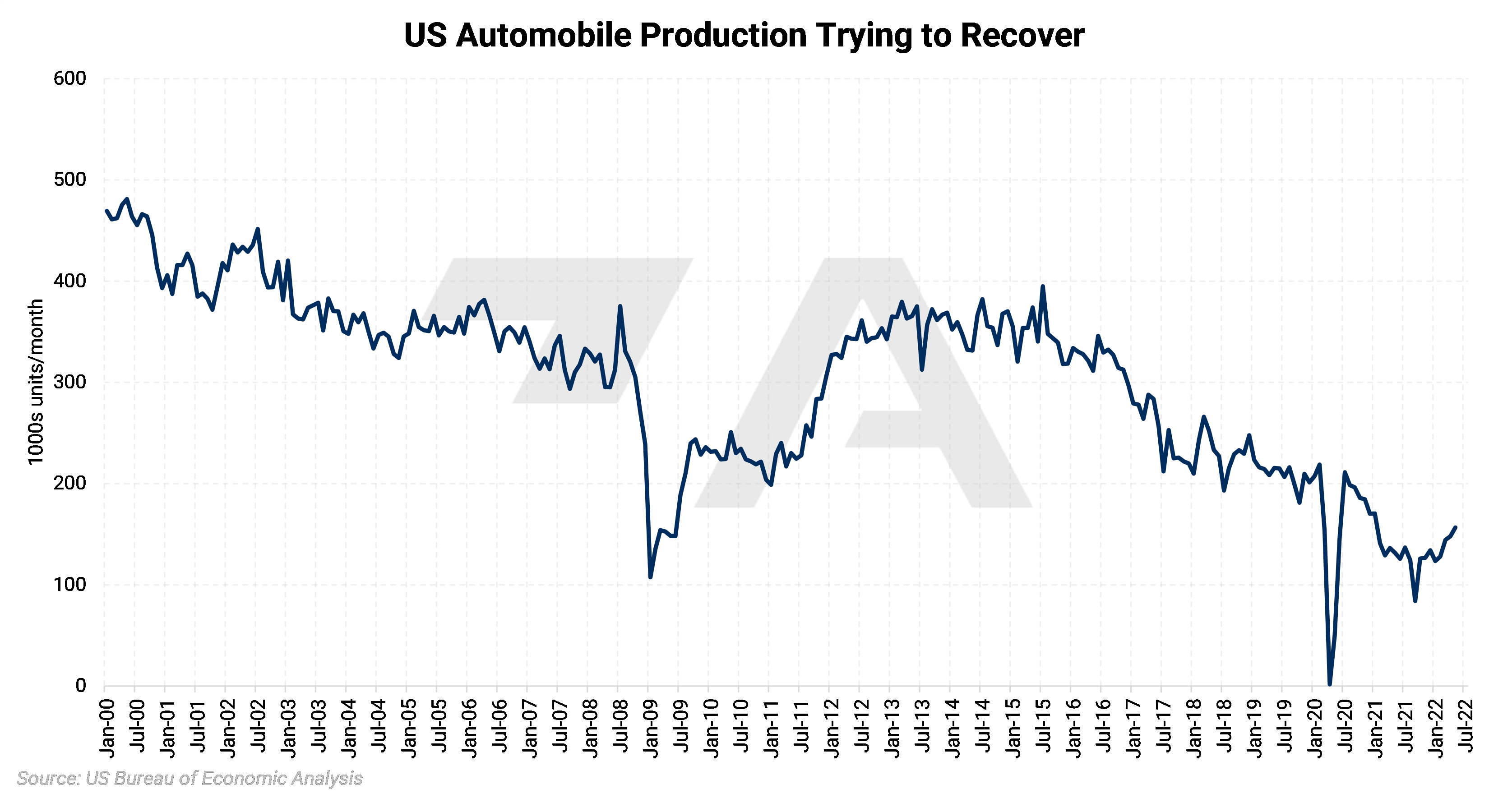

US automotive production has not yet recovered to pre-pandemic levels. After cratering to near zero in April 2020, production volume was 156,700 in May 2022. This is notably smaller than the 218,800 in February 2020, one month before the pandemic swept the nation. |

