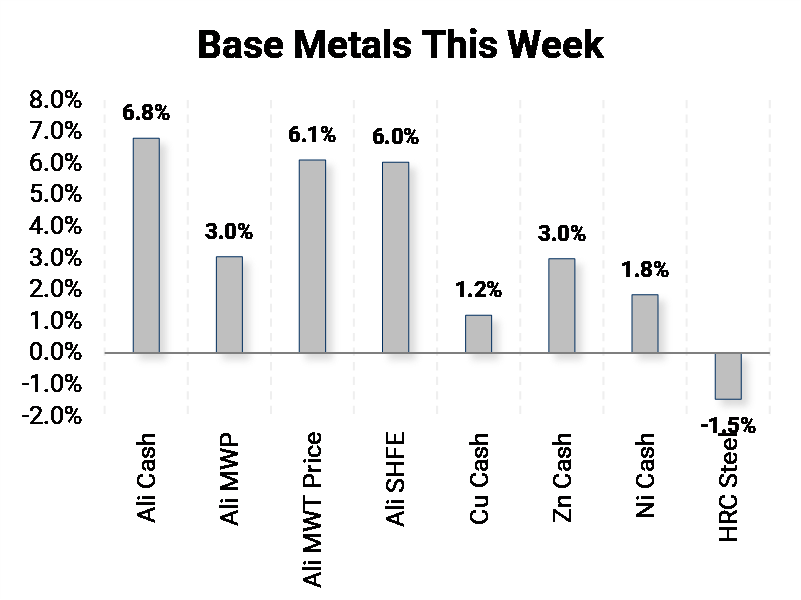

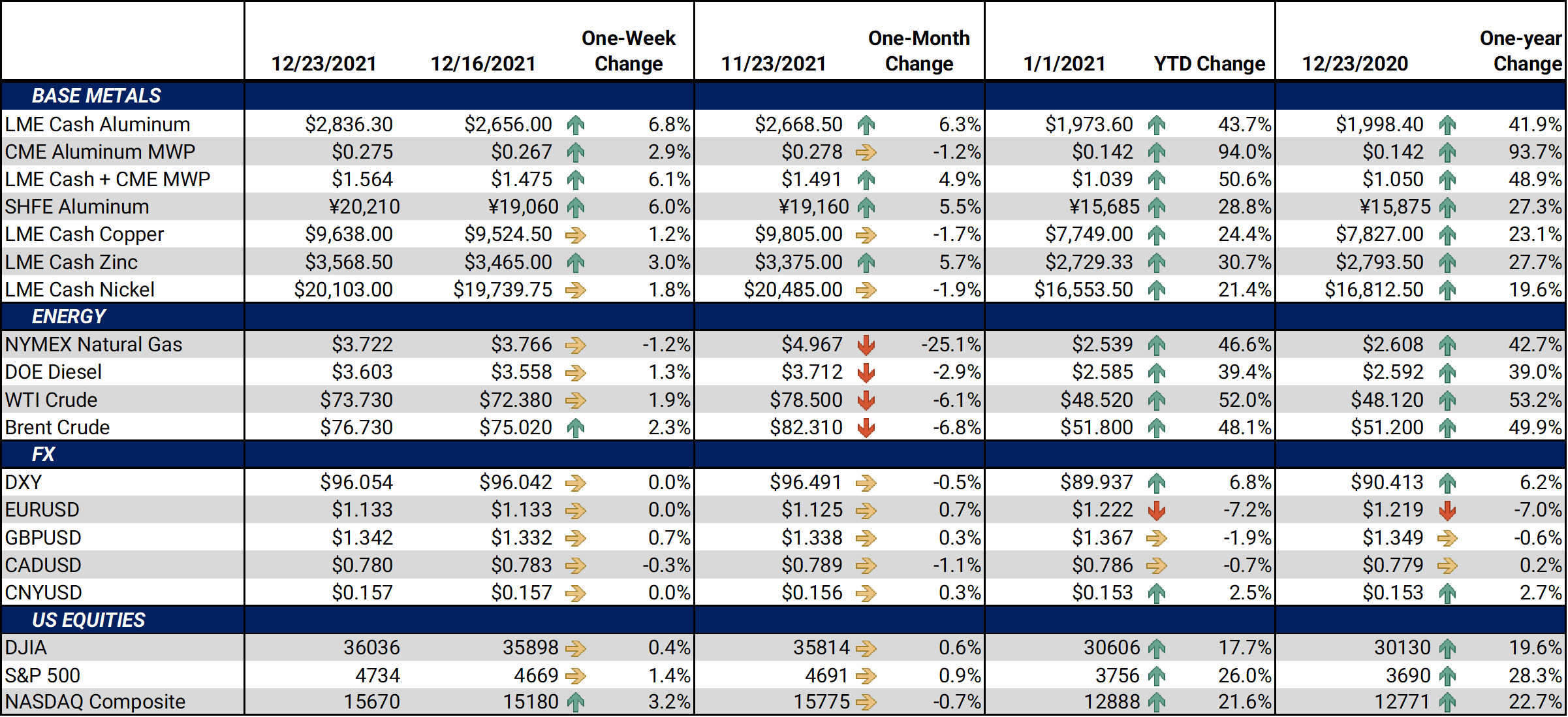

Bottom Line:**No Metals Daily First Look will be published on Friday, December 24 through Tuesday, December 28**Due to a tightening supply pictures, LME Zinc and Aluminum have rallied in the past two weeks. European smelters of aluminum and zinc are grappling with skyrocketing electricity costs. Several have had to stop or slow production as margins have evaporated.We should keep on an eye on the US Dollar Index. A weakening USD Index might be partially to blame for this week’s rally. The USD Index is normally negatively correlated with base metal prices. A weakening USD would make dollar-denominated goods cheaper to foreign-currency buyers, so the price falls to keep their purchasing power intact. |

