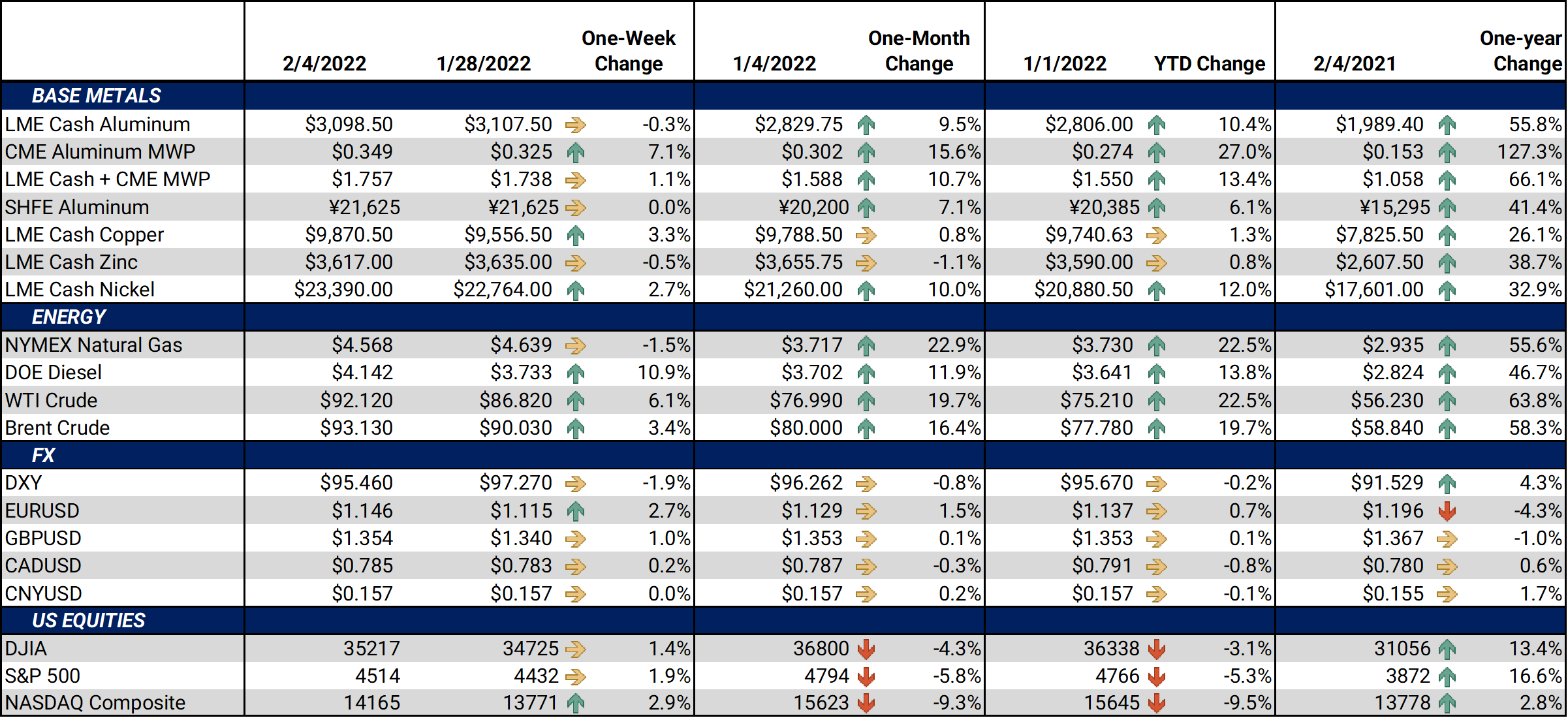

Bottom Line:Metals markets were slightly positive this week. China was on their New Year holiday this week, which might be partially to blame for the muted action.The Russia-Ukraine tensions continue to simmer. Many Western countries are threatening sanctions if Russia invades Ukraine. The immediate threat to markets would be European gas supply, of which around 35% comes from Russia (Reuters). This could severely impact European metals production, because of potentially much higher gas and power prices. Natural gas inventories in Europe are already low and could dissipate further if Russian flows are shut off. For example, as of January 31, the European Union’s natural gas storage facilities are only 39% full, down from 52% at this time in 2021 and 72%in 2020, according to Germany Eye. |

Notable Metals News

Due to maintenance issues, asset sales, and COVID-related challenges, mining company Glencore reduced production for several metals in 2021, according to Mining Magazine. The company did not provide any insight into 2022 production. Glencore represented approximately 6% of global copper production, 4% of nickel, and 10% of zinc production in 2020. Copper production was 1,195,700 mt, down from 1,258,200 mt in 2020. Likewise, zinc production was 1,117,800 mt, down from 1,170,400 mt in 2020, and nickel production was 102,300 mt, down from 110,200 mt in 2020, according to Mining Weekly.

