|

Aluminum Global aluminum buyers and sellers are meeting in Barcelona, Spain, this week to hammer out deals for 2024. Russian aluminum has been a hot topic at this conference, as some participants feel the country’s production should not be sanctioned, while others have shunned Russian metal. According to London-based commodity merchant Concord Resources, self-sanctioning efforts against Russian metal have increased compared to 2022, and “Some aluminium consumers are putting out requests for quotations for contracted supplies for 2024, specifically excluding Russian metals.” This so-called “mating season” is taking place at the Fastmarkets International Aluminium Conference, which started yesterday. (Source: Reuters) |

LME aluminum inventories continue to surge. On Thursday morning, total LME on-warrant inventories, meaning the metal is available to trade, surged by 4%, or 9,225 mt, to 238,475 mt. Most of this jump in inventories was due to deliveries into South Korean warehouses, which are known repositories of Russian aluminum. At 246,700 mt, South Korean on-warrant inventories are nearly the highest level of the year, mainly due to large inflows of Russian aluminum amid subpar Chinese demand. (Sources: Bloomberg, LME)

|

|

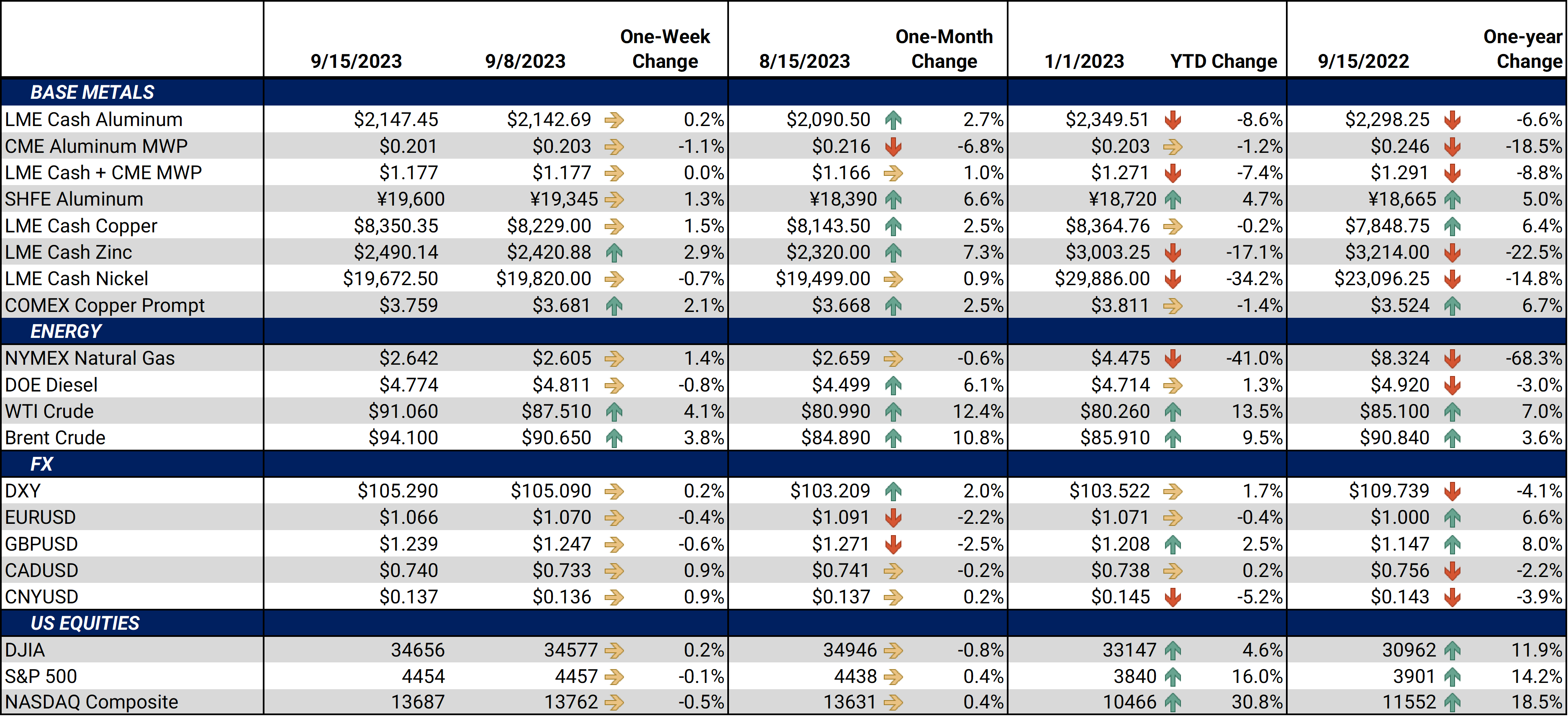

||||||

|

Russia’s domination of LME warehouses continues unchallenged. Russian-origin inventories dipped to 183,500 mt in August, down from 227,525 mt at the end of July. This slight drawdown was expected as traders took delivery out of South Korean warehouses. Russian-origin aluminum now represents nearly 81% of the LME’s total inventories. (Source: LME)

Chinese aluminum production continues to surge. China’s aluminum production could hit 3.51 million mt in September, up 5.1% compared to last year, according to Shanghai Metal Market. This is also up from the 3.623 million mt produced in August. Based on September estimates, the country’s aluminum smelters could be at 95.3% of capacity by the end of the month. (Source: Shanghai Metal Market)

