|

Aluminum BMI, a unit of Fitch Solutions, believes aluminum demand will see limited growth this year. This is largely due to a slower-than-expected recovery in China. Outside of China, the global construction, packaging, and automotive sectors will remain weak due to a “grim global macroeconomic outlook.” Global aluminum demand should start to recover in 2024, they also stated. (Source: Mining Weekly) |

Shanghai Metal Market continues its bearish comments on the global aluminum market. Overseas demand for aluminum semi-finished is “not good.” As for China, demand remains lower than expected, and new orders from downstream end-users and consumers remain “weak.” (Source: Shanghai Metal Market)

Despite the bearish undertone of Chinese demand, the country continues to import large volumes of aluminum, specifically from Russia. Through April, China imported 261,384 mt of Russian aluminum, nearly triple the amount during the same period last year. Last month alone, they brought in 88,859 mt, just shy of the record set in August 2020.

Aluminum continues to flow into Southeast Asian LME warehouses. As of this morning, the volume of on-warrant aluminum, which is available to trade, in South Korea-based LME warehouses stood at 238,000 mt, a jump of nearly 20,000 mt this week alone. This is up from near zero in mid-October 2022. South Korean LME warehouses are a known repository for Russian-origin aluminum.

Copper

A copper market recovery depends largely on the energy transition, according to BNEF. They estimate that refined copper demand for the energy transition will grow at a compound annual growth rate of 10.8% between now and 2025, but non-transition-related demand will decline. Total copper demand will grow from 25.6 million tons last year to 28.2 million tons by 2025, based on their estimates. (Source: Bloomberg)

LME Copper Cash is currently trading at an approximately $29/mt discount to the 3M contract. On Tuesday, the cash to 3M spread closed at a $66/mt contango, the widest contango since at least 1994. This is likely due to subpar spot demand. Prices for both cash and futures have dropped significantly since early March due to chronic global oversupply. (Source: Bloomberg)

Chinese end-user copper demand has recently shrunk, according to Shanghai Metal Market. Production of copper rods, which are used in wiring, fell by 3.5% month-over-month in April due to low orders. Due in part to lower-than-expected Chinese demand, copper prices have dropped significantly since early March, making new lows on the year. (Source: Shanghai Metal Market)

Steel

Argus’s weekly domestic HRC steel assessment fell by $76.75/st to $1,023.5/st this week, the largest weekly dollar decline since June 2022. Most of the physical deals that are being made are for smaller than usual volumes, with some mills willing to offer discounts on smaller tonnages, Argus also stated.

The CME HRC to CME Busheling Scrap spread, which is a key gauge of steel mill profitability, currently sits near $650/st, having dropped nearly $60/st since the highs of late April. If the futures forward curve is an indication of future profitability, then tough times could be ahead for American steel mills. Based on the futures forward curve, steel mill profitability through June 2024 hovers near $400/st, or nearly 40% lower than the current level.

