|

Aluminum “Green” aluminum, which is produced using renewable energy, is currently being sold to European car manufacturers at a $10 to $15/mt premium over LME prices, according to Australian aluminum producer South23 Ltd. South23 Ltd also stated that demand for “green” aluminum is accelerating, and some buyers might soon exclude non-green aluminum from physical contracts. (Source: Bloomberg) |

The US Aluminum Association recently stated they are concerned about a potential supply glut of Russian aluminum, without further elaborating. Despite low global demand and self-sanctioning efforts by European aluminum buyers, Russian aluminum is still having an oversized impact on the global market. Chinese buyers have become large importers of Russian aluminum since early 2022, thereby keeping global supplies elevated. Inventories of Russian aluminum in LME warehouses have increased dramatically in early 2023 and have also likely weighed on LME prices. These Russian stocks now represent nearly 53% of LME aluminum warehouse inventories. Most of these stocks are in Southeast Asian warehouses and are blocked from being delivered to US-based LME warehouses, per LME rules. Russian aluminum is also largely barred from the US market due to the Biden administration’s 200% tariff on imports of Russian-origin aluminum products.

The global aluminum market will be in deficit this year, according to analysts from Bank of America and Macquarie. Electricity shortages in China’s top aluminum production regions will cap both production and exports. At the same time, due in part to self-sanctioning efforts, more Russian aluminum will flow into China and greater Asia, thereby constraining European supplies. Power prices across Europe have dropped substantially since last summer, but previously curtailed smelters have been slow to ramp up production. These factors will lead a to supply deficit of 1.53 million mt according to Bank of America, while Macquarie estimates the deficit could reach 670,000 mt this year. Macquarie estimates global consumption will hit 70.8 million mt.

