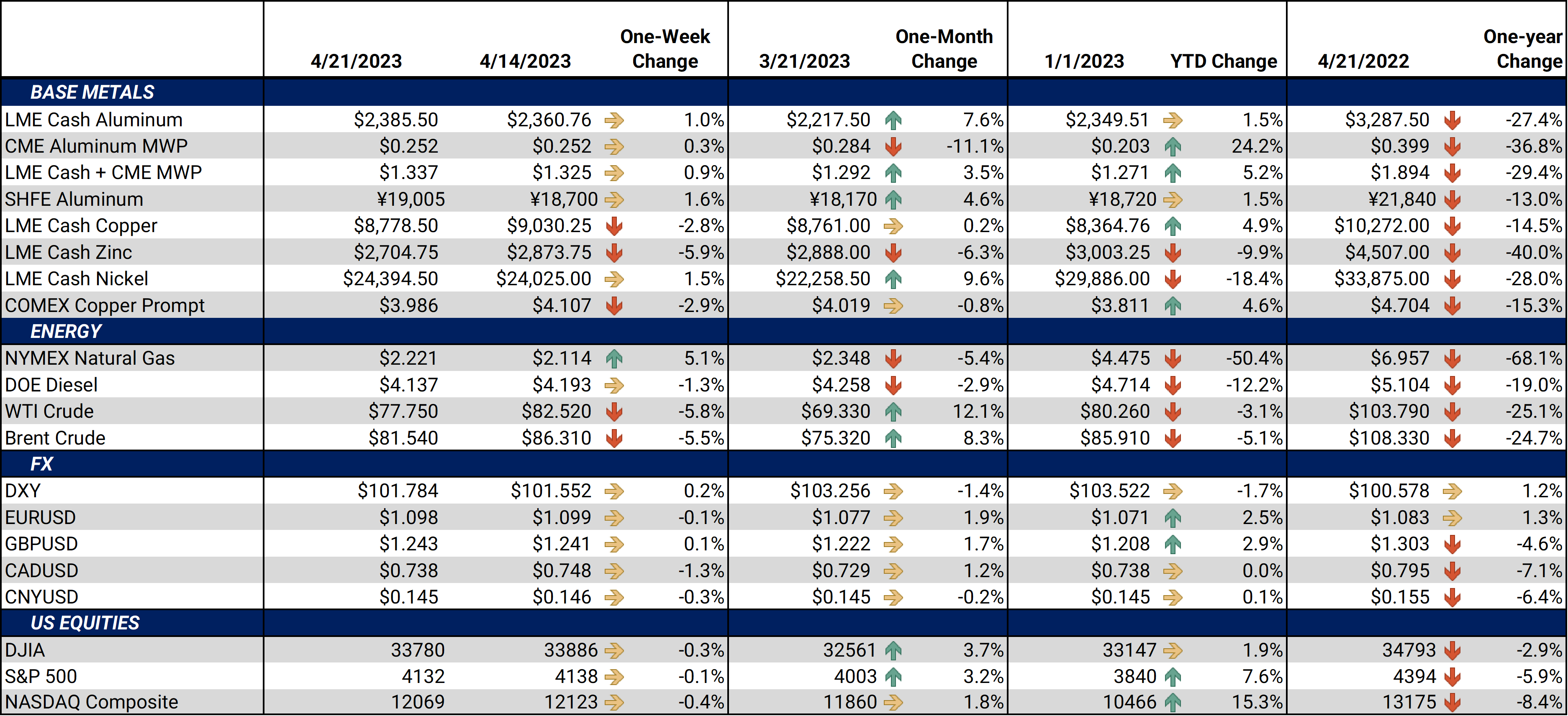

|

Aluminum Alcoa shipped 600,000 mt of aluminum in 1Q2023, down 5.4% from 1Q2022. Despite the lower volumes last quarter, the company estimates they will ship 2.5 to 2.6 million mt of aluminum this year, nearly unchanged from the 2.6 million mt they shipped in 2022. In a post-earnings note, Citigroup analyst Alexander Hacking predicts that Alcoa will have similar results in 2Q as they did in 1Q. Citigroup also foresees that the potential aluminum supply deficit in China will offset surpluses in the rest of the world, leaving the global market “in balance.” |

There is some potentially bullish supply news from China. The worsening drought in China’s top aluminum production region, Yunnan province, could force more aluminum smelters to curtail output, Mysteel said in a note earlier this week. The province has 5 million mt in annual production capacity, but two recent rounds of curtailments have already put approximately 1.84 million mt out of commission. The government issued another round of power cuts earlier this month, but aluminum smelters weren’t included in the latest round. Yunnan province, which relies on hydropower for its aluminum production, has only had about 40% of normal rainfall so far this year, leading to power rationing throughout the region. Even though aluminum smelters were not included in the latest round of power cuts, smelters could eventually be targeted. This could lead to higher aluminum prices both domestically and internationally. If you are an aluminum end-user that is subject to upside price risk, please contact AEGIS regarding hedging strategies.

