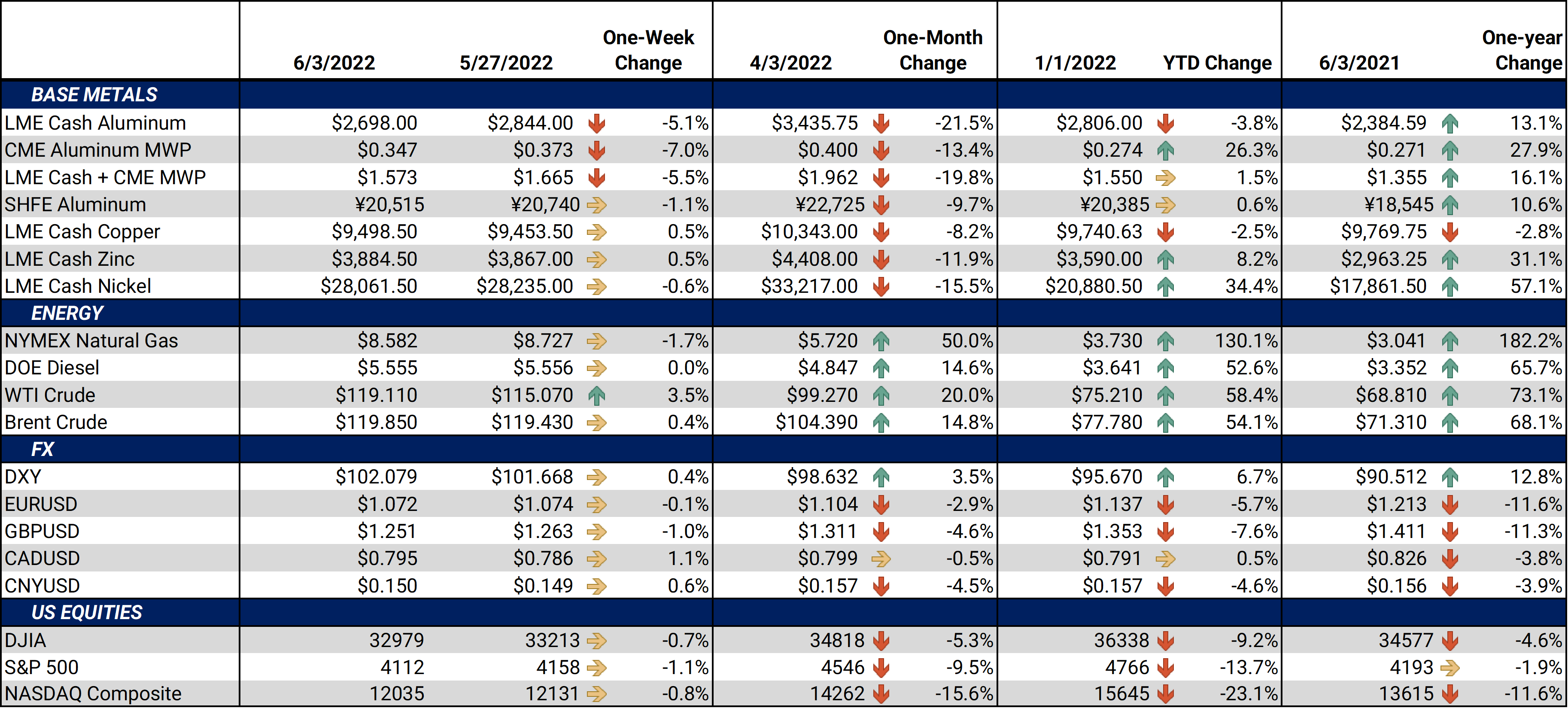

Bottom Line:AEGIS is attending the Harbor Aluminum Summit at the Radisson Blu Aqua Hotel in Chicago on June 7 – 9. If you would like to schedule a meeting during the summit, please contact Patrick McCrann at pmccrann@aegis-hedging.com or (713) 936-2806. Prices were mixed during this holiday-shortened week. Thursday and Friday were holidays for the LME. Friday to Friday at the LME, aluminum prices fell nearly 5%; however, copper finished positive. Economic data released by China this week showed their economy has contracted. However, China's lockdowns are slowly ending, which could allow metals demand to recover. |

Notable Metals News

Aluminum had year-over-year demand growth in the US and Canada during 1Q2022, according to The Aluminum Association’s monthly Aluminum Situation report. Total 1Q2022 North American aluminum demand (shipments by domestic producers plus imports) reached 7.0 million mt, up from 6.6 million in 1Q2021. “The picture for the U.S. aluminum industry remains very strong,” President & CEO of the Aluminum Association Charles Johnson proclaimed. The association estimates that in 2021 North American demand reached 26.3 million mt, an 8.2% increase over the 2020 demand of 24.4 million mt.

JSW Steel, which is India’s largest producer, will not pass along India’s new export tax to its buyers, according to its CEO. India implemented what the industry described as a “surprise”15% tariff on HRC and CRC steel exports early last week. There was no forewarning to domestic producers and exporters. At the time, producers cited by Reuters feared the move would close off export markets, specifically Europe. At least for In an interview with The Economic Times on Monday, CEO Seshagiri Rao stated "Exporting after paying 15% duty is definitely a loss-making proposition. But we have to look at the long term…. If we don't supply to our customers that we have developed over the last decade, we will lose them." JSW produced 17.62 million mt of steel in the fiscal year 2022, with 4.57 million mt going to foreign buyers, according to their FY2022 results. India exported 13.5 million mt of finished steel in the fiscal year 2022, according to the Ministry of Steel. (For a more detailed overview, please see our latest post: India's Steel Exports Tariffs Shock Producers).

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,726.00/mt, down $145.50/mt on the week. With this week’s drop in prices, the forward curve for LME Aluminum has shifted lower compared to last Friday. The forward curve is now backwardated beyond November 2022, peaking with a small “hump” that month. The backwardated curve from November onwards provides an opportunity for aluminum end-users to buy at prices cheaper than spot. The aluminum market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last settled at 34.65¢/lb this week. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this market is tricky, so we recommend using strategically placed limit orders. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $9,499.50/mt, up $40.50/mt on the week. LME Copper’s forward curve has shifted higher compared to last Friday, as prices have rallied. Prices are flat through April 2023, but the forward curve reverts to backwardation past that contract. A backwardated forward curve favors copper consumers. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $28,119/mt, down $165/mt on the week. Nickel’s forward curve has shifted higher by about $900/mt this week, and remains in a slight contango, meaning that spot prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded at $1,140/T, down $45/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with strategically placed limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

06/1/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 05/23/2022: India's Steel Exports Tariffs Shock Producers 05/11/2022: China's Metals Exports are on the Rise |

|||||

Notable News |

|||||

|

6/2/2022: Copper price scales $10,000 on Chinese stimulus, lockdown reprieve 6/1/2022: UPDATE 1-Global aluminium producers seek Q3 premiums of $172-$177/T in Japan talks - sources 5/30/2022: JSW Steel to maintain shipments to Europe without passing on cost of India's new export tax 5/30/2022: Steel export duty dilemma: Sell at a loss or lose customers, says JSW Steel's Seshagiri Rao 5/30/2022: JSW Steel sees Indian steel export duties as temporary

|

|||||