|

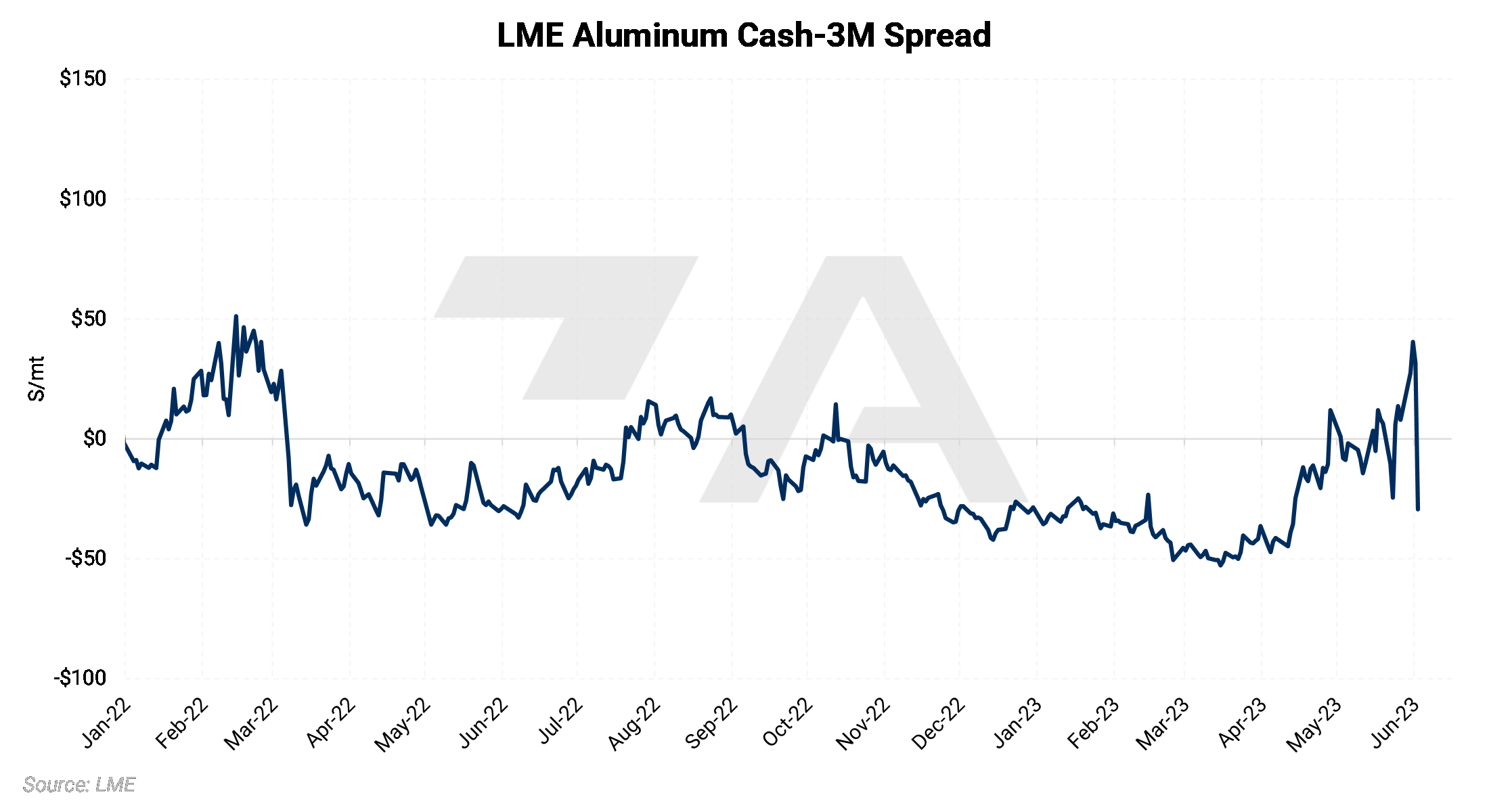

Aluminum The spread between LME Aluminum Cash and the 3M contract has been extremely volatile this week. At Friday’s close, LME Aluminum Cash was at an approximately $29/mt discount to the 3M contract. On Wednesday, LME Aluminum Cash closed at over a $40/mt premium over the 3M contract, the largest backwardation since February 2022. This initial backwardation was likely due to tight supply in the spot market. According to LME data, one firm holds between 50% to 79% of inventories and spot contracts as of May 26. (Source: Bloomberg) |

