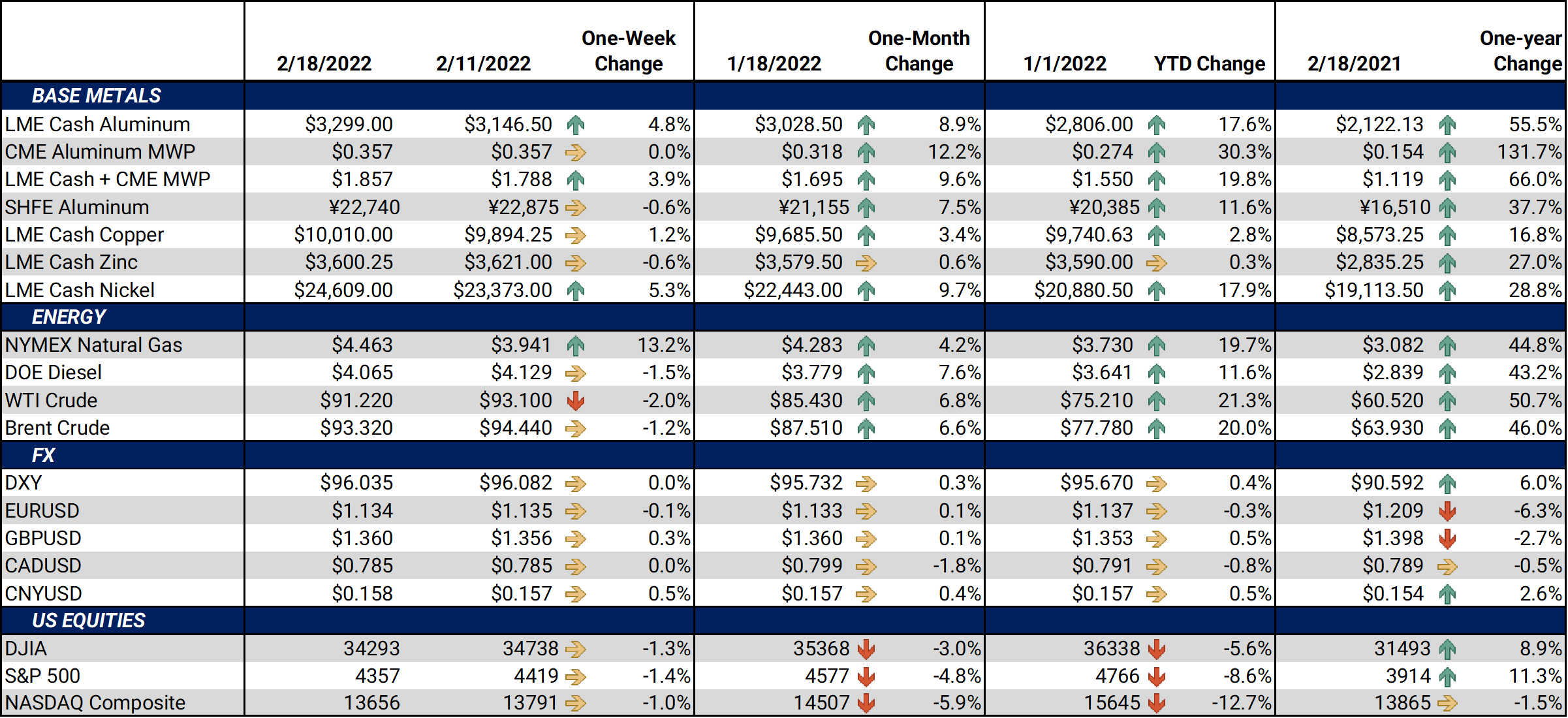

Bottom Line:LME Aluminum closed at a 13-year high this week. Aluminum consumers continue to watch the Russia-Ukraine situation with great interest, as Russia is the world’s second-largest aluminum producer. Sanctions on Russia or Rusal (the state-owned aluminum producer) could impact supply and prices. The CME Midwest Premium (MWP) could also be vulnerable, as Russia is the fourth-largest supplier of primary aluminum to the US. In 2020, the US imported 133,000 mt of primary aluminum from them. The US represented nearly 7% of Rusal’s revenue in 2020, according to their annual report.Similar to the CME MWP, European aluminum premiums could be impacted by sanctions. Europe imports nearly 9% of their aluminum tubes and pipes from Russia, according to trendeconomy.com. Likewise, Europe represented nearly 41% of Rusal’s revenue in 2020, according to their annual report. Rusal does not give regional volume breakdowns in their annual report, only revenue by region.*** Please note that our offices will be closed on Monday, February 21 due to President’s Day. We will not produce a First Look that morning. However, the trading desk will provide LME coverage, and current clients can contact metals@aegis-hedging.com for indications. *** |

