|

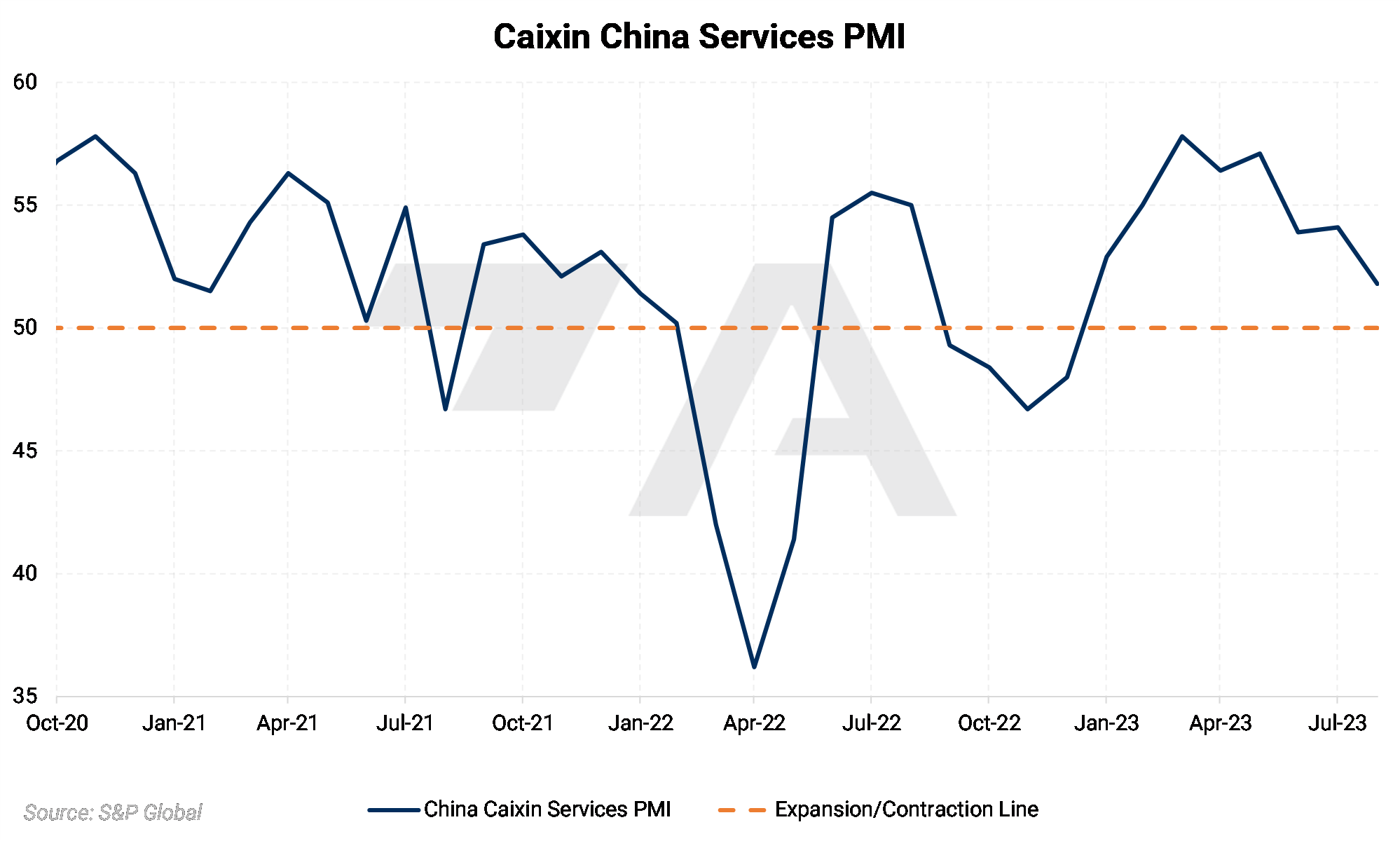

Aluminum China’s lackluster economy remains a burden for metals prices. Earlier this week, the Chinese government announced a series of new stimulus measures to boost the faltering real estate sector. Meanwhile, private economic data released earlier this week reiterated that the country’s manufacturing and services sectors are barely growing. LME metals seem to have reacted more to economic data than stimulus measures. (Source: Bloomberg) |

|

China’s aluminum exports in August were little changed compared to July. Last month, the country exported 490,130 mt of unwrought aluminum, up slightly from the 489,740 mt shipped in July. Chinese aluminum exports tend to rise alongside global prices, so the substantial drop in exports compared to summer 2022 could suggest that Chinese exporters are unwilling to sell at lower prices. (Source: China Customs)

