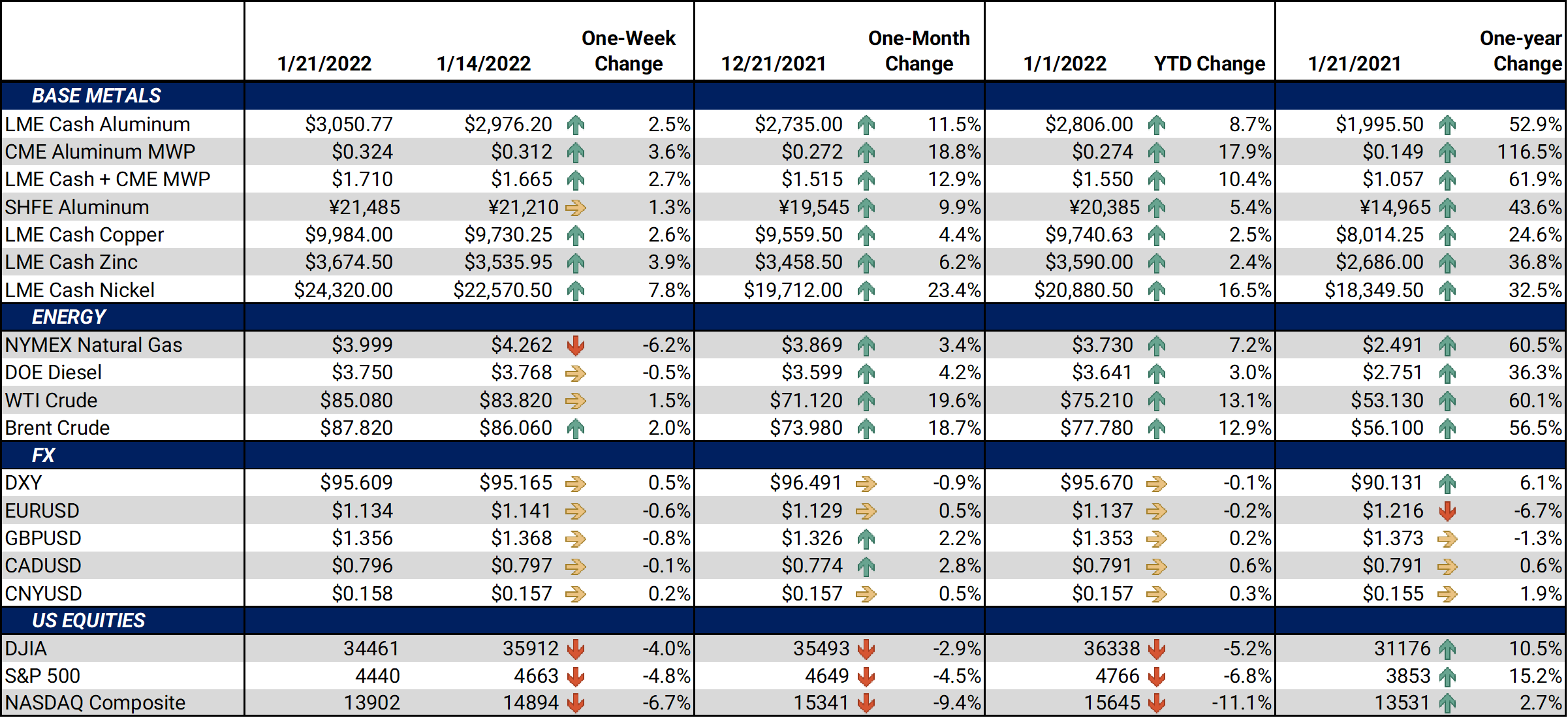

Bottom Line:After rallying $1,455/mt, or 7.0% last week, LME Nickel 3M Select rallied another $1,935/mt, or 8.7% this week. Nickel prices are now at the highest levels since 2011. Warehouse stocks, which are a measure of the balance of supply and demand, have dwindled in recent months. LME nickel stocks now sit at 93,480 mt, down from 259,986 mt on May 7, 2021. On January 14, Shanghai Futures Exchange Nickel weekly stocks were pegged at 3,866 mt, a record low.The ongoing situation between Russia and Ukraine is also a likely reason for the continued rally in aluminum and nickel. In 2019, Russia was the third-largest producer of nickel and second-largest producer of aluminum. Sanctions or other export issues could further tighten global supplies of both metals. |

