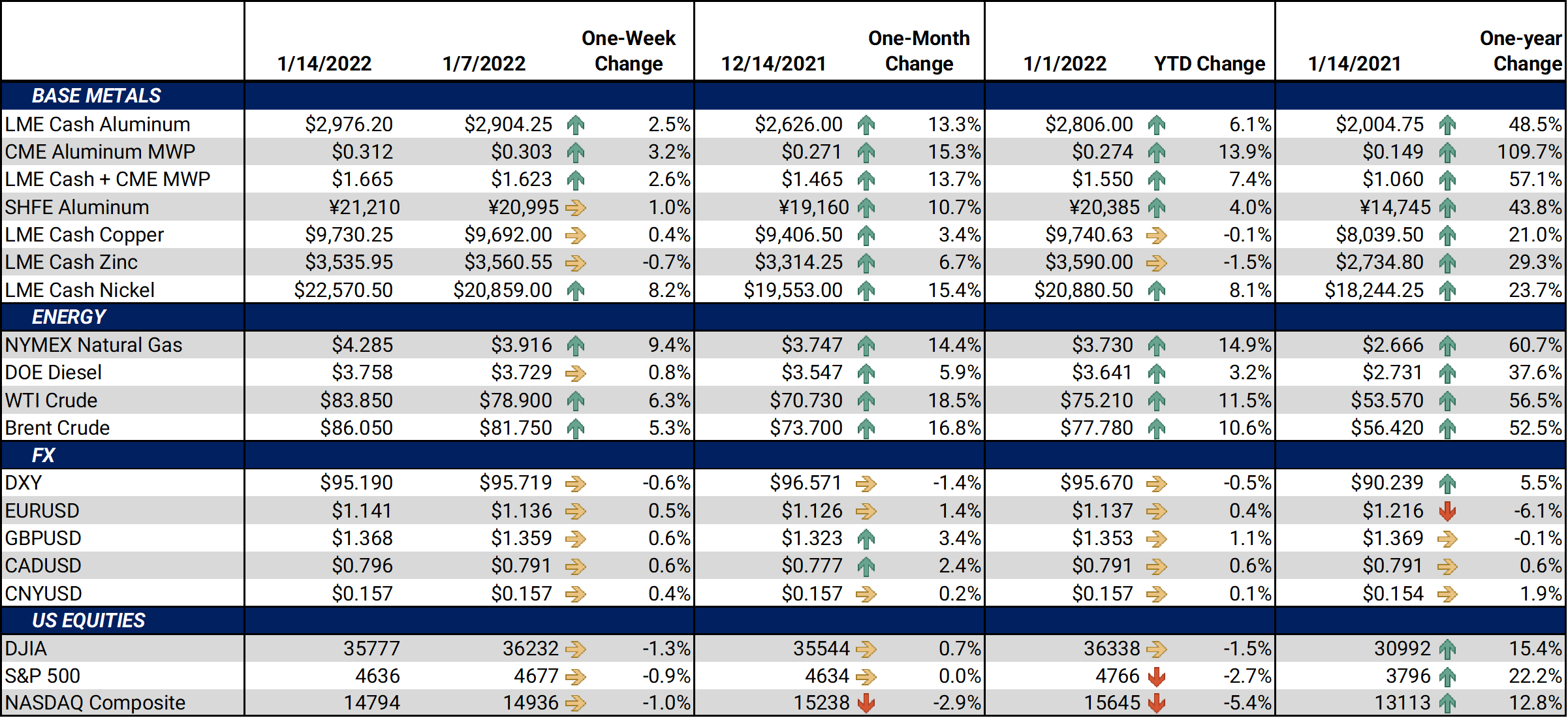

Bottom Line:LME Nickel 3M has rallied about $1,455/mt, or 7.0%, this week. This is largely because nickel supplies might further tighten in the coming years. Talon Metals has signed an agreement to supply 75,000 mt of nickel over six years to carmaker Tesla. The Minnesota-based mine project is set to open in 2026. Electric vehicles such as Tesla use nickel in their batteries. Likewise, Tesla’s upcoming Cybertruck uses nickel in the stainless-steel body parts. The burgeoning electric-vehicle industry might keep nickel demand high and supplies tight in the coming years.Also supporting nickel prices were reports that Indonesia, the world’s largest nickel supplier, is considering an export tax. The country is concerned about depleting domestic stocks. Indonesia produced 760,000 mt of nickel in 2020.We should also keep an eye on the situation between Russia and Ukraine. US Senate Democrats are aiming to place sanctions on Russia if it invades Ukraine. Renewed sanctions, specific to industrial metals, could further tighten global aluminum supplies. |

