|

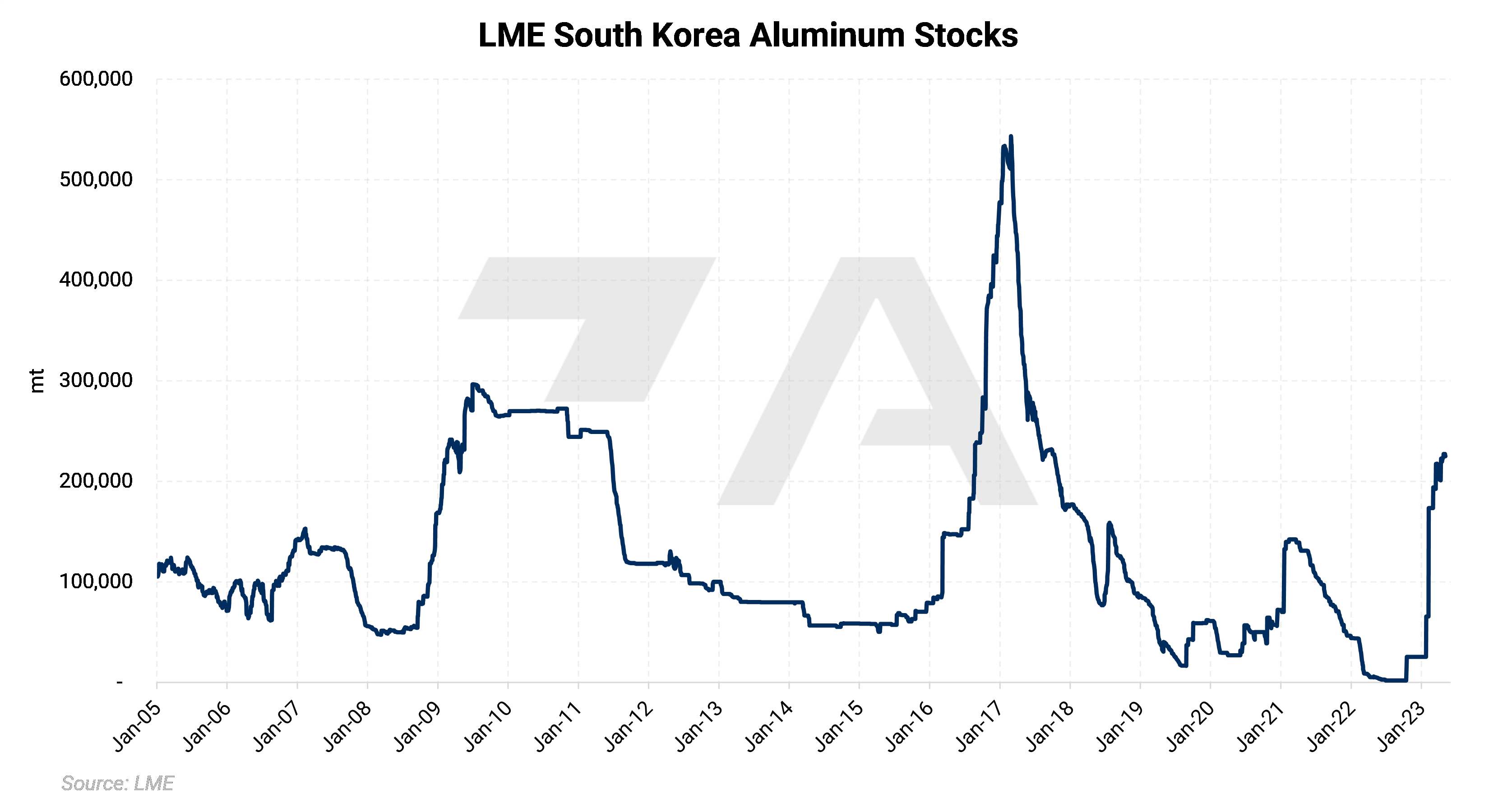

Aluminum At 225,150 mt, aluminum inventories in South Korean LME warehouses are nearly at the highest levels since 2017 and have increased almost 10-fold since January 1. Most of these stocks are of Russian origin. Traders have been offloading these volumes into LME warehouses due to poor global demand and sanctions, thereby weighing on prices. |

