Bottom Line:*Please note that our offices will be closed on Monday, June 20 due to the Juneteenth holiday. We will not produce a Metals First Look that morning. However, the trading desk will provide LME coverage, and current clients can contact metals@aegis-hedging.com for indications. *

|

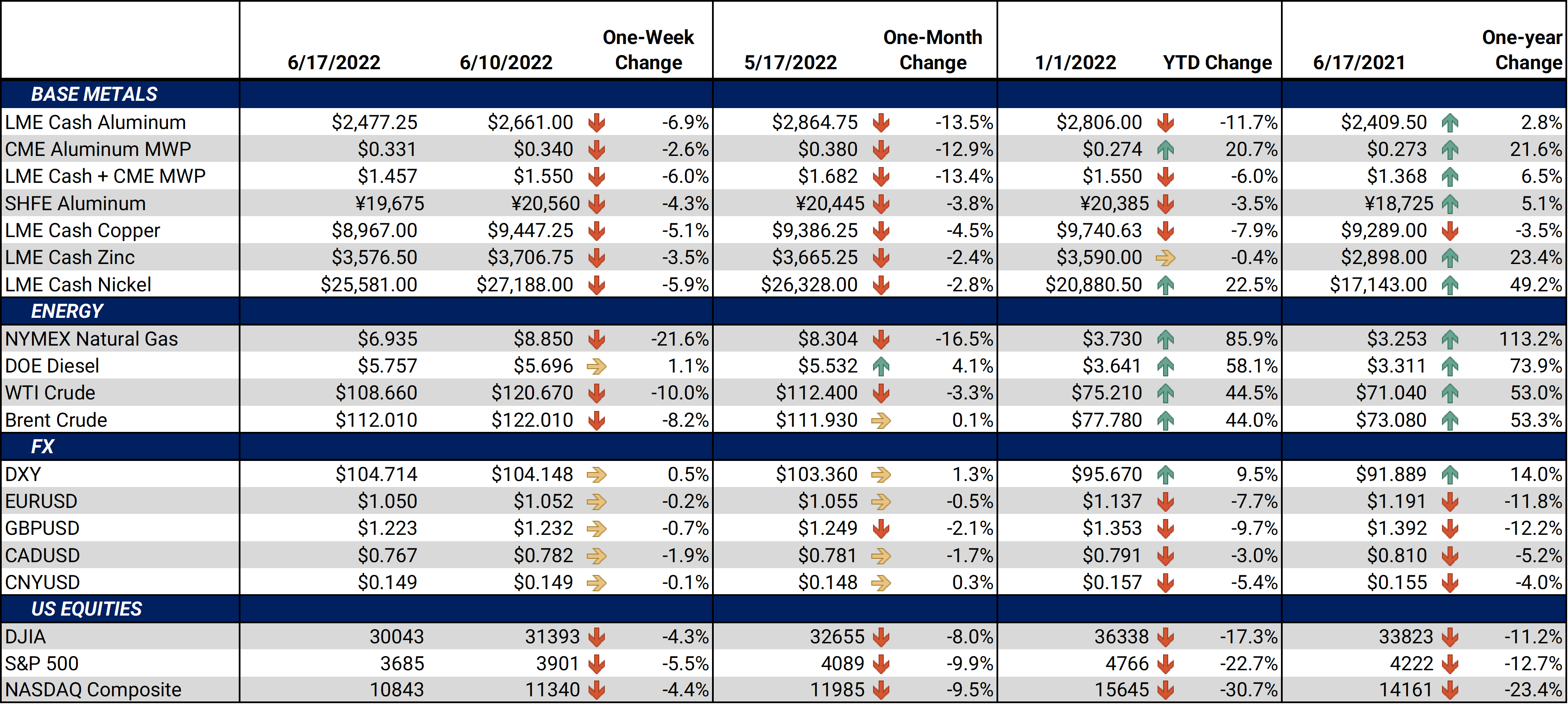

LME Copper prices have slumped this week, due in part to Shanghai reinstating COVID lockdowns late last week. Over the weekend, authorities conducted COVID screenings in 15 out of 16 of Shanghai’s districts, and six of these districts were on lockdown during the tests. These new lockdowns come less than a week after Shanghai and Beijing reopened in early June. Copper prices jumped early last week; however, the optimism quickly faded after Beijing restarted some lockdowns on Thursday. LME copper finished nearly unchanged last week, but pessimism reined this week.

