|

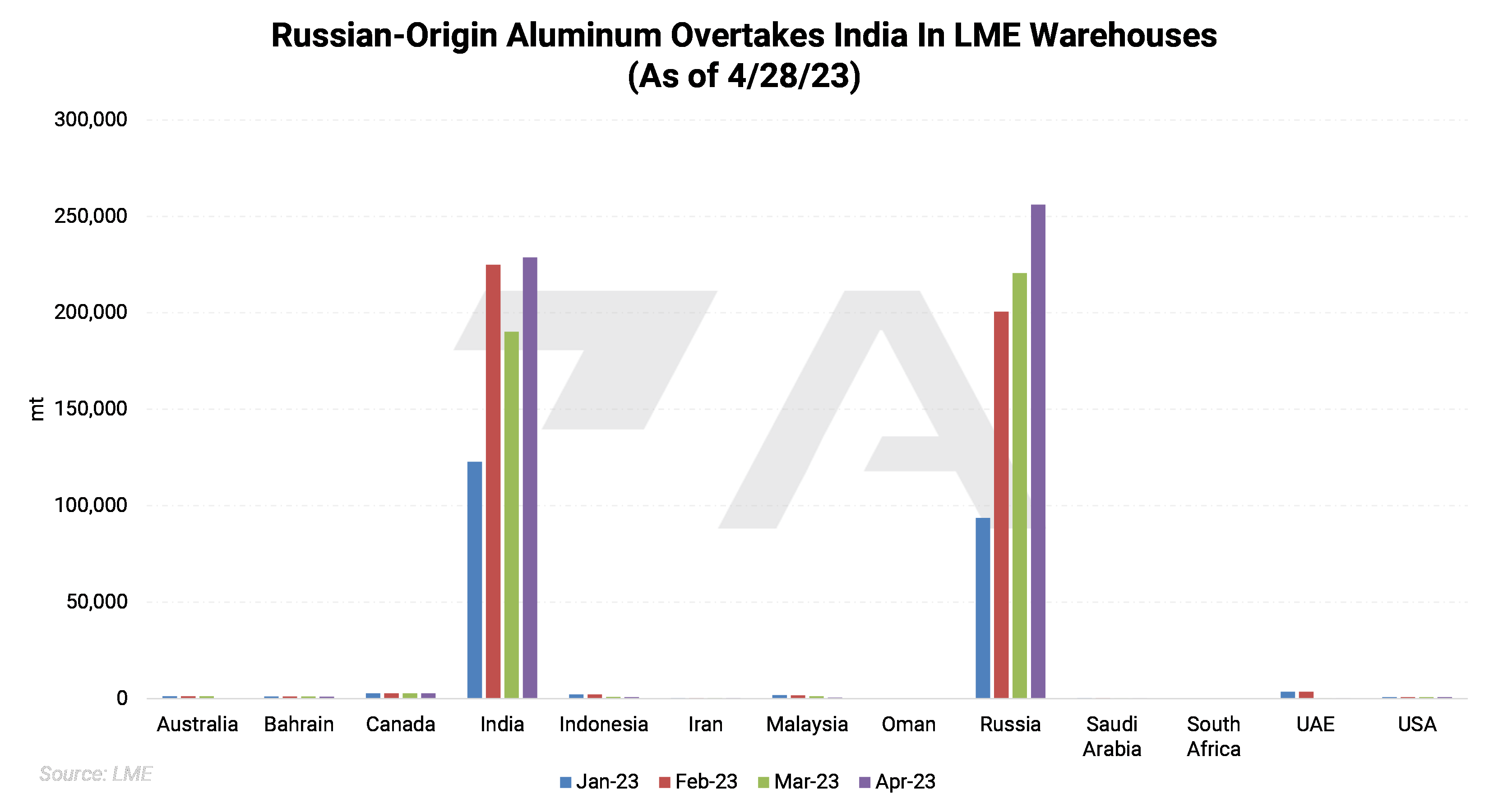

Aluminum Russian-origin aluminum continues to dominate LME warehouses. According to the monthly LME Country of Origin report, out yesterday, Russian aluminum totaled 256,125 mt as of April 28, up from 220,575 mt at the end of March. Indian-origin aluminum also increased last month. At the end of March, Indian volumes were 190,275 mt, but had jumped to 228,800 mt by April 28. Nearly 98.6% of LME warehouse aluminum stocks were of Indian or Russian origin on April 28. |

