|

Copper Copper prices could be on the rebound, as China announced a $146 billion stimulus package that focuses on new infrastructure and housing. China’s home prices and sales volumes have fallen in recent months, according to Bloomberg. Home builders, many of which are cash-strapped and debt-ridden, have stopped construction on new projects, to the detriment on copper demand. However, one analyst interviewed by Bloomberg on Thursday proclaimed that copper prices could stabilize due to low global inventories.

|

* Please note that due to the UK Summer Bank holiday, the LME will be closed on Monday, August 29. We will not produce the First Look that morning. However, the trading desk will provide CME coverage, and current clients can contact metals@aegis-hedging.com for indications. *

Steel

HRC prices could see little upside this year, as steel producers see little reason to cut production, despite a nearly 50% drop in HRC prices so far this year. Steelmakers normally cut production after a steep drop in prices, according to Argus. However, in an interview with Argus earlier this week, Cleveland-Cliffs stated they do not expect the steel industry will experience production cuts. That said, other market participants feel the market is still oversupplied, further fueling a bearish sentiment. Likewise, market participants were disappointed that no major producers announced any potential production cuts during their 2Q earnings calls. Production in 2022 has hovered between historical, pre-COVID norms of 1.723 to 1.833 million st/week, according to the American Iron and Steel Institute (AISI).

Steel mill maintenance season, which runs from September through November, will remove an estimated 600,000 st total, or 6,450 st/day, from flat-rolled production according to Argus. However, sources polled by Argus believe that this will do little to change the supply picture, especially since an additional 18,700 st/day in new production capacity will be brought online in 2H 2022. Argus also notes that the oversupply issues have been exacerbated by weak consumer demand and a lack of buying interest by service centers.

Zinc

Will hot-dipped galvanized (HDG) steel producers be forced to raise prices? Zinc, which is a key component in HDG production, has been subject to a nearly 22% price increase since mid-July due to European smelter curtailments. Normally, rising zinc prices would be bullish for HDG prices, but HDG producers likely can't pass along the cost due to lower buyer appetite amid slumping demand, according to Argus. They also believe that rising zinc prices could squeeze margins and lead to production curtailments, as the market is unlikely to accept higher HDG prices while demand is falling. If margins shrink because of high input costs, HDG producers may be forced to reduce output or suffer through weak profits.

Aluminum

Finally, regarding aluminum production, more European aluminum smelters are grappling with rising electricity prices, and now some are contending with worker strikes. Despite these issues, the aluminum market seems to be in balance right now, as prices have largely trended sideways for nearly two months. However, aluminum prices could rally if more production is taken offline due to increasing electricity prices or more worker strikes occur. This past Monday, Alcoa announced that workers at its 200,000 mt/yr capacity Mosjøen plant would begin a strike, effectively immediately. According to the press release, the plant will work towards a 20% reduction in production by September 19. After that date, an additional 10% of production will be shuttered every other week, until only 34 of the 404 pots remain operational. This was the second Norwegian-based smelter shutdown announcement in as many weeks. Last week, Norsk Hydro announced that 20% of production at its Norway-based Sunndal plant will be taken offline due to a worker strike that was set to begin on Monday, August 22.

