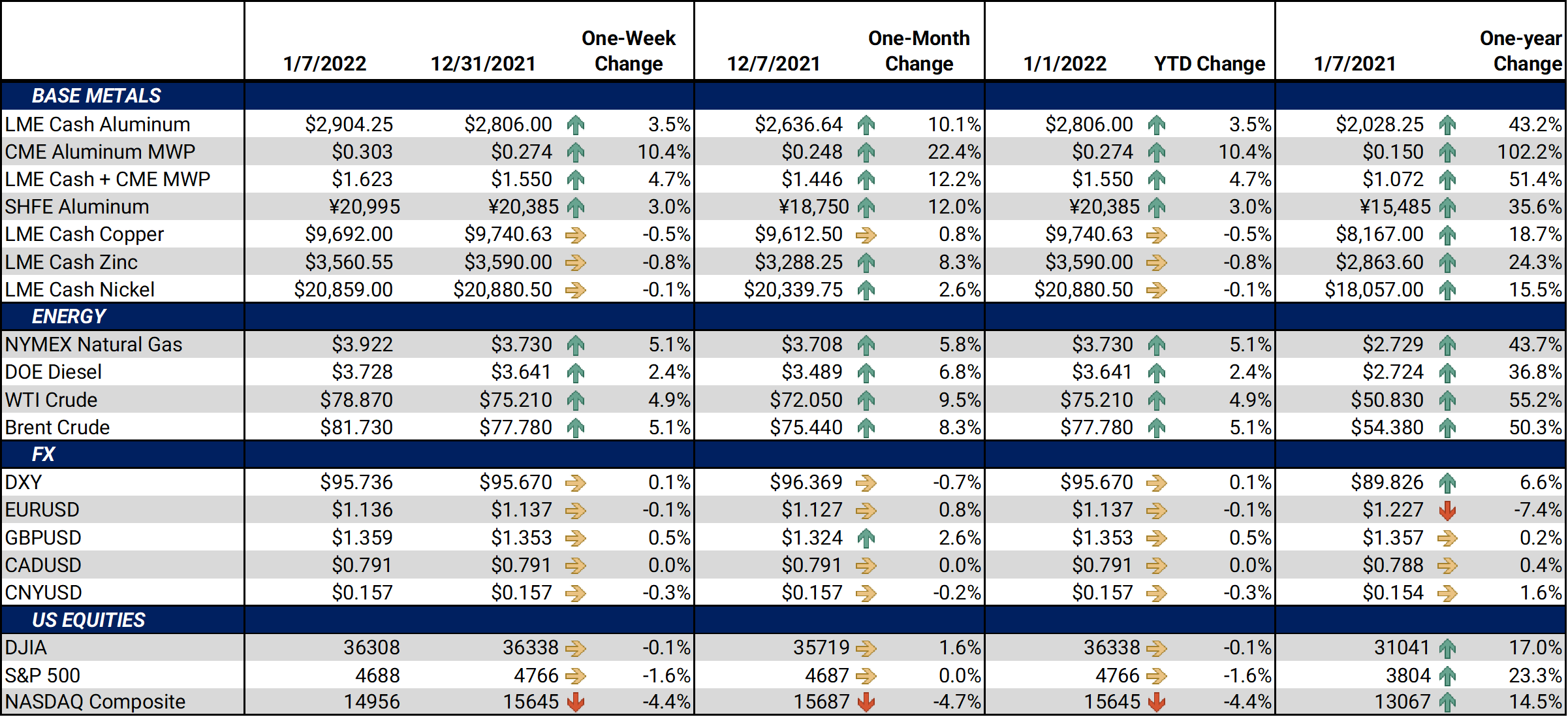

Bottom Line:LME Aluminum continued its rally this week, as smelter shutdowns in Europe might constrain future supply. Six European smelters have announced production cuts in recent weeks. Total capacity of these six smelters is 1.123 million mt/year, of which approximately 57%, or 0.635 million mt/year would be taken offline. By our estimations, the cuts announced by these six smelters are approximately 13% of European annual capacity. |

Notable Metals News

Japanese aluminum premiums have fallen as demand has stalled. The premium for aluminum imports to Japanese buyers for January to March was set at $177/mt, down from $220/mt the previous quarter (Reuters). This is the premium over the London Metal Exchange (LME) cash price that Japanese importers agree to for primary aluminum shipments. Through November, the country had imported approximately 2.064 million mt in 2021. Japan’s import pace was similar in 2020: Japan imported 2.067 million mt during that same 11-month period. Japanese aluminum demand has stalled in recent months as automotive production has slowed.