|

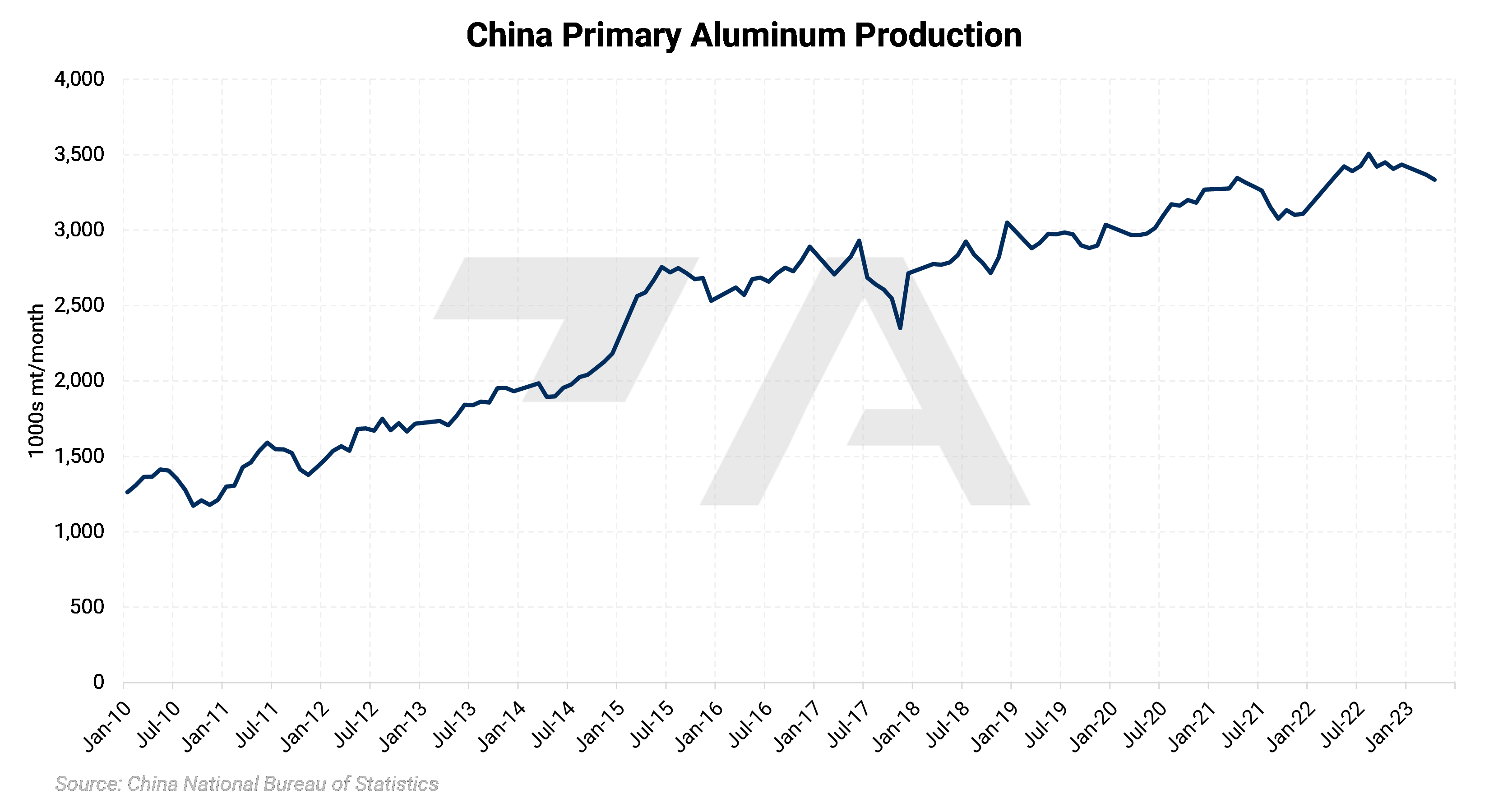

China’s recent primary aluminum production and related hydropower issues remain a mixed signal for the market. A small amount of aluminum capacity in Guizhou province restarted last week, but several large producers in the top-producing Yunnan province remain shuttered. Aluminum smelters in both provinces are heavily reliant upon hydropower, however, a recent drought has led to power rationing in both regions. (Source: Shanghai Metal Market)