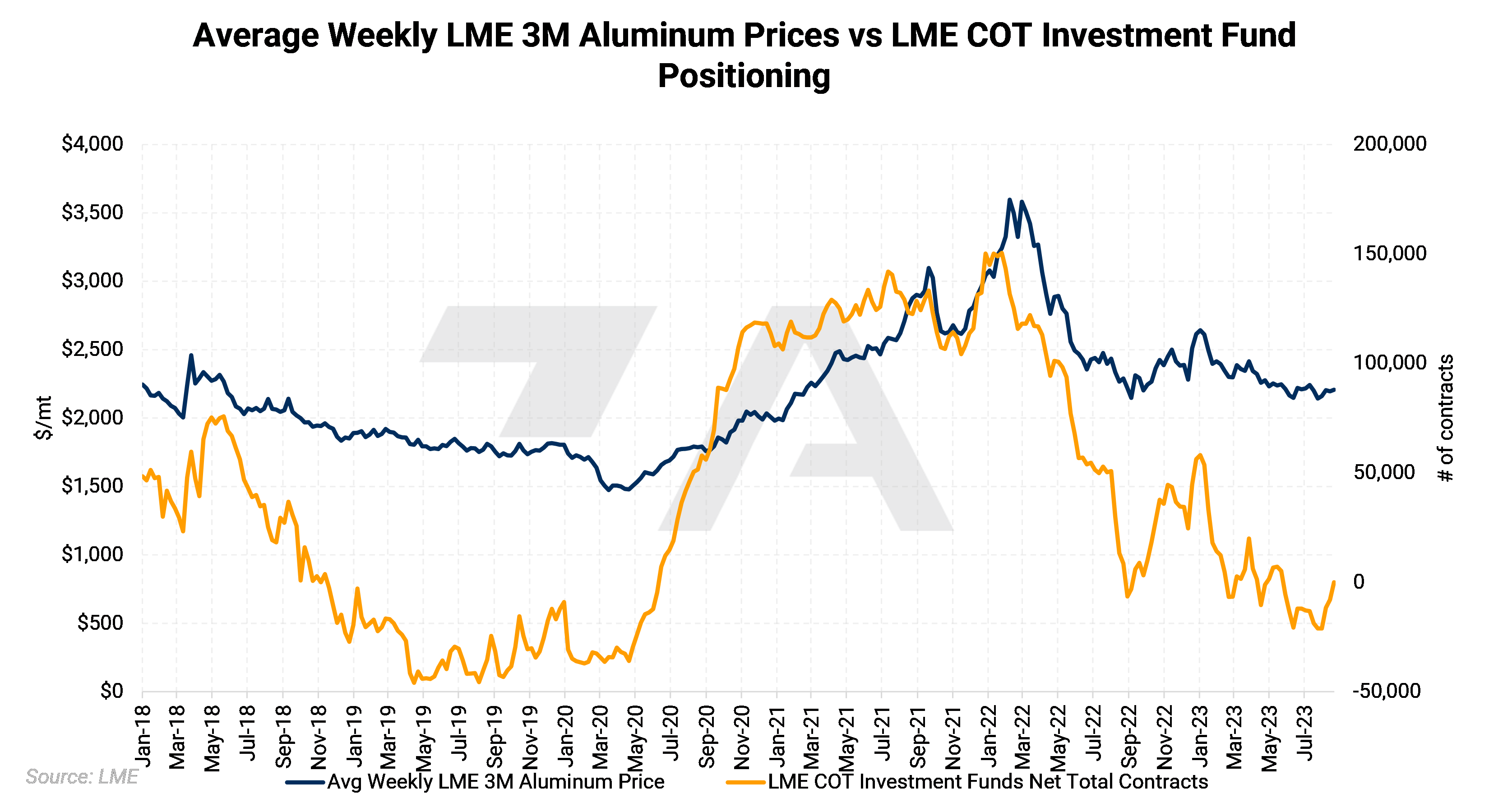

Lastly, investment funds, which are purely speculators in the LME aluminum futures markets, can have an oversized impact on financial prices. With a net short position of 7,980 contracts, these investment funds have dramatically reduced their short position since late August. Investment funds were net long for most of 2023 and only flipped to a short position in late summer. The last time these funds started building a significant long position coincided with an uptick in Chinese aluminum imports and growth in China’s manufacturing and construction sectors. Given that these sectors are slowing or contracting, and imports remain lackluster, we do not think that investment funds will either build a significant long position or significantly influence prices in the immediate future until fundamental aluminum demand begins to improve. (Source: LME)  Copper Saudi Arabia aims to dramatically increase domestic metals production in the coming years. The Khnaiguiyah site, which is west of the country’s capital (Riyadh), has an estimated 25 million mt of zinc and copper ore reserves. The country expects this site to produce 100,000 mt/year of zinc and 10,000 mt/year of copper by 2025, with expectations to double output within several years. (Source: Bloomberg)

Meanwhile, Codelco, Chile’s state-owned copper producer and the world’s largest, stated its 2023 production of 1.3 million mt would be a low point, as they expect production to ramp up to 1.7 million mt by the end of the decade. This expected advancement in production is mainly due to improving efficiencies and expanding current projects. Despite concerns about rising costs amid subpar production, the company is “financially solid,” Chairman Maximo Pacheco recently told a government mining committee. Codelco’s copper production has been hampered in recent years due to road blockages by political strikers, poor weather, declining ore grades, and outdated technology. (Source: Bloomberg)

|

|