|

Notable Metals News

Potentially bullish zinc news occurred late last week. Citing high electricity costs, Nyrstar will shut down in January its zinc smelter in Auby, France. The duration of the possible shutdown is currently unknown. According to a recent factsheet from the company, the smelter can produce 149,000 mt of zinc per year. The smelter’s production had already been cut by 50% in October 2021 due to soaring energy costs. Nystrar is the one of the world’s largest zinc producers, with 720,000 mt of annual zinc production in Europe, according to Reuters. Most of Nystar’s production is based in Europe, with smaller operations in Australia and the US. According to Reuters, global zinc supplies this year are estimated at around 14 million mt. This outage represents about 1% global production.

Like zinc smelters, European aluminum producers are seeing similar power crunches and production cuts. High electricity costs are forcing the France-based smelter Aluminum Dunkerque to consider deeper production cuts. The company has cut production by a mere 3% in the past two weeks, but a union representative quoted by Reuters stated, “further curtailments may be necessary if power prices remain at sky-high levels.” This representative also said the plant has lost about 20 million euros ($22.6 million) since the beginning of November. According to Reuters, “at one-month baseload prices in France, it would cost about $11,000 for the power typically needed to make one ton of aluminum, which was trading at about $2,800 a ton on the London Metal Exchange on Wednesday.” Aluminum Dunkerque has a production capacity 285,000 mt/yr and is Europe’s largest. Last year France produced 430,000 mt of aluminum.

HRC Steel demand continues to see headwinds. Earlier this week Toyota announced that a lack of semiconductors and other supply-chain issues have forced them to stop operations on seven production lines at five Japanese factories in January. This will lower Toyota’s global production by 20,000 vehicles that month. Prior to this announcement, the company had planned to produce 800,000 vehicles in January. The company has had several production cuts in recent months (14,000 units in December, 135,000 units in November, and 360,000 units in both September and October). Toyota recently stated they still plan to make nine million vehicles by fiscal year end March 31.

