|

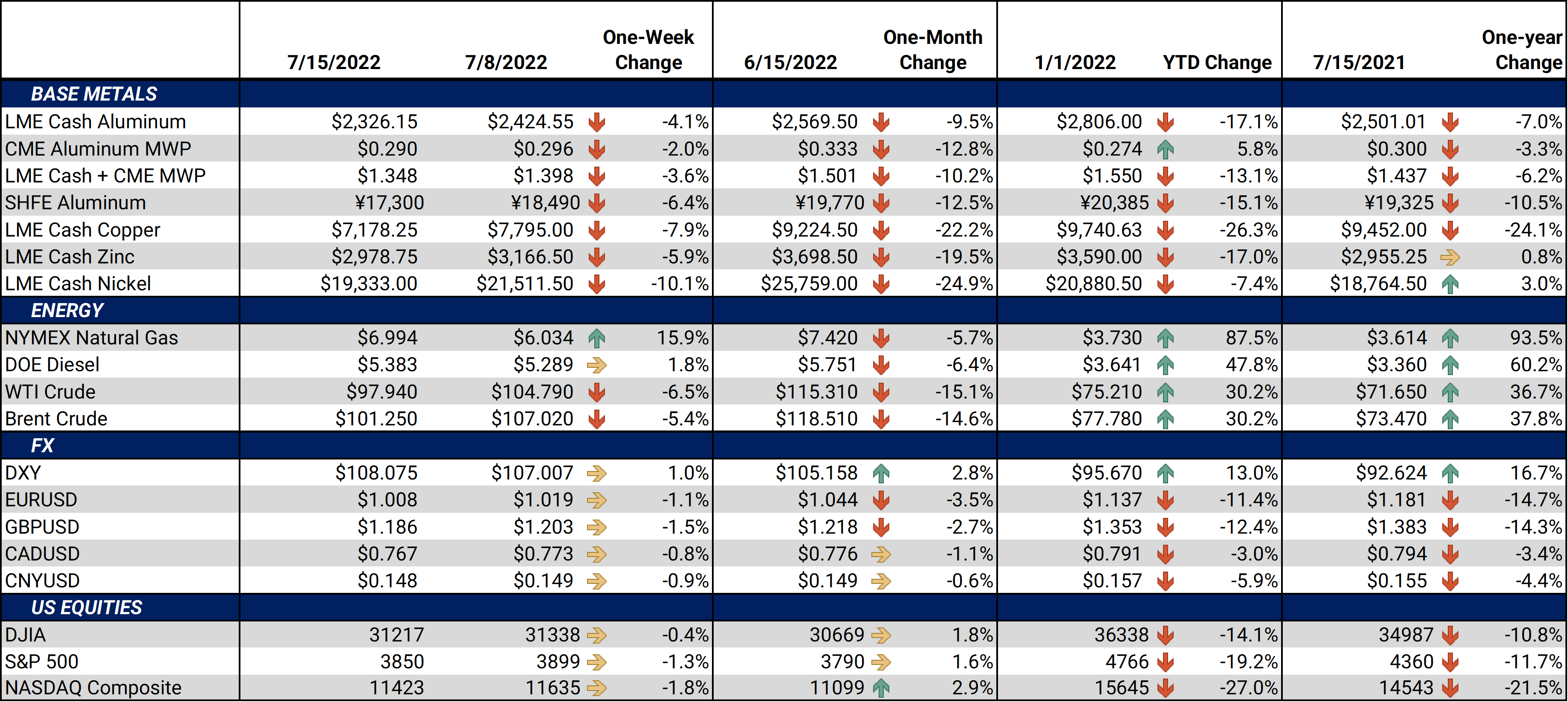

Steel plate is unusually expensive. Argus’s spot HRC assessment is currently $895.50, and their spot plate price assessment is now approximately $1,845.50, giving plate a $950/st premium over HRC, according to Argus’s most recent reports. This is a reversal; traditionally, plate prices have generally lagged $100/st below HRC. Could plate prices return to their more typical relationship? In recent months, the three major plate producers in the US have only dropped plate prices by minimal amounts. However, there are concerns that new capacity and cheaper imports could weigh on plate prices in the future. |

Continuing on steel, demand for HRC steel in the US is strong; however, there are concerns that demand could fall in the second half of 2022, according to Argus. Buyers are doing minimal spot purchases, and some are even reducing purchases to below contract minimums. Sources also told Argus that lower raw-material costs could put further downward pressure on prices for finished steel products such as cold-rolled coil (CRC) and hot-dipped galvanized coil (HDG).

