|

Copper The copper and nickel markets could be undersupplied in the long term, according to Oz Minerals. They blame a lack of new discoveries and an expected increase in demand from global decarbonization efforts. Although they downplayed comments from competitor BHP over a feared short-term supply glut, Oz did say that the markets for both metals could be volatile in the short term. In its most recent production guidance, Oz expects to produce between 127,000 - 149,000 mt of copper this year. However, according to comments they made to Bloomberg, the company expects its copper production to double within the next “half dozen” years and will begin nickel production soon. |

Adding to the potential bullishness for copper, China’s copper demand could finally be on the mend. Evergrande, which is one of China’s largest real estate developers, has restarted construction on 668 of its 706 stalled projects, according to Bloomberg. China’s peak construction season usually lasts until the end of October, so this welcomed news comes just as metals demand for construction normally falls. According to Bloomberg, China’s property sector has been hit in recent months as home prices and sales volumes have fallen. Many home builders, including Evergrande, stopped construction on new projects, thereby weighing on copper demand.

Aluminum

As for aluminum production, due to a worsening power crisis, aluminum producers in China’s Yunnan province, a key production hub, might cut production by 20 to 30%, or 1 to 1.5 million mt, Shanghai Metals Market stated Thursday, citing a recent producer survey. This revelation comes just days after the local government ordered local producers to curtail production by 10%, or 500,000 mt. Earlier this week, an anonymous source cited by Fastmarkets, proclaimed that deeper production cuts than the initial 10% could occur, as the government plans to ration power until May 2023. At 5 million mt, Yunnan province represents about 12.8% of China’s total aluminum production last year, based on USGS and Fastmarkets data.

Steel

Finally, regarding steel, due in part to falling demand, the Argus HRC steel index has fallen by nearly 50% this year. Argus’s latest spot HRC weekly assessment, released on Tuesday, was $800/st, a $20/st increase from the prior week’s assessment. Despite the price jump, Argus reports that service centers are still “holding off” on replenishing stockpiles and are only buying short-term needs. Contract negotiations for 2023 are currently ongoing, with at least one source telling Argus that “value-add” prices are down 4% from last year. As for supply, continuing contract negotiations between the United Steelworkers (USW) union and US Steel could change the supply picture if either side walks away from the negotiating table.

