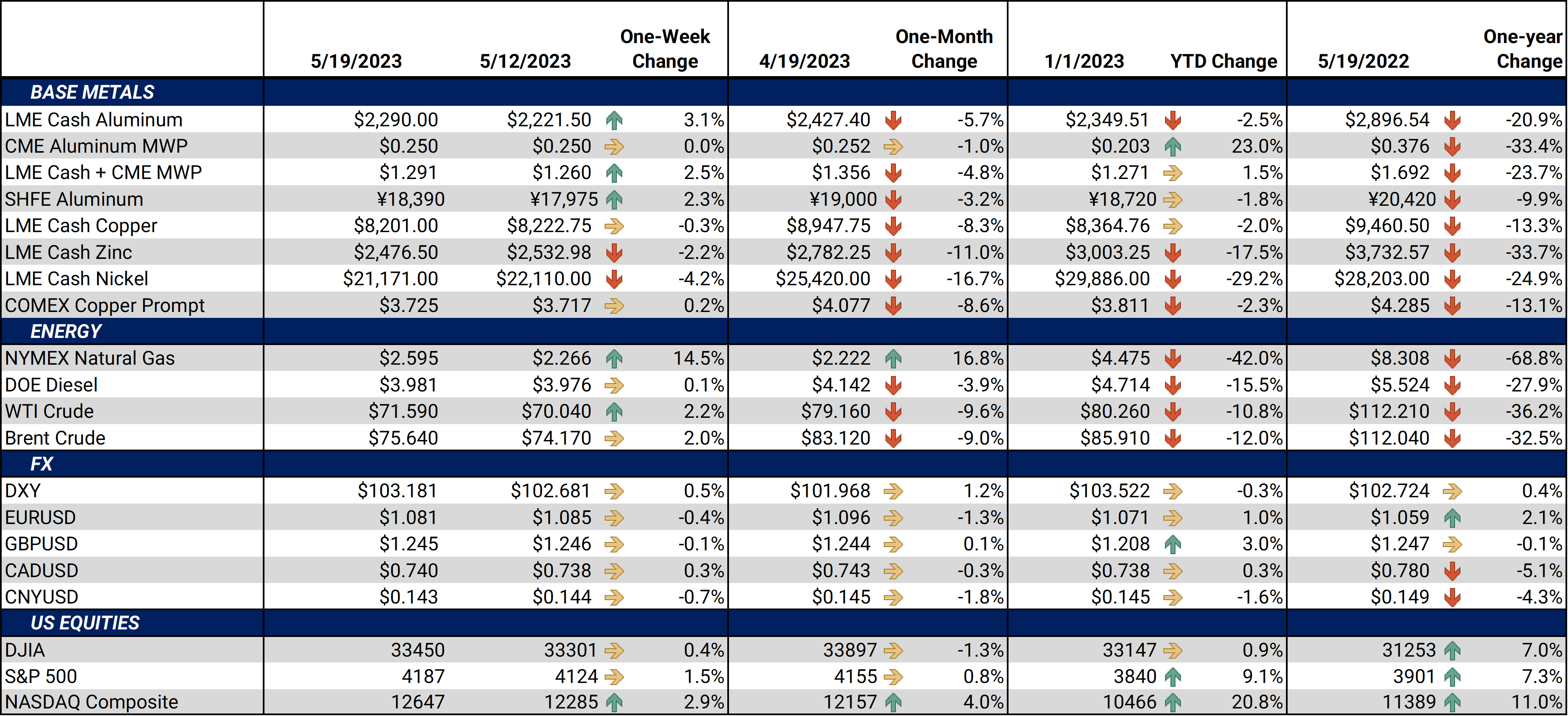

|

Aluminum Market participants at this week’s LME Asia conference were mixed about Chinese aluminum prospects in 2023, as inventories remain high despite faltering production. Chinese production growth will largely depend upon restarts in Yunnan province. If restarts are lower than expected, then imports will need to rise. This would pull Russian metal off the global market and could support LME prices. (Source: Macquarie) |

Metals markets are currently being driven by the “speed and depth of China’s recovery,” Ed Meir, of Commodity Research Group, said in a note this week. Concerns over the US debt market are adding to the bearishness, he also stated. Daniel Ghali of TD Securities echoed similar comments, stating “China’s reopening is a bust for industrial metal demand, with signs the economic engine is sputtering amid slumping manufacturing activity tied to low export demand.” (Source: Bloomberg)

