Bottom Line:Nickel markets made history this week. The LME 3M contract traded to $101,365/mt early Tuesday, a 250% move from Friday’s settle at $28,919/mt. Citing “orderly market grounds,” the LME suspended nickel trading Tuesday morning, and all trades after midnight UK time were cancelled. LME Nickel markets were closed the remainder of the week.The extraordinary market action stemmed from a rare phenomenon known as a “short squeeze.” Tsingshan Holding Group Co, the world’s largest nickel and stainless-steel producer, had a large short position in LME nickel contracts. This short position was meant as a hedge on future nickel sales. To hold a futures position on exchange, hedgers may be required to post margin in the form of cash and other securities to offset any losses that might occur. If losses occur, hedgers or traders might incur a margin call requesting more collateral to hold the position. The short squeeze occurred when prices accelerated rapidly and short positions such as Tsingshan’s were required to put up ever-increasing collateral or face liquidation. To cover margin calls and maintain the short position (i.e., hedge), Tsingshan has received loans from JP Morgan and China Construction bank, according to the South China Morning Post.However, most hedging in the US is not done directly on an exchange. It is especially rare for AEGIS clients to trade directly on an exchange, subject to those margin requirements. Instead, our clients almost exclusively place hedges (trades) with banks and other swap dealers (large, regulated traders). These trading counterparties offer margin management as part of the service. Their margin requirements are usually tailored to the company and differ from what the exchange would require. We can guide you in what terms to watch for when selecting counterparties.LME Nickel price volatility can be mitigated through financial hedging for both consumers and producers. AEGIS urges a statistical approach that measures how much you should hedge to reach your financial goals if prices move against you. Please contact AEGIS for specific strategies that fit your operations. |

