|

Aluminum The White House is considering banning all Russian metal imports, hiking tariffs, or sanctioning Rusal, according to anonymous sources cited by Bloomberg and Reuters. AEGIS notes this could be supportive of aluminum prices, as nearly 10% of our aluminum imports come from Russia. These possible actions stem from Russia’s ongoing conflict with Ukraine. The Biden administration has yet to make a formal announcement on the matter. |

Prior to the White House announcement, the LME made a similar declaration late last week regarding Russian metals. The LME stated it could limit Russian metal traded on the exchange, via a quota system or ban it all, under two alternatives proposed. These options were outlined in a discussion paper the exchange launched last Thursday. It aims to gather market opinion on how to treat Russian metal that is currently on the exchange, and potentially might be delivered against LME futures contracts. Three possible outcomes were suggested. First, if LME maintains the “status quo,” the LME notes that an “influx of Russian metal into the physical network” could occur and have an impact on the market. As for a quota system (the second option proposed), the exchange feels that the market would not see any benefits, given the complexities of maintaining such a system. Regarding a possible suspension (the third of three options), the LME outlined several additional scenarios, including if the suspension should begin immediately or be delayed until 2023. The LME has given market participants until October 28 to respond.

Will US scrap prices jump if Mexico bans aluminum and steel scrap exports? The Institute of Scrap Recycling Industries (ISRI), a US-based trade organization, is trying to dissuade Mexico from banning aluminum and steel exports to the US. ISRI recently stated they understand the Mexican government’s aim to reduce food inflation, but the organization does not understand why scrap steel and aluminum that are used in food packaging should be targeted. The proposed export ban stems from a set of anti-inflationary laws introduced by the Mexican government last week. Aluminum cans are one packaging product that could be affected more than others. So far this year, Mexico was the second-biggest supplier of aluminum scrap and ferrous scrap to the US, according to Argus. Mexico exports most of its used beverage cans to the US, because the former does not have a rolling mill that produces rolling can sheets (Source: Argus)

Some European aluminum producers are making plans for smelter restarts. For example, to aid its planned 2024 restart of the San Ciprian smelter, Alcoa has signed an additional power purchase agreement with Spanish electricity producer Endesa, according to a press release from late last week. Alcoa had closed the 225,000 mt/year smelter in December 2021 after soaring electricity prices made production unprofitable. The agreement with Endesa runs from 2024 through at least 2030 and will provide approximately 30% of the smelter’s electricity needs. Alcoa now has 75% of the smelter’s electricity needs met, as they signed an earlier agreement with Greenalia. Negotiations are ongoing for the remaining 25%.

Lead

A recent scramble to buy LME warehouse lead stocks has pushed inventories to the lowest level in over 20 years and to the equivalent of just a few hours of global consumption, according to Reuters. As of Friday morning, “on-warrant” LME warehouse lead stocks, which are available to trade, totaled 10,975 mt, down 17,050 mt, or 61% since October 3. AEGIS notes the recent rush on LME warehouses was likely initiated by end-users that are worried about global supplies. Soaring electricity prices in Europe have forced several large smelters to curtail production or contemplate shutdowns due to unprofitability. One Germany-based smelter has been closed for over a year due to flood damage and related regulatory issues. China, which is the world’s largest lead miner and refiner, is also grappling with low scrap supplies and power issues.

Steel

Late last week, Nucor announced they would not load barges with steel shipments “for a few weeks” due to low water levels in the lower Mississippi River, according to Bloomberg. AEGIS has been closely monitoring the water levels on the Mississippi River nearest to Nucor’s Jackson MS, plant, and the water level has only improved by about one foot. The current water level is approximately 4.09 feet, up from just under three feet last week Friday. Nucor is currently opting to ship via rail or truck, both of which are far more expensive than barge shipments.