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

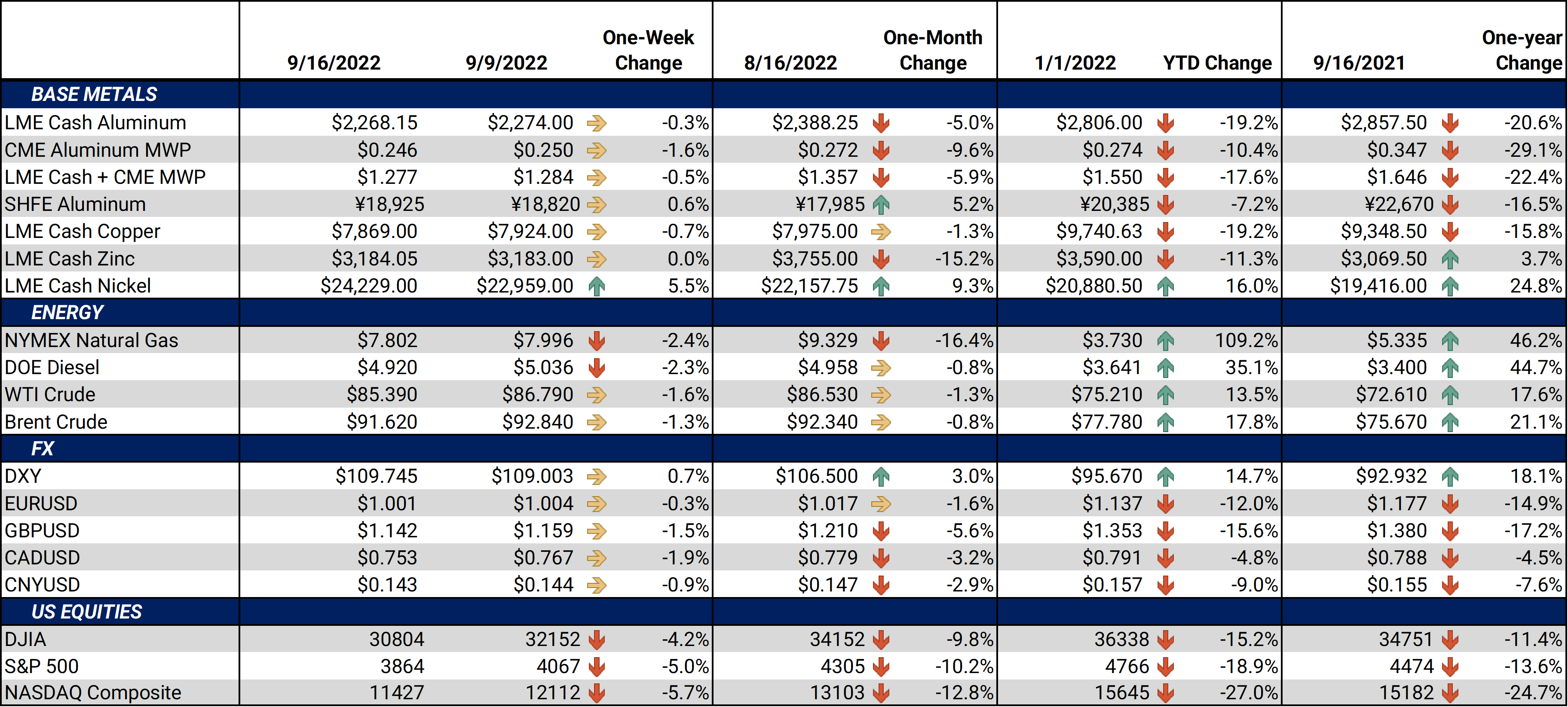

LME Aluminum 3M settled at $2,277.00/mt, down $9.00/mt on the week. Aluminum prices were down this week, but the forward curve's shape and position is little changed. It remains in contango, meaning that spot prices are lower than futures prices. Aluminum consumers that are concerned about increasing prices but want to maintain downside participation may consider hedging future needs by executing zero-cost collars. If you are an end-user, you might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. The aluminum market has sufficient liquidity to use swaps and options. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last settled at 24.6¢/lb this week. The CME Midwest Premium contract was steady this week and remains in backwardation. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this thinly traded market is challenging, so we recommend using strategically placed limit orders. Please contact AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only.* |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $7,762.00/mt, down $94.50/mt on the week. Compared to last Friday, LME Copper's forward curve has shifted slightly lower, by about $100/mt. It remains backwardated, meaning that spot prices are higher than futures prices. Copper consumers that are concerned about increasing prices but want to maintain downside participation may consider hedging future needs by executing zero-cost collars The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $24,249/mt, up $1,255/mt on the week. Nickel’s forward curve shifted slightly higher this week, by about $1,200/mt. It remains in contango, meaning that spot prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded at $789/T, down $29/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with strategically placed limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

9/14/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 8/31/2022: Will Chilean Production Issues Drive Copper Prices Higher? 8/24/2022: Chinese Aluminum Supply Issues Could Rally Prices 8/16/2022: Zinc Prices Are On The Rebound Due To Supply Issues 8/9/2022: Aluminum prices are finding support: Consumers can lock in lower costs in 2023 and beyond |

|||||

Notable News |

|||||

|

9/15/2022: US Steel idles Indiana blast furnace 9/15/2022: European metals producers say EU energy measures fall short 9/15/2022: To buy or not to buy: Russian aluminium dilemma for Europe's buyers 9/13/2022: US HRC: Prices rise, market uncertain 9/12/2022: Electricity restrictions in Yunnan may increase aluminum price 9/9/2022: Current gas, electricity prices threaten European steelmaking viability: Eurofer 9/8/2022: BHP says copper strategy does not depend on M&A after OZ Minerals snub 9/7/2022: EU, US step up Russian aluminum, nickel imports since Ukraine war 9/6/2022: US HRC: Prices flat on holiday |

|||||