|

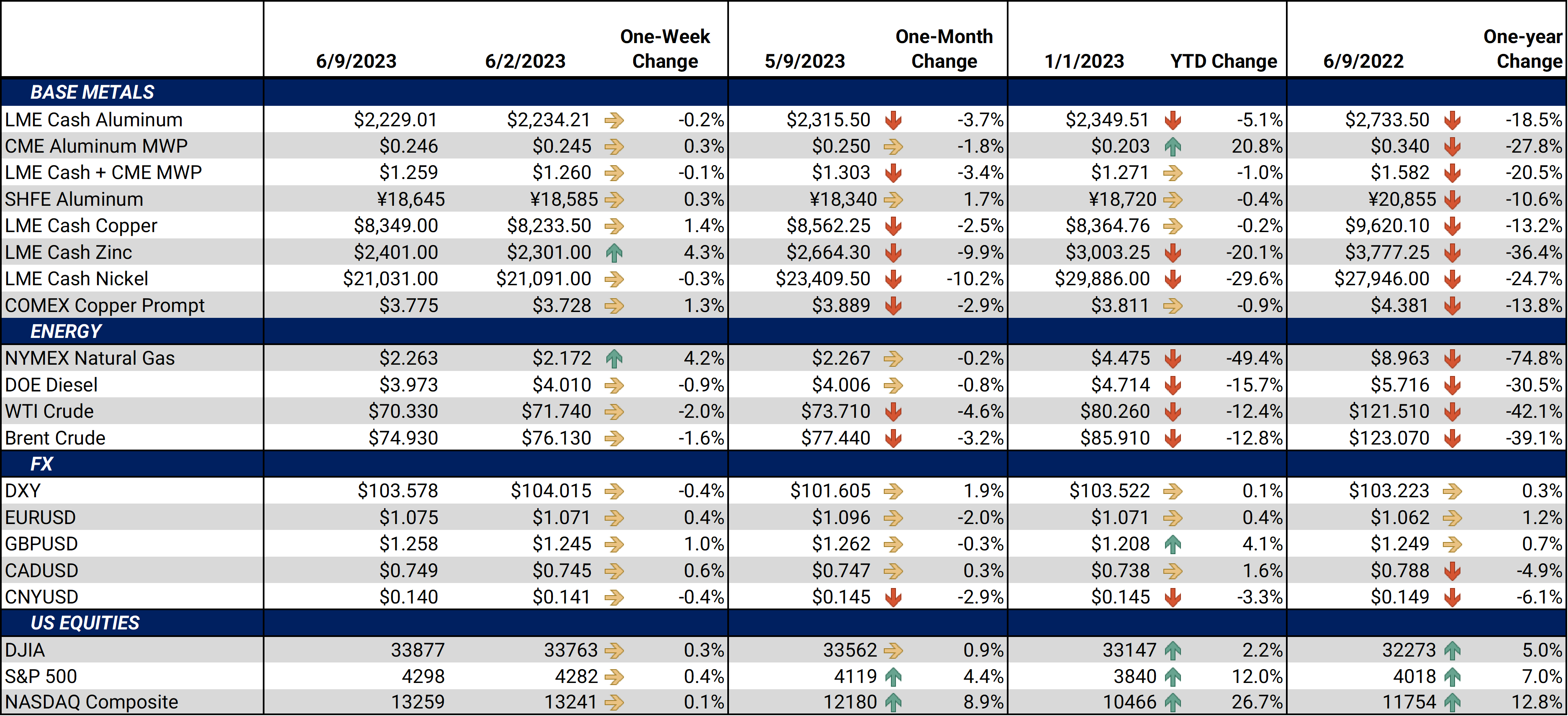

Aluminum The current Section 232 tariffs on aluminum imports into the US will likely remain in place, according to comments at a recent aluminum industry conference. This is likely a non-issue, however, as approximately 80% of US aluminum imports come from Section 232-exempt countries. |

As for Russia, aluminum industry participants feel that Russian aluminum will likely remain unsanctioned by the US. The Biden administration’s current 200% tariff on imports of Russian aluminum is effectively a sanction, as it makes those purchases uneconomical. This tariff has not meaningfully impacted global aluminum flows, as even before the Russia-Ukraine conflict, the US imported little from Russia. Any flows that could have landed in the US have already found new buyers (namely China).

Contrary to the US, however, EU sanctions against Russian aluminum are still possible, according to the European Aluminum Association. Approximately 10% of the region’s aluminum imports come from Russia, the association also stated. These comments were also made at the Harbor Aluminum Summit in Chicago earlier this week. (Source: Bloomberg)