Tsingshan Holding Group, which is one of China’s top metals producers, has started operations at its 250,000 mt/yr Huaqing, Indonesia aluminum smelter. According to Shanghai Metal Market, production at this smelter could reach 2 million mt/yr as it expands. Tsingshan’s expansion into Indonesia is largely due to China’s government-mandated 45 million mt aluminum production capacity cap. (Sources: Bloomberg, Shanghai Metal Metals)

Press Metal Aluminium, a Malaysia-based aluminum extruder, had poor 1Q results due to the recent slump in global aluminum prices. Aluminum demand could fall in the near term as increasing interest rates could weigh on regional real-estate sectors throughout the world, Hong Leong IB analyst Jeremie Yap recently suggested. Because of this, spot aluminum prices could remain subdued, he also stated. (Source: Wall Street Journal)

Copper

LME copper finished May down 5.6% for the month, its worst monthly performance since June 2022. This is largely due to a slower-than-expected economic recovery in China. Earlier this week, government data showed that their manufacturing sector contracted for the second month in a row. (Source: Bloomberg)

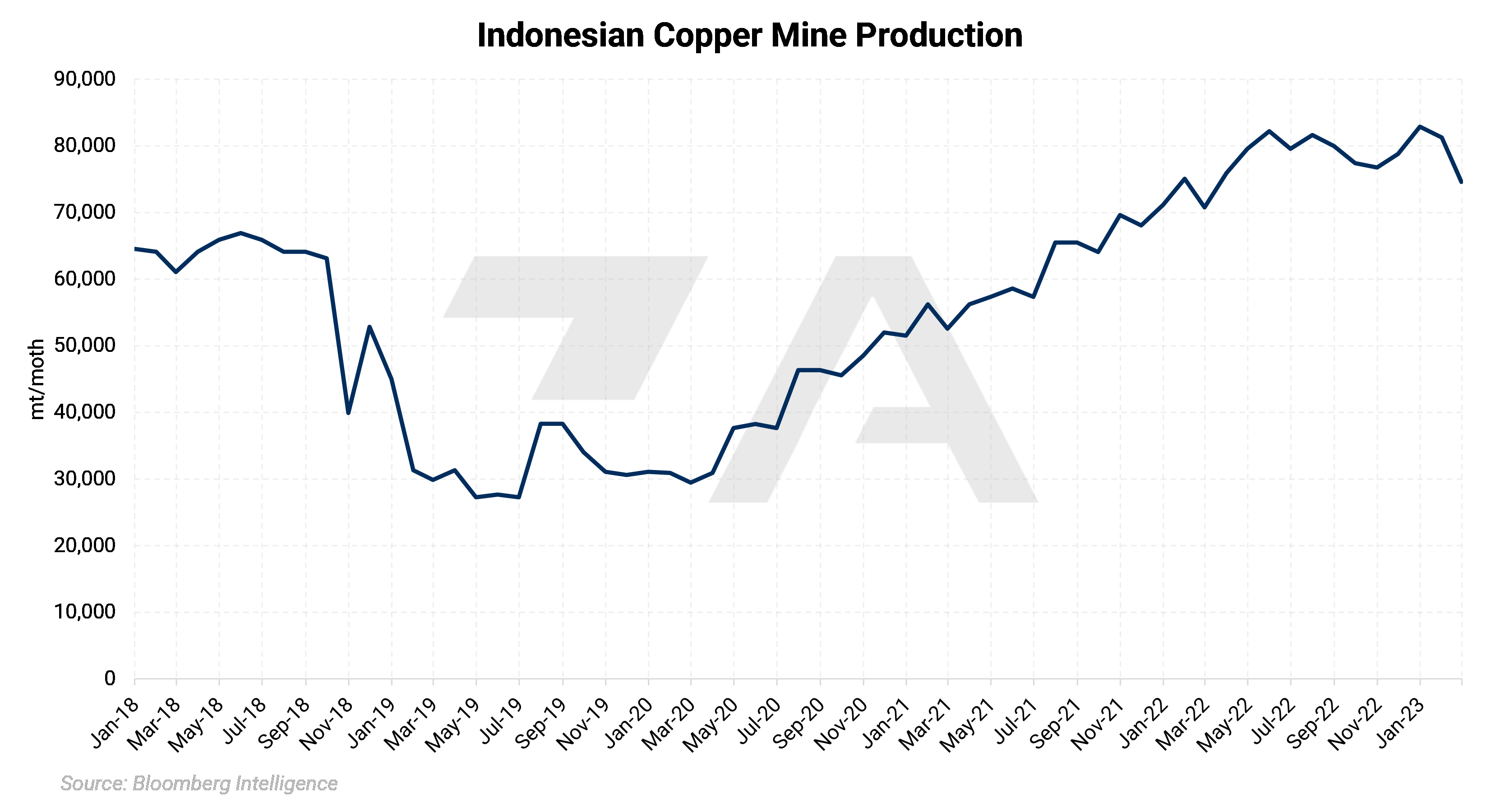

Indonesian copper production could hinge on a deal between the government and Freeport McMoran. The Indonesian government is aiming to increase its interest in the country’s largest copper mine (Grasberg) to 61% from 51%. They also want Freeport to build a smelter, and delays in constructing the smelter could lead to fines and sanctions. At approximately 400,000 mt, the Grasberg mine is responsible for about 2% of global production. It also holds the world’s second-largest volume of copper reserves. (Sources: Bloomberg, Visual Capitalist)

|

||||

|

Glencore will soon invest $1.5 billion in expanding the Antapaccay copper mine in Peru. This is up from the $590 million investment the company previously announced. Antapaccay, which is one of Peru's largest copper mines, currently produces about 150,000 mt/year, down from 221,000 mt in 2016. This recent drop in output makes the expansion project important, Glencore stated. They also stated that the expansion will also lengthen the mine’s lifespan from approximately 2045 to 2050. (Source: Shanghai Metal Metal)