Notable Metals News

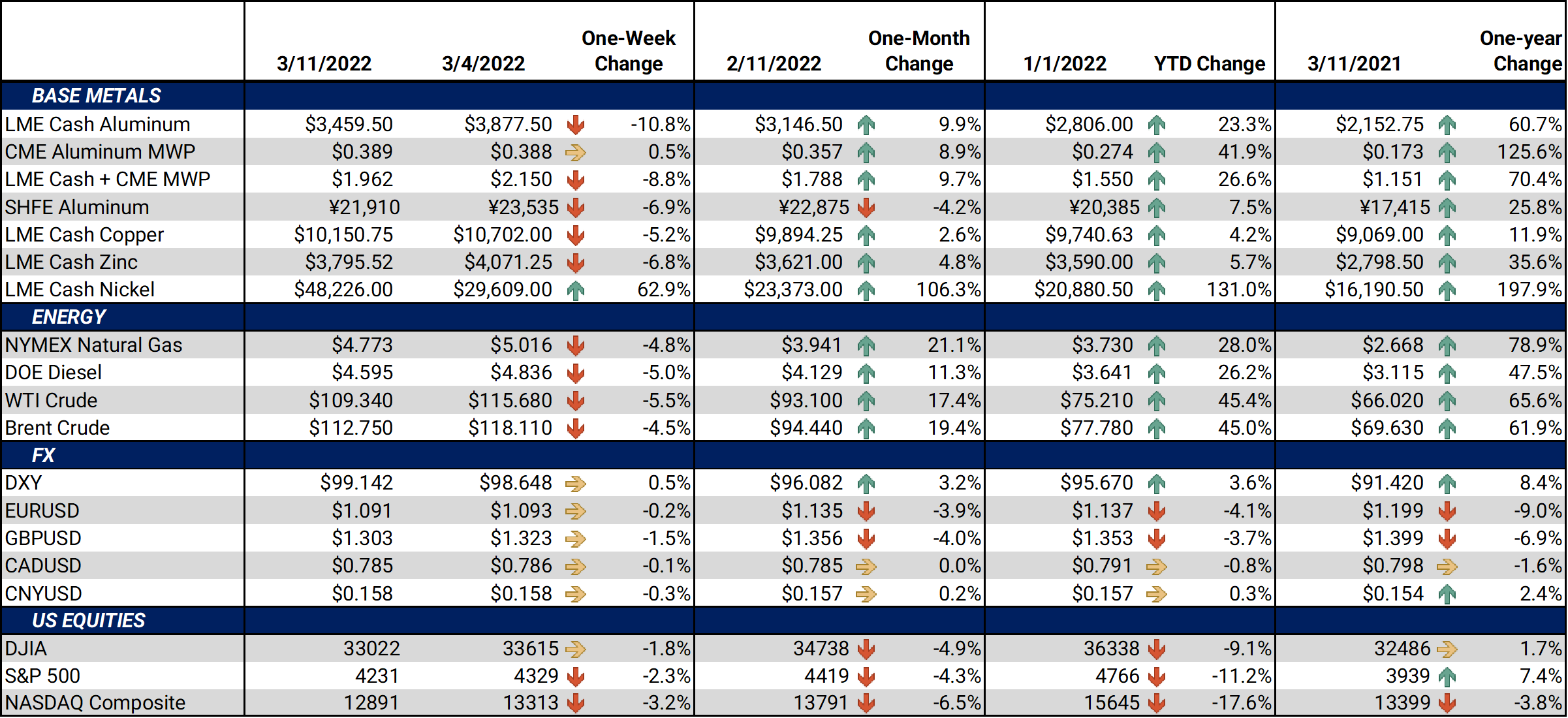

LME Aluminum 3M is down nearly $366/mt, or approximately 9.5%, this week, despite news that Oleg Deripaska, Rusal’s founder and largest shareholder of its parent company, EN+, was sanctioned by the UK government Thursday.

Rusal itself was not sanctioned; however, Western efforts to distance themselves from Russian companies could strain supplies of commodities such as aluminum. Importers are already beginning to source material from other suppliers, according to mining.com. One analyst cited by Bloomberg yesterday stated, “The fact that all these men are ‘under the gun’ makes dealing with their underlying companies all the more problematic.”

Rusal’s export market might change in the coming years if it partners with Chinese aluminum producers. Early this week Bloomberg reported that several state-owned Chinese metals and energy companies are seeking stakes in major commodities firms, including Rusal. These potential ventures are meant to strengthen China’s energy and metals security, according to Bloomberg. Rusal is the largest aluminum producer outside of China, with 3.76 million mt of production in 2020 or about 5.7% of world production, according to S&P Global and USGS data.

China already heavily relies on Russian aluminum. Last year, approximately 18.4% of China’s primary aluminum imports came from Russia, according to Chinese customs data. Similarly, approximately 7.5% of Rusal’s aluminum exports were shipped to China that year, based on Rusal and Chinese customs data. Rusal’s exports to China might increase if a state-owned Chinese aluminum company invests in Rusal. However, this might have little effect on aluminum prices in the short term.

Like aluminum, copper prices also dropped this week. LME Copper 3M has lost nearly $490.5/mt since last Friday’s all-time high close of $10,600/mt. Shanghai Metal Market blames slowing Chinese demand for the current pullback in prices.

Copper has rallied in recent weeks as the Russia-Ukraine conflict could strain supplies. Russia was the world’s fifth-largest copper refiner in 2020, with about 4.25% of global copper refined production that year, according to USGS data. Russia has historically been a net exporter of refined copper, with most going to Europe and China, according to Shanghai Metal Market and Russian customs data. Market participants recently cited by Reuters fear that copper exports from Russia could slow, as several shipping companies have stopped accepting bookings to and from the country.

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M closed at $3,483/mt, down $366/mt on the week. The forward curve for LME Aluminum is currently quite backwardated, meaning that spot prices are higher than futures prices. A backwardated forward curve favors the consumer hedger. The aluminum market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

The prompt month (March) last settled at 38.443¢/lb this week. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this market is tricky, so we recommend using strategically placed limit orders. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

LME Copper |

|||||

|

LME Copper 3M closed at $10,183.5/mt, down $490.5/mt on the week. The forward curve for LME Copper is currently quite backwardated, meaning that spot prices are higher than futures prices. A backwardated forward curve favors the consumer hedger. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M closed at $48,033/mt, up $19,114/mt on the week. Like LME copper and aluminum, the forward curve for LME Nickel is currently quite backwardated, meaning that spot prices are higher than futures prices. A backwardated forward curve favors the consumer hedger. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

The prompt month (March) last traded at $1,125/T, down $50/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with strategically placed limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

03/02/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 02/15/2022: Section 232 Tariffs: Most relevant developments (AEGIS Reference) |

|||||

Notable News |

|||||

|

3/10/2022: Rio Moves To Stop Shipments To Russian-Owned Alumina Plant 3/10/2022: Billionaire Oleg Deripaska, owner of Aughinish Alumina in Limerick, hit with sanctions 3/9/2022: Nickel price spike “purely financial” but Tsingshan effect could linger 3/8/2022: Russian metals industry’s reliance on China set to rise as sanctions disrupt supplies 3/8/2022: Nickel short seller could take $8 billion hit after price soars past $100,000 a tonne 3/8/2022: LME cancels nickel trades after prices double to over $100,000 3/8/2022: VIEW LME suspends nickel trading after price surge 3/7/2022: Chile a step closer to nationalizing copper and lithium 3/7/2022: Oil, wheat, nickel storm higher on fears of supply chaos 3/7/2022: Oil, nickel, commodities prices soar as global shares tumble 3/7/2022: London bullion market bars Russian gold refineries |

|||||