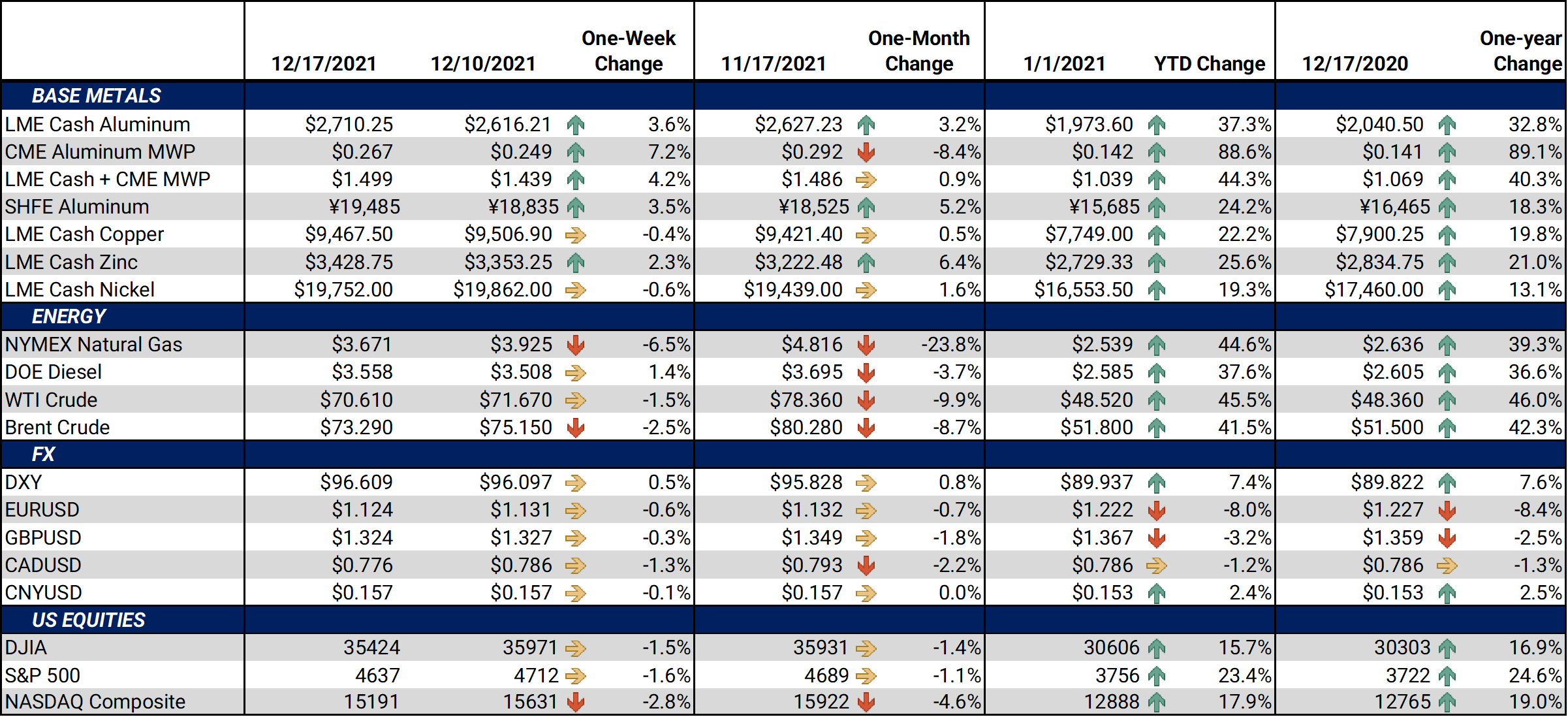

Bottom Line:LME Copper finished nearly unchanged this week. The shutdown of the Las Bambas copper mine in Peru might cause tighter supply issues in the future. However, expectations of this shutdown have circulated for several weeks, so this event’s effect on prices on the curve was likely already done. There is still some risk, though; little is known on how long this shutdown will last.An interesting market to note is HRC Steel. American production is now back to pre-COVID shutdown levels. Capacity utilization, which measures how much capacity is being used relative to the total available capacity, is at the highest level since 2008. On the demand side, year-to-date imports into the US were 20,056,751 mt through September, up from 15,174,901 mt during that period in 2020 (US Census Bureau). Fastmarkets AMM Steel hot-rolled coil, import, DDP (delivered duty paid) Houston prices have dropped from $1,675/T on July 9 to $1,340/T on December 10. A continued increase in imports, along with increasing production, might weigh on both CME and import prices. |