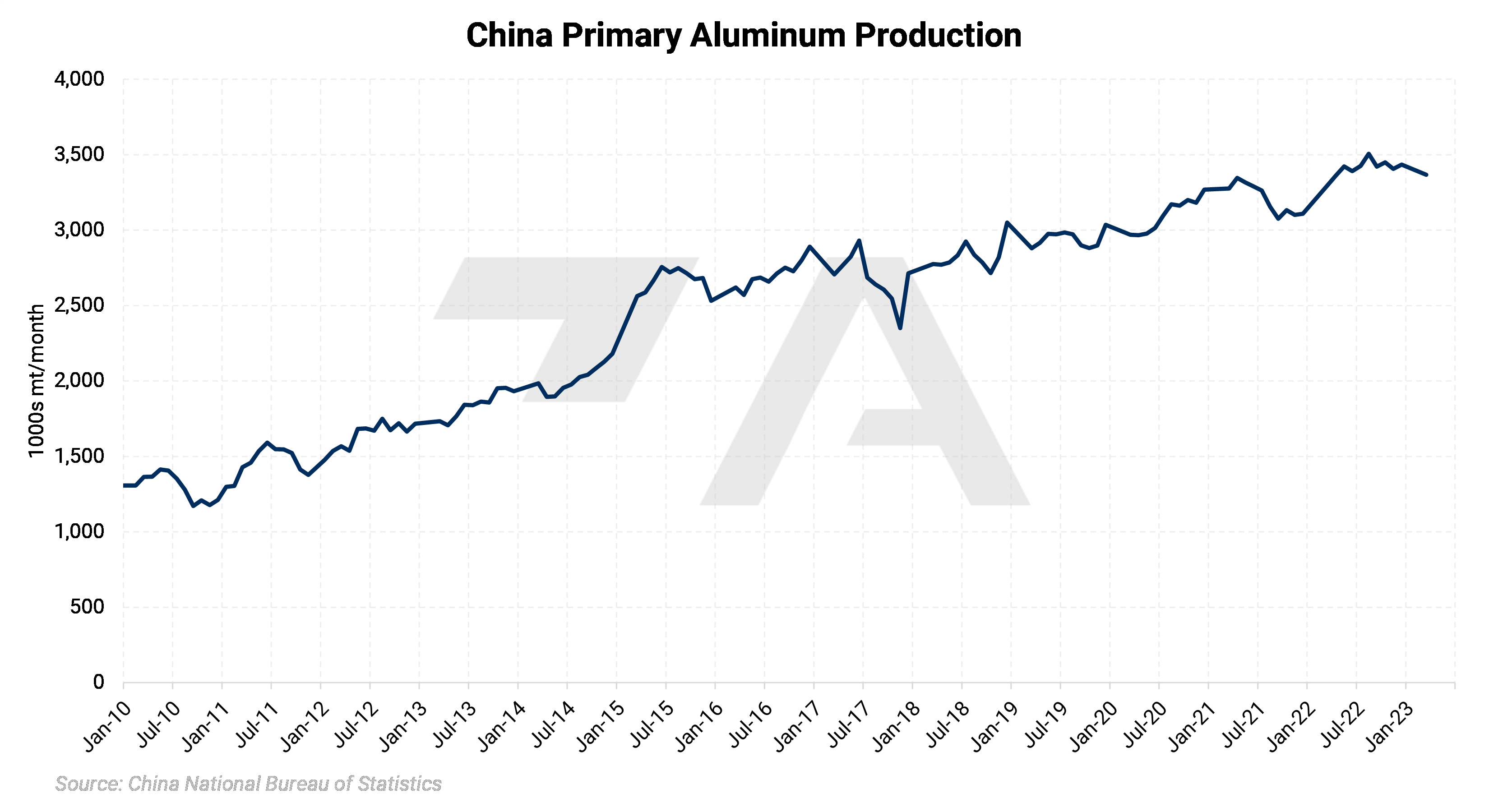

China’s primary aluminum smelters produced 3.348 million mt last month, up 1.5% compared to April 2022, according to Shanghai Metal Market. This was largely due to restarts in the south and improving hydropower supplies. Operational capacity now stands at 40.89 million mt or nearly 91% of the country’s total annual capacity. Production could jump to approximately 3.46 million mt in May, as more idled capacity restarts and new capacity is brought online. (Source: Bloomberg) (Please note that the chart below reflects government data, not SMM data)

