To begin the week, increased COVID fears and a broad selloff in most asset classes put metals markets on the back foot. Likewise, reports that China’s State Reserve Bureau will be releasing more copper and aluminum than expected also weighed on markets. Nickel wiped away almost two weeks of gains, and both LME Select 3M Copper and Aluminum traded at levels not seen since mid-June. Early trade on Tuesday morning saw a minor bounce for most metals and held strong for the remainder of the day. Wednesday’s trade was quiet, and Thursday’s and Friday’s trade rallied into the weekend. |

Note: Hot-rolled coil was unchanged. |

||||

|

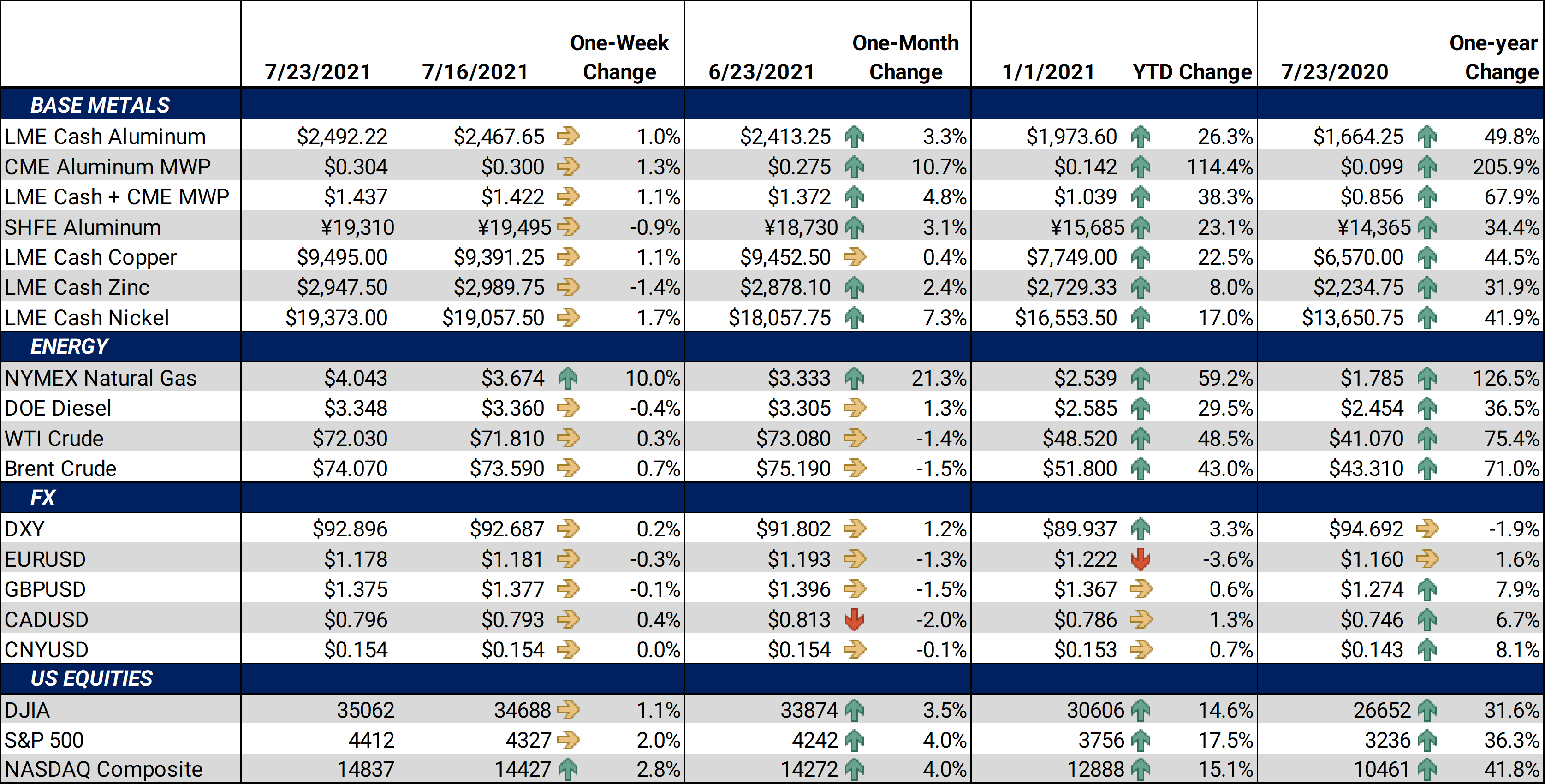

The violent protests and political crisis which started last week in South Africa have become front page news for metal markets. South Africa is the sixth-largest producer of iron ore in the world. Also, several of their ports are the preferred channels for Congo-produced cobalt. As we discussed in a prior research article, initial reports from the onset of the conflict suggested that cobalt shipments had not been affected; however, the fluid situation has seen several port closures and reopenings. Reports from Tuesday morning this week suggested activity was returning at ports in and near Durban. There have been no reports of slowdowns in mining activity as of yet. In a press conference this past Monday, the National Development and Reform Commission confirmed that China will sell more metal from its state reserves this year. Although this is not news, the market was taken aback by hints that the volume may be larger than initially thought. This was confirmed on Wednesday morning with the announcement that sales would be 30,000 mt of copper, 90,0000 mt of aluminum, and 50,000 mt of zinc. All of these volumes are higher than the initial sales over July 5-6, which were 20,000 mt copper, 50,000 mt of aluminum and 30,000 mt of zinc. No specific future sale dates were announced. The much-discussed Russian exports tariffs kick in on August 1, and the market participants are fretting on how much more upside both European and Midwest premiums could see. The MWP stalled early this week but rallied into the weekend. Similarly, European premiums continued the march higher. In question is whether Russia will be able to pass the cost to importers. This week was light on economic data, both here and abroad. Of note was initial home construction, which rose 6.3% last month to a 1.64 million annualized rate, slightly higher than the 1.59 million trade estimate. However, builder confidence hit an 11-month low in July, according to a survey from the National Association of Home Builders. Developers are citing sky-high material costs and labor shortages for the erosion in confidence. More housing data will be released next week, and the Federal Reserve interest rate decision and press conference will be closely watched as well. |

