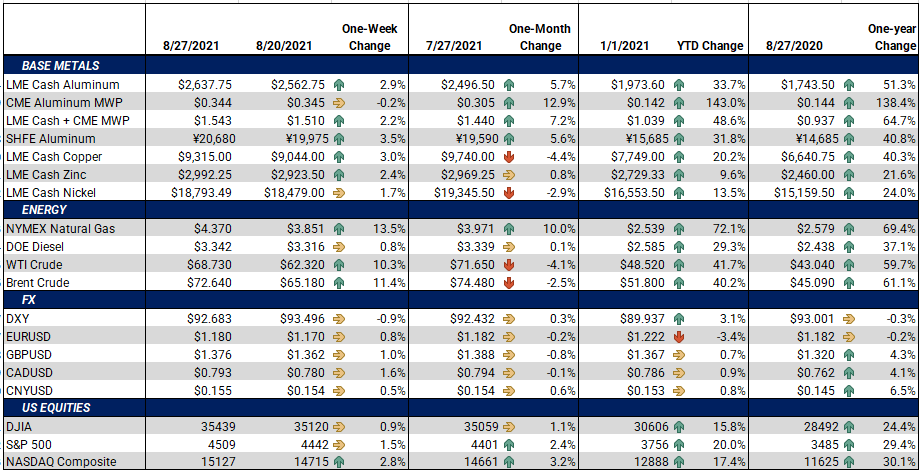

Most base metals rallied this week, as FDA approval of the Pfizer COVID vaccine aided in boosting most asset classes. Late Monday, the head of China’s central bank commented that the bank will support credit and aid to small businesses. Such comments are supportive to assets such as copper, and aluminum, as we saw on Tuesday through the remainder of the week. “Old” news such as labor shortages and logistical issues continue to remain supportive for base metals. |

Notable Metals News

Chinese authorities implemented new rounds of electricity consumption restrictions in more aluminum production regions, thereby hampering production. Aluminum production regions in China are currently experiencing severe electricity supply crunches, due to an overwhelmed summertime power grid. Perhaps aided by this decreased utilization, domestic aluminum prices have held firm despite an economic slowdown.

In Chile, one group of union miners at Codelco’s Andina copper mine reached an agreement on Tuesday to end a strike, which began several weeks ago. However, three other groups at this mine are still on strike. Strikes and resolutions at Chilean copper mines have had minimal impact on the market in recent weeks.

According to data from the World Steel Association, global steel production was up 3.3% year-over-year in July, to 161.7 million mt. Production in China was 86.8 million mt, down 8.4% y/y. Large y/y production gains were seen in the US, Germany, Japan, and India.

Notable Economic Data

The main event for the US economic news was the virtual Jackson Hole Federal Reserve summit, in which Chairman Jay Powell stated that the Fed will likely start to taper its bond-buying program by the end of the year. This week’s economic data for the US was consistently, but moderately negative. Out Monday, the Manufacturing Purchasing Manager Index was 61.2, down from 63.4 last month. On Wednesday, month-over-month Durable Goods Orders were -0.1%, down from +0.8% in June. Lastly, on Thursday, Q2 GDP was 6.6%, slightly below the 6.7% estimate.

The US dollar index fell this week, which correlated to higher metals prices. Short-term support for the index now sits at 92.50, and longer-term support at 91.50. The USD typically has an inverse relationship to metals prices. A strengthening dollar makes our goods more expensive for foreign buyers.

