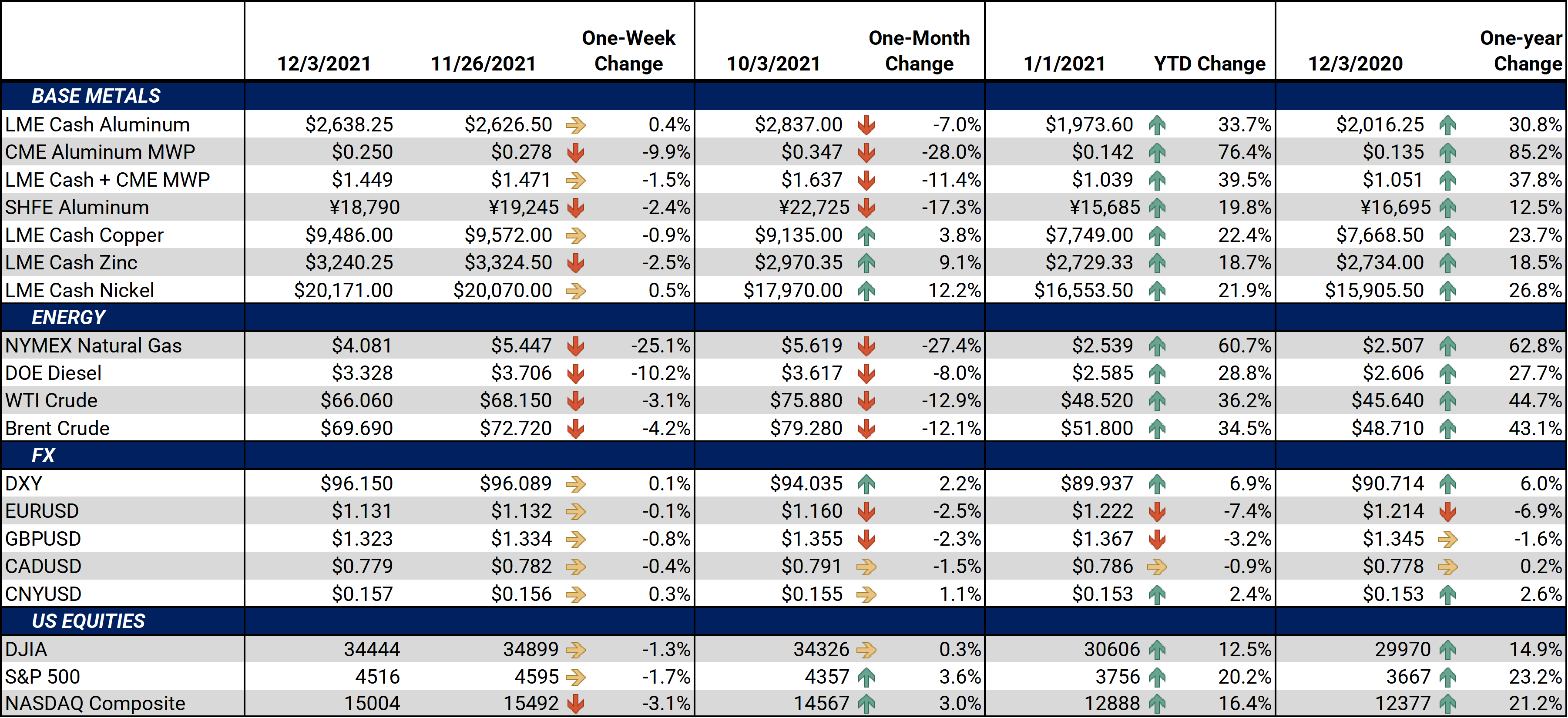

Bottom Line:Metals markets traded sideways this week as investors gauge the potential socioeconomic impact of the newly found Omicron COVID variant. Omicron first propagated in South Africa, which is a major metals production hub. |

Notable Metals News

Omicron has been detected in most of western Europe. Many European countries are implementing lockdowns and other measures to combat its spread and COVID in general. On Thursday, Germany announced a lockdown for the unvaccinated. Greece is enforcing mandatory vaccinations for those over 60 years old. Other Eurozone countries are implementing a variety of measures to slow the spread. European metals supply and demand could suffer depending upon how long these lockdowns persist.