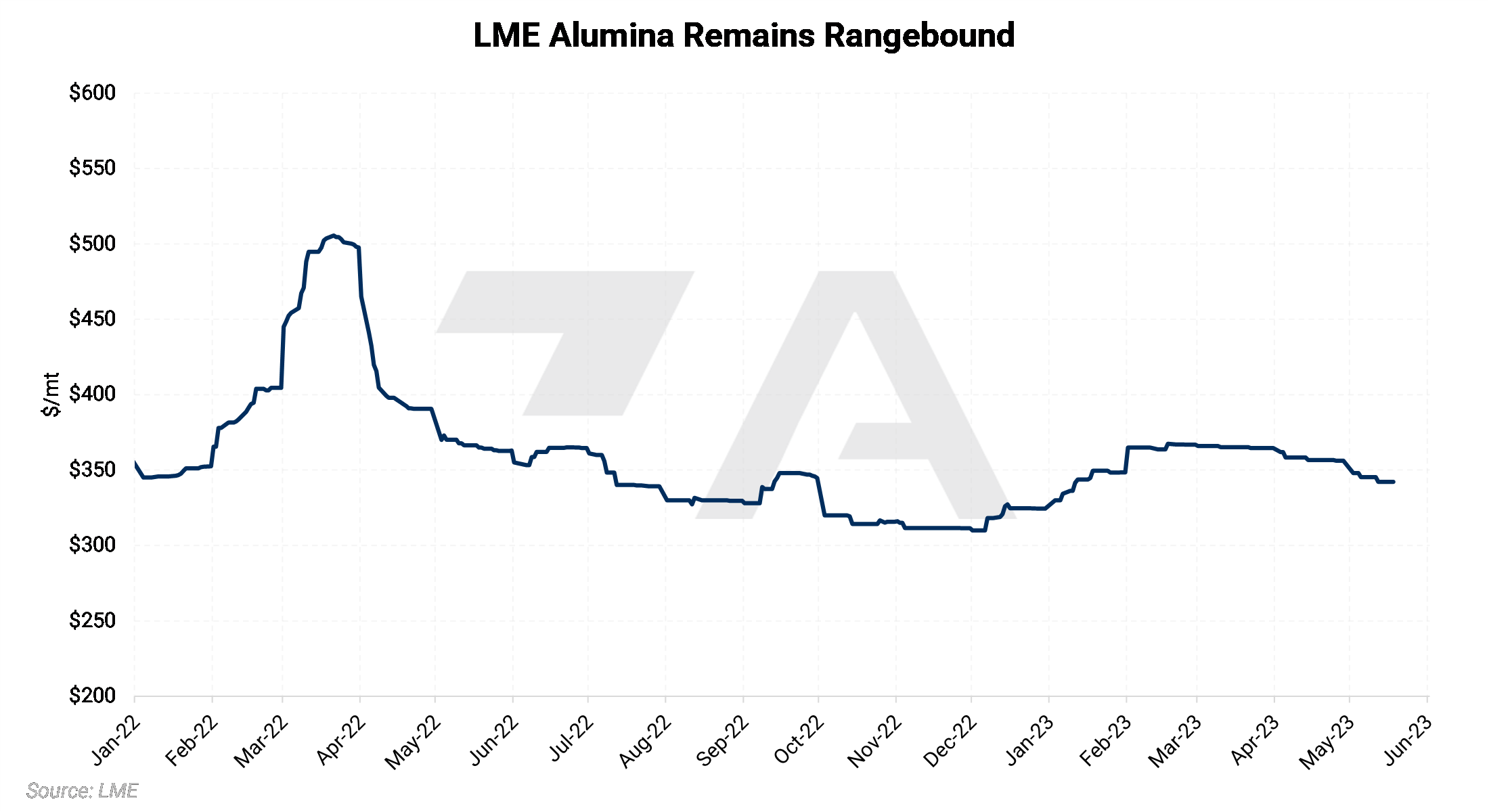

Aluminum production in the Middle East could be ramping up soon. Alcoa just signed a long-term agreement to supply Emirates Global Aluminum with 15.6 million mt of alumina over an 8-year period, starting in 2024. Like aluminum, LME alumina prices have tumbled in recent months due to chronic global oversupply.