| Bottom Line: | |||||

|

The bulls took control this week, as outside markets and influences helped to support base metals prices. As mentioned in the opening, comments by China’s central bank and FDA approval of the Pfizer vaccine were positive catalysts. That said, there is plenty of bearish news that could weigh on the market. Lockdowns, which have cooled metals demand and created worsening logistical issues, remain prevalent throughout southeast Asia. This includes partial shutdowns at several of China’s busiest ports. We continue to recommend that metal consumers layer in hedges in a disciplined manner and select between swaps or call options depending on their risk-management objectives. Option structures are generally preferred due to the recent rise in volatility. However, call options premiums have increased during this rally, so collars (selling put options to offset the cost of call options) are a logical strategy. We also suggest using limit orders along with reasonable stop-loss targets to add incremental protection if prices trend higher. |

|||||

|

|

|||||

LME Aluminum |

|||||

|

This week’s trade regained last week’s losses and also set new highs for 2021. Last trade on the LME 3M Select was $2,654/mt, and trade ranging from $2,557.50/mt to $2,697.50/mt. Cash-3M last traded at a $25.75/mt backwardation (where cash is higher than 3M), adding to the $16.25/mt backwardation at last week’s closing trade. Farther down the curve, Dec ‘21/Dec ‘22 continued to show backwardation, suggesting that there are still few buyers for long-dated contracts. In general, we have seen less long-dated consumer hedging with both premiums and LME at high levels. |

|||||

|

|||||

|

The CME MWP contract for September ‘21 had a last trade of 33.50¢/lb at time of this writing, which is unchanged on the week. The market cannot seem to shake the influence of “old” news. This includes the worker strike at Rio Tinto’s Kitimat aluminum smelter, sky-high freight costs and other logistical issues, which keep the MWP elevated. Similar to the past several weeks, there was little MWP trading activity in Cal ‘22; the backwardation in the forward curve remains significant and makes inventory hedging expensive. |

|||||

|

|

|||||

|

|||||

|

Similar to aluminum, this week’s trade regained most of last week’s losses. Last trade for the LME 3M Select was $9,420/mt, and trade ranging from $9,058.5/mt to $9,458.50/mt. From a chartists’ perspective, resistance is now last week’s high trade of $9,554.50/mt. Copper seems to be more influenced by outside markets in recent weeks, rather than normal fundamentals. The supply-demand picture has not changed a great deal in recent weeks despite ongoing strikes and resolutions at Chilean copper mines and flooding in China’s metal production areas. Likewise, economic data for the US and China show that both economies are slowing, which could hinder metals prices.

|

|||||

|

|

|||||

|

|||||

|

Nickel traded higher this week, closing below last week’s low price. Last trade on the LME 3M Select contract was $19,005/mt, with a trade range of $18,635/mt to $19,050/mt for the week. Like other base metals, nickel tends to benefit from industrial demand. However, like February’s trade, we seem to run into resistance at or slightly above the $19,900/mt level. New, positive fundamental news will likely need to occur to have a breakout above the $20,000/mt level. |

|||||

|

|

|||||

|

|

|||||

|

|||||

|

HRC steel rallied this week. As of this writing, the CME HRC futures contract for September ’21 last traded at $1,941/T, up $26 for the week. Trade range was from $1,922/T to $1,942/T. Deferred, or longer-dated, contracts through the remainder of the year and into 2022 continue to show signs of backwardation. Opportunities remain open for HRC consumers to hedge future prices below the current spot price. For both producers and those carrying inventory, we continue to believe that buying put options remains the best structure to achieve protection against a major market correction. From a consumer perspective, buying calls can be used to protect against a continued rally. Using options with staggered strike prices allows for participation in a downward price correction. |

|||||

|

|

|||||

|

|

|||||

Notable News |

|||||

|

Iron ore price dives 13% on Fed, Chinese growth worries Why is the iron ore price crashing and what does it mean for Australia and the dollar? China’s Central Bank vows to boost credit support and stabilize money growth Fed officials will seek to avoid a tantrum as they keep ‘taper talk’ going at key summit Prompt ferrous prices refuse to slump RANKED: World’s 10 biggest copper mining companies Copper price rises as China reports no new covid-19 cases Chalco profits soar on higher aluminium prices, production Global Steel July Production Up Even as China Output Drops The First Delivery of 'Green Steel' Suggests Its Future Is Not Far Off Aluminium near three-year high as disruptions tighten market

|

|||||