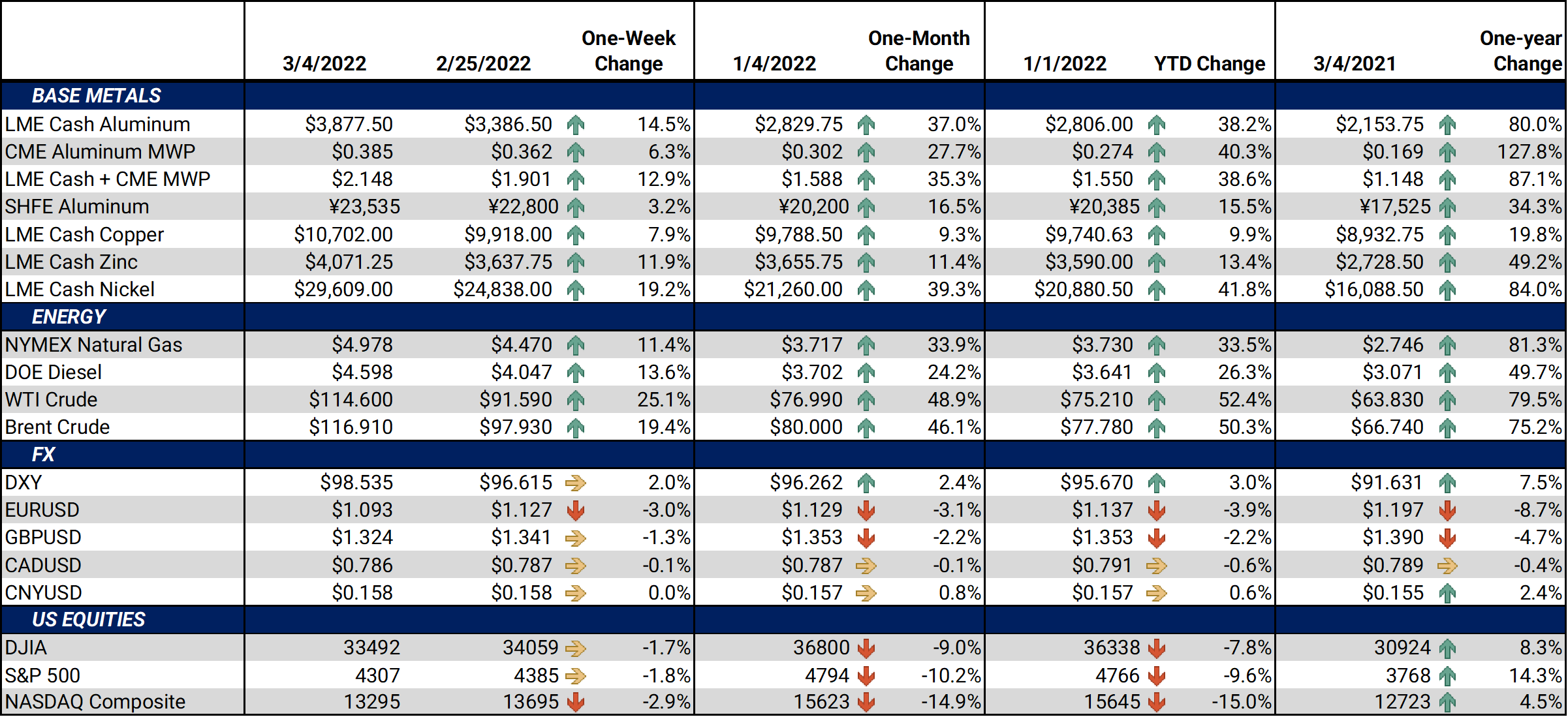

Bottom Line:Aluminum prices have never been higher. LME Aluminum 3M closed at $3,840.5/mt, which is up about $460/mt for the week, or 13.6%, and another new record. LME Nickel 3M did not set a new record when it closed at $29,130/mt, up $4,915/mt on the week, or about 20.3%. Still, it was the highest level since 2011. Even before the Russia-Ukraine conflict, metal supply had been scarce, and supply is now more at risk. Several large Russian banks and people close to Vladimir Putin have been sanctioned; however, no metals producers have been directly sanctioned. Even without direct sanctions on any Russian metals producers, metals prices have rallied as supply-chain issues continue to mount. Ukraine, which is a major steel producer and exporter, has closed all ports until the end of the war, according to Ukraine’s Maritime Administration. Several major shipping companies have cancelled bookings to and from Russia, according to Reuters. This could slow or stop metals shipments from the country. Importers are already beginning to source material from other suppliers, according to mining.com. |