Notable Metals News

Like nickel and aluminum, supplies of copper might continue to tighten. Chilean miner, Antofagasta, is forecasting lower 2022 copper output as the country faces a water shortage. The London-listed miner said 2021 copper production fell 1.7%, to 721,500 mt. In 2022, it forecasts production to be between 660,000-690,000 mt. Copper prices reached record levels in 2021, and Chile is the world's largest producer, responsible for nearly 30% of global supply. Water is vital in several steps of copper production, including separating the mineral from its ore. Many mining companies desalinate ocean water and use it in their processes, but not all. As a result, the water shortage will threaten some companies' operations and place copper supply at risk.

Moving to China, Chinese exports of unwrought copper and copper products rose sharply in 2021. Exports totaled 932,451 mt in 2021, according to China’s General Administration of Customs data release earlier this week. The 2020 total was 744,457 mt. Due to tight supplies and high demand, LME Copper prices hit a 10-year in 2021. Chinese exporters were able to take advantage of this rally.

Lastly, daily global aluminum production was 181,400 mt last month, up from 180,900 mt per day in November according to the International Aluminum Institute. However, December 2021 production was down from 183,700 mt the previous December. Output in China, the world's largest producer, was stable at 103,000 mt/day in both November and December 2021; however, December output dropped by 106,500 mt/day compared to the previous December.

|

Hedge Strategy Suggestions: |

|||||

|

Aluminum prices continued to rally this week and now sit near the highs of 2021. The LME Aluminum forward curve is now even more backwardated than last week’s curve. End users who have longer-term price risk might consider zero-cost collars in this backwardated market. Producers can sell forward a portion of forecasted production volumes using swaps at historically high prices to increase the likelihood of achieving revenue targets. Those who have short-term (i.e., one to four months forward) downside inventory price risk in the Midwest Premium (MWP), might consider selling forward in a contango to flat market. End users who need to make forward purchases in the MWP might consider buying swaps in a backwardated market (where longer-term contracts are priced lower than the cash and near-term market) from July ’22 onwards. The MWP market is extremely thin, so please contact us for details on hedging opportunities. LME Copper has retested the highs of last week, and likewise sits near the highs of October 2021. Copper’s forward curve remains in backwardation through December 2023. End users who have longer-term price risk might consider zero-cost collars in this backwardated market. Producers can sell forward a portion of production forecast using swaps at historically high prices to increase the likelihood of achieving revenue targets. For CME HRC Steel, the backwardation has steepened since last week. Last week’s spread between January ’22 and February ’22 was approximately $150 and is currently trading at nearly $200. Layering into swaps with tenors throughout the second half of 2022 might be a logical tactic for end users. Low liquidity in the HRC Steel market makes hedging challenging, but it is still feasible. Contact us for strategies to execute hedges efficiently. |

|||||

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

Tight supplies continue to be one of main influences on aluminum prices. As aluminum continues to rally, the forward curve continues to shift higher. The forward curve has risk of even more severe backwardation, or perhaps another parallel shift higher in price, if production slows while demand remains elevated. |

|||||

|

|||||

|

As LME Aluminum has rallied, so too has the MWP. The forward curve for the MWP is similarly shaped to that of last week’s and remains backwardated. |

|||||

LME Copper |

|||||

|

LME Copper rallied this week; however, the forward curve is little changed from last week. Let’s keep an eye on the Chilean production issues, as that could affect the forward curve.

|

|||||

|

|||||

|

As nickel prices have rallied, nickel’s forward curve has shifted higher by nearly $2,000/mt compared to last Friday’s. Like some other LME metals, nickel’s forward curve is quite backwardated. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

The prompt month (January) HRC contract continues to trade sideways. Likewise, its weekly trading range remains tight. This week’s trading range was only $18. Despite the sideways trade, the forward curve remains severely backwardated throughout calendar year 2022 and has shifted lower this week. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

01/10/2022: Section 232 Tariffs: Most relevant developments (AEGIS Reference) 01/05/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 11/30/2021: Will the Omicron COVID Variant Impact South African Metals Production or Exports? |

|||||

Notable News |

|||||

|

1/19/2022: Antofagasta says Chile water shortage to hit 2022 production |

|||||