LME Copper calendar spreads surprised the market early this week, after a steep backwardation occurred between the cash and 3M contracts. Backwardation is market jargon for when near-term prices are more expensive than prices farther in the future. A shortfall of copper inventories in LME warehouses led to this steep backwardation as the October contract went to expiry. Late Tuesday, the LME announced it will be setting backwardation limits on members of the exchange. These limitations include spread buying and the cash-and-carry trade. These new rules came after the LME Copper Cash - 3M surged to over $1,000/mt backwardation on Monday. |

Notable Metals News

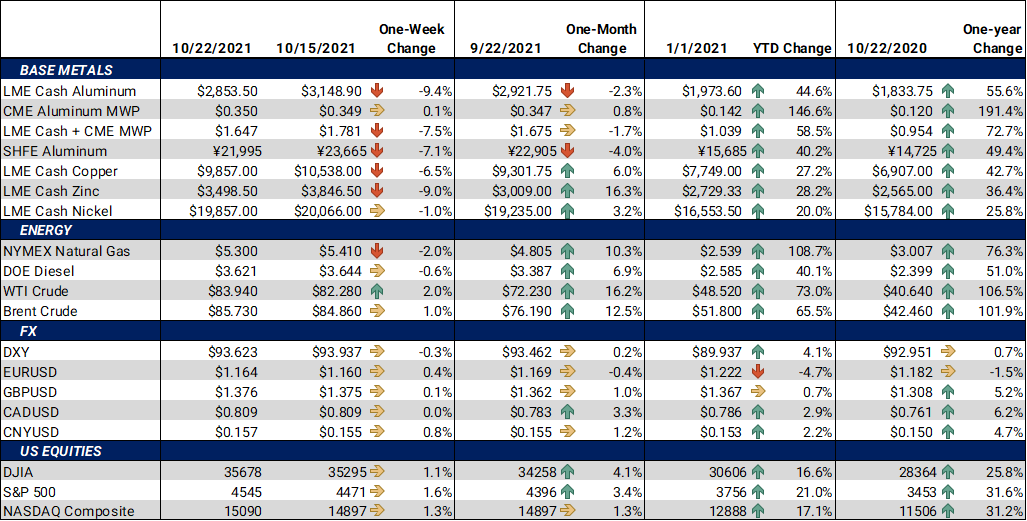

Chinese metals producers may get relief from power outages as coal production seems to be on the mend. The Shanxi province, which produces nearly 25% of China’s coal, had devastating floods earlier this month. Lack of fuel to power plants had contributed to power outages. However, reports from over the weekend indicate that trucks are moving from the mines. This may result in higher metals production soon. The news may have contributed to lower LME Zinc 3M, Aluminum 3M and Copper 3M prices on Monday and Tuesday.

China’s government is looking into the coal crisis. On Tuesday, the National Development and Reform Commission stated they are researching ways they may intervene in the coal markets. This statement came after a meeting with major domestic coal companies. Prices for domestic thermal coal, coking coal, zinc, and aluminum all sold off on Wednesday.

Continuing in China, concerns over Evergrande and similar real-estate firms remain. Sinic Holdings defaulted on a $206M bond that matured on Monday. Shares of Evergrande, which resumed trading on Wednesday, fell 12.5% after a potential asset sale fell through. However, late Thursday, Evergrande made an $83.5 million interest payment to offshore bondholders. This last-minute payment averts a potential default, which would have triggered on October 23. Nearly 25% of China’s GDP is tied to property. A debt-crisis in the property sector could weigh on deferred metals prices if little construction activity occurs.

In Russia, the ministry of economic development has adjusted metals export taxes. The ministry has removed export duties on some noble alloys; however, duties on some bulk alloys were only lowered to 5%. They are also considering raising and extending the tariff on ferrous scrap. Lower taxes decrease the all-in cost of supply.