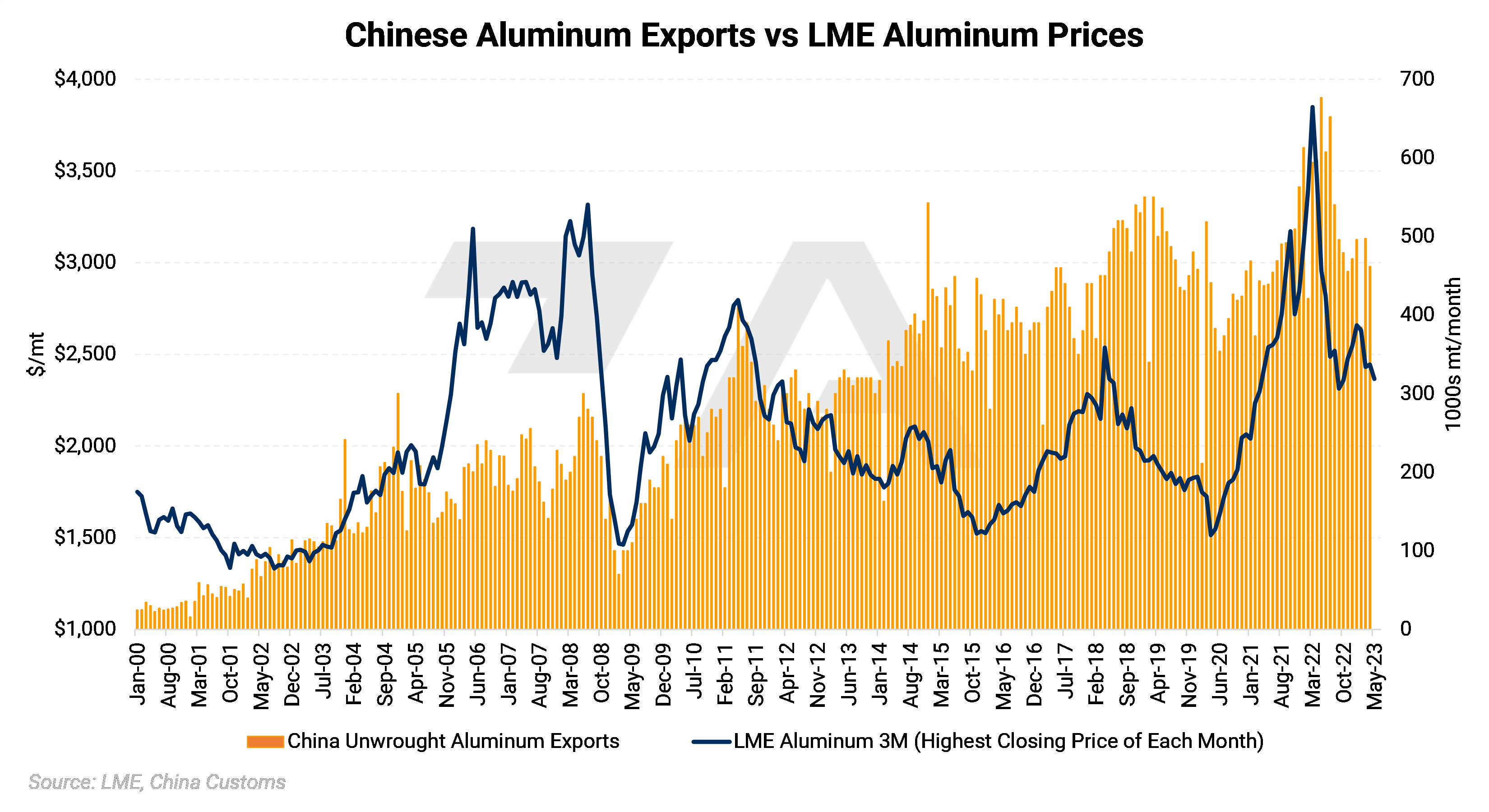

Despite slowing demand and ample domestic production, Chinese aluminum exports have dropped in 2023. Through April, the country exported 1.84 million mt, down from 2.23 million mt during the same period in 2022. According to Shanghai Metal Market, China’s aluminum inventories remain mixed, with ingot inventories at the highest level in three years, but billet has been decreasing.

Due to a recovery in aluminum production in China’s Yunnan Province, the global aluminum supply will be in a surplus of 156,000 mt this year, according to Bloomberg Intelligence. The surpluses will continue over the next two years, with 238,000 mt in 2024 and 156,000 mt in 2025, largely due to new capacity coming online in Canada, India, and Indonesia.

Global demand will grow in the coming years, but will trail behind that of supply growth, Bloomberg Intelligence also believes. This is mainly due to greater usage and demand in the EV sector. As for China, most of its demand growth will come from the transport, construction, and packaging sectors.