Notable Metals News

Potential supply issues for nickel and several other base metals occurred in Indonesia this week. The Minerals and Coal Directorate General of Indonesia has halted operations for over 1,000 miners due to a failure to submit 2022 work plans, according to Reuters. The suspended miners include over 12 tin miners and 80 coal companies. Also included are several nickel, gold, manganese and bauxite miners. To resume work, the suspended miners must present their 2022 work plans within 60 days. Last month Indonesia revoked the permits of nearly 2,000 companies because of non-compliance. In 2020, Indonesia was the world's largest producer of nickel and was also very important producer of gold, bauxite, tin and other metals. These work stoppages could reduce supply and provide some support for prices.

In Austrlia, a potential zinc and lead production setback also occurred this week. After failing to consult with all Indigenous custodians of the Damangani sacred site, a planned expansion of Glencore’s McArthur River mining operation near the site has been halted by the government of Australia’s Northern Territory. Under a 1989 law, companies are required to consult with all Indigenous custodians of a sacred site before mining operations can begin or expansions occur. In 2020, this mine produced approximately 633,000 mt of zinc and 216,000 of lead according to Glencore’s 2021 Annual Report. The McArthur mine is one of the world’s largest deposits of zinc and lead, according to Glencore’s website on the operation. Zinc is an important industrial metal used in steel production. In 2019, nearly 85% of zinc consumption in the US was from galvanization, according to the USGS.

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

Aluminum prices were up this week. The LME Aluminum forward curve remains backwardated, or downward sloping. For most 2022 contracts, the curve has shifted slightly higher. The backwardated curve shape is a benefit to consumers, allowing for hedging at prices lower than current cash or near-term prices. End users who have longer-term price risk might consider zero-cost collars as pressure to the upside remains in play. Producers can sell forward a portion of forecasted production volumes using a layered swap strategy. Please note that doing so may incur losses if prices rally further. Such producers may consider purchasing out-of-the-money puts at historically high prices to increase the likelihood of achieving revenue targets. Finally, tensions between Russia and Ukraine remain high. Russia is an important aluminum supplier, and trade frictions or sanctions could endanger global supply and send prices higher. |

|||||

|

|||||

|

The forward curve for the Midwest Premium (MWP) has shifted slightly higher compared to last week. Those who have downside inventory price risk in this time frame might consider selling forward as prices have rallied alongside LME Aluminum. Please note that doing so might incur hedging losses if prices rally further, perhaps offsetting the beneficial increase in asset values. Those who need to make sales further down the curve might consider hedging a smaller percentage of expected exposure. |

|||||

LME Copper |

|||||

|

LME Copper prices were also up this week. Copper’s forward curve remains in backwardation through December 2023. End users who have longer-term price risk may consider zero-cost collars. The backwardation allows for an attractive ceiling (cap) price by buying a call option, while still participating in much lower prices (should they decline), compared to cash. The risk in such a strategy is chiefly reduced access to low prices in an extreme bearish event. Producers can sell forward a portion of production forecast using swaps at historically high prices to increase the likelihood of achieving revenue targets. Please note that selling swaps may incur hedging losses if prices rally further, so matching the price basis of your hedges with the price basis of your production is very important.

|

|||||

|

|||||

|

Nickel prices rallied this week, and the entire forward curve has shifted higher, while the shape of the curve is relatively unchanged from last Friday’s. Like some other LME metals, nickel’s forward curve is quite backwardated. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

For CME HRC Steel, the forward curve for 2022 has shifted slightly lower from last week and has flattened tremendously in recent weeks. This curve is still somewhat backwardated, meaning that future prices are lower than spot prices. Consumers can take advantage of this backwardation by purchasing swaps or call options. Please note that doing so might incur losses if prices slide further. The CME HRC steel market is thinly traded, so please contact AEGIS for strategies. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

02/16/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 02/15/2022: Section 232 Tariffs: Most relevant developments (AEGIS Reference) 11/30/2021: Will the Omicron COVID Variant Impact South African Metals Production or Exports? |

|||||

Notable News |

|||||

|

2/16/2022: Aluminum price nears 13-year high on tight supply 2/16/2022: News Brief: NT Government blocks MacArthur River mine expansion 2/15/2022: Russia says it pulls back some of its troops, Ukraine and West want proof 2/14/2022: Steel prices hit lowest level in a year 2/14/2022: A vital US-Canadian border crossing reopens after trucker blockade of Ambassador Bridge is cleared 2/10/2022: Indonesia suspends operations of more than 1,000 miners |

|||||