|

|

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

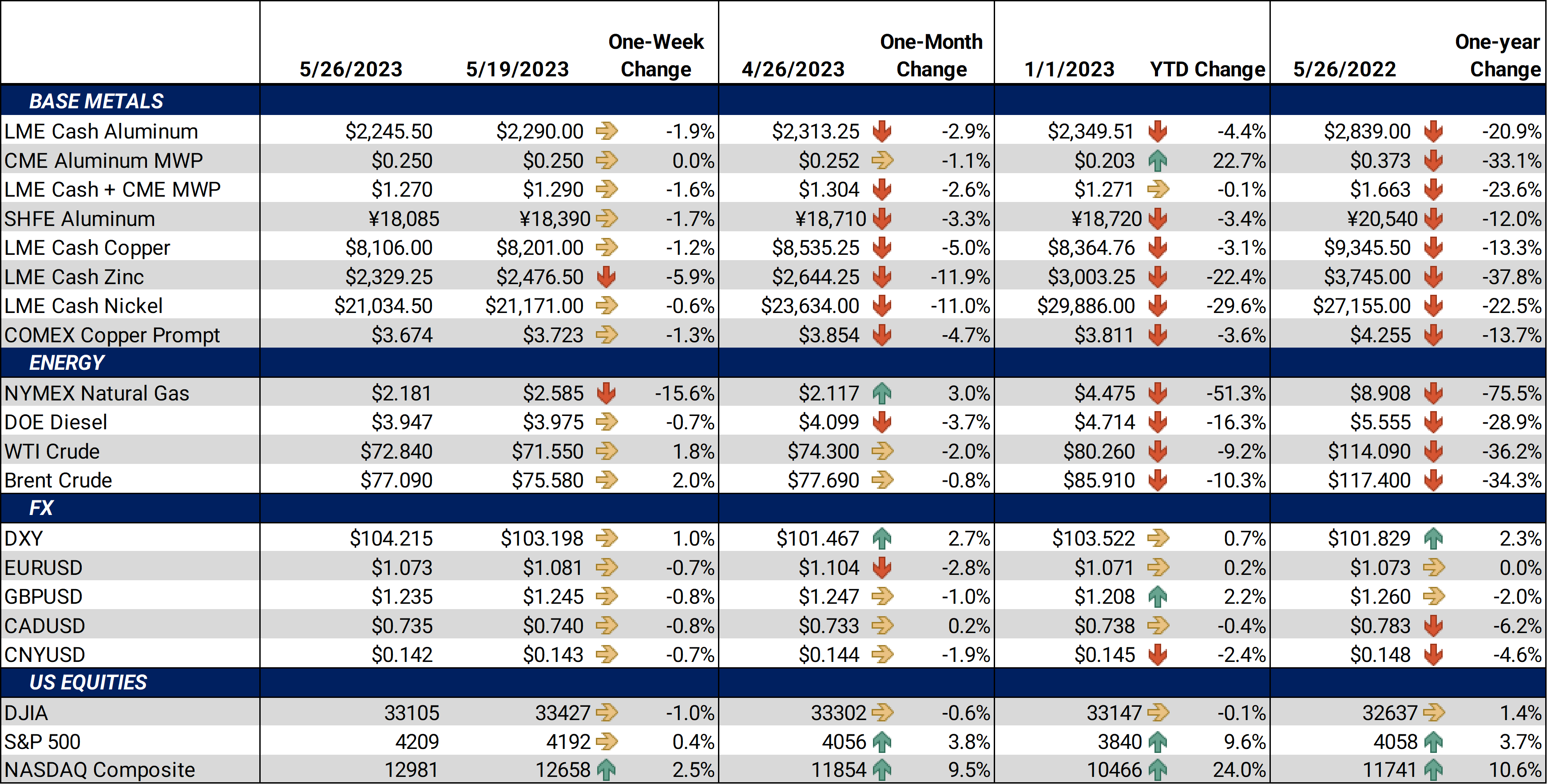

LME Aluminum 3M closed at $2,237.5/mt, down $46/mt on the week. Aluminum prices were down this week. This has caused the forward curve to shift vertically lower by approximately $40/mt. It remains in a steep contango, meaning that nearby prices are lower than forward prices. Aluminum consumers that are concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last settled at 24.95¢/lb this week. The CME Midwest Premium market is backwardated through July 2023 but then largely becomes flat for the August through December ’23 contracts. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please contact AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M closed at $8,135/mt, down $116.5/mt on the week. Compared to last Friday, LME Copper's forward curve has shifted lower by about $116.5/mt. The forward curve is in contango. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon their risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M closed at $21,162/mt, down $116/mt on the week. As prices were down this week, nickel’s forward curve has also shifted vertically lower, by about $260/mt. It is in a steep contango after the July 2023 contract, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded at $1,099/T, up $5/T on the week. For CME HRC Steel, liquidity is lower than other metals for swaps, but hedging can still be done with limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

05/24/2023: AEGIS Factor Matrices: Most important variables affecting metals prices |

|||||

Notable News |

|||||

|

5/23/2023: Some EU steel mills mull output cuts |

|||||