Steel Spot steel prices fell this week as fears over a potential autoworkers strike weighed on the market. Argus’s weekly domestic HRC assessment fell $30/st to $690/st, the lowest price in 2023 and nearly 43% off the April peak. The autoworkers’ strike could reduce steel demand by almost 100,000 st/month, according to Bloomberg estimates. Although this initial strike is smaller than anticipated, the blow to demand could further impact steel prices in both the spot and futures markets. (Source: Argus, Bloomberg) As for Chinese steel demand, Mysteel, a Chinese price reporting agency and market researcher, believes that the recent Chinese government housing stimulus measures might only provide a “limited boost to steel demand,” the company stated in a note to Bloomberg yesterday. This could mean that further stimulus measures might be necessary, they added. China’s real estate accounts for about 40% of the country’s steel demand. (Source: Bloomberg) The US and EU could soon slap new import tariffs on Chinese steel. It is currently unclear what the new tariff rate will be. The US’s current tariff on Chinese steel imports is 25% and was instated by the Trump administration in 2018 due to security reasons. US imports of Chinese steel have fallen dramatically in recent years, so the market impact will likely be minimal. (Source: Bloomberg) Raw material prices for Chinese steel production continue to surge. Iron ore prices jumped again on positive economic data from China. Demand for the steel-making raw material has increased recently, with Chinese steel production hitting 2.9 million mt/day, according to investment bank Barrenjoey. “That’s consuming a lot of physical iron ore and dragging high-cost iron ore into the market to feed China,” Barrenjoey stated. (Source: Bloomberg) Finally, investors are rewarding steelmakers aiming to reduce their carbon footprint. Over the past five years, stocks of low-carbon steelmakers have outperformed those of higher-carbon producers by about 68%, according to a recent analysis by Bloomberg. Emissions from steelmaking can vary widely depending on production. In one example, one producer that uses scrap and low-carbon electricity to produce steel had an 82% smaller carbon footprint than a competitor that uses iron and coal. Switching technologies will have little market impact, as the steel quality is essentially the same no matter how it is produced. (Source: Bloomberg) |