|

|

|

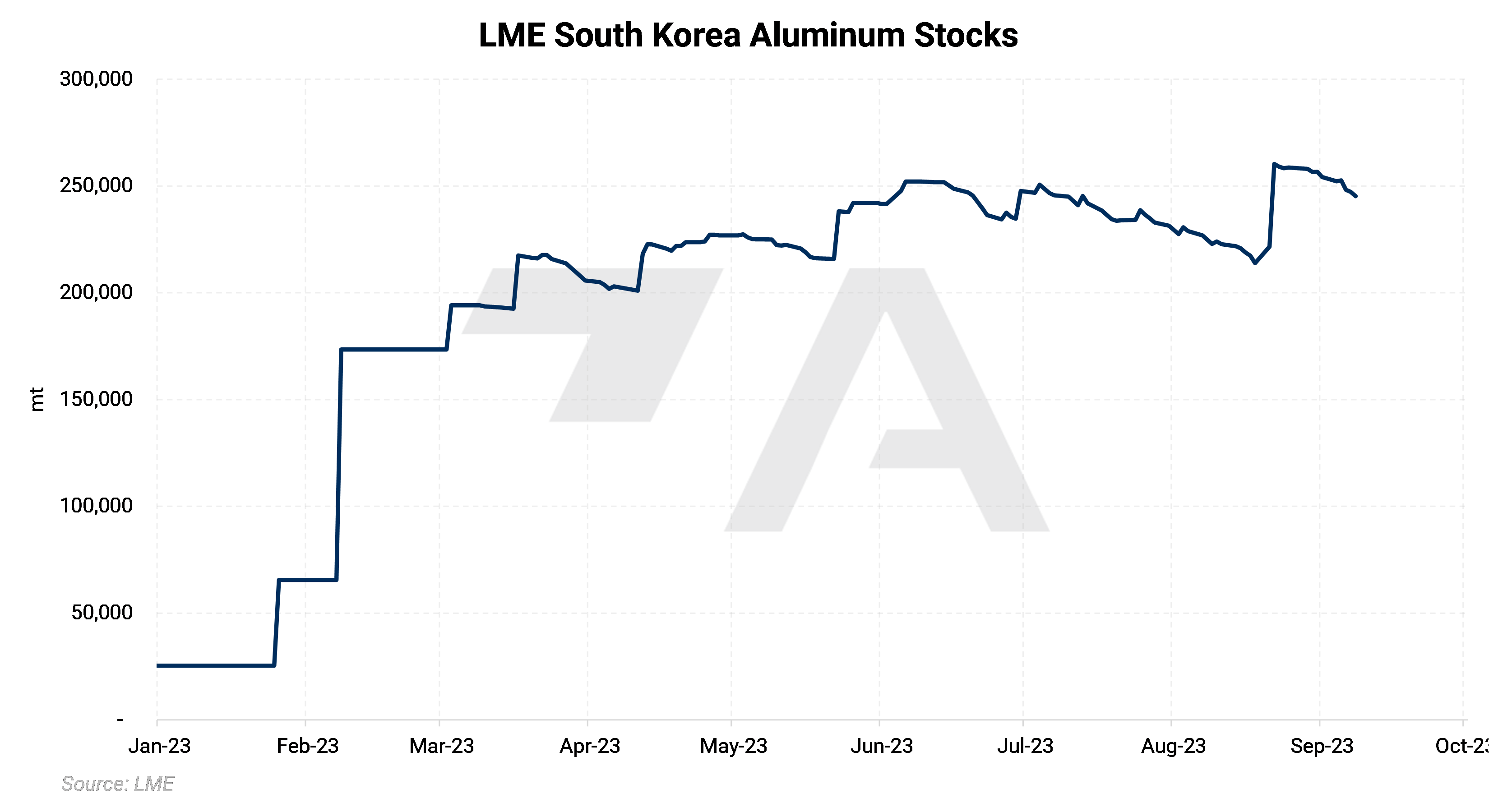

Unlike China, US exports of unwrought aluminum fell by nearly 36% in July. The country exported 5.67 million mt that month, down from 8.98 million mt in June. As usual, most exports went to Mexico and Canada. Given that the US exports large amounts of raw aluminum to Canada and Mexico and, in turn, imports finished aluminum products, this could signal continually suppressed aluminum demand here in the US. (Source: US Commerce Department) As for global inventories, the LME’s warehouses in South Korea have become a “battleground” for aluminum stocks, according to recent comments by Andy Home of Reuters. As of this writing, 254,275 mt, or approximately 49% of the LME’s aluminum inventories, are in South Korean warehouses. The LME’s South Korean warehouses are a known repository of Russian metal. Inventories in these South Korean warehouses have risen nearly 10-fold since January, as several large traders have delivered Russian-origin aluminum into these warehouses amid ample supplies and subpar global demand. (Source: Reuters, LME)

