|

Aluminum The future for European aluminum is “at risk,” as escalating electricity costs have made the region’s production uncompetitive against Russian imports, according to Norsk Hydro. The Norway-based but global aluminum producer therefore encourages the EU and US to implement sanctions against Russia’s top aluminum producer, Rusal. Norsk also believes that Russia is “benefiting” from the recent smelter curtailments occurring across Europe, as Russian aluminum production continues at pre-war levels. |

|

Since the start of the Russia-Ukraine conflict, Russia has largely cut off natural gas flows to Europe, leading to soaring electricity prices across the region, and forcing many European aluminum smelters to curtail production fully or partially. AEGIS estimates that nearly 26% or 1.16 million mt, of Europe’s annual aluminum smelter capacity has been curtailed as high electricity costs have production unprofitable. |

|

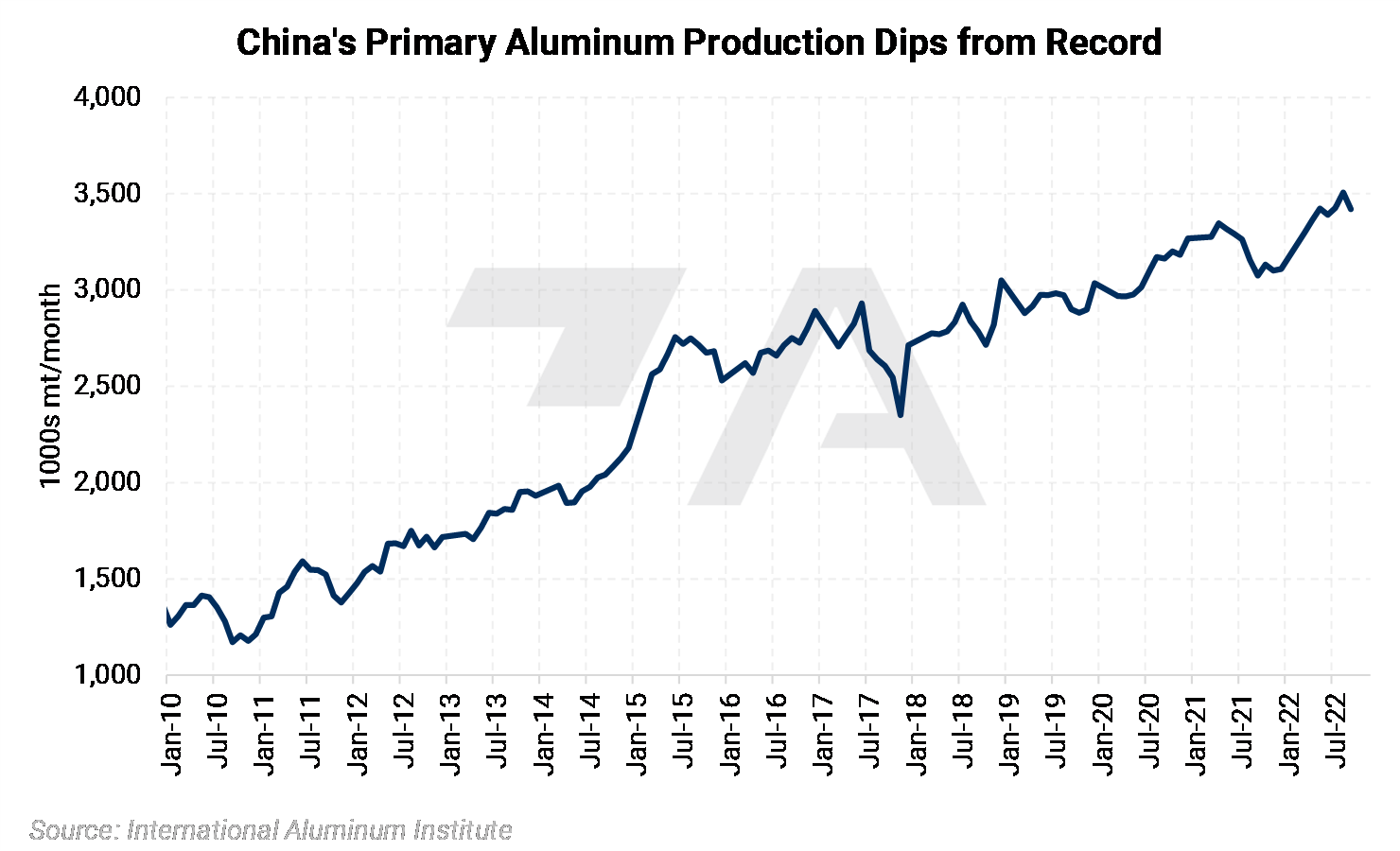

Elsewhere, Chinese aluminum production continues at a blistering pace. Aluminum production averaged over 114,000 mt/day in September, a new record daily volume, as authorities have eased power restrictions. However, total monthly production was 3.42 million mt last month, down slightly from 3.51 million mt in August, according to China’s National Bureau of Statistics. Production dropped month-over-month because authorities in Yunnan province, a key production area, asked smelters to reduce output from September 10 due to low hydropower supply, according to Reuters. The country has produced 29.88 million mt of aluminum so far this year, up 2.8% from the same period last year.