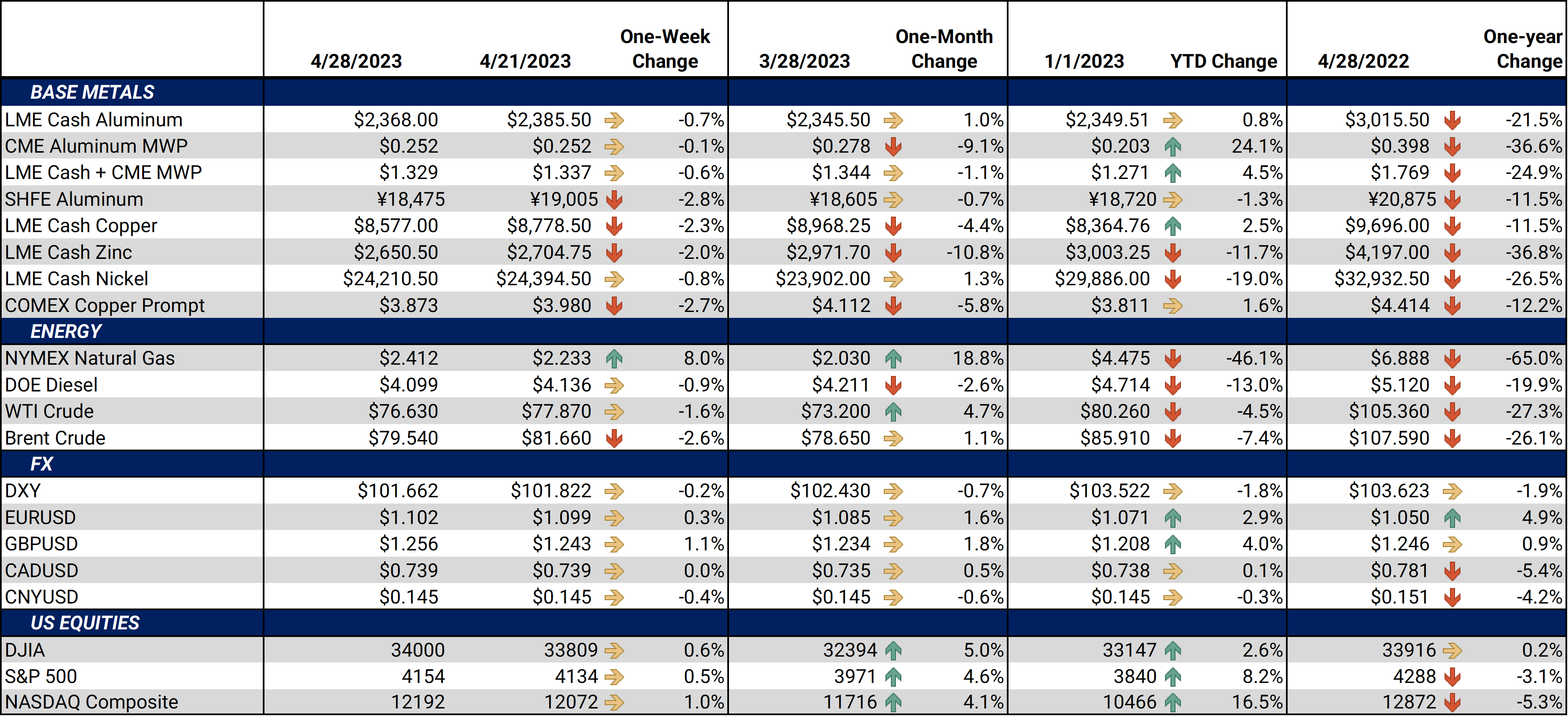

Japanese importers will pay an import premium of between $125-$130/mt for 2Q2023 shipments, at least five sources told Reuters late last week. This is up nearly 53% from the $86/mt premium last quarter. The Japanese premium, which is set on a quarterly basis, has rallied on the back of rising import premiums in Europe. Aluminum supply shortages in Europe have led to a significant jump in European premiums since early January.

|

Copper

Concerns over global growth have weighed copper prices and demand in recent months, according to Bloomberg. Specifically for the US, metals demand has been stunted due to uncertainty over the Federal Reserve’s future interest policy. If credit tightens too much, the US could fall into a recession, according to a recent Bloomberg survey of economists.