More aluminum supplies will soon be coming to the US. MetalX and Manna Capital Partners will soon construct a 220 million lb/year aluminum slab facility that will supply alloys to the automotive, beverage, and packaging industries, the companies said late last week. The companies stated it will be built in the US Midwest, without specifying a location. They plan to have operations start by 2026. This announcement is the latest in a series of aluminum plant investments due to rising demand from the automotive and beverage sectors. Most of these other projects have broken ground and are set to open within the next two to three years, according to company statements. The Aluminum Association recently proclaimed that the average North American-produced car will contain 550 lbs of aluminum by 2030, a 233% compared to 1990.

Copper

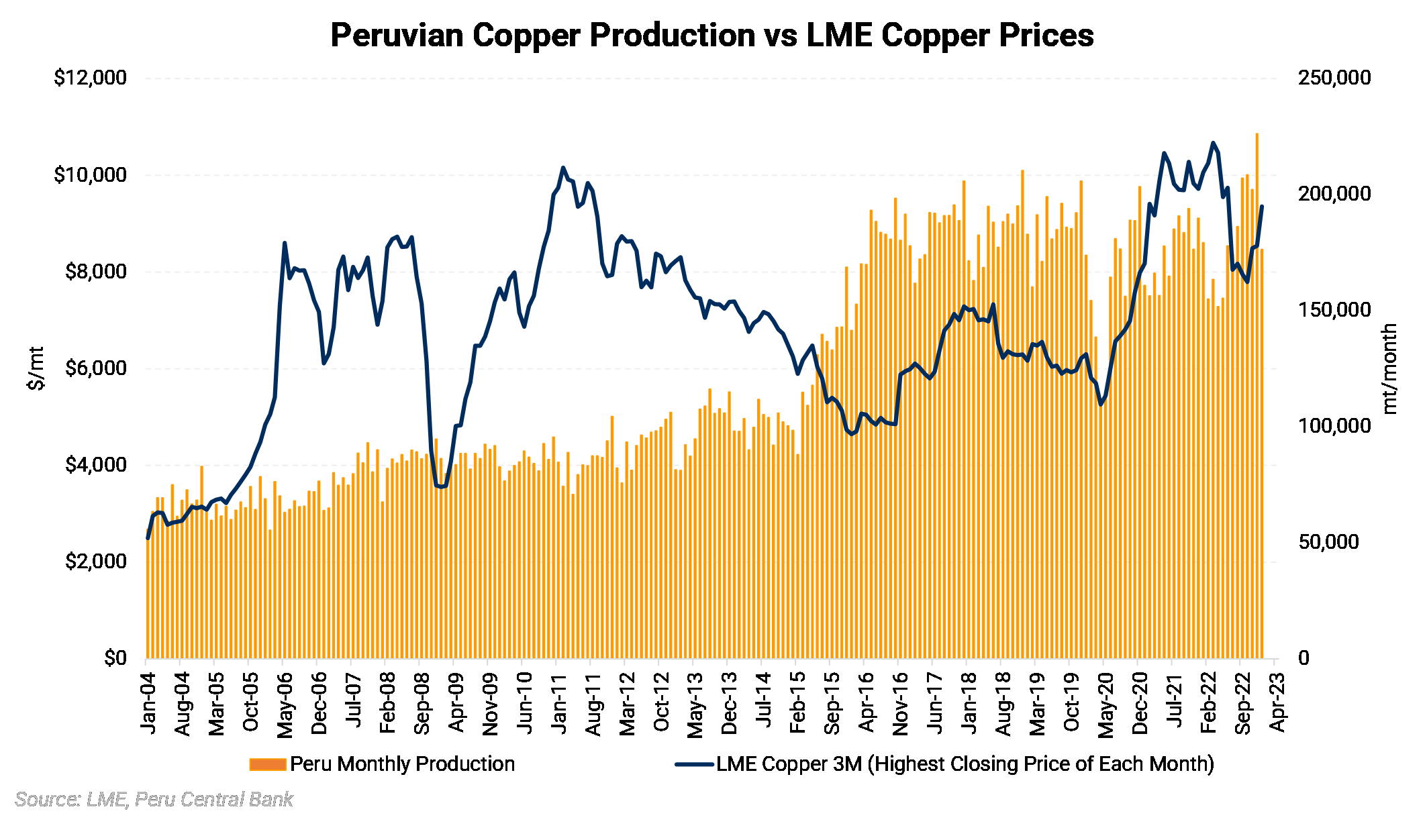

Due to civil unrest and subsequent road blockages late last year and in early 2023, thousands of tons of copper remain in storage at mines throughout Peru, according to Bloomberg. Last month, MMG Ltd stated it had 85,000 mt of copper inventories at the Las Bambas mine that couldn’t be transported to seaports due to the unrest. They also stated that it would take until 4Q2023 to move all the excess inventories. Compared to last year, total Peruvian copper exports were down 20% in January and February. Despite the inability to ship copper, Peru’s copper production jumped 5% in the first two months of 2023, according to Peru’s Ministry of Foreign Trade and Tourism. The transportation issues in Peru have likely contributed to the nearly 6.3% rally in LME copper prices so far this year. If they persist, these issues could remain supportive for LME Copper in the short term.

|

|

Cobalt An oversupply of cobalt hydroxide and poor demand from the EV and consumer electronics sectors could weigh on cobalt demand and prices this quarter, according to S&P Global Commodity Insights. Chinese EV sales have shown signs of improvement this year, but excess inventories could weigh on that market. Q2 demand prospects remain uncertain, thereby weighing on short-term cobalt demand, sources recently told S&P Global. S&P Global analysts believe that cobalt demand and prices won’t recover until 2H2023, when the Chinese economy starts to recover, and EV sales begin to “normalize.” Prompt month CME Cobalt prices have fallen about 55% from the $40/lb. high in May 2022. If short-term demand falls as S&P Global predicts, forward curve pricing may offer hedging opportunities at a discount to historical procurement costs. A hedging strategy that utilizes set price targets should be implemented to take advantage of lower pricing while also guarding against rising prices as market sentiment or actual demand may change. When establishing a hedging program, counterparty negotiations and account setup can take several weeks, consumers should contact AEGIS immediately to get started. |