South Korean steel producer POSCO said this year’s production will be lower due to carbon emissions cuts, mainly in China. The company has projected they will produce 36.5 million mt in 2022, down from approximately 38.2 million mt, or 4.7%, in 2021. The company owns four steel manufacturing plants in China, according to their website. However, market impact is likely minimal if the output declines are limited to POSCO and are not representative of the industry. POSCO was the world’s sixth-largest producer in 2020, according to World Steel.

However, steel production is expected to increase elsewhere in Asia. The Neelachal Ispat Nigam Ltd steel mill, which closed in March 2020, was just purchased by Tata Steel for $1.6 billion, including debt. This sale is part of India’s effort to divest from certain businesses. We expect that change of ownership would eventually bring the mill’s production back online. The plant has an annual production capacity of 1.1 million mt of iron and steel. Global production for Tata was 28.4 million mt in fiscal year 2019-20, with annual an annual global capacity of 34 million mt, according to their website. Approximately 20.6 million mt of their pre-existing capacity and 18.2 million mt of production is based in India.

Finally, in Chile, the cost of Teck Resources’ Quebrada Blanca Phase 2 copper mine expansion has ballooned because of COVID-related issues. It will now cost between $900 million to $1.1 billion, up from their previous estimate of $600 million, according to mining.com. The Canadian company cites higher diesel prices, absenteeism and labor inefficiencies, and higher supply costs. Production is slated to begin later this year and is estimated to be 300,000 mt of copper per year by 2023. Another expansion plan, which would double production to be 600,000 mt per year, is also being studied. The second expansion would make it the world’s second-largest copper mine.

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

Aluminum prices were up slighly this week. The LME Aluminum forward curve remains backwardated. This curve shape is a benefit to consumers because they may hedge at prices lower than current cash or near-term prices. Likewise, consumers who are bullish may interpret this week’s slight down-move as temporary and an opportunity to “buy the dip.” End users who have longer-term price risk might consider zero-cost collars or buying swaps as pressure to the upside remains in play. Producers could sell forward a portion of forecasted production volumes using a layered swap strategy or purchasing out-of-the-money put options to increase the likelihood of achieving revenue targets. They won’t like the backwardation in the curve; however, options structures are one way to mitigate the curve shape. The AEGIS desk can price put options if you would like to explore setting strike prices (protective floors) as aluminum prices have risen. Finally, the Russia-Ukraine situation could affect aluminum prices. Russia is the world’s second-largest aluminum producer, and sanctions could slow exports. Likewise, natural gas flows to Europe could be disrupted and could severely impact metals production in that region. |

|||||

|

|||||

|

The nearby contracts (i.e., one to four months forward) for Midwest Premium (MWP) are little changed from last week. Those who have downside inventory price risk in this time frame might consider selling forward in a contango to flat market. The upward-sloping curve means some prices in the future are at a premium to near-term prices. Those who need to make sales further down the curve might consider hedging a smaller percentage of expected exposure. The backwardation further down the curve has increased this week. End users who need to make forward purchases in the MWP might consider buying swaps. The MWP market is extremely thin, so please contact us for details on hedging opportunities. |

|||||

LME Copper |

|||||

|

LME Copper prices were up slightly this week. Copper’s forward curve remains in backwardation through December 2023. Like our aluminum comments, end users who remain bullish might consider this an opportunity to “buy the dip.” End users who have longer-term price risk might consider zero-cost collars. Producers can sell forward a portion of production forecast using swaps, which are at historically high prices, to increase the likelihood of achieving revenue targets.

|

|||||

|

|||||

|

Nickel prices increased this week, but the shape of the forward curve is similar to last Friday, albeit about $600/mt higher. Like some other LME metals, nickel’s forward curve is quite backwardated. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

For CME HRC Steel, the backwardation is little changed from last week. It has flattened tremendously compared to 90 days ago. However, the spread between February ’22 and March ’22 is still approximately $177/T. To protect against further possible price increases, we recommend that consumers layer into swaps with tenors throughout the second half of 2022. Contact us for strategies to execute hedges efficiently. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

02/02/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 02/01/2022: Section 232 Tariffs: Most relevant developments (AEGIS Reference) 11/30/2021: Will the Omicron COVID Variant Impact South African Metals Production or Exports? |

|||||

Notable News |

|||||

|

2/2/2022: Ukraine tensions: US trying to draw Russia into war, Putin says 2/2/2022: US troops to deploy to Eastern Europe amid Ukraine crisis 2/2/2022: Glencore reports 43% higher ferrochrome production 2/1/2022: German natural gas storage facilities only 37 percent full 1/31/2022: POSCO projects 5% drop in 2022 crude steel output 1/28/2022: Teck Resources’ QB2 to cost up to $500m more than planned |

|||||