South Africa has been rocked by civil unrest after the recent imprisonment of former President Jacob Zuma. South Africa's ports are the preferred export channels for Congo-produced cobalt. Continued unrest, which has hampered port flows, could further tighten an already strained cobalt market.

|

See our previous commentary on South Africa unrest .

Summary:

- Cobalt is a key metal used in the production of lithium-ion batteries. Lithium-ion batteries are used in a variety of everyday products such as laptops, electric vehicles and smartphones.

- According to , the Congo "is the world's largest producer of cobalt feedstocks, contributing more than 70pc of the global supply of 135,000 t/yr metal equivalent. More than 90pc of China's cobalt feedstock imports, which total 86,000 t/yr metal equivalent come from the [Congo]."

- Initial from the onset of the conflict suggested that cobalt shipments had not been affected; however, the fluid situation has seen several port closures and reopenings.

|

| |

|

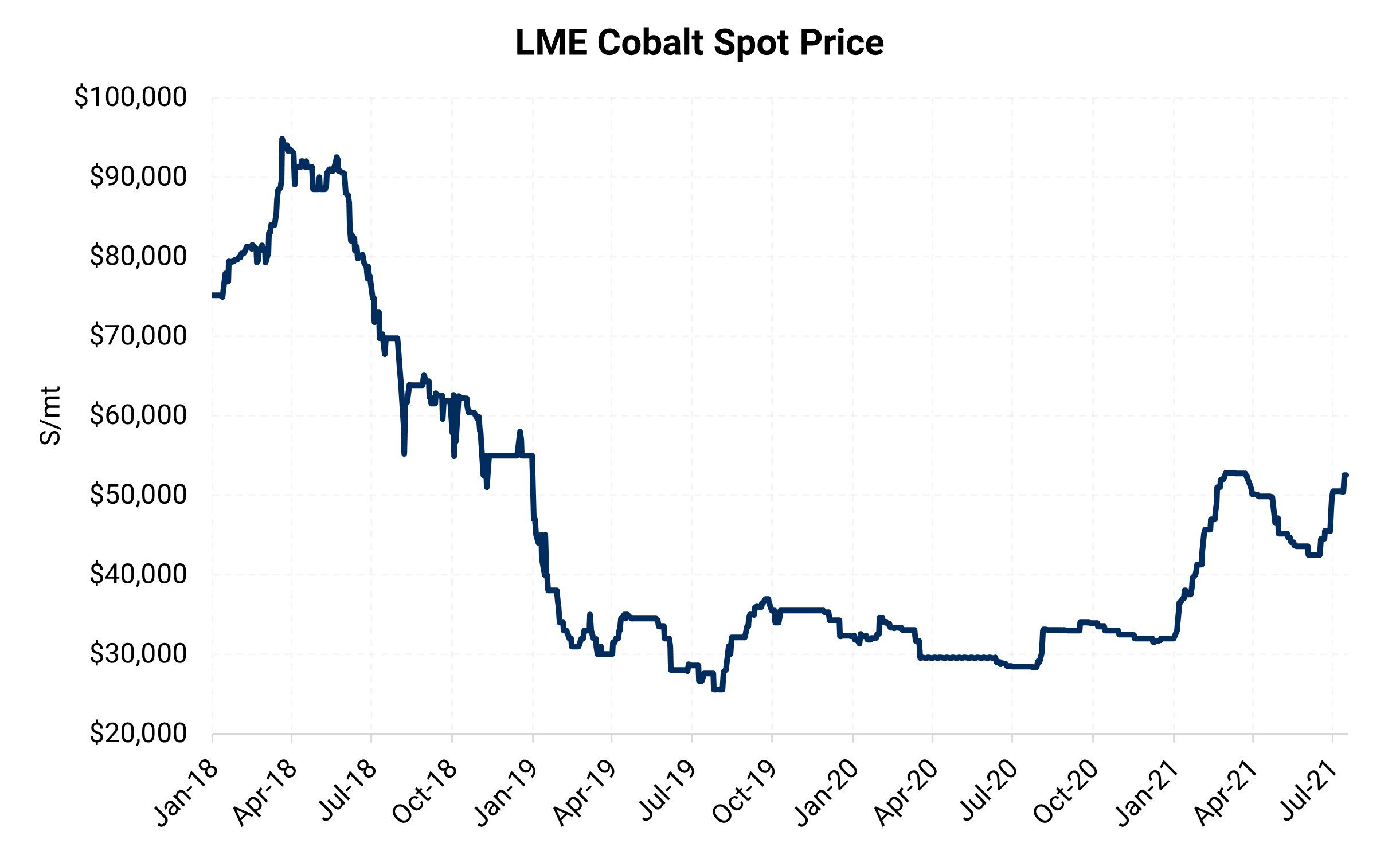

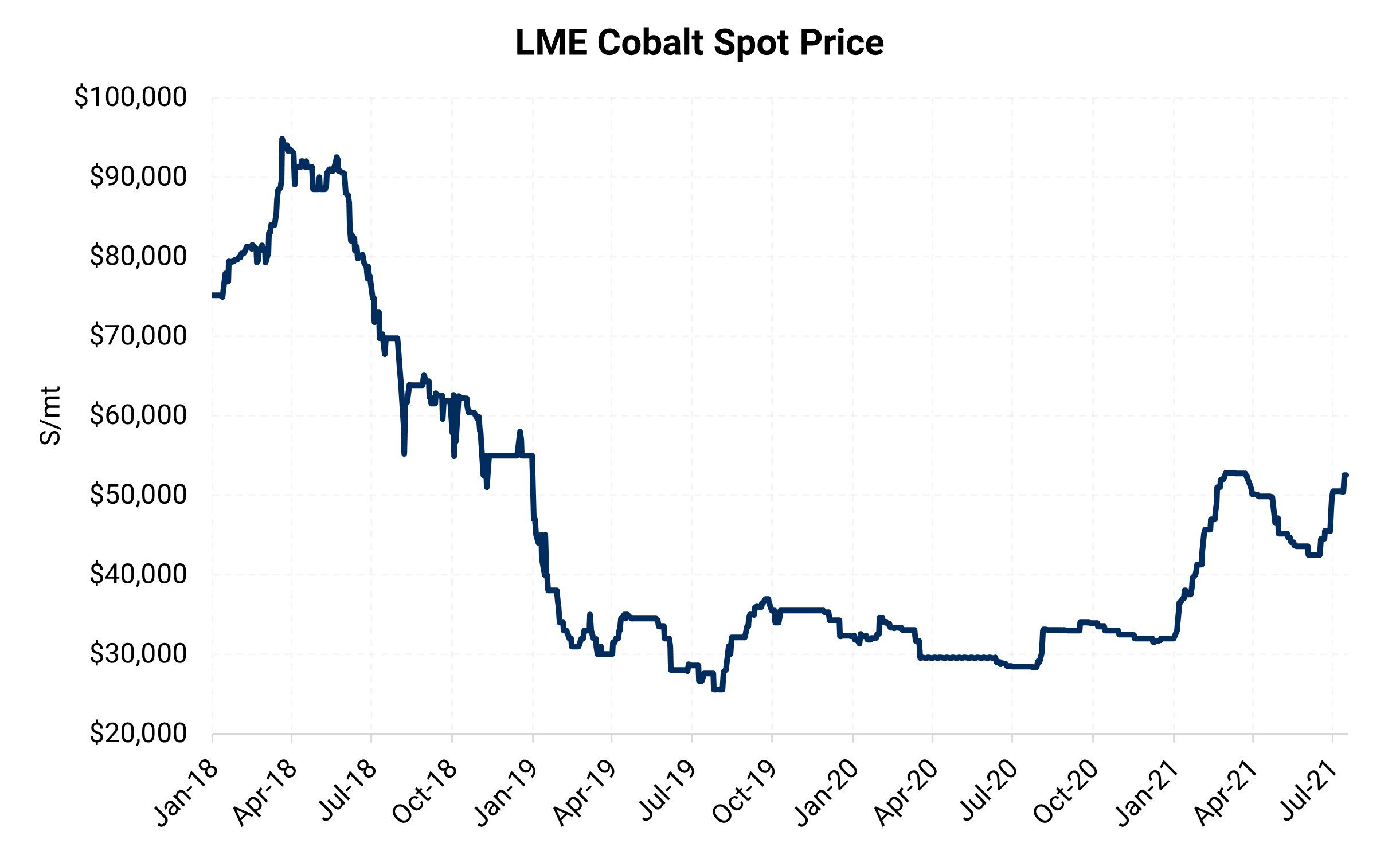

AEGIS Thoughts & Strategies: Cobalt prices have held firm throughout 2021, trading at levels not seen since late 2018. Demand has been strong and COVID-related supply constraints have kept a bid under the market. On top of this, any port closures caused by the South African protests, which flared last week, should aid in keeping prices elevated. However, recent economic data (see AEGIS notes and ) show that China's economy is slowing. For instance, the Hang Seng Index, which is China's most watched stock index, is down approx. 8% in the past six months. Any further slowing, could keep a cap on prices.

|

| |