|

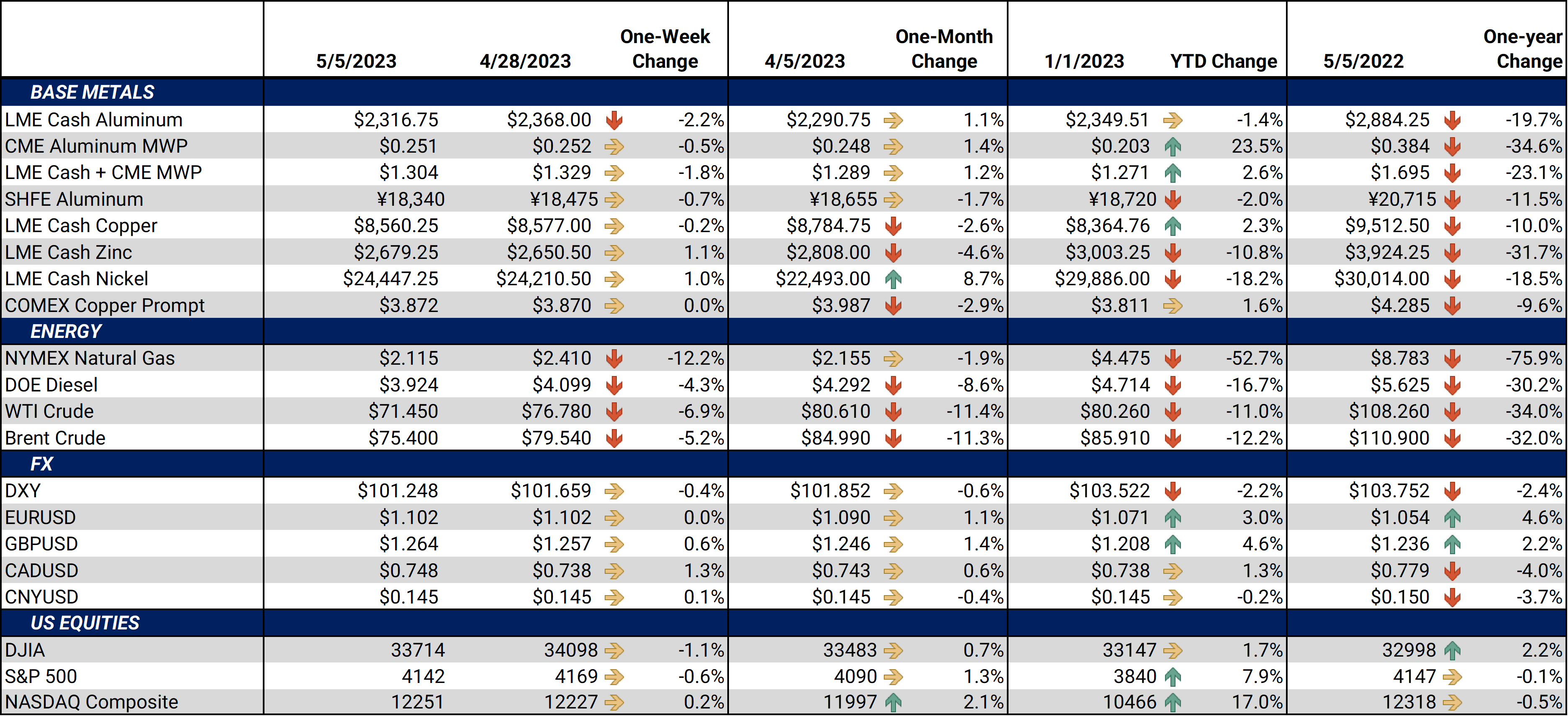

Chinese aluminum demand is mixed, according to Mysteel. Inventories of ingot have dropped in recent weeks, but aluminum extrusion orders have dropped at the same time. Further curtailments in Yunnan province, which is China’s top production region, remain a concern. Falling production costs due to an oversupply of alumina is a bearish factor, however.