Notable Metals News

Chinese stimulus measures and Russian supply issues will support nickel prices in 3Q 2022, according to Fitch Solutions. “Chinese stimulus measures improve the demand outlook and the Russia-Ukraine war continues to disrupt supply,” Fitch said this week. Russia’s top nickel producer Nornickel has not been sanctioned, but supply chain issues have led to lower supply forecasts, Fitch notes. However, they believe that refineries, specifically in Indonesia, will increase production beginning in late 2022. This could weigh on prices, as Fitch predicts 2023 prices to be $24,000/mt, down from its estimate of $27,500/mt for 2022 prices. Nickel prices have been volatile in 2022, as the 3M contract traded to $55,000/mt in early March. Prices are down nearly 53% since then, closing at $25,669/mt today, down over 9% in June alone. The forward curve in 2022 and throughout 2023 currently hovers near $26,000/mt.

As for global steel production, South Korea’s top steel producer POSCO briefly curbed production this week due to a trucker strike, according to Bloomberg. On Sunday, the company told Bloomberg that cold-rolled steel production will be curbed by 4,500 mt, as the trucker strike has exhausted the company’s warehouse space. However, the strike quickly ended, late Tuesday afternoon, and POSCO announced that shipments would resume the following afternoon. The company also stated that they would increase production to make up for the 13,000 mt of cold-rolled steel that couldn’t be manufactured due to the strike. POSCO produced 13.645 million mt of cold-rolled plated sheets in 2021, of which 7.6 million mt was exported, according to steelmint.com. POSCO was the world’s sixth-largest raw steel producer in 2021, according to the World Steel Association.

The global lead market will be balanced in 2022, as supply deficits of lead in Europe and the US will offset a surplus in China, according to Reuters. On Monday, Wood Mackenzie’s Farid Ahmed said, "Demand has been super-hot in North America and Europe for almost two years and is only now starting to show indications of easing. But it remains tight with supply struggling to keep up with demand." Ahmed also added, "Globally, the refined lead market is quite well balanced." Wood Mackenzie is predicting a global supply surplus of 78,000 mt in 2022.

Finally, regarding tin production, the recent drop in global tin prices might force Chinese tin smelters to cut their capacity utilization to 40% or less, according to the International Tin Association (ITA). Capacity utilization is a measurement of how much available production capacity the industry is using. The ITA also stated on Tuesday that high import volumes have suppressed domestic prices, leading to operational risks and “huge price fluctuations” for tin smelters. Chinese refined tin production was 165,200 tons in 2021, according to Shanghai Metal Market. Based on ITA data, China produced nearly 44% of the world’s refined tin in 2021.

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,498.00/mt, down $182.00/mt on the week. Compared to last Friday, the forward curve for LME Aluminum has shifted lower vertically by approximately $200/mt into early 2024. The forward curve is now in contango into 2025, meaning that spot prices are lower than futures prices. This allows aluminum producers to hedge future sales at prices higher than that of spot prices. The aluminum market has sufficient liquidity to use swaps and options. Consumers of aluminum might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last settled at 33.12¢/lb this week. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this market is tricky, so we recommend using strategically placed limit orders. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,961.50/mt, down $486/mt on the week. LME Copper's forward curve has shifted vertically lower by approximately $500/mt compared to last Friday and is essentially flat into early 2024. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $25,669/mt, down $1,595/mt on the week. Nickel prices were down again this week. Nickel's forward curve is in contango, meaning that spot prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded at $1,126/T, down $34/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with strategically placed limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

06/15/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 05/23/2022: India's Steel Exports Tariffs Shock Producers |

|||||

Notable News |

|||||

|

6/17/2022: China to ban new heavy industrial projects in key zones 6/16/2022: Tesla to charge more for cars in United States as inflation bites 6/15/2022: Hyundai Motor, Posco restart shipments as trucker strike ends 6/14/2022: South Korea's truckers end crippling strike, reach deal with govt 6/13/2022: Dollar at two-decade high as risky assets sell off; yen recovers ground 6/13/2022: China's lead surplus to offset shortages in U.S. and Europe 6/13/2022: Copper’s outlook under threat as economic risks pile up 6/12/2022: Top Steelmaker in South Korea Halts Production on Trucker Strike 6/12/2022: POSCO to halt some plants as South Korea trucker strike continues |

|||||