Copper production in Chile has dropped in recent months. According to the Chilean Copper Commission, total copper production in November fell by 0.6% year-on-year to 481,800 mt. Lower production by BHP’s Escondida is largely to blame. Escondida, which is the world’s largest copper mine, saw output drop by 11.6% year-over-year to 80,300 mt in November. In 2021, total Chilean production was approximately 3.8 million mt through November. During that same period in 2020, production was over 5.2 million mt. According to Bloomberg, some mines were performing maintenance, which had been delayed due to the pandemic.

Steel imports into the US continue unabated. Data released by the US Census Bureau last week showed that through October, the US had imported 22.5 million mt of steel in 2021. Through October 2020, the US had imported just 16.4 million mt of steel. Imports from Canada, our largest supplier, are up by nearly 2 million mt (5.9 million mt through October 2021, vs 3.9 million mt through October in 2020). High demand and record import prices have fueled the flood of imports into the US.

|

Hedge Strategy Suggestions: |

|||||

|

Aluminum producers who have short-term (over the next one to four months) downside inventory price risk in aluminum might consider selling forward into a contango-to-flat curve (where shorter-term contracts are priced lower than the deferred market). Doing so would create hedges at prices higher than current cash or near-term prices. The curve changes shape farther out, so different hedging tactics would be more beneficial. The forward curve’s steep backwardation remains in the latter half of 2022. Thus, end users who have longer-term price risk might consider zero-cost collars in this backwardated market. Like LME aluminum, those who have short-term (over the next one to four months) downside inventory price risk in the Midwest Premium (MWP), might consider selling forward in a contango to flat market. End users who need to make forward purchases in the MWP might consider buying swaps in a backwardated market (where longer-term contracts are priced lower than the cash and near-term market). The MWP market is extremely thin, so please contact us for details on hedging opportunities. Copper has been quite rangebound recently, so our strategies are similar to last week’s. LME Copper’s forward curve is in backwardation through December 2023. Thus, end users can make deferred purchases at a deep discount to the cash market. Layering into swaps with tenors throughout the second half of 2022 might be a logical tactic for such end users. Collars could be considered, too. For CME HRC Steel, the backwardation remains significant. Like our copper ideas, layering into swaps with tenors throughout the second half of 2022 might be a logical tactic for end users. The HRC Steel market is extremely thin, so contact us for strategies to execute hedges efficiently. |

|||||

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum has rallied since mid-December as production cuts at European smelters remain a key issue for the market. The forward curve continues to shift higher, and from July 2022 onwards it is higher than where it was 90 days ago. The forward curve has risk of even more severe backwardation, or perhaps another parallel shift higher in price, if production slows while demand remains elevated. |

|||||

|

|||||

|

The forward curve for the MWP is similarly shaped to that of last week’s and remains backwardated. July ’22 and beyond has shifted about 0.5¢ to 1¢ higher compared to last week. |

|||||

LME Copper |

|||||

|

LME Copper has been rangebound since late October. Copper’s forward curve is essentially where we were 30 days ago and remains severely backwardated.

|

|||||

|

|||||

|

Nickel’s forward curve is little changed from last week. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

The prompt month (January) HRC contract has essentially traded sideways for over a month. Despite the sideways trade, the forward curve remains severely backwardated throughout calendar year 2022 and has shifted lower this week. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

01/05/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 01/05/2022: Section 232 Tariffs: Most relevant developments (AEGIS Reference) 11/30/2021: Will the Omicron COVID Variant Impact South African Metals Production or Exports? |

|||||

Notable News |

|||||

|

1/6/2022: Column: Europe's power crunch sparks aluminium smelter meltdown 1/5/2022: Japan Q1 aluminium premium falls 20% to $177/T -sources 1/5/2022: Japan aluminium buyers to pay lower premiums for Jan-March imports 1/5/2022: Power prices propel aluminium to 2-month peak 1/4/2022: Copper price down, pressured by stronger dollar 1/4/2022: Chile’s November copper output falls amid drops from Codelco and Escondida |

|||||