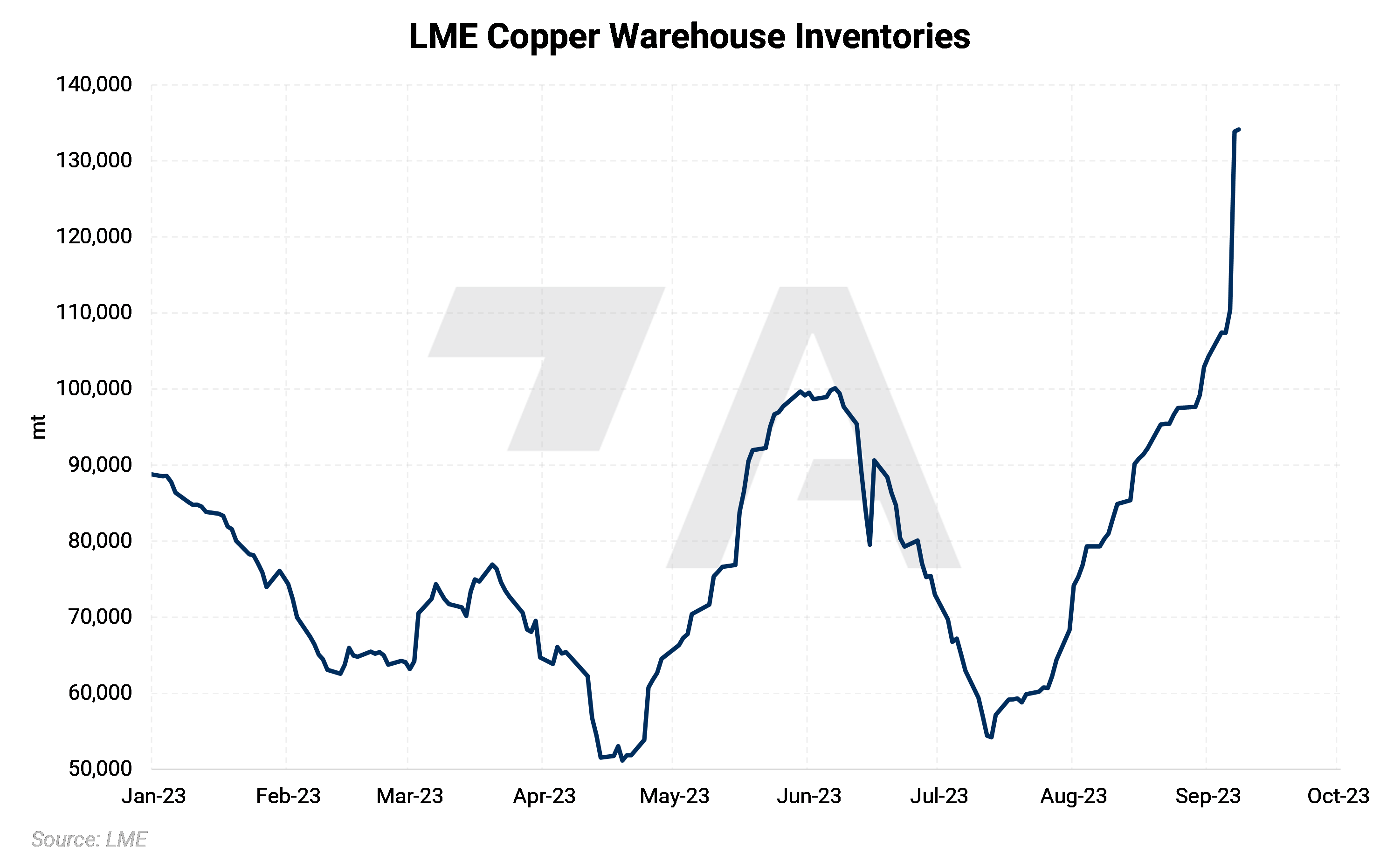

Copper At 134,475 mt, the LME’s copper inventories have more than doubled since mid-July, while global demand has faltered. One of the most dramatic inventory increases occurred on Thursday, when stocks surged to 133,850 mt, up from 110,400 mt, or 21%, on Wednesday morning. Despite the recent surge in inventories, some analysts are downplaying the implications and believe that further significant increases are unlikely. “It is unlikely that copper stocks will rise more materially unless there is a much sharper deterioration in end-use consumption,” BMO Capital Markets told Bloomberg earlier this week. (Source: Bloomberg, LME)  |

|

In July, Germany's Industrial Manufacturing Orders, a key gauge of the country’s manufacturing activity, slipped by 11.7% compared to June. This is the largest month-over-month slump since the early days of the pandemic. Germany is one of Europe’s largest manufacturing hubs, making it a large consumer of copper. (Source: Bloomberg)