Notable Metals News

Potentially bullish copper-supply news also occurred this week. Copper supplies could drop by 119,000 mt per year if union workers at Canada’s largest open-pit copper mine decide to strike. Union workers at Teck Resources’ Highland Valley Copper mine gave notice earlier this week that a strike might begin on January 16. The company did not provide a reason for the strike; however, according to Reuters, both sides were negotiating a new collective bargaining agreement to replace the previous agreement, which expired on September 30, 2021. As a country, Canada mined 495,000 mt in 2020.

European aluminum smelters are still implementing production cutbacks. On Friday, January 7, Reuters reported that France-based Aluminium Dunkerque will cut aluminum production by an additional 15% starting the week of January 10. In late December, Bloomberg reported that production had already been cut by 3%. High electricity costs have evaporated profits, leading to production cuts throughout Europe. Aluminium Dunkerque has a production capacity 285,000 mt/yr and is Europe’s largest aluminum smelter.

|

Hedge Strategy Suggestions: |

|||||

|

Aluminum producers who have short-term (over the next one to four months) downside inventory price risk might consider selling forward into a contango-to-flat curve (where shorter-term contracts are priced lower than the deferred market). Doing so would create hedges at prices higher than current cash or near-term prices. The curve changes shape farther out, so different hedging tactics would be more beneficial. The forward curve’s steep backwardation remains in the latter half of 2022. Thus, end users who have longer-term price risk might consider zero-cost collars in this backwardated market. Like LME aluminum, those who have short-term (over the next one to four months) downside inventory price risk in the Midwest Premium (MWP), might consider selling forward in a contango to flat market. End users who need to make forward purchases in the MWP might consider buying swaps in a backwardated market (where longer-term contracts are priced lower than the cash and near-term market). The MWP market is extremely thin, so please contact us for details on hedging opportunities. Given that LME Copper has rallied this week and is now briefly made a three-month high, a change in hedge tactics might be in order. Copper’s forward curve remains in backwardation through December 2023. End users who have longer-term price risk might consider zero-cost collars in this backwardated market. Producers can sell forward a portion of production forecast using swaps at historically high prices to increase the likelihood of achieving revenue targets. For CME HRC Steel, the backwardation remains significant. Layering into swaps with tenors throughout the second half of 2022 might be a logical tactic for end users. Low liquidity in the HRC Steel market makes hedging challenging, but it’s still feasible. Contact us for strategies to execute hedges efficiently. |

|||||

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

Production cuts by European continue to be a key issue for the market. With this week’s rally, the forward curve continues to shift higher. The forward curve has risk of even more severe backwardation, or perhaps another parallel shift higher in price, if production slows while demand remains elevated. |

|||||

|

|||||

|

As LME Aluminum has rallied, so too has the MWP. The forward curve for the MWP is similarly shaped to that of last week’s and remains backwardated. |

|||||

LME Copper |

|||||

|

LME Copper rallied early in the week, but lost ground on Thursday and Friday. Copper’s forward curve is slightly above last week’s and remains severely backwardated.

|

|||||

|

|||||

|

As nickel prices have rallied, nickel’s forward curve has shifted higher by nearly $1,500/mt compared to last Friday’s. Like other LME metals, nickel’s forward curve is backwardated. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

The prompt month (January) HRC contract has traded sideways since early December. Likewise, it’s weekly trading range remains tight (between to $30/T to $40/T in each of the last three weeks). Despite the sideways trade, the forward curve remains severely backwardated throughout calendar year 2022 and has shifted lower this week. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

01/10/2022: Section 232 Tariffs: Most relevant developments (AEGIS Reference) 01/05/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 11/30/2021: Will the Omicron COVID Variant Impact South African Metals Production or Exports? |

|||||

Notable News |

|||||

|

1/14/2022: 'Be afraid': Cyberattack hits Ukraine as Russia moves more troops 1/12/2022: Workers at Teck’s Highland Valley mine threaten to strike 1/12/2022: Nickel price storms to 10-year peak on supply worries 1/11/2022: Exclusive: China's Metals Output in December 1/10/2022: Tesla signs deal for first U.S. nickel supply with Talon Metals 1/10/2022: Nickel price hits highest in a month with inventories close to record lows 1/7/2022: French aluminium smelter to cut output by 15% on energy costs |

|||||