|

Aluminum Russia is planning to build an alumina plant to move away from its reliance on imports, according to Reuters. The country imports 65% of its alumina, most of which now comes from China. This is a new phenomenon; China had previously exported little alumina to Russia – only 1,747 mt in 2021. However, since March, they have shipped 577,000 mt to Russia. Prior to the Russia-Ukraine conflict, Russia relied heavily upon supplies from Ukraine and Australia. The replacement alumina imports have helped Russia’s aluminum producer, Rusal, to keep aluminum production flowing, and having domestic alumina production further insulates them from supply disruptions. The proposed alumina plant will be based near Russia's Baltic Sea port of Ust-Luga. The plant’s arrival date and capacity are unclear. |

The saga between the LME and Russian aluminum producer Rusal continues. Alcoa fears that actions by Rusal could exert undue influence on LME aluminum prices and could upset the global aluminum supply-and-demand balance. Alcoa, therefore, believes that Rusal’s aluminum should not be allowed for delivery against LME contracts. Neither should they be allowed to use the LME as a “market of last resort,” as many Western buyers have shunned Russian metal since the start of the Russia-Ukraine conflict. These statements were taken from a letter that Alcoa penned to the LME earlier this week. Last Thursday, the LME announced that it will be creating a “discussion paper” on the topic of banning Russian metal from the exchange. However, the LME has not announced any formal action. (Source: Bloomberg)

As for US import tariffs, The Aluminum Association does not anticipate any revisions to the current Section 232 tariffs on aluminum imports, despite continuing talks with federal officials. However, the association stated that any proposed changes should “be made very carefully so they don’t upset the current market conditions.” These comments, first reported by Bloomberg, were made at an aluminum industry conference held late last week.

Section 232 tariffs are at the discretion of the US executive branch and are allowed for reasons of national security. Current tariffs are 10% on aluminum imports. These tariffs were meant to reduce the flow of metals imports, thereby preventing foreign exporters from dumping cheap aluminum onto the US market. AEGIS notes the cost of the tariffs has supported the Midwest Transaction Price (MWP). Reducing or eliminating those tariffs would likely reduce costs and perhaps prices in the U.S, as these tariffs are based on aluminum prices, and are built into the MWP.

Finally, regarding Japanese aluminum demand, the premium for 4Q 2022 aluminum deliveries into Japan will likely be approximately $99/mt, a 33% drop in that premium compared to the prior quarter and the lowest premium in nearly two years, according to Bloomberg. This is the premium over the London Metal Exchange (LME) cash price that Japanese importers agree to pay for primary aluminum shipments. It is set on a quarterly basis, negotiated directly between Japanese end-users and global aluminum producers. At least two Japanese aluminum buyers have agreed to this $99/mt premium, thereby signaling what pricing other buyers are likely to pay. This premium has dropped in recent quarters as demand, specifically from the automotive sector, has softened. However, this premium could rebound in spring 2023 if automotive demand returns, according to recent comments by Sumitomo Corporation. Japan imported approximately 2.793 million mt of aluminum in 2021, or about 4% of global production, according to the Japan Ministry of Finance and USGS data.

Zinc

Glencore will idle its 165,000 mt/yr Nordenham, Germany zinc smelter starting November 1. AEGIS now estimates that approximately 19% of Europe’s zinc smelter capacity is now offline. AEGIS notes both the declining price of zinc and surging electricity costs very likely played a part in this curtailment, as both factors have destroyed margins for many European smelters. Glencore cited “various external factors” for the shutdown, also stating the plant will remain closed “until the macro-economic environment improves,” according to a company memo supplied to Reuters. As soaring electricity prices have plummeted profit margins, some European smelters have been forced to curtail production fully or partially since late last year. Based on prior estimates from Macquarie, AEGIS now approximates that 399,000 mt of Europe’s zinc smelter capacity is now offline. This is about 19% of Europe’s production, or approximately 2.9% of global production, according to Argus and USGS figures.

Steel

US Steel will not restart its 1.4 million ton/year Mon Valley Works (Pennsylvania) blast furnace after completing routine maintenance, according to Argus. A company spokesperson told Argus the shutdown will "balance our production with our order book." This is US Steel’s second plant idling since early September. On September 7, the company idled its 1.5 million ton/year blast furnace in Gary, IN, citing “market conditions and continued high levels of imports.” The Gary, IN closure, was the first closure by a US steelmaker due to deteriorating market conditions “in recent memory,” according to Argus.