Continuing on China, the country’s manufacturing sector activity fell last month. The country’s official manufacturing Purchasing Managers’ Index (PMI) slumped to 49.2 in April, down from 51.9 in March. A reading below 50.0 signals that the sector is contracting. This is the first time China’s manufacturing PMI has fallen into contraction since December. China’s manufacturing sector is a large consumer of aluminum. The automotive sector alone is responsible for approximately 26% of China’s total aluminum demand. (Sources: Reuters, SMM)

|

Continued high energy costs throughout Europe could lead to more aluminum smelter curtailments, according to Norsk Hydro. Nearly 25% of Europe’s annual aluminum production capacity remains offline due to high energy costs. Norsk Hydro’s production was down about 8% last quarter due to curtailments and a worker strike.

As for demand, Norsk Hydro stated that the aluminum market could be in a deficit of 100,000 to 800,000 mt, citing CRU and Wood Mackenzie estimates. These deficits come despite lower demand compared to 2022. CRU believes that European extrusion demand will fall by 7% this year, while North American extrusion demand could fall by 3%, mainly due to weakening construction demand. Automotive demand on both continents is improving, however. (Source: Norsk Hydro)

Copper

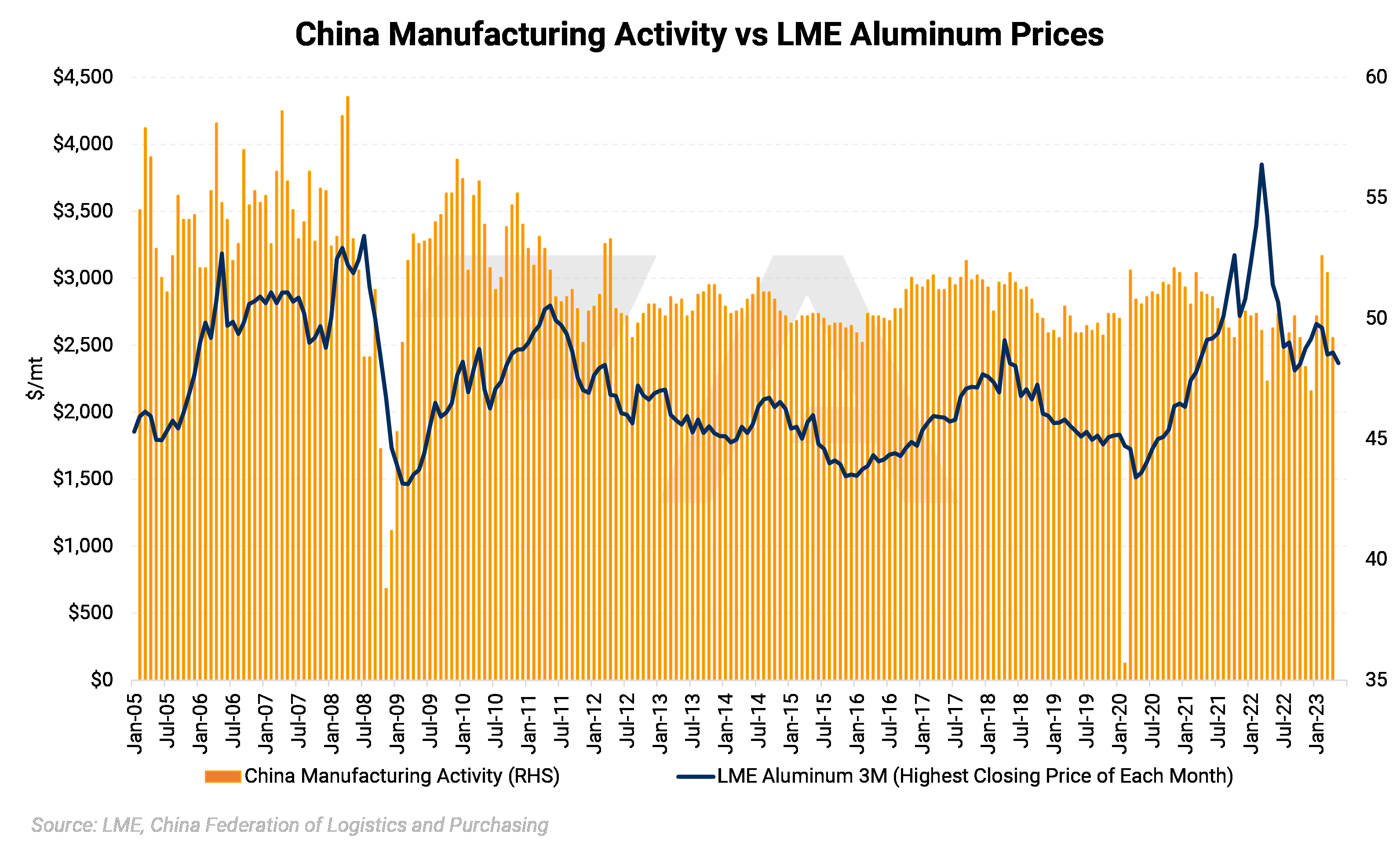

Earlier this week, Codelco, which is the world’s largest copper producer, reported that 1Q2023 production was 326,000 mt, down 10% compared to 1Q2022. This is nearly their lowest in 25 years. The company cited equipment issues, a dam freeze, and a rockslide for the drop in production. Annual production guidance is 1.35 million to 1.42 million mt, according to Bloomberg figures. Despite the Chilean production issues, Macquarie estimates there will be a small 133,000 mt surplus in global refined copper production in 2023.

|

Despite an export ban that begins in June, Indonesia will allow Freeport McMoran and Amman Mineral to continue exporting copper concentrate until May 2024, according to the country’s mining minister. Both Freeport and Amman are building smelters in Indonesia, however, pandemic-related construction delays have pushed back opening dates. Because of these delays, the government will allow Freeport and Amman to continue exports. Indonesia’s export ban on raw copper is part of an effort to stimulate investment and boost the value of the country’s exports. (Source: Bloomberg)

Steel

European steel demand remains subpar. Tata Steel, which is one of Europe’s steelmakers, stated that European sales revenues fell 16% last quarter compared to the same period last year. Production volume was unchanged, while deliveries fell by 11%, the company also stated.