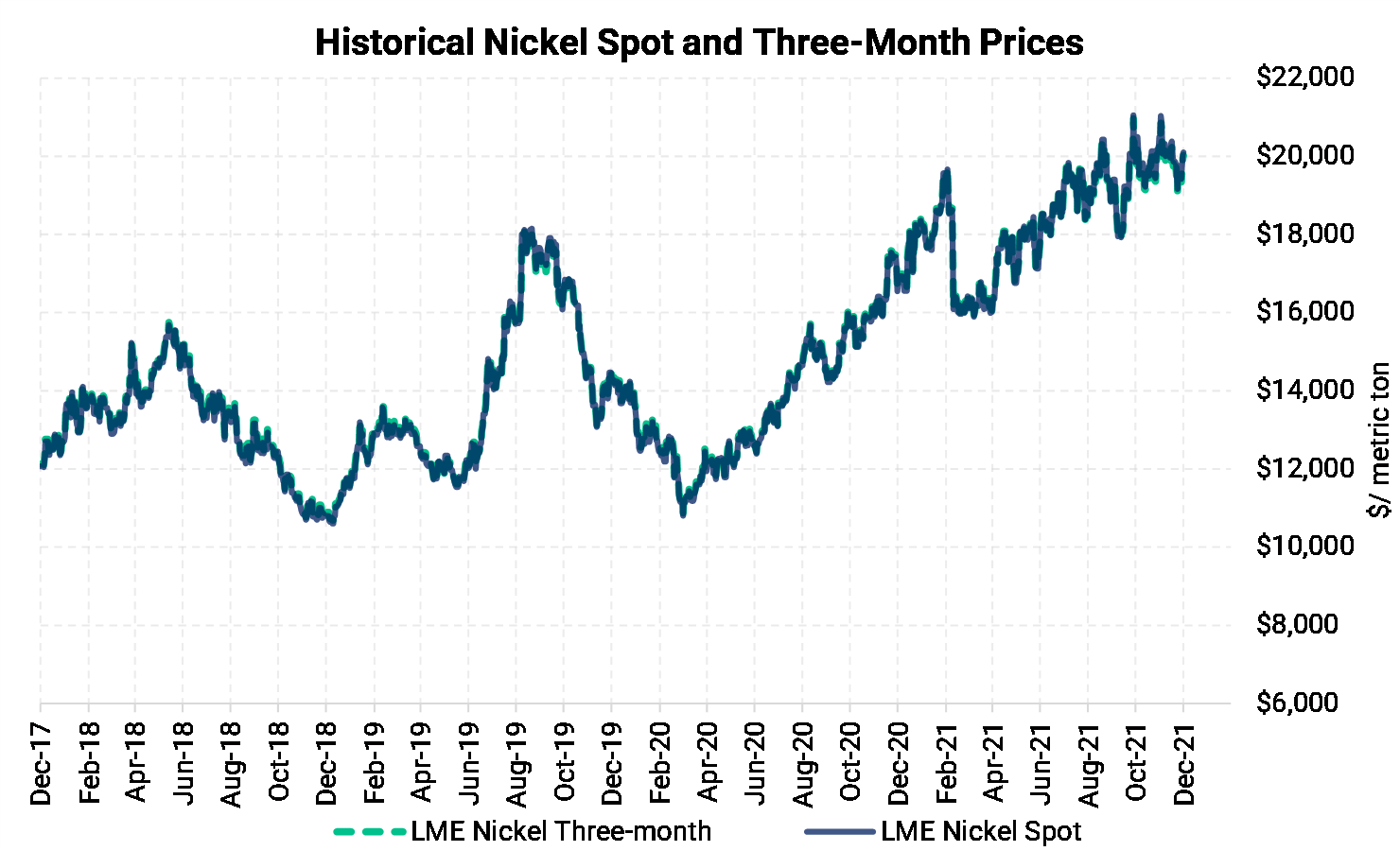

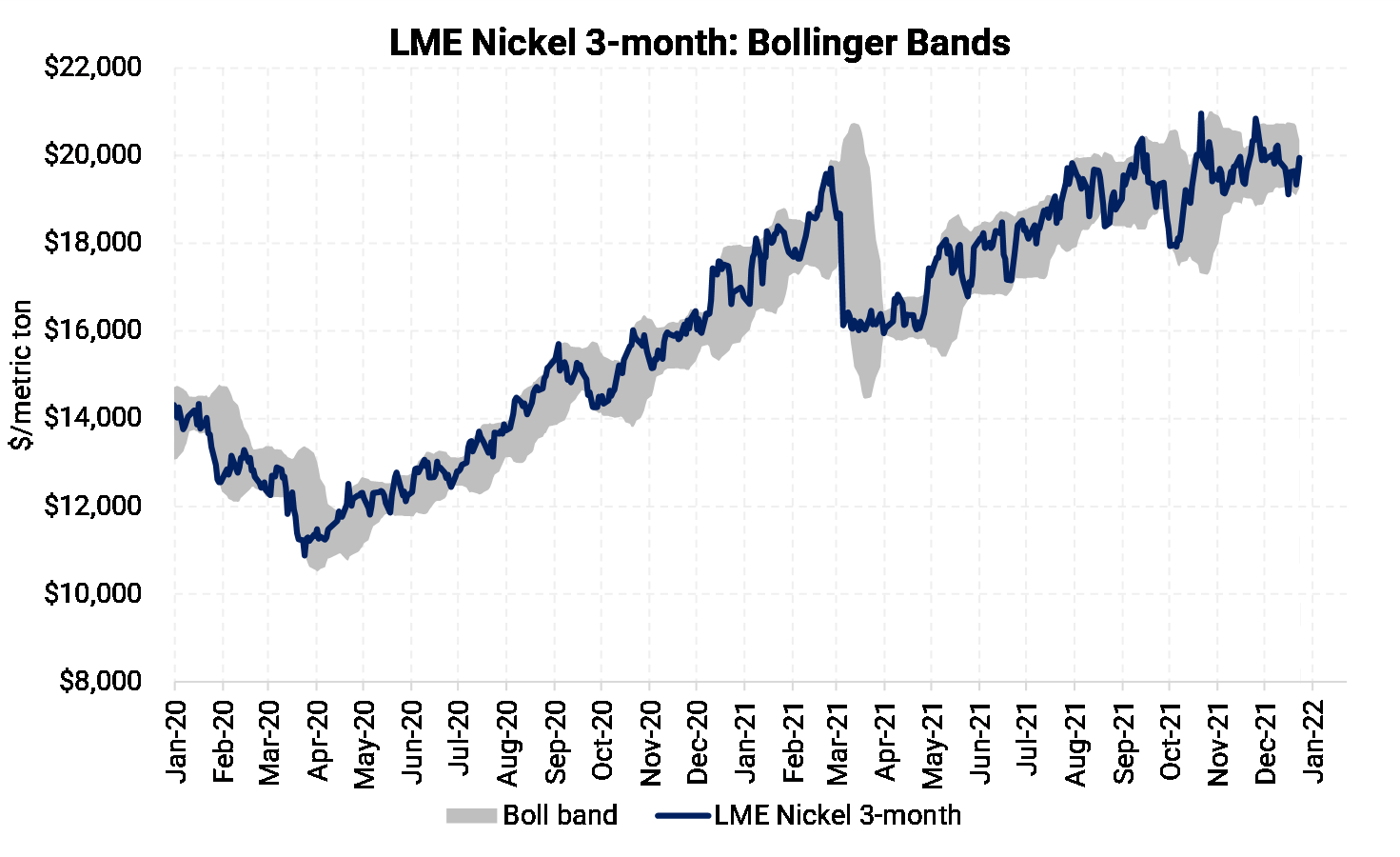

Nickel prices have rallied in 2021 but might suffer in 2022. The Global Palladium Fund, a precious metals fund, estimates a nickel surplus of 59,000 mt for 2022. The COVID pandemic stopped a capacity expansion in Indonesia, leading to a potential deficit of 150,000 mt in 2021. According to the USGS, global production was 2.5 million mt in 2020, with Indonesia as the largest producer at 760,000 mt. The final global and Indonesian production volumes for 2021 have not yet been released.