|

|

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,396.50/mt, up $11/mt on the week. Aluminum prices were up this week. This has caused the forward curve to shift vertically higher by approximately $10/mt. It remains in a steep contango, meaning that nearby prices are lower than forward prices. Aluminum consumers that are concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last settled at 25.2¢/lb this week. The CME Midwest Premium market is backwardated through June 2023 but then largely becomes flat for the August through December ’23 contracts. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please contact AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,794.50/mt, down $229/mt on the week. Compared to last Friday, LME Copper's forward curve has shifted lower by about $220/mt. The forward curve is relatively flat throughout 2023 but becomes backwardated in 2024 and beyond. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon their risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $24,477/mt, up $345/mt on the week. As prices were up this week, nickel’s forward curve has also shifted vertically higher, by about $350/mt. It remains in a steep contango, meaning that spot prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last settled at $1,178/T, up $3/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

04/19/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 03/14/2023: Why Are Steel Prices Increasing? 02/24/2023: European Aluminum Smelters Improve, But Not Enough To Entice More Production |

|||||

Notable News |

|||||

|

4/20/2023: Global aluminium output rises 0.5% y/y to 5.77 mln T in March -IAI 4/19/2023: Factbox: Red-hot copper riding a new wave of consolidation 4/19/2023: Column: China's loss of import appetite damps copper's bull fires 4/18/2023: Hefty shortages to help buoy aluminium prices this year 4/17/2023: Column: Tin spooked by threat of supply disruption in Myanmar 4/16/2023: Column: LME volumes still subdued a year after nickel crisis 4/16/2023: Big copper deals to take centerstage in Santiago as demand heats up 4/15/2023: Glencore digs in for battle as momentum shifts against Teck 4/14/2023: Copper price is rallying but China stimulus could be “phantom tailwind” 4/14/2023: TRADE REVIEW: Lithium prices to be pressured in Q2 by low demand, higher feedstock supply |

|||||