|

Copper

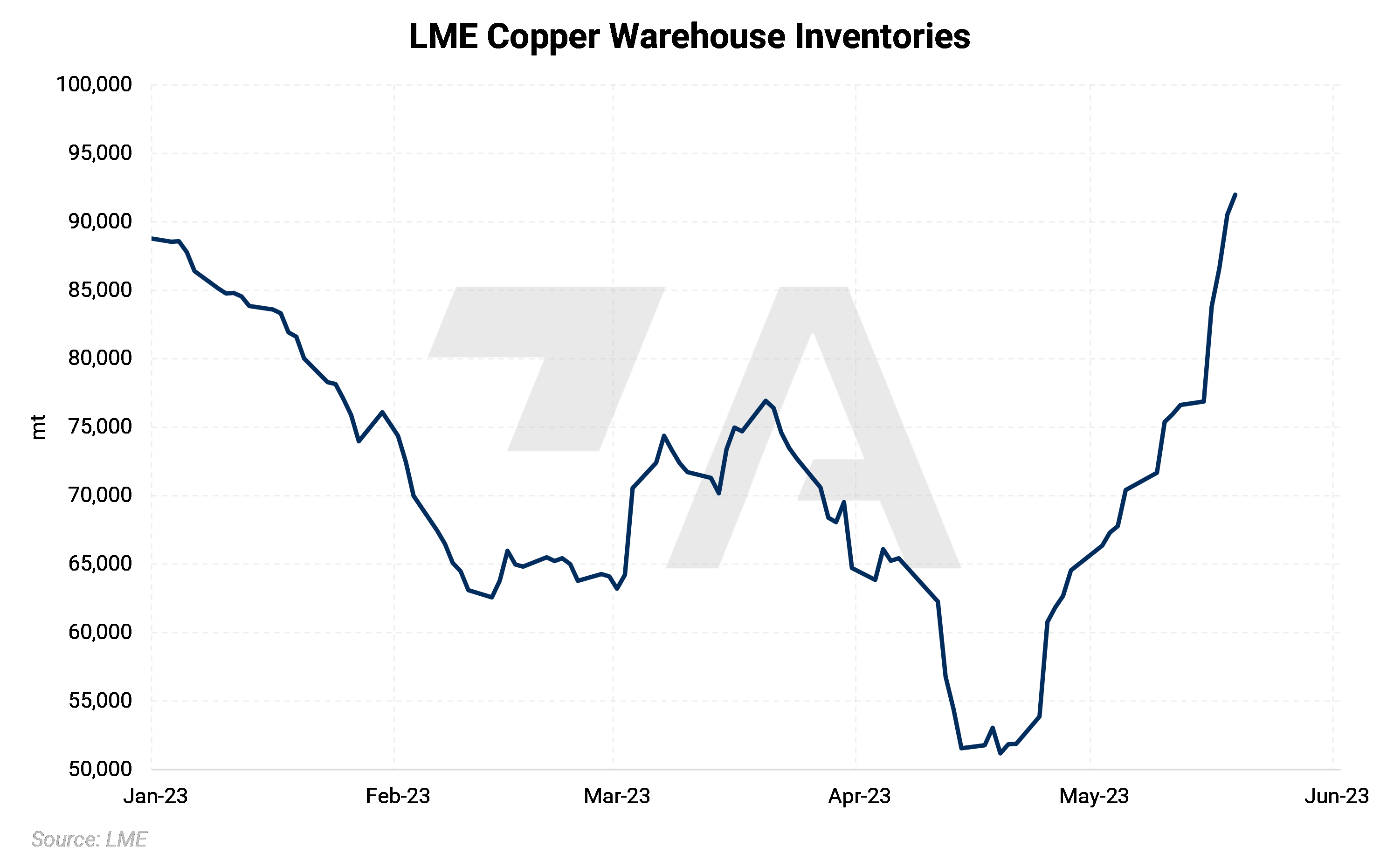

As for copper, LME Asia conference attendees said that the recent bearishness has been driven by China’s poor macroeconomic fundamentals. Low production has kept domestic inventories in check, with no large physical surpluses being built. As Macquarie points out, recent production and inventory figures do suggest they could draw further on the import market soon. (Source: Macquarie)

As of this morning, LME Copper warehouse inventories were 91,975 mt, up 40,800 mt, or nearly 80% from the lows of mid-April. Inventories have increased for 20 straight days. This is likely due to faltering global demand, specifically in China.

|

|||

|

One of China’s largest copper mines has temporarily closed. The Julong Copper and Polymetallic mine in Tibet shut down on Sunday after an accident left six miners missing. A search and rescue mission is currently underway, and the mine will remain closed during the duration. The Julong mine produces approximately 160,000 mt/yr or about 8.4% of China’s total production. (Source: Bloomberg)

|

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,283.50/mt, up $52/mt on the week. Aluminum prices were up this week. This has caused the forward curve to shift vertically higher by approximately $50/mt. It remains in a steep contango, meaning that nearby prices are lower than forward prices. Aluminum consumers that are concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last settled at 25.0¢/lb this week. The CME Midwest Premium market is now quite flat for the July 2023 through December ’23 contracts. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please contact AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,251.5/mt, down $1.50/mt on the week. Compared to last Friday, LME Copper's forward curve is essentially unchanged. The forward curve is in contango. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon their risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $21,278/mt, down $939/mt on the week. As prices were down this week, nickel’s forward curve has also shifted vertically lower, by about $940/mt. It is in a steep contango, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last settled at $1,094/T, down $2/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

05/17/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 05/17/2023: Cobalt End-Users Should Hedge While Market Is Oversupplied 05/3/2023: Copper Producers Can benefit From Hedging Both Inputs and Production |

|||||

Notable News |

|||||

|

5/17/2023: Auto parts, EVs aid S Korean April auto output, exports 5/17/2023: Oil, auto demand drives Japan’s Jan-Mar economy rebound 5/17/2023: European car sales rise in April, ACEA says 5/16/2023: US HDG/CRC: Prices mostly flat, market slow 5/15/2023: Glassmaking decline to weigh on metals demand 5/15/2023: EU automotive industry braces for 2H slowdown 5/15/2023: LME to require warehouses to feel their nickel bags after heist 5/15/2023: Copper prices rise after last week's slump with China liquidity injection 5/15/2023: Platinum facing biggest deficit in years as carmakers snap up metal |

|||||