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

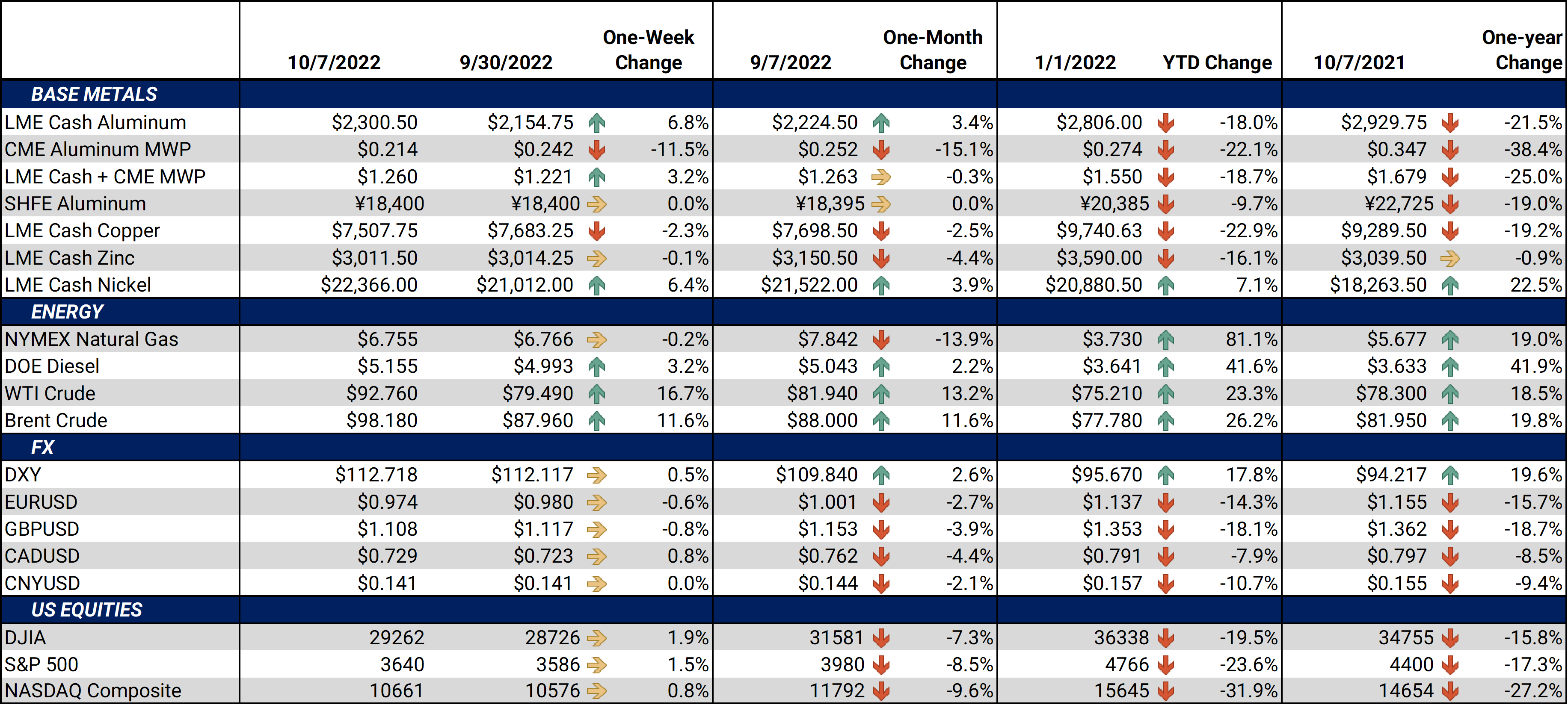

LME Aluminum 3M settled at $2,299.00/mt, up $137.00/mt on the week. Aluminum prices were up this week. The forward curve has shifted higher by approximately $100/mt, but its shape continues to look the same. It remains in contango, meaning that spot prices are lower than futures prices. Aluminum producers that are concerned about decreasing prices might consider hedging future sales by selling swaps or buying put options. The aluminum market has sufficient liquidity to use swaps and options. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last settled at 21.4¢/lb this week. The CME Midwest Premium contract was down this week and remains in backwardation. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this thinly traded market is challenging, so we recommend using strategically placed limit orders. Please contact AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only.* |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $7,457.50/mt, down $102.50/mt on the week. Compared to last Friday, LME Copper's forward curve has shifted slightly lower, by about $100/mt. Prices throughout the curve are relatively flat. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $22,487/mt, up $1,380/mt on the week. As prices rallied this week, nickel’s forward curve has also shifted higher, by about $1,300/mt. It remains in contango, meaning that spot prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last settled at $748/T, down $28/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

10/05/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 10/05/2022: European Aluminum Smelters Might Have Negative Margins Through 2023 8/31/2022: Will Chilean Production Issues Drive Copper Prices Higher? 8/24/2022: Chinese Aluminum Supply Issues Could Rally Prices 8/16/2022: Zinc Prices Are On The Rebound Due To Supply Issues |

|||||

Notable News |

|||||

|

10/6/2022: LME seeks market opinion on possible Russian metal ban 10/6/2022: Russia may build alumina plant to cut costly dependence on China 10/5/2022: Glencore to place Nordenham zinc smelter on care and maintenance from Nov 1 10/4/2022: Column: London Metal Exchange ducks Russian sanctions pressure 10/3/2022: AutoForecast cuts NorthAm production outlook further 10/3/2022: US Steel idles Mon Valley blast furnace 10/3/2022: BHP lifts steel consumption forecast on surging demand from renewable power farms 10/3/2022: Copper price pressured by crumbling demand |

|||||