Copper

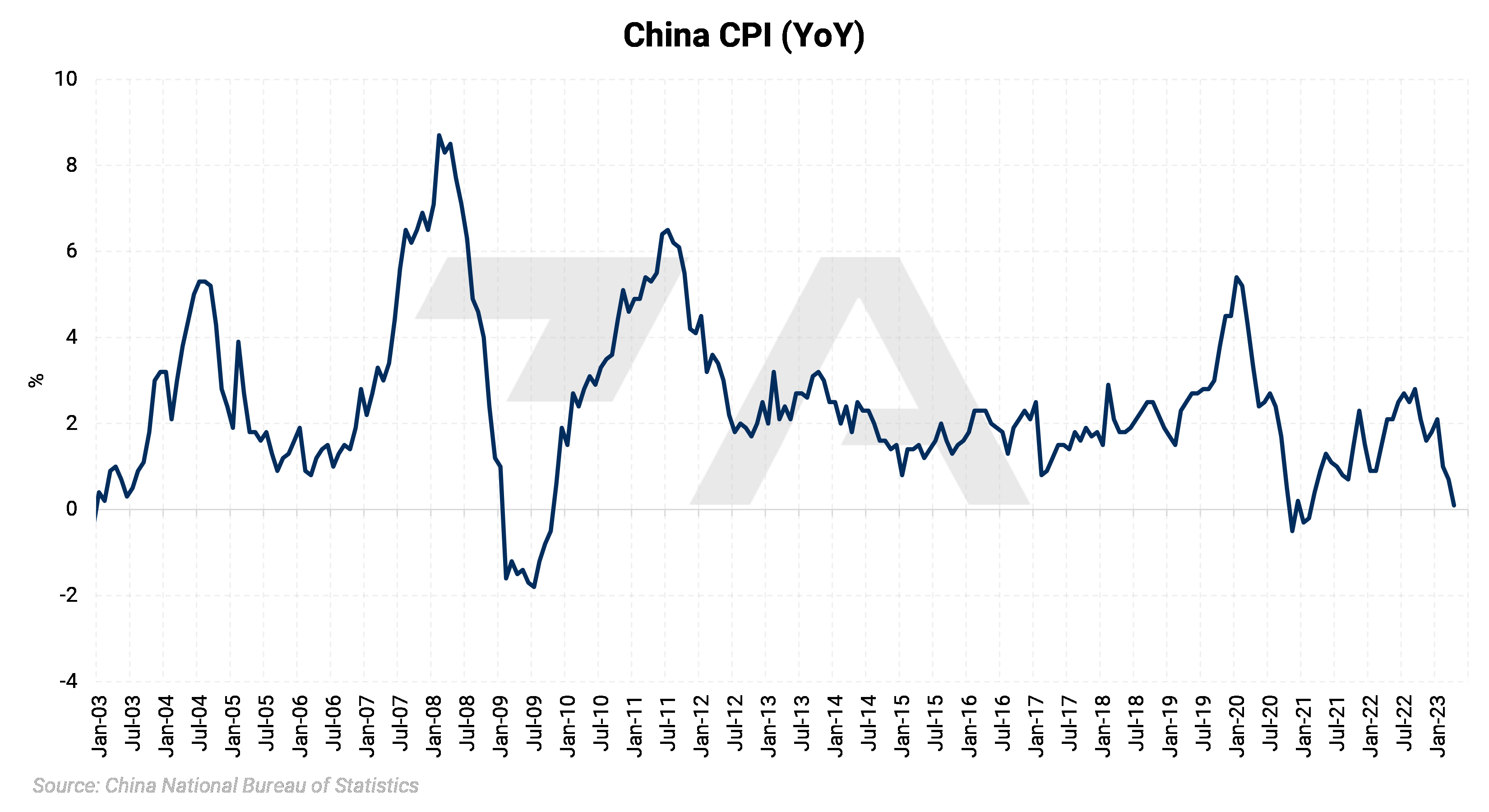

LME copper prices fell by 4.1% this week, due in part to China’s consumer inflation rate falling to near zero last month. This lower-than-expected reading sent copper prices plummeting on Thursday, largely because it shows that China’s economy is not recovering as fast as initially thought. A slowing economy will likely weigh on metals demand.

|

Like aluminum, China’s copper output also jumped in April. Volume last month hit 970,000 mt, up 17% compared to April 2022, mainly due to some plant restarts after maintenance. Production could fall to approximately 953,000 mt this month; however, as other smelters start seasonal maintenance.