Notable Metals News

Citing worker safety, shipping giant Maersk has stopped shipments to and from Russia. Rusal, which is the largest aluminum producer outside of China, contracts Maersk for “some” aluminum shipments, according to Reuters. These cancelations might cause metals exports to slow and lead importers to source metals from other suppliers.

Rusal has other supply-chain issues. The Ukrainian-based Nikolaev alumina refinery, which is Rusal’s second-largest alumina refinery, has closed, and ceased shipments, citing logistical challenges on the Black Sea and the surrounding area, according to Reuters. Alumina, a key ingredient for aluminum production, is produced in Nikoleav and shipped to three aluminum smelters in Russia. This alumina refinery supports 900,000 mt of annual aluminum output, or 23% of Rusal’s primary aluminum production, according to Wood Mackenzie. Rusal is the largest aluminum producer outside of China, with 3.76 million mt of production in 2020 or about 5.7% of world production, according to S&P Global and USGS data. Based on USGS data, approximately 97% of Rusal’s production is in Russia.

Steel markets are affected, too. Several Ukrainian steel mills have temporarily shuttered production due to the ongoing war with Russia. Metinvest, which is Ukraine’s largest steelmaker, closed two plants (Ilyich and Azovstal) late last week due to safety concerns. These two plants represented 8.56 million mt, or 40% of Ukraine’s raw steel production in 2021. Likewise, ArcelorMittal has reduced production at one Ukrainian plant.

In 2020, Ukraine was the world’s twelfth largest steel producer at 20.6 million mt, according to the USGS. The country produced 21.4 million mt of raw steel in 2021, according to the International Iron and Steel InstituteAbout 80% of Ukraine’s steel production is exported, with shipments mainly going almost everywhere except the Far East: the Middle East, Turkey, the EU, Africa and the Americas, according to S&P Global Platts.

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M closed at $3,840.5/mt, up $460/mt on the week. The forward curve for LME Aluminum is currently quite backwardated, meaning that spot prices are higher than futures prices. With this week’s rally, this especially true. A backwardated forward curve favors the consumer hedger. The aluminum market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

The prompt month (March) CME MWP contract last traded at 38.5¢/lb today. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this market is tricky, so we recommend using strategically placed limit orders. Please contact AEGIS for specific strategies that fit your operations. |

|||||

LME Copper |

|||||

|

LME Copper 3M closed at $10,660/mt, up $800/mt on the week. The forward curve for LME Copper is currently quite backwardated, meaning that spot prices are higher than futures prices. A backwardated forward curve favors the consumer hedger. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M closed at $29,130/mt, up $4,915/mt on the week. Like LME copper and aluminum, the forward curve for LME Nickel is currently quite backwardated, meaning that spot prices are higher than futures prices. A backwardated forward curve favors the consumer hedger. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

The prompt month (March) CME HRC contract last traded at $1,150/T, up $140/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with strategically placed limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

03/02/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 02/15/2022: Section 232 Tariffs: Most relevant developments (AEGIS Reference) |

|||||

Notable News |

|||||

|

3/4/2022: Copper price hits all-time high as warehouses empty out 3/4/2022: COMMODITIES Russia supply angst fuels hefty weekly gains for Oil, gas and metals 3/1/2022: World's largest container lines suspend shipping to Russia 3/1/2022: Russian miners hit by sanctions likely to get boot from FTSE 100 3/1/2022: Aluminium nears record high as Russia-Ukraine conflict threatens supplies 2/28/2022: Rusal halts alumina shipments from Ukraine 2/28/2022: Ukraine’s Ports to Stay Closed Until Russian Invasion Ends – Maritime Administration 2/28/2022: Invasion sparks EU flat steel supply concerns 2/25/2022: Ukraine ports and steel plants shut down: Update 2/24/2022: Invasion halts Ukraine steel shipments; appetite wanes for Russian steel |

|||||