The global steel market also has some upcoming changes. India will likely abolish or reduce the 15% export tariff on certain steel products, according to Bloomberg’s summation of local media reports. This 15% export tariff, which was implemented in late-May 2022, sought to reduce domestic prices and raise supplies. However, domestic demand has remained subdued and domestic end-users have not rebuilt inventories despite lower prices. According to the Ministry of Steel, in June, exports dropped by 53% year-over-year. Trade sources cited by the Hindu Business Line believe this drop in exports was because the export tariff made Indian steel uncompetitive compared to Chinese offerings, and recession fears weighed on global demand. Major steel industry producers are planning to meet with ministry officials later this week to discuss the tariffs, according to the Hindu Business Line.

Moving on to copper, copper prices could continue downward in 2H 2022, according to a Goldman Sachs note from earlier this week. LME Copper 3M ended this week at $7,190.50/mt (see below for charts). The bank has cut its three-month price target to $6,700/mt, down from $8,650/mt, as a gloomy demand outlook could weigh on prices into 3Q and 4Q. Strength in the USD has exacerbated the drop in copper prices and could remain a “headwind” until global economies show signs of improvement. Regarding demand, Macquarie echoed similar comments earlier this week, stating that Chinese end-users are not looking to stockpile copper.

Finally, regarding zinc, China’s zinc supply is expected to remain short for the second half of 2022, according to Shanghai Metal Market (SMM). According to their analysis, domestic zinc end users were only able to import enough to cover their needs in the third quarter, as a narrowing SHFE/LME price ratio did not provide enough incentive for exporters to ship greater volumes. An aggressive bid in China is likely to widen the ratio, thereby signaling to exporters to send more material to China and away from other markets such as Europe or the US.

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,343/mt, down $93.50/mt on the week. Compared to last Friday, aluminum’s forward curve has shifted lower by approximately $100/mt, but its shape is essentially the same. It is in contango from November 2022 onwards, meaning that spot prices are lower than futures prices. This allows aluminum producers to hedge future sales at prices higher than that of spot prices. The aluminum market has sufficient liquidity to use swaps and options. If you are a consumer of aluminum, you might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last settled at 28.9¢/lb this week. The CME Midwest Premium contract continued lower this week and remains in backwardation. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this thinly traded market is challenging, so we recommend using strategically placed limit orders. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $7,190.50/mt, down $615/mt on the week. LME Copper's forward curve is essentially flat through December 2026. It continues to shift vertically lower, this week by approximately $600/mt. It is essentially flat through December 2026. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $19,385/mt, down $2,196/mt on the week. Nickel’s forward curve continues to shift lower, and is in contango, meaning that spot prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded at $915/T, down $2/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with strategically placed limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

07/13/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 07/07/2022: Have Copper Prices Begun to Find a Bottom? 06/23/2022: What is Green Steel Anyways? |

|||||

Notable News |

|||||

|

7/13/2022: Historic US plate/HRC spread stokes concerns 7/13/2022: Column: Collapsing metal inventories clash with plunging prices 7/13/2022: Latin America steel demand to fall in 2022 -industry report 7/12/2022: US HRC: Prices fall below $900 7/12/2022: Goldman goes cold on copper price 7/12/2022: China ramp-up pushes aluminum prices to 14-month lows 7/11/2022: Explainer: What happens if Germany's Russian gas flows stop 7/11/2022: Column: China's massive stimulus talk does little for metals as confidence fades 7/11/2022: Indian shares pare losses to end flat after reports of export tax on steel ending 7/11/2022: India’s finished steel exports fall 53 per cent in June |

|||||