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

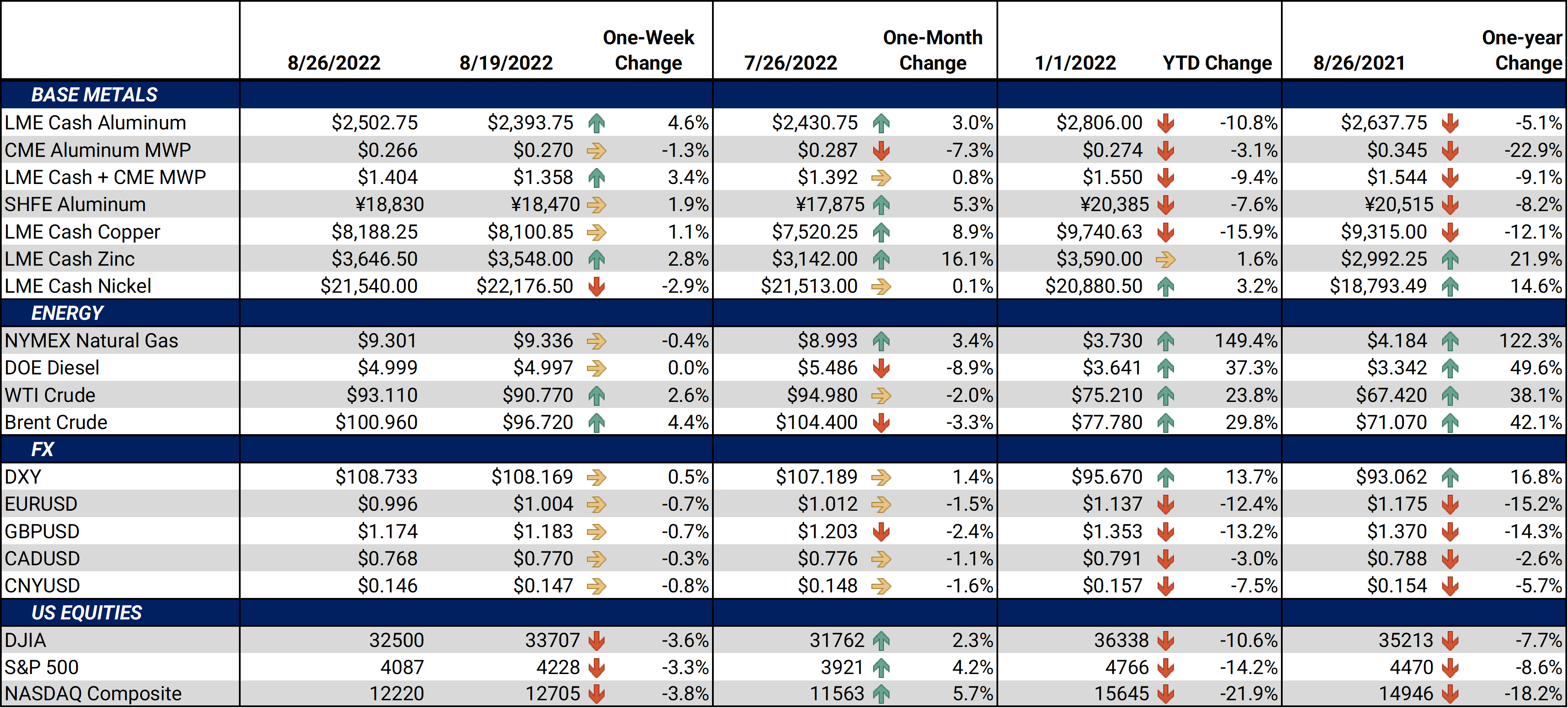

LME Aluminum 3M settled at $2,493.50/mt, up $107.50/mt on the week. Aluminum prices were up this week, so the forward curve has shifted higher by approximately $100/mt, but its shape continues to look the same. It remains in contango, meaning that spot prices are lower than futures prices. Aluminum consumers that are concerned about increasing prices but want to maintain downside participation may consider hedging future needs by executing zero-cost collars. If you are an end-user, you might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. The aluminum market has sufficient liquidity to use swaps and options. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last settled at 26.6¢/lb this week. The CME Midwest Premium contract was steady this week and remains in backwardation. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this thinly traded market is challenging, so we recommend using strategically placed limit orders. Please contact AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only.* |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,160.50/mt, up $82/mt on the week. Compared to last Friday, LME Copper's forward curve has shifted slightly higher, by about $100/mt. It remains backwardated, meaning that spot prices are higher than futures prices. Copper consumers that are concerned about increasing prices but want to maintain downside participation may consider hedging future needs by executing zero-cost collars The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $21,633/mt, down $625/mt on the week. Nickel’s forward curve shifted slightly higher this week, by about $600/mt. It remains in contango, meaning that spot prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded at $794/T, up $7/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with strategically placed limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

8/24/2022: Chinese Aluminum Supply Issues Could Rally Prices 8/24/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 8/16/2022: Zinc Prices Are On The Rebound Due To Supply Issues 8/9/2022: Aluminum prices are finding support: Consumers can lock in lower costs in 2023 and beyond |

|||||

Notable News |

|||||

|

8/23/2022: Cliffs CEO does not foresee sheet output cuts 8/22/2022: Strike at Alcoa’s Mosjøen smelter in Norway commences 8/22/2022: Ford cuts workforce amid EV push 8/22/2022: Climate disasters risk putting a damper on electric-car making 8/22/2022: European gas prices surge on renewed Russian gas supply uncertainty 8/22/2022: Japan's Tokyo Steel cuts sales prices on weak demand 8/22/2022: Japan’s ferrous scrap outlook mixed |

|||||