This increasing daily production comes despite Chinese economic data showing their economy is slowing. Perhaps in-country demand is falling, or the country has generated a metals surplus, because Chinese aluminum imports have dropped 19.6% month over month, according to Chinese customs data. AEGIS notes that these factors have likely contributed to falling global aluminum prices.

Copper

Declining copper prices will delay copper mine expansions, further exacerbating the currently “tight” physical market, Freeport McMoran stated in its 3Q earnings call. Freeport believes that the recent drop in copper prices is largely due to a strong US dollar, the European energy crisis, a slowing economy in China, and weak investor sentiment. However, Freeport says its customer demand is strong, and long-term conditions appear favorable due to the “energy transition.” In the first nine months of 2022, the company sold 3.171 billion lbs of copper, up from 2.787 billion lbs in the same period last year.

Steel

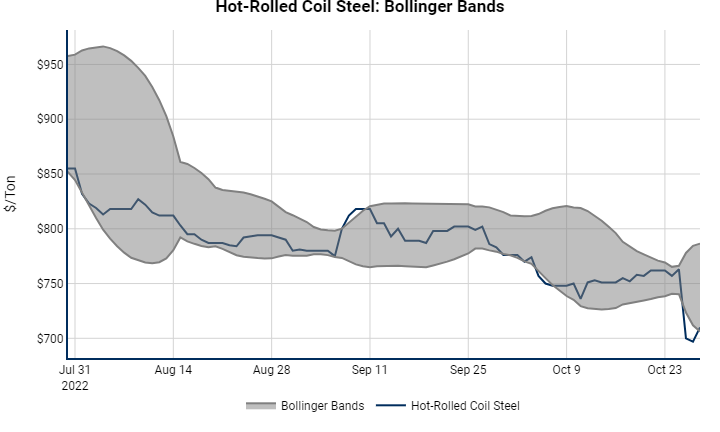

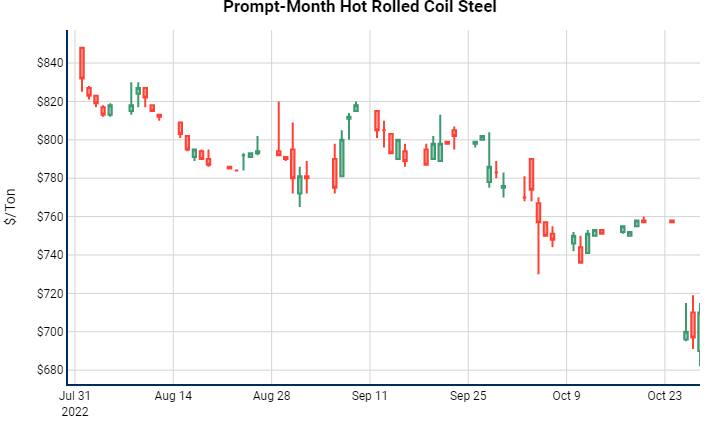

Argus's US HRC assessment has fallen 8% since September 20, now at $736.25/st. Oversupply of steel is already suppressing prices, yet Cleveland Cliffs says it will increase production. On Tuesday, Cleveland Cliffs announced that they will increase production by 300,000 to 400,000 st in 4Q 2022, as demand from its automotive customers increased by 100,000 st in 3Q. The company now expects 4Q production to be 3.9 to 4.0 million st, up from an average of 3.6 million st in the first three quarters of this year. According to Argus, oversupply continues to be a “top issue” for the industry, as more supply will come online in the next six months.

Contrary to Cleveland Cliffs’ expected pick-up in steel demand, some appliance makers are expecting demand to shrink. Whirlpool Corporation believes raw material costs for steel and plastics peaked in 3Q, and could fall into the first half of 2023, as they expect appliance demand to fall. The company cited inflationary pressures and a weakening economy for the expected pullback in appliance demand into next year. They, therefore, cut production volumes by 35% last quarter “in anticipation of a temporary soft demand environment.” Sales have already fallen, as revenue contracted by 10% in North America last quarter, and deeper cuts were seen in Europe and Latin America. Whirlpool’s net sales totaled $4.784 billion in 3Q, down 12.8% compared to 3Q 2021. They expect full-year 2022 revenues to total $20.1 billion, down approximately 9% from 2021. (Source: Argus, Whirlpool)