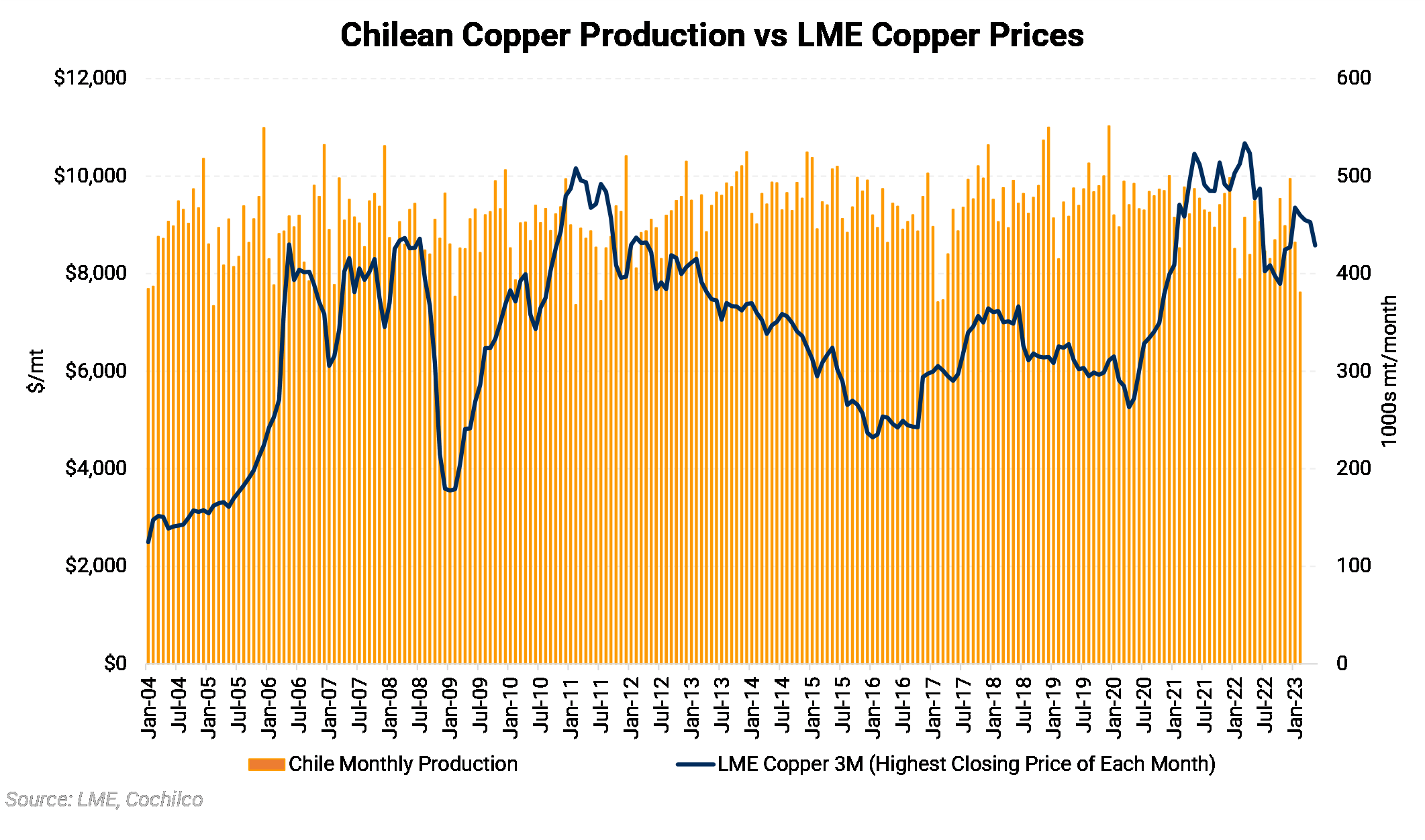

The Chilean government has reached an agreement with Senators regarding the proposed 46.5% royalty for miners that produce over 80,000 mt of copper, according to the Chilean finance ministry. This tax has been a long-debated sticking point for government officials. Chile’s finance minister is trying to fund a myriad of social projects, without disincentivizing investment in copper mining projects. (Source: Bloomberg)

Continuing on Chile, the country will produce 5.8 to 5.9 million mt of copper this year, up from the 5.2 million mt produced in 2022, according to Cochilco, the country’s copper commission. Cochilco cited more mines coming online for the uptick in output. These projections come despite production struggles in early 2023. Chile’s top producer, Codelco, recently had lower production due to a rockslide, dam freeze, and equipment issues. Declining ore grades have also become a concern in recent years. (Sources: Bloomberg, Codelco, USGS)

|

Despite several recent large mergers and acquisitions, the global copper supply and demand balance will remain short over the coming years, according to Shanghai Metal Market. Geologist Doug Kirwin echoed similar comments, stating that “not enough copper deposits [are] being found or developed.” Copper mine supply will grow by 16% by 2040, but demand will grow by 53% during that time, according to BloombergNEF estimates. Global mine production was 22 million mt in 2022, according to the USGS.

Steel

Compared to 2022, China’s year-to-date steel exports have surged by 55% this year. Exports now total 28 million mt through April. This could be due to high global prices, as revenue jumped by 32.8% to $33.89 billion. Subpar domestic demand is leading to a jump in exports, according to Bloomberg. (Source: Bloomberg)

|