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

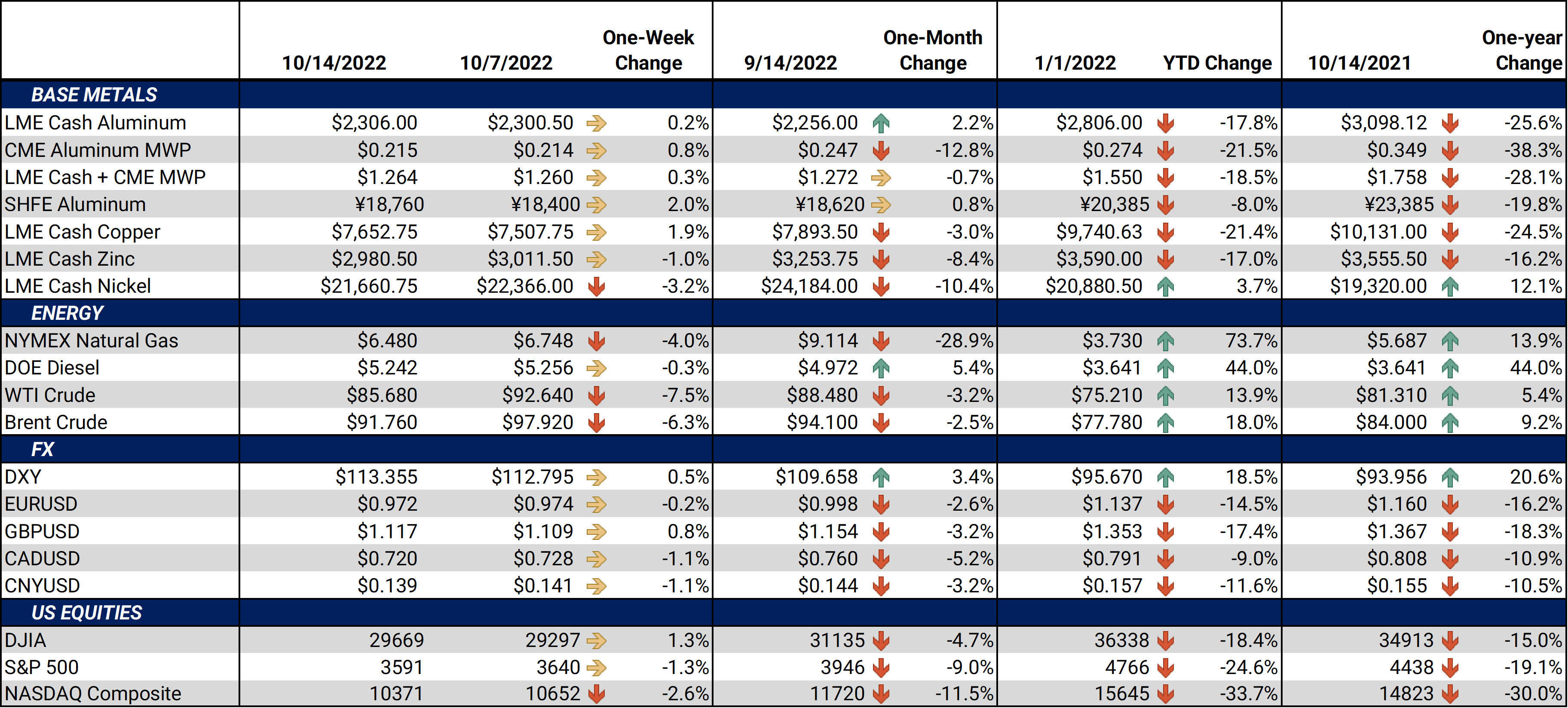

LME Aluminum 3M settled at $2,306.00/mt, up $7.00/mt on the week. Aluminum prices were up slightly this week. However, it was not enough to meaningful change the position or shape of the forward curve. It remains in contango, meaning that spot prices are lower than futures prices. Aluminum producers that are concerned about decreasing prices might consider hedging future sales by selling swaps or buying put options. The aluminum market has sufficient liquidity to use swaps and options. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last settled at 21.5¢/lb this week. The CME Midwest Premium contract was essentially unchanged this week and remains in backwardation. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this thinly traded market is challenging, so we recommend using strategically placed limit orders. Please contact AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only.* |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $7,538.50/mt, up $81.00/mt on the week. Compared to last Friday, LME Copper's forward curve has shifted slightly higher for the first half of 2023. Prices throughout the curve are relatively flat. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $21,777/mt, down $710/mt on the week. As prices dropped this week, nickel’s forward curve has also shifted lower, by about $700/mt. It remains in contango, meaning that spot prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last settled at $751/T, up $3/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

10/05/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 10/05/2022: European Aluminum Smelters Might Have Negative Margins Through 2023 8/31/2022: Will Chilean Production Issues Drive Copper Prices Higher? 8/24/2022: Chinese Aluminum Supply Issues Could Rally Prices 8/16/2022: Zinc Prices Are On The Rebound Due To Supply Issues |

|||||

Notable News |

|||||

|

10/13/2022: Codelco offers 2023 European copper premiums at record high -sources 10/13/2022: Aurubis raises 2023 copper premium 85% to $228 a tonne 10/13/2022: Explainer: Will market mayhem erupt if US bans Russian aluminium? 10/12/2022: U.S. may block Russian aluminum imports -source 10/12/2022: USW ratifies agreement with steelmaker Cliffs 10/11/2022: Column: Supply hits catch up with lead as LME stocks shrink 10/10/2022: How a ban on Russia’s mining giants could shake the metals world 10/8/2022: Alcoa Inks 131 MW Wind Power Agreement For 2024 Restart Of San Ciprián Aluminium Smelter |

|||||