| Bottom Line: | |||||

|

Even though copper cash started fast, both LME Aluminum 3M and Copper 3M had their deepest selloff since May. If the new rules implemented by the LME truly do cool markets, long-term end users may benefit. The forward curves for aluminum and copper were largely unchanged from last week. Given the backwardation in those markets, end users of those base metals can still hedge forward purchases at a sizable discount to the cash markets. For these metals end users, we continue to recommend that zero-cost collars (selling put options to offset the cost of call options) could be a logical strategy. We also suggest using limit orders along with reasonable stop-loss targets to add incremental protection if prices trend higher. |

|||||

|

|

|||||

LME Aluminum |

|||||

|

The LME Aluminum 3M fell $300/mt this week. The last trade on the LME 3M Select was $2,875/mt, with trade ranging from $2,856/mt to $3,229/mt. Cash-3M last traded at a $14.50/mt contango (where cash is lower than 3M), narrowing from last week’s trade of $22.60/mt contango. This week’s selloff did little to change the shape of the forward curve through August ’22. However, the deferred forward curve steepened, with more backwardation. Thus, longer-term consumers can still hedge at discount to the cash and nearby market. |

|||||

|

|||||

|

The CME MWP contract for October ‘21 last settled at 34.962¢/lb at the time of this writing, but it had no trades this week. Even with LME Aluminum’s setback this week, the MWP remained firm. It seems as if the MWP’s bullish factors, including freight costs, counterbalance the perceived slowdown in demand. The MWP forward curve remains relatively flat compared to LME aluminum. |

|||||

|

|

|||||

|

|||||

|

The LME Copper 3M fell $475/mt this week. Last trade for the LME 3M Select was $9,740/mt, with trade ranging from $9,690/mt to $10,452/mt. The LME was the source of copper’s major news this week. Extreme volatility in the nearby contracts led the exchange to implement new rules aiming to cool the market. Thus, last week’s bullish charge through $10,000/mt was short-lived.

|

|||||

|

|

|||||

|

|||||

|

LME Nickel 3M was down a mere $90 for the week. Last trade on the LME 3M Select contract was $19,810/mt, with a trade range of $19,620/mt to $21,425/mt for the week. |

|||||

|

|

|||||

|

|

|||||

|

|||||

|

HRC steel futures traded slightly higher this week. As of this writing, the CME HRC futures contract for October ‘21 last traded at $1,904/T, up only $6/T for the week. Trade range was from $1,891/T to $1,905/T. Longer-dated contracts, through the remainder of the year and into 2022, continue to be backwardated. HRC consumers can still hedge future prices below the current spot price. For both producers and those carrying inventory, zero or low-cost collars, or swaps, are currently the best structures to achieve protection against a major market correction. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

10/14/2021: Is It Wise to Hedge HRC Steel with Crude Oil? 10/5/2021: Section 232 Tariffs: Most relevant developments (AEGIS Reference) 09/16/2021: AEGIS Factor Matrices: Most important variables affecting metals prices 09/07/2021: China Exports Are an Economic Spot as Value Hits All-Time High 08/09/2021: China's Copper Imports Slow as Prices Weigh on Demand |

|||||

Notable News |

|||||

|

10/22/2021: Evergrande averting default to do little to revive China property bond sales 10/21/2021: Copper is the new toilet paper, hoarding is one reason LME inventories at 47-year low 10/21/2021: London Metal Exchange has to restrain disorderly copper: Andy Home 10/20/2021: China Evergrande shares plunge 12.5%, after $2.6 billion asset sale falls through 10/20/2021: China's commodity prices tumble after planner mulls coal intervention 10/20/2021: Russia may extend and raise scrap export duty 10/20/2021: London Metal Exchange moves to stem draining copper reserves 10/20/2021: Cost pressures mount for China's aluminum smelters as regions end discount power deals 10/19/2021: Trafigura played key role in draining LME copper inventories 10/19/2021: China's Sep primary aluminum output posts first on-year decline since June 2020 10/19/2021: Chinese developer Sinic defaults as Evergrande deadline looms 10/18/2021: Moscow cuts ferro-alloy export duties after pushback 10/18/2021: Steel Dynamics Reports Record Third Quarter 2021 Results 10/18/2021: Dow futures shed 100 points as investors await a big week of earnings 10/18/2021: Defaults loom over more property developers as China reassures investors on Evergrande 10/17/2021: China Sept daily steel output lowest since Dec 2018 on power curbs 10/17/2021: China’s coal hub Shanxi emerges from floods, easing coal supply concerns 10/17/2021: Coal supply to non-power sector has been controlled, not stopped: Coal India official 10/15/2021: Rusal plans to supply 300,000-400,000 tonnes of aluminium to China in 2021 |

|||||