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,231.50/mt, down $87/mt on the week. Aluminum prices were down this week. This has caused the forward curve to shift vertically lower by approximately $90/mt. It remains in a steep contango, meaning that nearby prices are lower than forward prices. Aluminum consumers that are concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last settled at 25.0¢/lb this week. The CME Midwest Premium market is now quite flat for the July 2023 through December ’23 contracts. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please contact AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,253/mt, down $328.50/mt on the week. Compared to last Friday, LME Copper's forward curve has shifted lower by about $330/mt. The forward curve is in contango through 2025. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon their risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $22,217/mt, down $2,314/mt on the week. As prices were down this week, nickel’s forward curve has also shifted vertically lower, by about $2,300/mt. It is in a steep contango, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last settled at $1,091/T, down $10/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

05/10/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 05/3/2023: Copper producers can benefit from hedging both inputs and production |

|||||

Notable News |

|||||

|

5/12/2023: India’s automobile sales, output rise in April 5/11/2023: Auto dip adds to European Al demand woes 5/10/2023: Consumer prices in China rose 0.1% in April, the slowest rate in two years 5/9/2023: US HRC: Prices drop on lower sales, offers 5/8/2023: Copper Shortage Is Irreparable Even after Biggest Mergers and Acquisitions, Here’s Why 5/8/2023: India's April finished steel exports hit 13-month high |

|||||