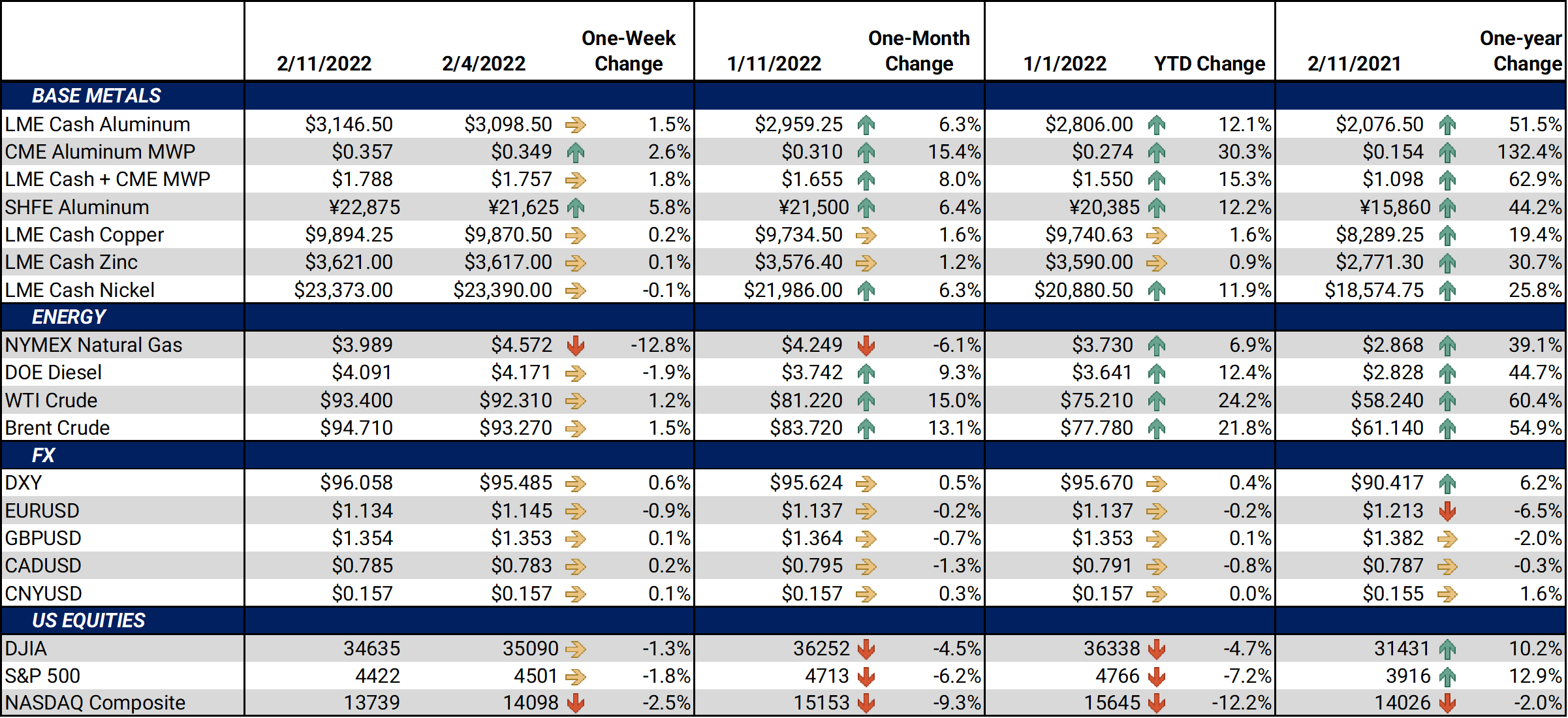

Bottom Line:**Minutes before the close of LME trading on Friday afternoon, US National Security adviser Jake Sullivan announced that an invasion of Ukraine by Russia "could begin at any time." Both aluminum and nickel slightly rallied in the final few minutes of trade. Both still closed lower on the day, but higher for the week. Traditional risk-related markets – oil, foreign exchange, and equities – made larger moves. **Metals prices were mixed this week. LME Aluminum 3M closed near a 13-month high on Tuesday after Baise, a key aluminum production city in China, shut down due to a COVID-19 outbreak. Aluminum production has not stopped; however, transportation of raw materials and aluminum ingots has been hampered. Some analysts and market participants in the region are concerned that production could also slow or stop. Aluminum prices might stay supported if further curtailments occur. Baise has an annual aluminum production capacity of nearly 2.2 million mt, or some 5% of China's total, according to Channel News Asia. |

Notable Metals News

Demand and prices for steel, aluminum, copper and other base metals might fall if the ongoing border blockade between Detroit, MI and Windsor, Ontario, Canada continues. A large group of truckers are blocking the Ambassador Bridge border over COVID-19 vaccination mandates. This closure has led to full or partial production cuts by Ford, General Motors, Toyota and Stellantis (formerly Chrysler). This includes reducing schedules, eliminating second shift production, or complete work stoppages. None of the companies has provided any guidance on when production will resume or increase. All four companies cite part shortages for the rollback in production. These companies already had production problems and cutbacks due to a semiconductor shortage. Capacity utilization, which measures a company’s actual output versus potential output, is only about 66% for US auto manufacturers, according to the most recent data from the US Federal Reserve. Canada is a major supplier of aluminum to the US; however, according to our contacts, only a small amount of aluminum from Canada is imported by truck, so impact to the MWP is likely minimal.