Notable Metals News

The US has made steps to negotiate with Japan regarding the current import tariffs on Japanese-produced steel and aluminum. Last Friday, December 10, the US submitted a new proposal to the newly elected Prime Minister of Japan, Fumio Kishida. The current tariffs levels are 25% on steel and 10% aluminum and have been in place since 2018. The US is proposing a tariff-rate quota system in which volumes are taxed at different levels. Talks between the two nations are private, so specific details are unknown. According to government data, the US imports of Japanese steel fell from 1.73 million mt in 2017 (pre-tariffs) to 1.14 million mt in 2019.

Staying with Japan, Toyota continues to cut car production. Logistical problems and low employee attendance at part suppliers have forced Toyota to reduce car production by about 14,000 units in December. Toyota had previously cut global production by 360,000 units in both September and October, which equates to a 40% year-over-year drop. Production also fell by 135,000 units in November, which equates to 15% year-over-year decline. According to the BBC, the company stills aims to produce nine million units by its fiscal year-end, March 31.

Moving on to China, the Chinese real estate sector continues worsening statistics for metals demand. According to Reuters, Chinese new home prices fell by 0.3% month-over-month in November. This was the largest price drop since February 2015. New construction starts (as measured by floor area) were down 21.03% on year, according to government data. This marks the eighth consecutive monthly decline for new construction starts.

Lastly in Peru, the Las Bambas copper mine will shut down production on December 18. Protestors have been blocking roadways into the mine since mid-November. Negotiations between the mine and the protestors have failed several times. The duration of the possible shutdown is currently unknown. The mine is owned and operated by MMG-Ltd, a China-based firm. According to the company, in 2021, the mine will produce 290,000 mt, which is down from 311,020 mt produced in 2020. Reuters recently stated the mine can produce 400,000 mt of copper concentrate per year, which is approximately 2% of world production.

|

Hedge Strategy Suggestions: |

|||||

|

The LME Aluminum forward curve is relatively flat throughout 2022. However, it becomes backwardated (where shorter-term contracts are priced higher than the deferred market) beyond 2022. For consumers who are unsure of market direction, option collars (buying a call and a selling a put) are logical strategies. Producers can also use the relatively flat curve to hedge inventory. LME Copper’s forward curve is in backwardation through December 2023. Thus, end users can make deferred purchases at a deep discount to the cash market. Layering into swaps with tenors throughout the second half of 2022 might be a logical tactic for such end users. For CME HRC Steel, the backwardation has widened since last week. For example, last Friday, the spread between January 2022 and February 2022 was approximately $100/T. Now it is approximately $110/T. Similar to our copper ideas, layering into swaps with tenors throughout the second half of 2022 might be a logical tactic for end users. |

|||||

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum rallied this week; however, it remains within its trading range that began in early November. After this week’s rally, aluminum’s forward curve is now about $40/mt to $50/mt higher than last week. That said, the forward curve is similarly shaped to that of last week’s. |

|||||

|

|||||

|

The forward curve for the MWP looks like two letter “Z’s”. The backwardation now begins in May ’22. Like aluminum, the forward curve has shifted higher due to this week’s rally. |

|||||

LME Copper |

|||||

|

Copper’s forward curve essentially mirrors that of last week. Peru’s potential supply issues might impact the forward curve.

|

|||||

|

|||||

|

Continuing the theme, the shape of nickel’s forward curve is the same as last week. It is, however, lower by about $250/mt. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

As for HRC steel, charts remain in a downtrend and rallies have been met with quick resistance. Even as prices have begun to slide, the forward curve remains severely backwardated throughout calendar year 2022. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

12/13/2021: Section 232 Tariffs: Most relevant developments (AEGIS Reference) 12/10/2021: AEGIS Factor Matrices: Most important variables affecting metals prices 11/30/2021: Will the Omicron COVID Variant Impact South African Metals Production or Exports? |

|||||

Notable News |

|||||

|

12/16/2021: Iron ore price up on hopes of recovering steel production in China 12/16/2021: MMG shuts down Las Bambas copper mine as talks fail 12/15/2021: China housing market slumps again as another developer runs into trouble 12/14/2021: Global supply chain: Toyota extends Japan production stoppages 12/13/2021: Raw Steels MMI: Steel prices decline; more tariff negotiations 12/9/2021: China steps up overseas hunt for ore needed to make aluminum |

|||||