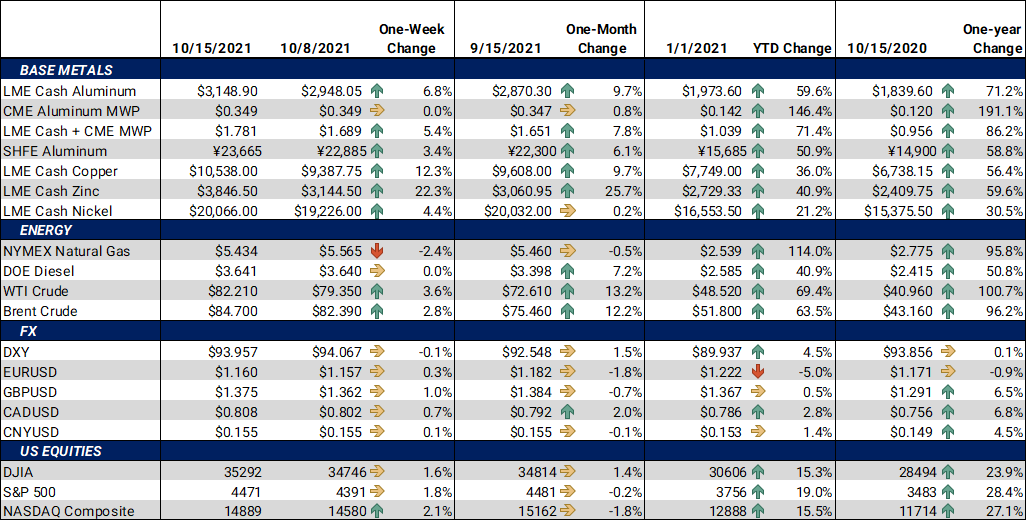

This week can be easily summed up with two words: bull stampede. Fuel shortages throughout Europe and China have led to skyrocketing fuel and electricity prices. This in turn led to production cuts by aluminum and zinc producers. Although production cuts in China have been occurring for several weeks, it seems as if the run on coal, aluminum, copper and zinc went into hyperdrive this week.News of further metals production cuts and fuel shortages drove this week’s rally in base metals. Chinese coal futures surged on Monday, after flooding hampered production in one of its main production regions. As coal is a major input for their aluminum production, the bounce in coal prices correlated to LME Aluminum 3M rallying past $3,000/mt in early Monday trade. LME Copper and Nickel followed aluminum higher.Similarly, LME Zinc rallied 5% on Wednesday alone after a large European producer announced it is cutting production by 50%.Most base metals remained strong throughout the week. |

Notable Metals News

Fears over embattled real-estate developer Evergrande resurfaced this week after it missed another bond payment. Previously, after it had missed a payment on September 23, the company was given 30-day grace period. The company has now missed at least three bond payments since September.

Other property developers in China are also in or near default, according to reports. Fantasia, a luxury-property developer, defaulted on a bond payment last week. China Modern Land has asked investors to extend bond maturity. Sinic Holdings stated that default on a bond payment due later this month is “likely.”

Continuing in China, 60 coal mines in the Shanxi region of China were shuttered early this week due to flooding. Approximately 25% of China’s coal production comes from this province. As coal is important fuel for aluminum production, a shortage of coal could hamper aluminum supply and further the rally in aluminum prices both in China and internationally. Likewise, most provinces of China are experiencing electricity supply crunches, and these coal-mine closures could deepen that power crisis.

Like China, European metals producers are also feeling the effects of higher electricity costs Nyrstar, a Belgium-based zinc producer, has had to cut production by nearly 50% at their three Europe-based production facilities (the Netherlands, Belgium, and France). The three affected facilities have a total annual production capacity of 672,000 mt. . In Europe, the rising costs are related to shortages in natural gas. Electricity prices in France and Netherlands have doubled since late July.