|

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,263.50/mt, up $26/mt on the week. Aluminum prices were up this week. This has caused the forward curve to shift vertically higher by approximately $25/mt. It remains in a steep contango, meaning that nearby prices are lower than forward prices. Aluminum consumers that are concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last settled at 24.3¢/lb this week. The CME Midwest Premium market is now quite flat for the August '23 through December ’23 contracts. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please contact AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,237/mt, up $102/mt on the week. Compared to last Friday, LME Copper's forward curve has risen vertically by approximately $100/mt and remains in contango. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon their risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $21,211/mt, up $49/mt on the week. As prices were up this week, nickel’s forward curve has also shifted vertically higher, by about $50/mt. It is in a steep contango, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last settled at $942/T, up $7/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

05/31/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 05/17/2023: Cobalt End-Users Should Hedge While Market Is Oversupplied 05/3/2023: Copper Producers Can benefit From Hedging Both Inputs and Production |

|||||

Notable News |

|||||

|

6/2/2023: India's April finished steel imports from China hit five-year high 6/1/2023: Column: London Metal Exchange renews stocks transparency drive 6/1/2023: Peru sees copper projects on track, to stay ahead of Congo on output 6/1/2023: EU hot metal output declining: Tathya 5/31/2023: Argentina to surpass Chile as Li supplier: Cochilco 5/30/2023: US HRC: Prices drop below $1,000/st 5/30/2023: US HDG/CRC: Prices remain pressured 5/30/2023: BHP taps Microsoft, AI, to improve recovery at top copper mine 5/29/2023: Toyota's April global sales rise on stronger demand in Japan, China 5/28/2023: China industrial profits tumble 18% in April as demand sputters |

|||||