|

|

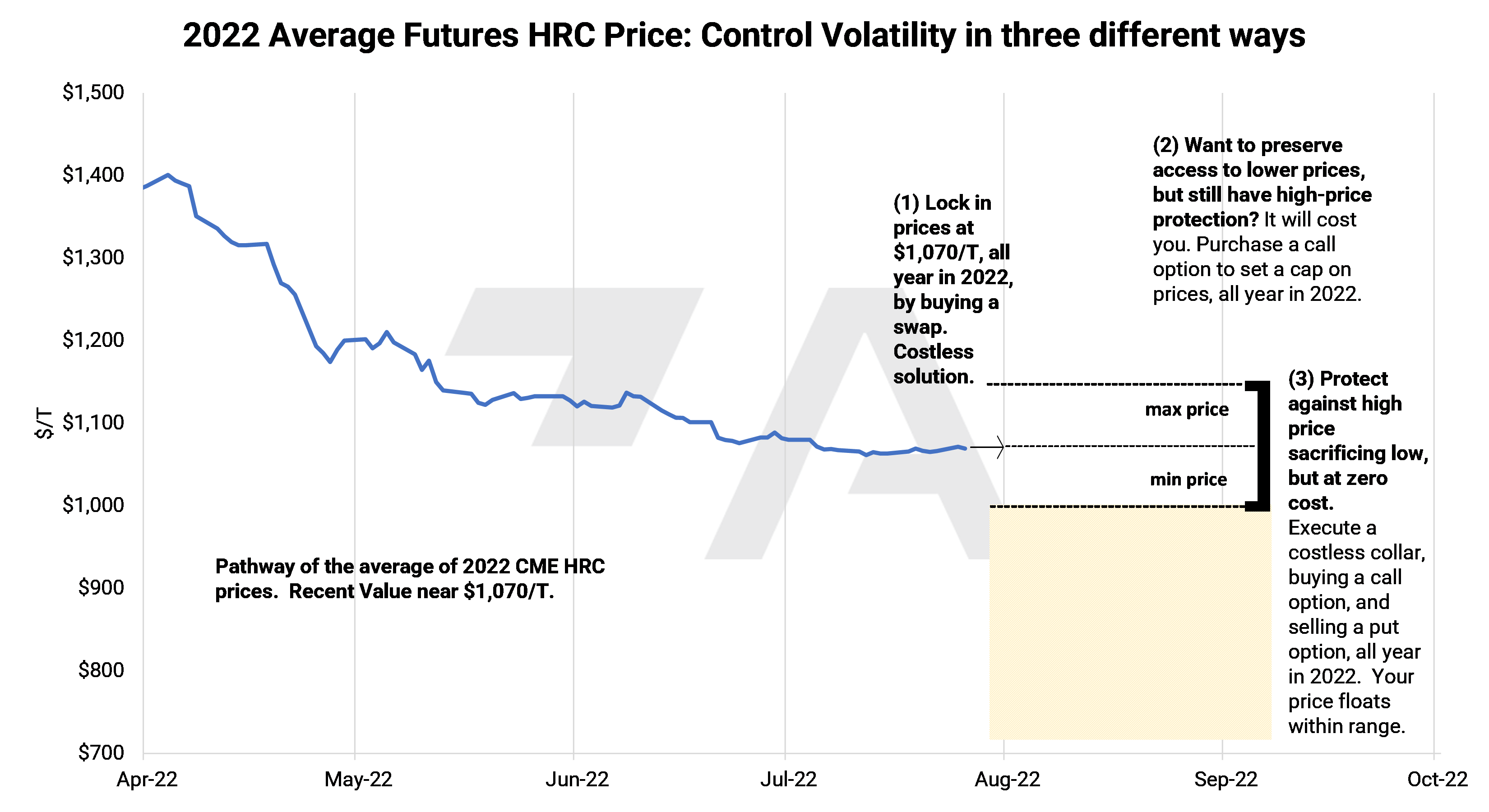

HRC steel prices could increase this year if Cleveland Cliffs’ prediction of higher steel demand for 2H 2022 comes true. As a result, this could be a good time for steel end-users such as automotive equipment manufacturers (OEMs) to hedge future needs by buying swaps or call options. In the chart below, we have plotted several such strategies. These positions are basic for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. |

|

Important Disclosure: Indicative prices are provided for information purposes only and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as "edge," "advantage," "opportunity," "believe," or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.