Finally, Middle Eastern steel production will increase in the coming years. Saudi Aramco, along with Baoshan Iron & Steel Co Ltd and Saudi Arabia's Public Investment Fund, will soon build a 1.5 million mt/yr steel plate production facility in Saudi Arabia, the companies announced earlier this week. According to their statements, the facility will be the first of its kind in the country, adding it will “be equipped with a natural gas-based direct reduced iron furnace and an electric arc furnace, which aims to reduce carbon dioxide emissions from the steel-making process by up to 60% compared to a traditional blast furnace.” Production is slated to begin in 2026, with sales directed towards domestic buyers as well as neighboring Middle Eastern countries.

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,318.50/mt, down $37.50/mt on the week. Aluminum prices were down this week. This has caused the forward curve to shift vertically lower by approximately $40/mt. It remains in a steep contango, meaning that nearby prices are lower than forward prices. Aluminum consumers that are concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last settled at 25.0¢/lb this week. The CME Midwest Premium market is backwardated through July 2023 but then largely becomes flat for the August through December ’23 contracts. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please contact AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,581.50/mt, down $14/mt on the week. Compared to last Friday, LME Copper's forward curve has shifted lower by about $15/mt. The forward curve is in slight contango through May 2024 but becomes backwardated after that contract. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon their risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $24,531/mt, up $312/mt on the week. As prices were up this week, nickel’s forward curve has also shifted vertically higher, by about $300/mt. It is in a steep contango, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last settled at $1,105/T, up $36/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

05/3/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 05/3/2023: Copper producers can benefit from hedging both inputs and production |

|||||

Notable News |

|||||

|

5/5/2023: Global copper smelting slides to two-year low in April, satellite data show 5/4/2023: ArcelorMittal beats profit expectations on higher steel demand 5/3/2023: Copper price is set to close at its lowest level since January 5 5/3/2023: Albemarle cuts annual profit forecast on softening lithium prices 5/2/2023: US HRC: Prices fall, buyers hold out 5/2/2023: India's Tata Steel Q4 profit slumps 83% 5/2/2023: Lithium prices bounce after big plunge, but surpluses loom 5/2/2023: Platinum prices surge as speculators bet supply will run short 4/28/2023: Aluminium producer Norsk Hydro's Q1 core profit falls less than expected 4/28/2023: Indonesia to allow Freeport, Amman Mineral to ship copper concentrate until 2024 4/28/2023: Chile's lithium takeover plan faces technical, political challenges 4/27/2023: Aerospace manufacturing curbed by labour, supply chains 4/26/2023: SDI starts year with strong Q1 4/26/2023: A Glance of the China Aluminum Market Week 4, April 2023 |

|||||