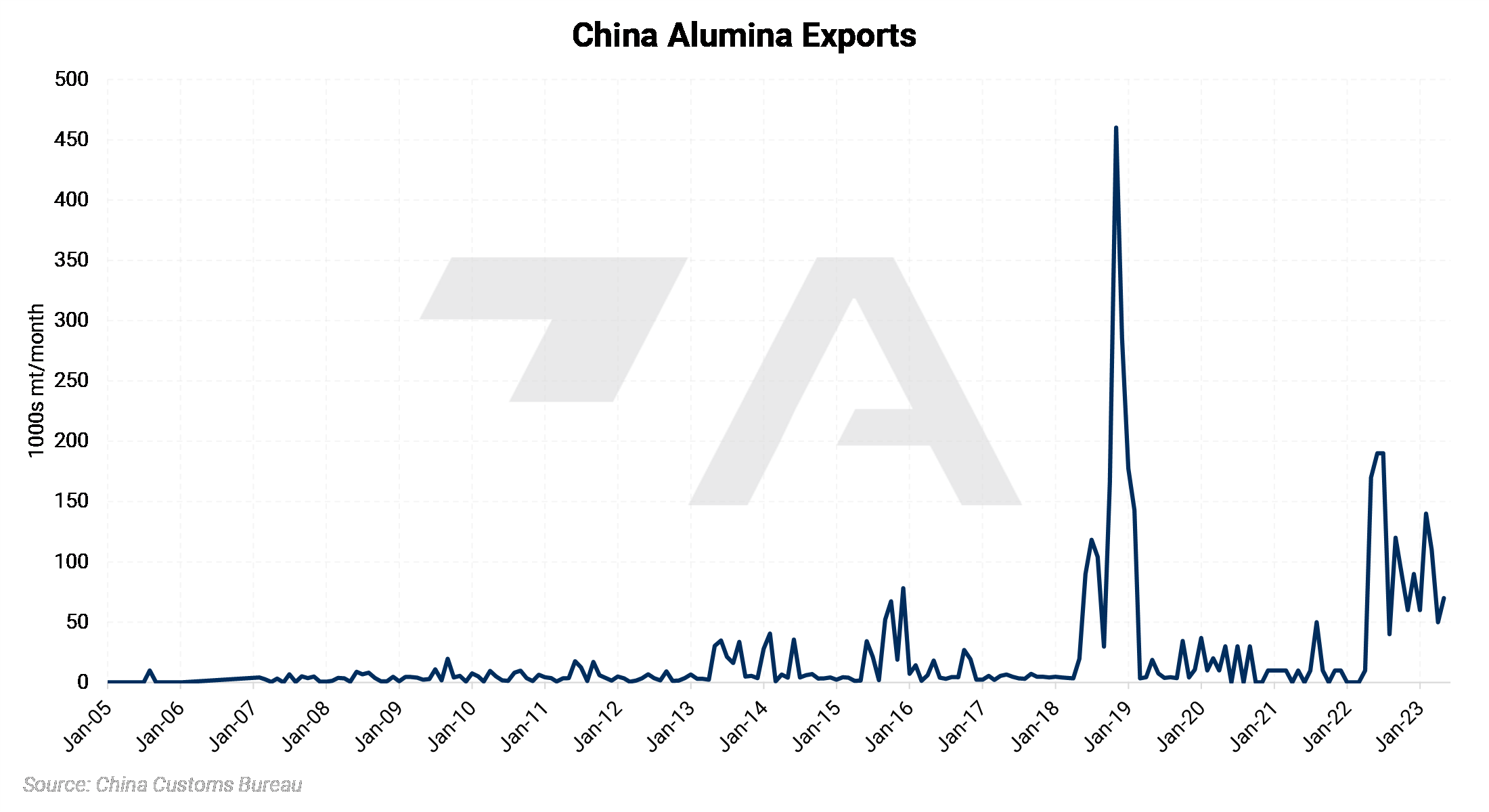

Rusal, which is Russia’s top aluminum producer, will need to import approximately 28% of its alumina needs this year, or 2.35 million mt, according to Bloomberg estimates. This shortfall is largely due to the Ukraine-based Nikolaev plant being closed because of the Russia-Ukraine war and Australia’s export ban on alumina to Russia. Nearly all of China’s recent alumina exports are going to Russia, thereby helping to fill the supply gap. (Source: Bloomberg)

|

|||||||||

|

Government authorities in China’s Yunnan province might grant 2 million Kw of power to the region’s aluminum smelters to restart production, according to Shanghai Metal Market. Smelters in Yunnan province, which is China’s top aluminum production, have experienced government-forced shutdowns in recent months due to drought-induced power rationing. (Source: Shanghai Metal Market)

|

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,268/mt, up $4.5/mt on the week. Aluminum prices were up this week. This has caused the forward curve to shift vertically higher by approximately $5/mt. It remains in a steep contango, meaning that nearby prices are lower than forward prices. Aluminum consumers that are concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last settled at 24.6¢/lb this week. The CME Midwest Premium market is now quite flat for the August '23 through December ’23 contracts. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please contact AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,371.5/mt, up $134.5/mt on the week. Compared to last Friday, LME Copper's forward curve has risen vertically by approximately $140/mt and remains in contango. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon their risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $21,170/mt, down $41/mt on the week. As prices were down this week, nickel’s forward curve has also shifted vertically lower, by about $40/mt. It is in a steep contango, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last settled at $927/T, down $13/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

06/07/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 05/17/2023: Cobalt End-Users Should Hedge While Market Is Oversupplied 05/3/2023: Copper Producers Can benefit From Hedging Both Inputs and Production |

|||||

Notable News |

|||||

|

6/8/2023: Factbox: Wildfires halt mining operations in Canada 6/8/2023: India unlikely to get U.S. exemption on steel, aluminium tariffs-sources 6/8/2023: China's big banks cut deposit rates, signaling monetary easing ahead 6/6/23: US HRC: Mills compete for orders, prices fall 6/6/2023: US HDG/CRC: Prices fall on limited buying 6/6/2023: Column: LME aluminum stocks battle comes with a Russian twist 6/2/2023: Peru bullish about copper No. 2 spot as Congo closes gap 6/2/2023: US sales of light vehicles fell to 15mn pace in May 6/2/2023: Rio Tinto's California mine shifts trucks to run on renewable diesel |

|||||