|

Hedge Strategy Suggestions: |

|||||

|

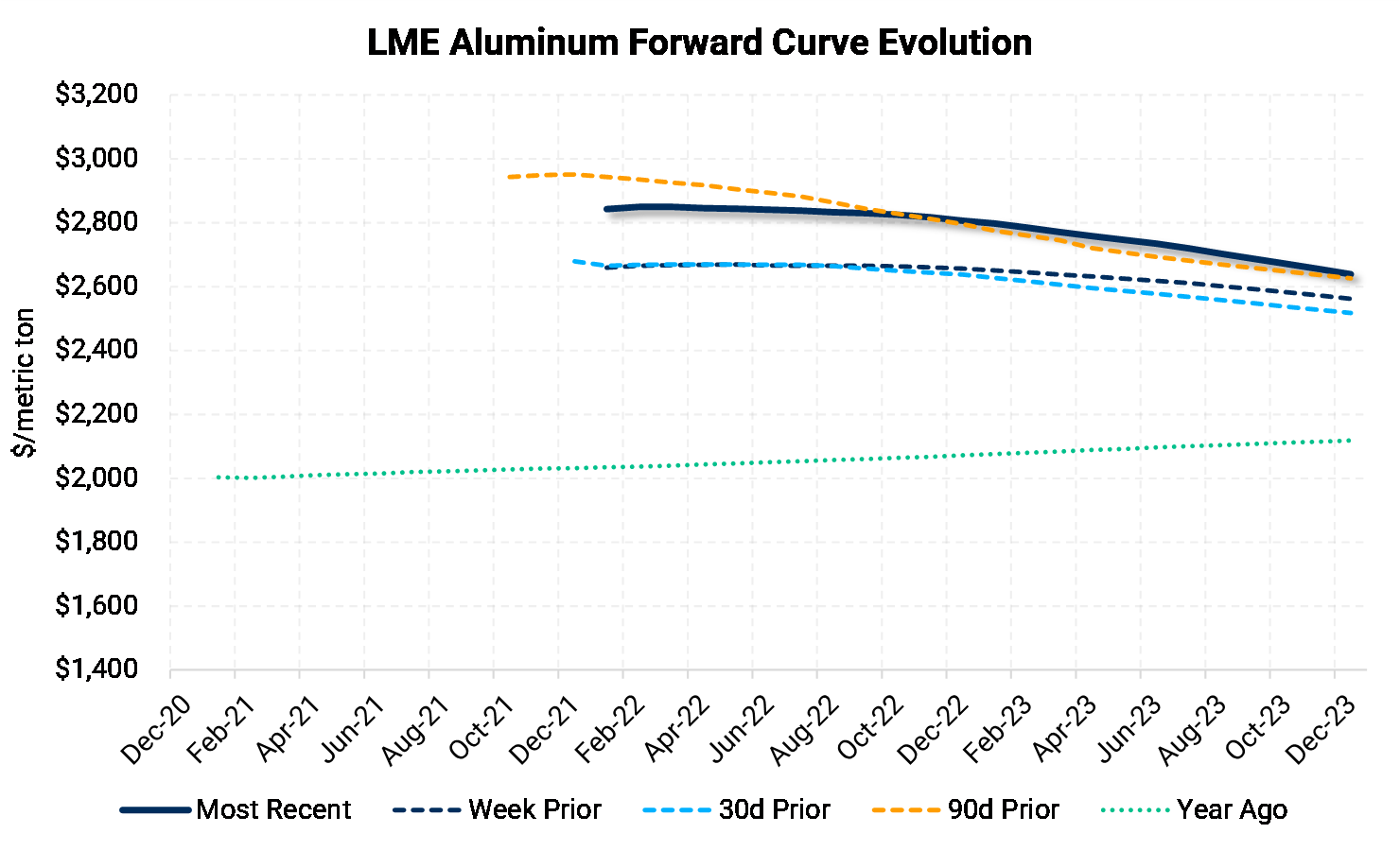

Those who have downside inventory price risk in the Midwest Premium (MWP)may consider selling forward in a contango market (where shorter-term contracts are priced lower than the deferred market). The MWP market is extremely thin, so please contact us for details on hedging opportunities. The LME Aluminum forward curve is relatively flat throughout 2022. However, it becomes backwardated (where the forward curve is downward sloping and becomes cheaper farther out in time) beyond 2022. For consumers who are unsure of market direction, option collars (buying a call and a selling a put) are logical strategies. Producers can also use the relatively flat curve to hedge inventory. LME Copper’s forward curve is in backwardation through December 2023. Thus, end users can make deferred purchases at a deep discount to the cash market. Layering into swaps with tenors throughout the second half of 2022 might be a logical tactic for such end users. For CME HRC Steel, the backwardation remains significant. Similar to our copper ideas, layering into swaps with tenors throughout the second half of 2022 might be a logical tactic for end users. |