American steel prices might fall if imports from Japan increase after the current import tariff is removed. Earlier this week Bloomberg reported that the US will be ending the current 25% tariff on Japanese steel imports, but no date has been set. The current tariff was set in 2018 as part of the Section 232 tariffs that sought to reduce the flow of metals imports, thereby preventing foreign exporters from dumping cheap steel onto the US market. At 732,157 mt, Japan was the sixth-largest source of steel imports into the US in 2020.

Peru’s copper production was 2.3 million mt in 2021, up from approximately 2.14 million mt, or 7%, in 2020, according to the Ministry of Energy and Mines of Peru. Production increased despite social unrest, including a road blockade at the Las Bambas mine that briefly stopped production there late last year. Peru is the world’s second-largest copper producer, after neighboring Chile.

The troubles may continue: Las Bambas copper mine, which represents 2% of global production and is one of Peru’s largest, will shut down on February 20, again due to road blockades, according to owner MMG Ltd. The residents blocking roadways into the mine are demanding jobs and other compensation. Production has already slowed, as electricity demand at the mine is down 40% since February 2, according to COES, an organization that represents Peru’s energy sector. Copper prices might be supported if the global supply decreases dramatically due to the shutdown.

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

Aluminum prices have rallied this week. The LME Aluminum forward curve remains backwardated, or downward sloping. For most 2022 contracts, the curve rose by about $200/mt. Beyond 2022, the forward curve is similar to last week. The backwardated curve shape is a benefit to consumers, because they may hedge at prices lower than current cash or near-term prices. End users who have longer-term price risk might consider zero-cost collars as pressure to the upside remains in play. Producers can sell forward a portion of forecasted production volumes using a layered swap strategy or purchasing out of the money puts at historically high prices to increase the likelihood of achieving revenue targets. Finally, tensions between Russia and Ukraine remain high. Russia is an important supplier for metal, and trade frictions or sanctions could endanger that supply and send prices higher. |

|||||

|

|||||

|

The forward curve for the Midwest Premium (MWP) is little changed from last week. Those who have downside inventory price risk in this time frame might consider selling forward in a mildly contango market. The upward-sloping curve means some prices in the future are at a premium to near-term prices. Those who need to make sales further down the curve might consider hedging a smaller percentage of expected exposure. |

|||||

LME Copper |

|||||

|

LME Copper prices were also up this week. The LME Copper 3M is now holding above $10,000/mt. Copper’s forward curve remains in backwardation through December 2023. End users who have longer-term price risk might consider zero-cost collars. The backwardation allows for an attractive ceiling (cap) price by buying a call option, while still participating in much lower prices (should they decline), compared to cash. The risk in such a strategy is chiefly reduced access to low prices in an extreme, bearish event. Producers can sell forward a portion of production forecast using swaps at historically high prices to increase the likelihood of achieving revenue targets.

|

|||||

|

|||||

|

Nickel prices rallied this week, but most of the rally occurred in the nearby contracts. For the latter of 2022 and beyond, the shape of the forward curve is similar to last Friday’s. Like some other LME metals, nickel’s forward curve is quite backwardated. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

For CME HRC Steel, the forward curve for the first half of 2022 is little changed from last week. However, the forward curve for the second half of 2022 and beyond has higher slightly higher. Also, the spread between February ’22 and March ’22 has narrowed from approximately $175/T last week to $150/T this week. We recommend that consumers layer into swaps with tenors throughout the second half of 2022. Contact us for strategies to execute hedges efficiently. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

02/02/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 02/01/2022: Section 232 Tariffs: Most relevant developments (AEGIS Reference) 11/30/2021: Will the Omicron COVID Variant Impact South African Metals Production or Exports? |

|||||

Notable News |

|||||

|

2/11/2022: Russia has enough troops massed to invade Ukraine, U.S. says 2/11/2022: The latest on Ukraine and Russia tensions 2/10/2022: Canada border protests start halting Detroit auto plant production 2/10/2022: Truck Blockade at U.S.-Canadian Border Shuts Auto Plants 2/9/2022: Electric vehicles and hybrids surpass 10% of U.S. light-duty vehicle sales 2/8/2022: Aluminium output stable in China's Baise amid lockdown but logistics under pressure 2/8/2022: Aluminium touches near 4-month peak on supply woes 2/7/2022: EXCLUSIVE Mining activity at Peru's Las Bambas tumbles amid blockade -data, source 2/7/2022: MMG to halt Las Bambas copper mine amid fresh blockade 2/4/2022: Peru copper output up almost 7% despite social unrest 2/4/2022: Chip shortage forces Ford to cut production of F-150, Bronco and other important vehicles |

|||||