|

|

|||||

LME Aluminum |

|||||

|

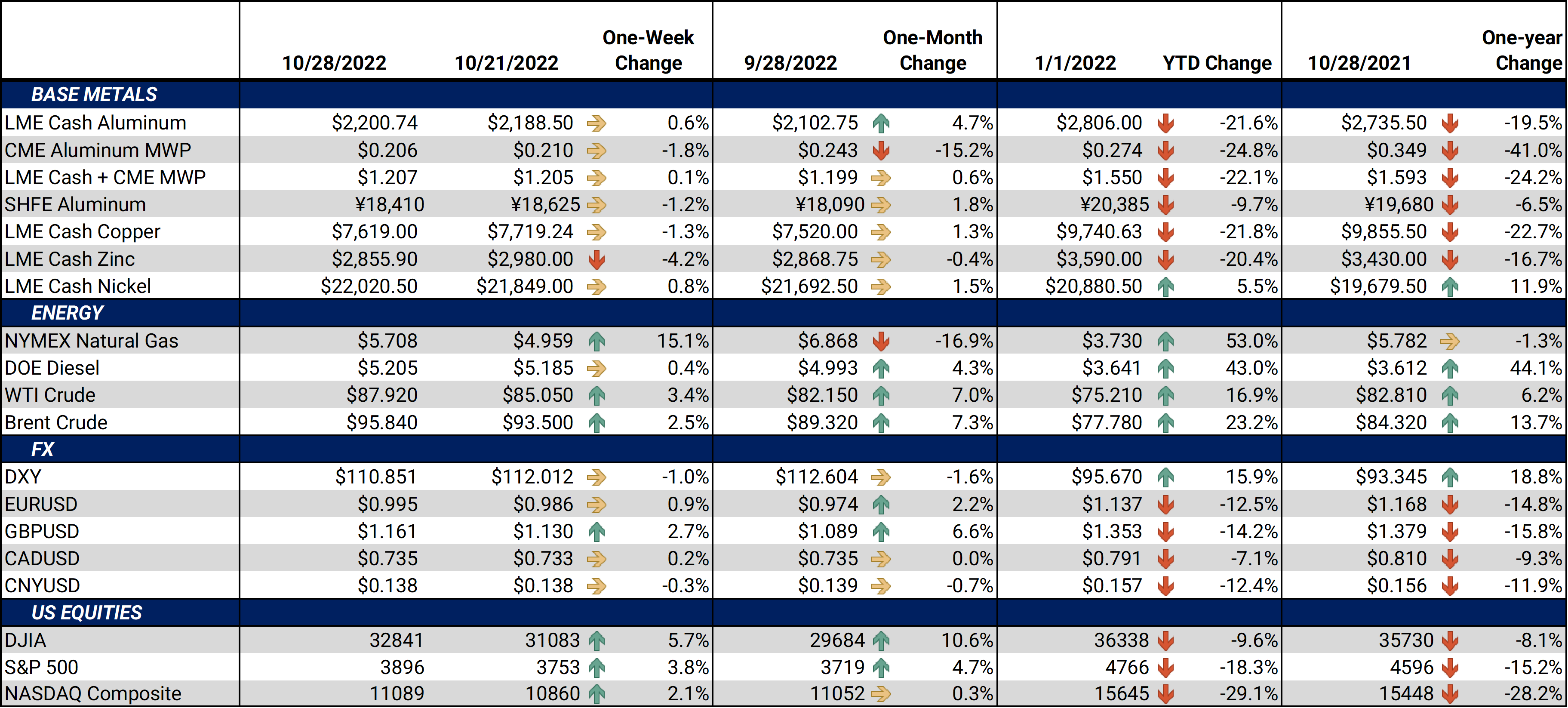

LME Aluminum 3M settled at $2,211.50/mt, up $5.50 /mt on the week. Aluminum prices were up this week; however, the position of the forward curve and its shape remain the same. It remains in contango, meaning that spot prices are lower than futures prices. Those that are carrying aluminum inventory and are concerned about decreasing prices might consider hedges that provide downside protection, such as selling swaps or buying put options. Such positions are standard; however, they can result in opportunity costs or cash costs if metal prices increase. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last settled at 20.6¢/lb this week. The CME Midwest Premium contract was essentially unchanged this week and remains in backwardation. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this thinly traded market is challenging, so we recommend using strategically placed limit orders. Please contact AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only.* |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $7,550.00/mt, down $74/mt on the week. Compared to last Friday, LME Copper's forward curve has shifted lower about $75/mt. Prices throughout the curve are relatively flat. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon their risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $22,134/mt, up $185/mt on the week. As prices rose this week, nickel’s forward curve has also shifted higher, by about $200/mt. It remains in contango, meaning that spot prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last settled at $710/T, down $18/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

||||

AEGIS Insights |

|||||

|

10/26/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 10/05/2022: European Aluminum Smelters Might Have Negative Margins Through 2023 8/31/2022: Will Chilean Production Issues Drive Copper Prices Higher? |

|||||

Notable News |

|||||

|

10/28/2022: Glencore cuts zinc output guidance after production drops 18% in nine months 10/27/2022: US Steel earnings, steel production drop 10/27/2022: Glencore to stick with Rusal's aluminium in 2023 -sources 10/26/2022: US steel imports lowest since Feb 2021 10/26/2022: Whirlpool cuts production by 35pc as demand falls 10/25/2022: US HRC: Prices flat, market sees lower offers 10/25/2022: Cliffs aims to increase quarterly steel production 10/25/2022: Norsk Hydro calls for EU, US sanctions on Russian aluminium 10/24/2022: China Sept aluminium output rises 9.3% y/y as power restrictions ease 10/24/2022: LME Week: Al market braces for the unknown 10/21/2022: Alcoa reduces 2022 alumina, bauxite outlook |

|||||