|||||

|

|

|||||

|

|

|||||

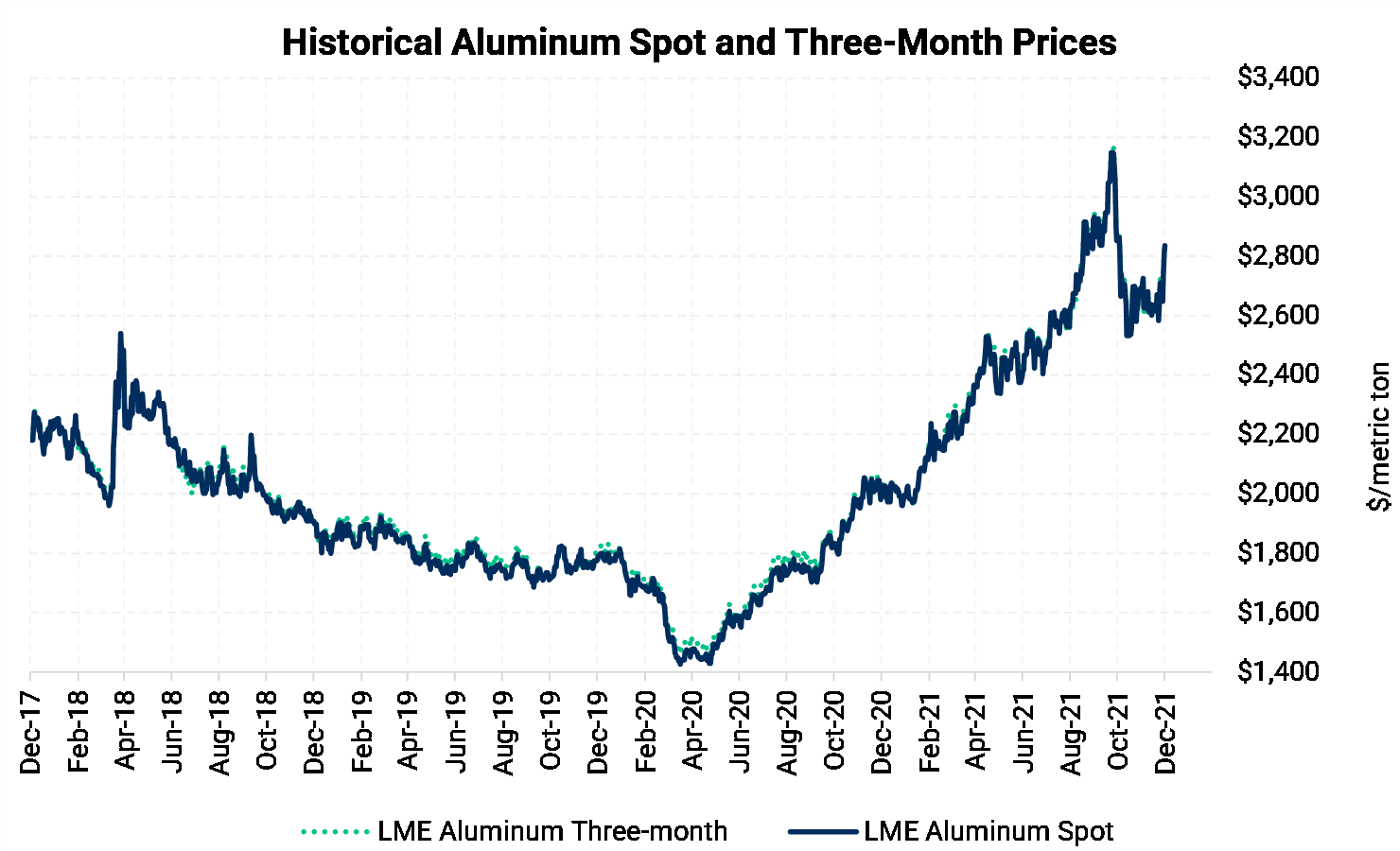

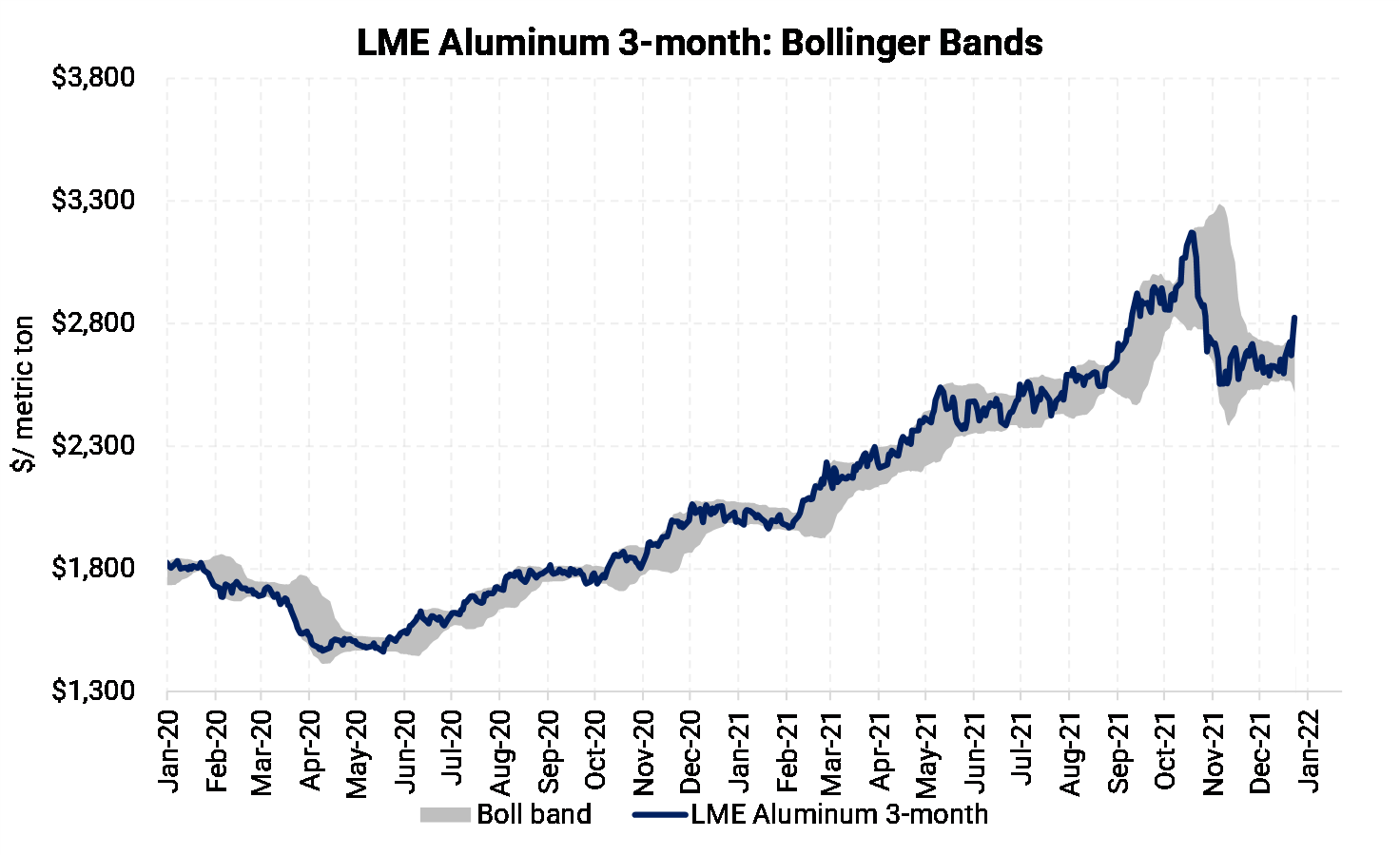

LME Aluminum |

|||||

|

LME Aluminum rallied for a second week in a row; however, it remains within its trading range that began in early November. After this week’s rally, aluminum’s forward curve is now about $100/mt to $200/mt higher than it was last week. TIt was a vertical shift; the curve’s shape changed little. Let’s keep an eye on the production situation in Europe. The forward curve might see more severe backwardation if production slows while demand remains elevated. |

|||||

|

|||||

|

The forward curve for the MWP still looks like two letter “Z’s”. The backwardation now begins in May ’22. Like LME Aluminum, the forward curve has shifted higher due to this week’s rally. |

|||||

|

|

||||

|

|

||||

|

|

|

||||

LME Copper |

|||||

|

Copper’s forward curve has shifted higher by about $100/mt. It remains severely backwardated. Peru’s potential supply issues might impact the forward curve.