|||||

|

|

|||||

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,190.5/mt, up $6.5/mt on the week. Aluminum prices were up this week. This has caused the futures forward curve to shift vertically higher by approximately $5/mt. It remains in a steep contango, meaning nearby prices are lower than forward prices. Aluminum consumers concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

Midwest Premium |

|||||

|

Prompt month CME MWP last traded/settled at 20.0¢/lb this week. The CME Midwest Premium market is now in a slight contango from the September ‘23 contract on forward. The CME Midwest Premium swap market is thinly traded, with no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please get in touch with AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,405.5/mt, up $163/mt on the week. Compared to last Friday, LME Copper's forward curve has risen vertically by approximately $160/mt and remains in contango for the remainder of 2023 and throughout 2024 and 2025. The copper market has sufficient liquidity to use swaps and options. Depending upon their risk tolerance, consumers might consider strategies that use only swaps or options or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $19,924/mt, down $128/mt on the week. As prices were down this week, nickel’s forward curve has also shifted vertically lower by about $100/mt. It remains in a steep contango, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Depending upon your risk tolerance, consumers might consider strategies that use only swaps or options or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded/settled at $704/T, down $16/T on the week. The spread between CME HRC Steel and CME MW Busheling Scrap is generally used as a proxy for steel mill profitability. This spread currently sits at about $340/st, falling nearly 53% since the mid-April high of $731/st. Despite this significant drop, steel mills should consider hedging production and raw material usage for late 2023 and early 2024. For most steel producers, this would consist of buying CME MW Busheling Scrap swaps and selling CME HRC swaps. Options are available for CME HRC, but they are relatively illiquid. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

09/13/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 09/12/2023: Important US Economic Data (AEGIS Reference) 09/08/2023: Despite Price Slump, Hedging is Still Feasible for Steel Producers 08/25/2023: Growing Secondary Aluminum Supply Could Further Weigh on Prices 08/18/2023: Steel Buyers Can Strengthen Pricing Power During Industry Consolidation |

|||||

Notable News |

|||||

|

9/15/2023: US auto workers launch strikes at three plants 9/15/2023: Tata Steel reaches £500mn deal with UK government 9/15/2023: Codelco ends long-term mined copper deals to China clients from 2025 -sources 9/14/2023: Aluminium sector surging in India, but hampered by labour shortages, Hindalco executive says 9/13/2023: China Hongqiao shifts 1.5 million T aluminium capacity to Yunnan so far 9/12/2023: US HRC: Market drops amid feared auto strike 9/12/2023: Russian aluminium splits dealmakers at Barcelona metals meet 9/12/2023: SMM Data: China’s Aluminium Output In August And Forecast For September 9/12/2023: Factbox: From UPS to Detroit Three automakers, US labor unions flex muscle 9/12/2023: India's steel mills expect wheel prices to ease after anti-dumping duty on China 9/11/2023: Russian miner Udokan Copper launches processing plant 9/10/2023: US, Saudi Arabia in talks to secure metals in Africa, Wall Street Journal reports 9/7/2023: Saudi Arabia’s crown prince looks to metals as new source of wealth |

|||||