Copper output in Zambia remains sluggish. Production at Zambia’s state-owned Mopani Copper Mines (ZCCM) slumped to 14,946 mt in 1H2023, down from 20,000 mt in the same period last year. The company’s financial position also worsened, with a $196 million loss, up from $120 million in 1H2022. This steepening loss is mainly due to lower production and increasing costs. Despite months of searching, ZCCM is yet to find a new investor, a process that will take until December, the company stated. Last week, Reuters reported that Sibanye Stillwater, a prominent South African precious metals producer, is a likely front-runner on the list of potential suitors for ZCCM. (Source: Reuters)

Aurubis AG, Europe’s largest copper producer, has fallen victim to an alleged theft ring that has stolen thousands of tons of materials, the company announced late last week. Due to the theft, the company will miss its full-year profit target, they also stated. An investigation and inventory count are ongoing, so the exact volumes are unknown. (Source: Reuters) Steel The potential United Autoworkers (UAW) strike could wipe away between 76,000 to 98,000 st of steel demand, according to Bloomberg estimates. This possible drop in demand comes while buyers have pulled back from purchases due to recession fears. Prompt month CME HRC Steel prices have fallen 3% this year, and an autoworkers’ strike could lead to further downside price risk. (Source: Bloomberg) The spread between CME HRC Steel and CME MW Busheling Scrap is generally used as a proxy for steel mill profitability. This spread currently sits at about $340/st, falling nearly 53% since the mid-April high of $731/st. Prompt month prices for HRC and Busheling Scrap have fallen substantially since the spring due to ample supply and subpar end-user steel demand. The spread based on the current futures forward curve shows slight improvement over the next several months, reaching nearly $390/st by summer 2024. (Source: CME, AEGIS) |

|||||

|

|

|||||

|

China’s demand for iron ore, the critical raw material for most of the country’s steel production, is looking “more encouraging,” according to miner Vale. This is mainly due to continually high steel output and low inventories of steel and iron, Vale recently stated during an investor presentation. Vale is the world’s second-largest iron ore producer. (Source: Bloomberg) Iron prices in Asia have jumped 15% since mid-August, even though some market participants have been disappointed by China’s slow rollout of economic stimulus measures. Australia’s ANZ Bank feels that the recent rally will be “short-lived” and that “the rally is susceptible to a bit of a sell-off if we don’t see any follow-through evidence that [China’s] economy is improving.” Another Australian bank, Westpac, echoed similar comments, stating that the objective of the recent stimulus measures was “to prevent the downward spiral in sentiment from continuing” (Source: Bloomberg) |

|||||

|

|

|||||

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,183.5/mt, down $53.5/mt on the week. Aluminum prices were down this week. This has caused the futures forward curve to shift vertically lower by approximately $50/mt. It remains in a steep contango, meaning nearby prices are lower than forward prices. Aluminum consumers concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

Midwest Premium |

|||||

|

Prompt month CME MWP last traded/settled at 20.3¢/lb this week. The CME Midwest Premium market is now in a slight contango from the September ‘23 contract on forward. The CME Midwest Premium swap market is thinly traded, with no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please get in touch with AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,242.5/mt, down $258/mt on the week. Compared to last Friday, LME Copper's forward curve has fallen vertically by approximately $250/mt and remains in contango for the remainder of 2023 and throughout 2024 and 2025. The copper market has sufficient liquidity to use swaps and options. Depending upon their risk tolerance, consumers might consider strategies that use only swaps or options or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $20,052/mt, down $1,033/mt on the week. As prices were down this week, nickel’s forward curve has also shifted vertically lower by about $1,000/mt. It remains in a steep contango, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Depending upon your risk tolerance, consumers might consider strategies that use only swaps or options or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded/settled at $725/T, up $5/T on the week. The spread between CME HRC Steel and CME MW Busheling Scrap is generally used as a proxy for steel mill profitability. This spread currently sits at about $340/st, falling nearly 53% since the mid-April high of $731/st. Despite this significant drop, steel mills should consider hedging production and raw material usage for late 2023 and early 2024. For most steel producers, this would consist of buying CME MW Busheling Scrap swaps and selling CME HRC swaps. Options are available for CME HRC, but they are relatively illiquid. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

09/08/2023: Despite Price Slump, Hedging is Still Feasible for Steel Producers 09/06/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 08/25/2023: Growing Secondary Aluminum Supply Could Further Weigh on Prices 08/18/2023: Steel Buyers Can Strengthen Pricing Power During Industry Consolidation |

|||||

Notable News |

|||||

|

9/7/2023: Vale Base Metals to invest $10 bln in Indonesia over next decade 9/6/2023: Metal industry urges EU to invest in processing energy transition materials 9/6/2023: EU lawmakers see recycling as key in search for critical minerals 9/5/2023: US HRC: Prices fall as near term bottom eyed 9/4/2023: Zambia's Mopani Copper Mine H1 losses worsen as output slumps |

|||||