|

|||||

|

|||||

|

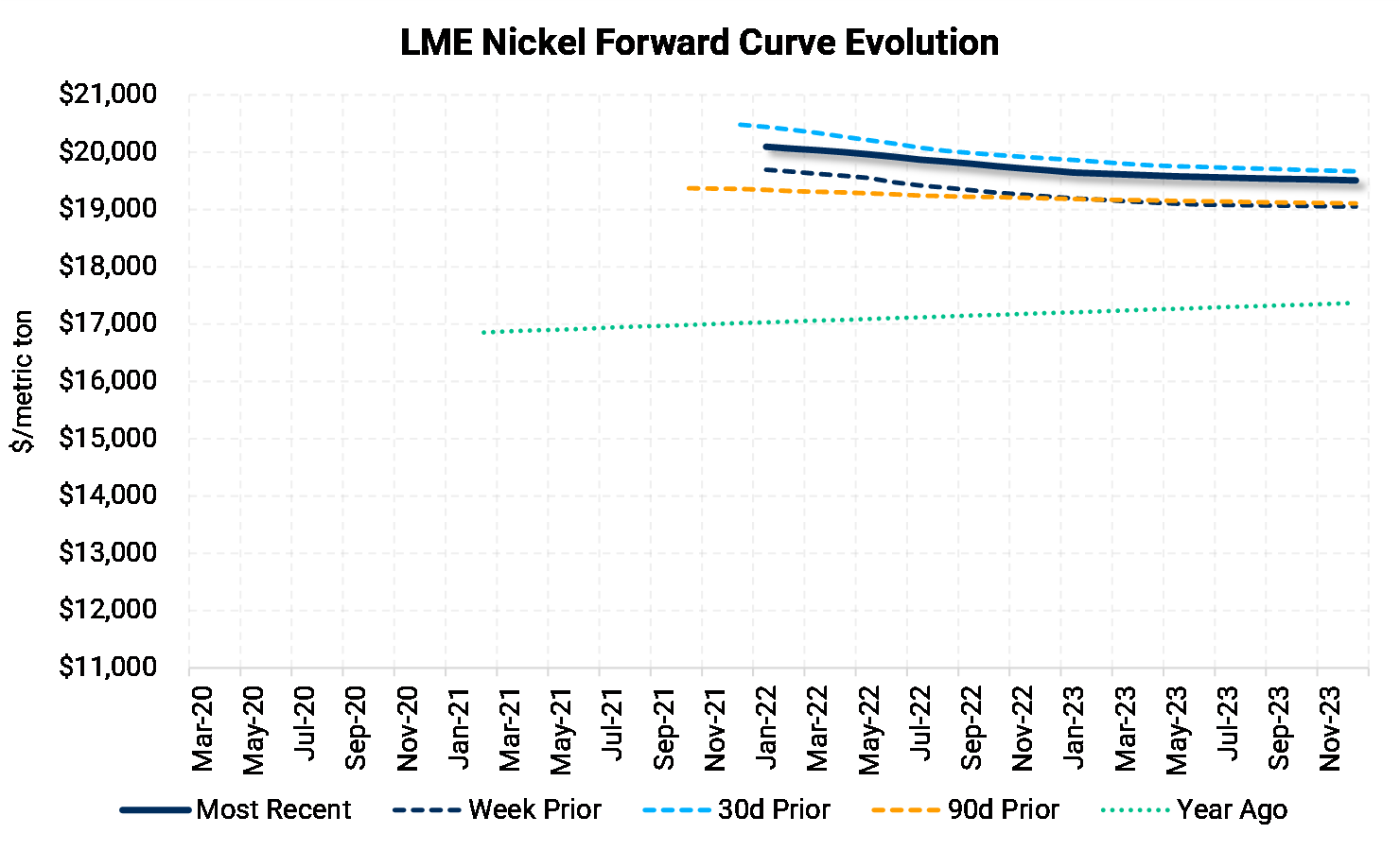

Continuing the theme, the shape of nickel’s forward curve is the same as last week. It is, however, higher by about $400/mt to $500/mt. |