|||||

|

Bottom Line: The broad selloff we saw on Monday should convince metals bulls that these markets cannot go up forever, despite continued supply-chain concerns. Likewise, inflation is becoming a real concern, as consumers push back on price hikes, and damage is being done to corporate profit margins. However, bulls seem to still have the upper hand as Monday’s selloff was rejected, and prices firmed late in the week. On the macro front, the dollar index has maintained a very tight range over the past several weeks, but it continues to slowly inch higher. Further strength in the dollar could keep a lid on metal prices. A strengthening dollar makes our products more expensive to foreign buyers. Exports of finished goods could stall should the dollar strengthen prices beyond the appetite of foreign demand. As always, COVID fears continue to dominate headlines, as the coronavirus delta variant is creating havoc in Asia and certain areas of the US. New shutdowns could slow the demand for base metals. We continue to recommend that metal consumers layer in hedges in a disciplined manner and select between swaps or call options depending on their risk-management objectives. However, option structures are generally preferred due to the recent rise in volatility. However, call options premiums have increased during this rally, so collars (selling put options to offset the cost of call options) are a logical strategy. We also suggest using limit orders along with reasonable stop-loss targets to add incremental protection if prices trend higher.

|

|||||

|

|||||

|

|

|||||

|

|||||

|

The LME 3M Select finished slightly higher for the week, with last trade at $2,508.50/mt, and trade ranging from $2,416/mt to $2,510/mt. A late day surge on Friday helped to wipe away last week’s losses. Chartists would note that this week’s trade took out the prior two weeks’ low, and never came close to any recent prior weeks’ highs. This could suggest a slightly bearish tone to the market. Cash-3M last traded at a $10.50/mt contango (where cash is cheaper than 3M), narrowing from $20.85/mt during last week’s trade. Farther down the curve, Dec ‘21/Dec ‘22 continued to show backwardation, suggesting that there are still few buyers for long-dated contracts. In general, we have seen less long-dated consumer hedging with both premiums and LME at high levels.

|

|||||

|

|||||

|

There is a new all-time high for the aluminum MW US Transaction premium. It stalled for the first two days this week, but the assessment jumped to 30.6¢/lb on Wednesday and jumped again on Thursday to a record 31¢/lb. The CME MWP contract for July had a last trade of 30.15¢/lb at time of this writing. Market participants cite a pending worker strike at Rio Tinto’s Kitimat aluminum smelter for these recent ticks higher in MWP. Sky-high freight costs and other logistical issues have caused the movement of metal to slow to a crawl. Market sources are stating that most end users have purchased their short-term needs. However, some are still scrambling for metal, with little to be found. Mimicking the activity we have seen over the past several weeks, there was little MWP trading activity in Cal ‘22; the backwardation in the forward curve remains significant and makes inventory hedging expensive. |

|||||

|

|

|||||

|

|||||

|

LME Copper 3M Select traded firm this week, with last trade at $9,624/mt. The LME 3M contract traded in a wider range than last week, from $9,131/mt to $9,632/mt. We have bounced off the $9,011/mt low set during the week of June 21, but it appears that trade needs a new catalyst to break us out of the $9,000/mt to $10,000/mt range. Likewise, the market has been bouncing indecisively between $9000/mt to $9,500mt for the past 5 weeks. The copper sales from China’s metals reserves earlier this month were surprisingly brisk, selling out 20,000 mt of copper in 75 minutes and prices were only about 1% below settlement of Shanghai futures. It will be interesting to see how the market reacts to the next sale (dates currently unknown), which will be 30,0000 mt.

|

|||||

|

|

|||||

|

|||||

|

Nickel continued its push higher this week, due to a late day surge on Friday. A brief dip below last week’s lows early in the week was quickly reversed. Last trade on the LME 3M Select contract was $19,470/mt, with a trade range of $18,275/mt to $19,500/mt for the week. Like other base metals, nickel tends to benefit from industrial demand. However, the US dollar’s recent rally and lower trade in copper has kept the price of nickel range bound. New, positive fundamental news will likely need to occur to break nickel out of the narrow range we have seen since late April. |

|||||

|

|

|||||

|

|

|||||

|

|||||

|

HRC steel traded in a very tight band this week, as outside markets weighed on the metal. The CME HRC futures contract for July ’21 last traded at $1,780/T. Trade range was from $1775/T to $1,784/T. Deferred, or longer-dated, contracts through the remainder of the year and into 2022 continue to show signs of backwardation, and there is little reason for this to change in the near term. As we mention in the opening comments, let’s keep a close eye on the situation in South Africa. Opportunities remain open for HRC consumers to hedge future prices below the current spot price. For both producers and those carrying inventory, we continue to believe that buying put options remains the best structure to achieve protection against a major market correction. From a consumer perspective, buying calls can be used to protect against a continued rally. Using options with staggered strike prices allows for participation in a downward price correction. |

|||||

|

|

|||||

|

|

|||||

Notable News |

|||||

|

NDRC: To further release copper, aluminium, and zinc reserves, strictly penalise price bidding China to auction copper, aluminium and zinc from state reserves - Xinhua Australia joins allies in accusing China of ‘malicious cyber activities’ Homebuilder confidence dips to 11-month low Corruption trial of South Africa’s ex-president is postponed |

|||||