Likewise, Omicron might impact metals production and exports from South Africa. The country is the world's largest exporter of platinum, and also major producers of gold and iron ore. As of this writing, there are no known shutdowns or slowdowns of mining or port activity. If they occur, shutdowns or slowdowns could be bullish if global demand stays elevated. (For more information on South African metals production and exports, please see our latest research article Will the Omicron COVID Variant Impact South African Metals Production or Exports?).

Major players in copper production are providing an unclear picture on the trajectory of copper prices into 2022 and beyond. Indonesia is considering a ban on exports, which could be bullish if their major customers (namely China and Japan) are unable to secure needed volumes elsewhere. However, the world’s largest copper producer, Codelco, is predicting lower prices in 2022 due to ample production.

Unlike copper, major producers of platinum are largely bullish. The World Platinum Investment Council expects platinum demand in the automotive sector to rebound in 2022 as its metal is a cheaper alternative to palladium. Platinum, which is used in many industrial applications such as cars and electronics, has been on a price downtrend throughout most of 2021. This could put CME platinum futures back on the upswing.

|

Hedge Strategy Suggestions: |

|||||

|

As stated in the outset, the potential impact of Omicron on metals supply and demand is yet to be known. Option strategies could be useful as we enter a new era of COVID uncertainty. Options by nature protect against extreme events and volatility, rather than providing absolute price protection, as swaps or futures do. Consumers of metal are preferring options-based hedges that can be layered in stages. Consider the following staggered hedging strategy. Consumers might begin to layer into call options, for protection against price increases, further out the forward curve. Later, that consumer could sell put options to offset the cost of the calls, if or when prices begin to stabilize. The hedger has effectively made a collar, possibly at several strike prices. This strategy could be used an alternative to a standard zero-cost collar. Metal producers may also find it advantageous to use costless collars. Their strategy is slightly different from that of the consumer, in that a producer would be selling calls and buying puts. These costless collars are a way to achieve most of the benefit, but avoid the high cost of put options. Recent volatility has made put options expensive. Copper continues to trend sideways, so producers of the red metal may opt for this strategy. |

|||||

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

Aluminum’s forward curve is the same shape as last week’s; however, it has shifted approximately $120/mt lower. It is flat throughout 2022, then the backwardation steepens into 2023 and beyond. This advantageous to aluminum producers who need make deferred purchases. |

|||||

|

|||||

|

The forward curve for the MWP is essentially flat. This is a tremendous change the from extreme backwardation of 30 days ago. Now the forward curve is advantageous to producers who need to make forward sales (this applies to anyone who is naturally “long” the MWP). Despite this week’s lower trade, the forward curve is about 1¢/lb higher than last week. |

|||||

LME Copper |

|||||

|

Copper’s forward curve has become slightly more backwardated than in prior weeks. It also shifted about $300/mt lower compared to last week.

|

|||||

|

|||||

|

The shape of nickel’s forward curve is the same as last week; however, is approximately $700/mt lower. Its shape is quite similar to that of copper. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

December ’21 HRC rallied slightly this week after a two-week pullback. Prices have started to form a downtrend, in contrast to the sideways trade in October and the first half of November. Even as prices have begun to slide, the forward curve remains severely backwardated throughout calendar year 2022. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

11/30/2021: Section 232 Tariffs: Most relevant developments (AEGIS Reference) 11/30/2021: Will the Omicron COVID Variant Impact South African Metals Production or Exports? 11/24/2021: AEGIS Factor Matrices: Most important variables affecting metals prices |

|||||

Notable News |

|||||

|

12/3/2021: Copper price down as dollar gains ahead of US jobs data 12/2/2021: Tin price surge worsens supply chain woes for electronics, solar and auto firms 12/1/2021: Codelco, world's largest copper producer, expects prices to fall in 2022 11/30/2021: Tin prices gain momentum as Indonesia mulls tin, copper export bans 11/30/2021: Minerals Council South Africa applauds mining industry’s vaccination milestone 11/29/2021: Gold SWOT: Platinum demand from auto sector expected to rise next year 11/29/2021: Iron ore price back above $100 despite Omicron variant fears 11/29/2021: Copper price rises as markets assess Omicron variant impact 11/29/2021: Dow futures rebound by 200 points after Friday’s big sell-off as investors reassess omicron risk 11/26/2021: Copper price sinks as new covid variant spooks markets |

|||||