|||||

|

|

|||||

|

|

||||

|

|

||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

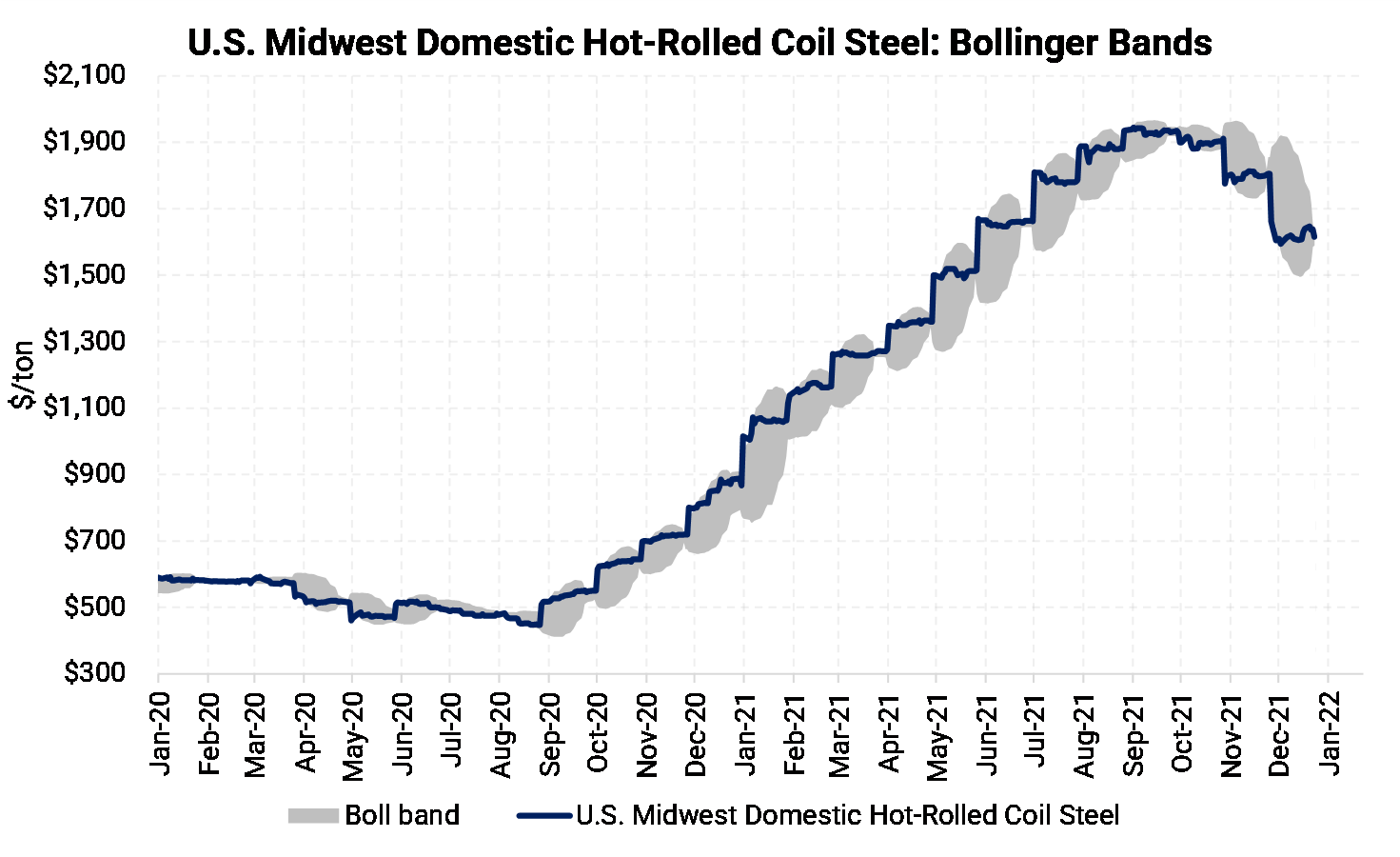

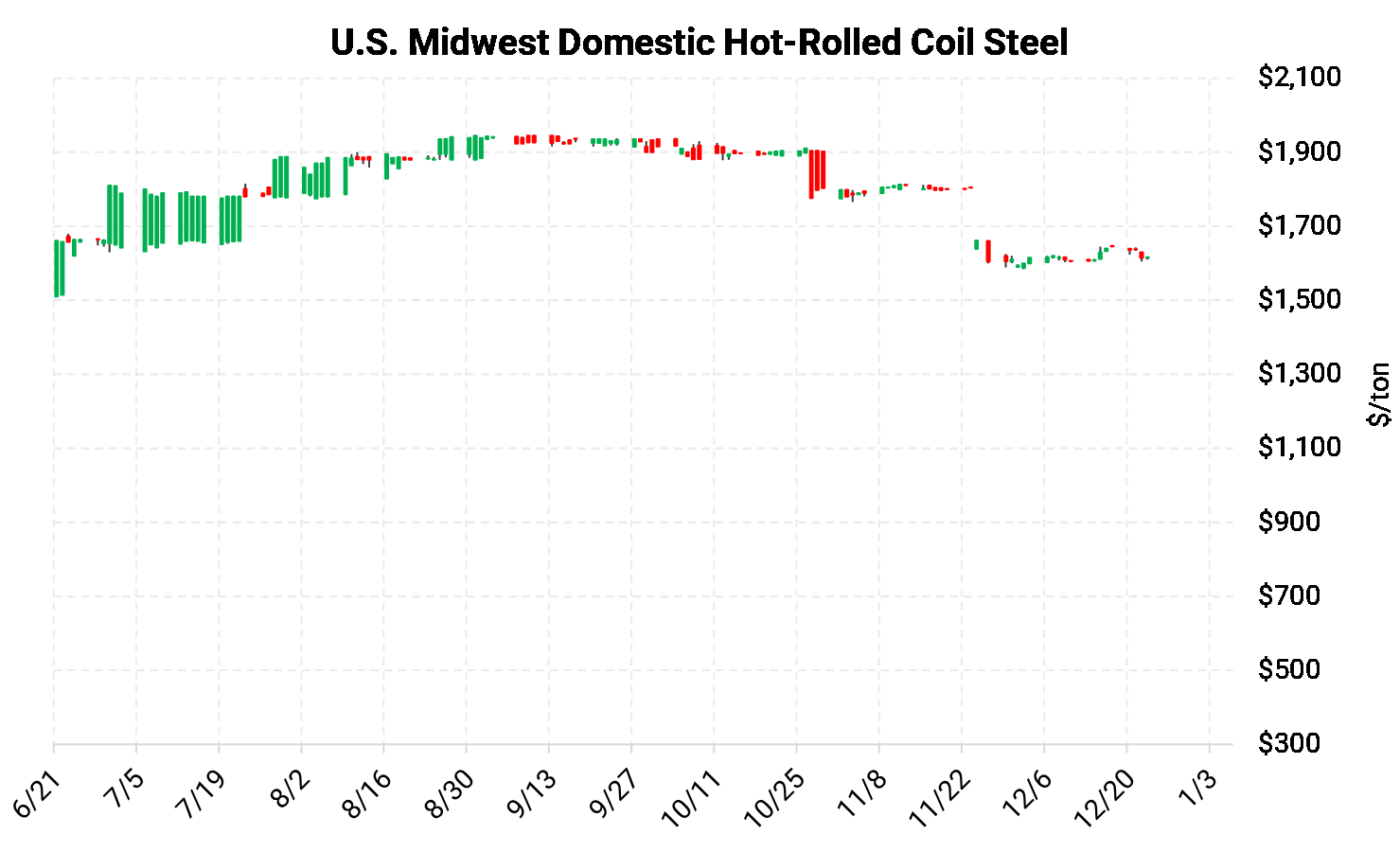

As for HRC steel, this week’s trade wiped away most of last week’s gains. The charts remain in a downtrend and rallies have been met with quick resistance. Even as prices have begun to slide, the forward curve remains severely backwardated throughout calendar year 2022. |

|||||

|

|

|||||

|

|

||||

AEGIS Insights |

|||||

|

12/22/2021: AEGIS Factor Matrices: Most important variables affecting metals prices 12/13/2021: Section 232 Tariffs: Most relevant developments (AEGIS Reference) 11/30/2021: Will the Omicron COVID Variant Impact South African Metals Production or Exports? |

|||||

Notable News |

|||||

|

12/22/2021: Europe’s Largest Aluminum Smelter Trims Output After Power Spike 12/21/2021: German zinc recycler Befesa expands in China 12/21/2021: Global nickel supply could increase by 20% in 2022 – report 12/20/2021: Toyota to cut production by 20,000 cars in Japan next month 12/19/2021: Toyota to halt production at 5 factories in January due to supply chain issues 12/17/2021: Zinc price soars as power crunch forces Nyrstar to idle French plant 12/16/2021: Nyrstar's Auby zinc operation on care and maintenance from Jan |

|||||