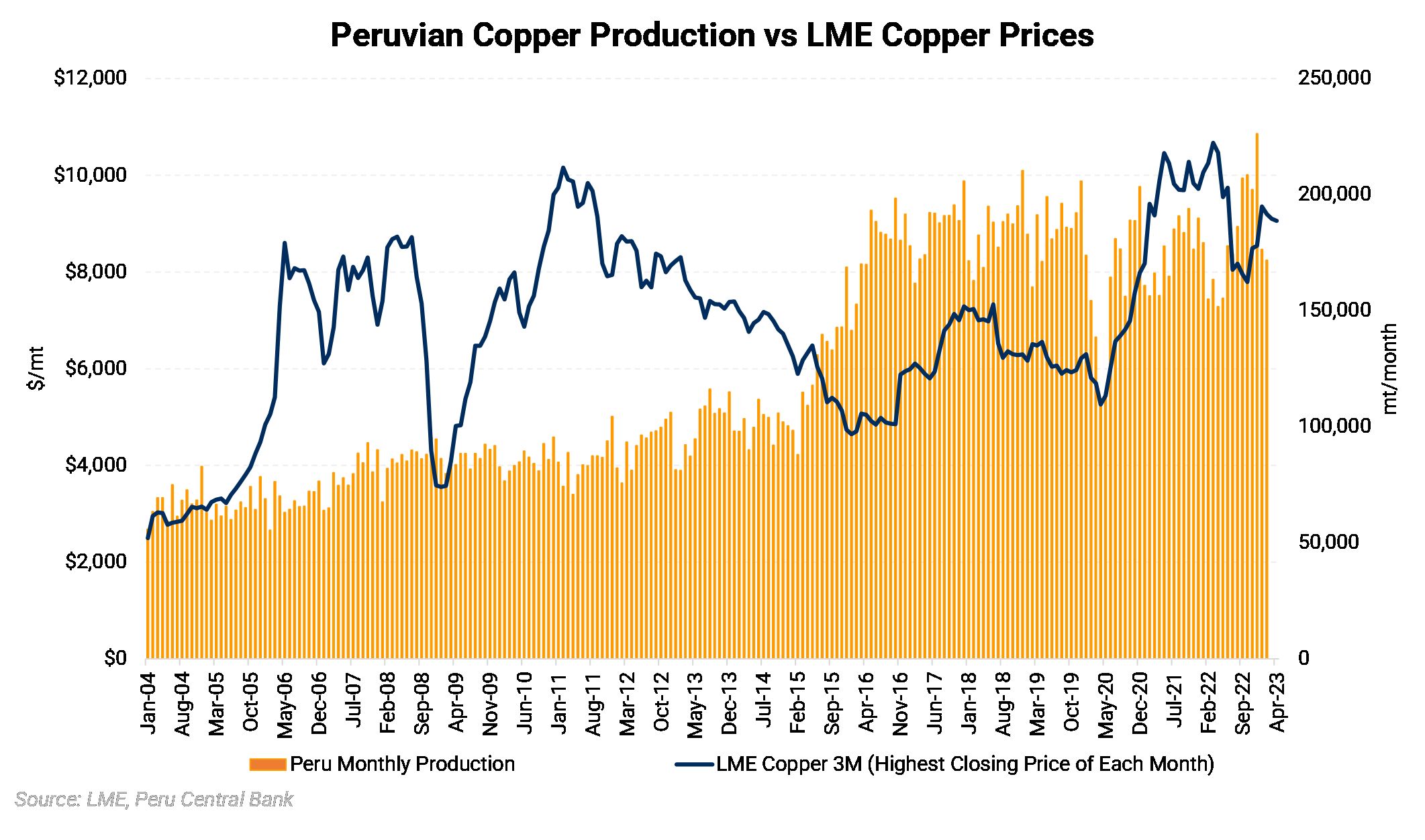

As major copper producers release their Q1 earnings reports, copper output has been mixed so far this year. Freeport McMoran produced 965 million lbs of copper last quarter, down 4.4% compared to 1Q2022. Freeport believes they will sell 4.1 billion mt this year, down slightly from their prior forecast of 4.2 billion mt. They cite production problems in Indonesia and Peru for the lower-than-expected sales.

Meanwhile, Anglo American stated they produced 178,000 mt of copper in 1Q2023, up 27% compared to the same period last year. The company cited a ramp-up in operations at their new Quellaveco mine in Peru for the increase in production. The increased Peruvian production helped to offset the 15% decline in Chilean output due to declining ore grades.

Peruvian copper production could increase dramatically in the coming years. In a recent press release, First Quantum Minerals stated they had signed an agreement with Rio Tinto to develop the La Granja copper project, one of the largest undeveloped copper deposits in the world. This project has approximately 4.32 billion mt of mineral resources and a copper ore grade of 0.51%. Peru is the world’s second-largest copper producer, according to the USGS.

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,356/mt, down $40.50/mt on the week. Aluminum prices were down this week. This has caused the forward curve to shift vertically lower by approximately $40/mt. It remains in a steep contango, meaning that nearby prices are lower than forward prices. Aluminum consumers that are concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last settled at 25.2¢/lb this week. The CME Midwest Premium market is backwardated through July 2023 but then largely becomes flat for the August through December ’23 contracts. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please contact AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,595/mt, down $199/mt on the week. Compared to last Friday, LME Copper's forward curve has shifted lower by about $200/mt. The forward curve is in slight contango through April 2024 but becomes backwardated after that contract. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon their risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $24,219/mt, down $258/mt on the week. As prices were down this week, nickel’s forward curve has also shifted vertically lower, by about $260/mt. It is in a steep contango after the July 2023 contract, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last settled at $1,170/T, down $22/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

04/26/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 03/14/2023: Why Are Steel Prices Increasing? 02/24/2023: European Aluminum Smelters Improve, But Not Enough To Entice More Production |

|||||

Notable News |

|||||

|

4/27/2023: Glencore to pay Norsk Hydro $700 mln for Brazilian assets 4/25/2023: US HRC: Spot market pressured on slow buying 4/25/2023: First Quantum Minerals Reports First Quarter 2023 Results 4/25/2023: Congo state miner and China's CMOC reach agreement on royalties 4/25/2023: Finland's Fortum begins battery material recovery from EV 'black mass' 4/24/2023: Nickel Asia to open two more Philippine mines, eyes power unit IPO 4/23/2023: Column: Aluminium's fortunes tied to Yunnan weather forecast |

|||||