Finally, in the US, aluminum producers continue to see raw material shortages. Matalco, a large aluminum billet producer, stated they might slow production in 2022 due to potential magnesium shortages. The company also noted that silicon is in short supply.

| Bottom Line: | |||||

|

For hedgers looking to make longer-term commitments, there is some good news in this week’s rally. The forward curves for aluminum and copper have steepened tremendously over the past few weeks, and this week’s trade intensified that backwardation. End users of those base metals can hedge forward purchases at a sizable discount to the cash markets. For these metals end users, we continue to recommend that zero-cost collars (selling put options to offset the cost of call options) could be a logical strategy. We also suggest using limit orders along with reasonable stop-loss targets to add incremental protection if prices trend higher. |

|||||

|

|

|||||

LME Aluminum |

|||||

|

Aluminum prices rallied this week. The last trade on the LME 3M Select was $3,175/mt, with trade ranging from $2,945/mt to $3,215/mt. Cash-3M last traded at a $22.60/mt contango (where cash is lower than 3M), widening from last week’s trade of $17.95/mt contango. The nearby forward curve has steepened in recent weeks. As aluminum prices have rallied, the latter half of 2022 and beyond has become further backwardated. Thus, longer-term consumers can still hedge at discount to the cash and nearby market. |

|||||

|

|||||

|

The CME MWP contract for October ‘21 last settled at 34.936¢/lb at the time of this writing. Even with LME Aluminum’s continued rally, the MWP seems to have stalled just shy of 35¢/lb. The front three contracts for MWP have traded in a 1¢ to 1.5¢/lb range since early September. It seems as if the bullish factors, such as freight costs, counterbalance the perceived slowdown in demand. The MWP forward curve remains relatively flat, compared to LME aluminum. |

|||||

|

|

|||||

|

|||||

|

Last trade for the LME 3M Select was $10,215/mt, and trade ranging from $9,308/mt to $10,328/mt. Relative to other base metals, copper had little news flow this week. Copper prices may have firmed due to higher aluminum and nickel prices. Copper stocks at the LME are at the lowest levels since 1974.

|

|||||

|

|

|||||

|

|||||

|

LME Nickel 3M was up $740 for the week. Last trade on the LME 3M Select contract was $19,900/mt, with a trade range of $18,830/mt to $20,120/mt for the week. |

|||||

|

|

|||||

|

|

|||||

|

|||||

|

HRC steel futures traded slightly higher this week. As of this writing, the CME HRC futures contract for October ‘21 last traded at $1,898/T, up $16/T for the week. Trade range was from $1,894/T to $1,906/T. Longer-dated contracts, through the remainder of the year and into 2022, continue to be backwardated. Opportunities still remain open for HRC consumers to hedge future prices below the current spot price. For both producers and those carrying inventory, zero or low-cost collars or swaps are currently the best structure to achieve protection against a major market correction. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

10/14/2021: Is It Wise to Hedge HRC Steel with Crude Oil? 10/5/2021: Section 232 Tariffs: Most relevant developments (AEGIS Reference) 09/16/2021: AEGIS Factor Matrices: Most important variables affecting metals prices 09/07/2021: China Exports Are an Economic Spot as Value Hits All-Time High 08/09/2021: China's Copper Imports Slow as Prices Weigh on Demand |

|||||

Notable News |

|||||

|

10/15/2021: Copper Warehouse Stocks Hit Critical Level in Global Squeeze 10/15/2021: Dow futures rise 130 points, S&P 500 heads for winning week on great start to earnings season 10/14/2021: Aluminum Makers Sound the Alarm About U.S. Magnesium Shortage 10/14/2021: China's PPI rises at fastest pace on record 10/13/2021: Chinese Wholesale Vehicle Sales Plunge 16.5% In September 10/13/2021: U.S. stock futures inch up ahead of JPMorgan results, consumer price inflation 10/13/2021: Zinc producer Nyrstar cuts output by up to 50% at three European smelters on energy price surge 10/12/2021: Evergrande default looms as another developer warns of trouble 10/12/2021: Evergrande bondholders say they have not received $148m interest payments 10/11/2021: Chinese coal prices hit record high and power cuts continue 10/11/2021: Global Energy Crisis Piles Pressure on Aluminum Supply 10/11/2021: LME to Develop Digital Metals Spot Market Beginning With 'Green' Aluminum 10/11/2021: Crisis looms in Britain, steel makers warn |

|||||