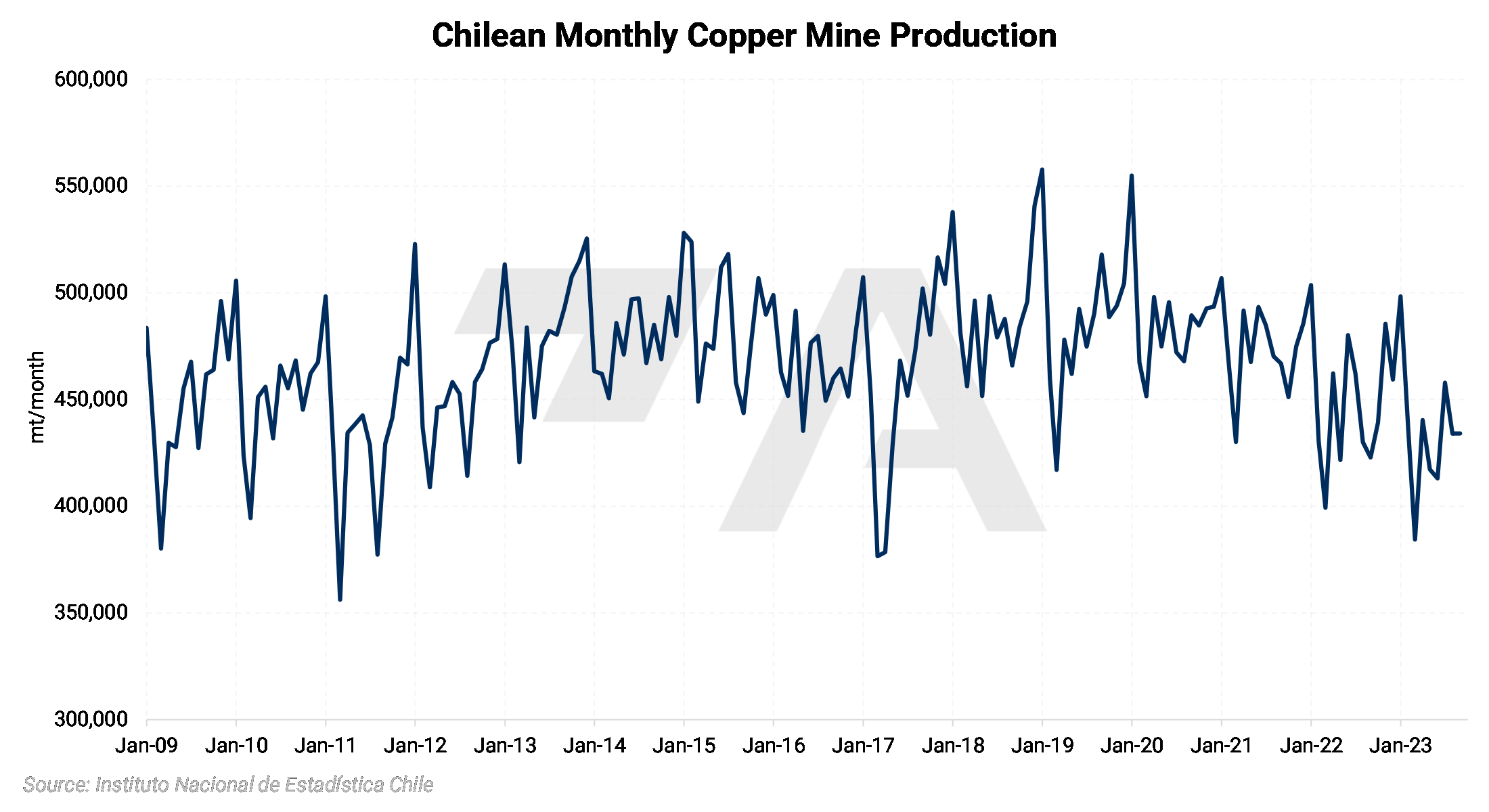

|

Aluminum Metals prices, including LME aluminum, fell this week while China was on its annual, eight-day-long Golden Week holiday. According to Bloomberg, the Golden Week holiday is often a test of the country's real estate market. Bloomberg also stated that China’s real estate sector has been slumping for nearly two years, and the country’s property developers will look to see if demand improves after the holiday. |

Meanwhile, investment funds have built their largest net long position in aluminum since late February. These investment funds, which are purely speculators in the aluminum market, are now net long 26,564 contracts as of Friday, September 29. Compared to the end of August, this is a net reversal of nearly 47,000 contracts, as investment funds were net short over 21,000 contracts at that time. This likely contributed to the surge in LME prices last week, as these investment funds can have an oversized influence on prices. (Source: LME)

|

|

||||

|

Continuing on the LME, traders keep draining inventories from the LME’s South Korean warehouses. On Friday, canceled warrants (meaning the metal is set for delivery) in South Korean warehouses jumped by 49,000 mt. The aluminum leaving these warehouses is likely of Russian origin, as the LME’s South Korean warehouses are known repositories of Russian aluminum. Due in part to this recent uptick in delivery requests, the amount of on-warrant aluminum (meaning the metal is available to trade) has fallen to a 13-month low. (Source: LME)

Approximately 80% of aluminum production in the US comes from secondary sources, but this could increase slightly to 82% by 2028, according to BNEF. This is mainly due to new plants by Novelis and Steel Dynamics coming online. Secondary aluminum production uses 95% less electricity than primary, making it less susceptible to electricity price shocks. The cost of production depends mainly upon scrap input costs and can vary depending on smelter capacity utilization. (Source: BNEF/Bloomberg)

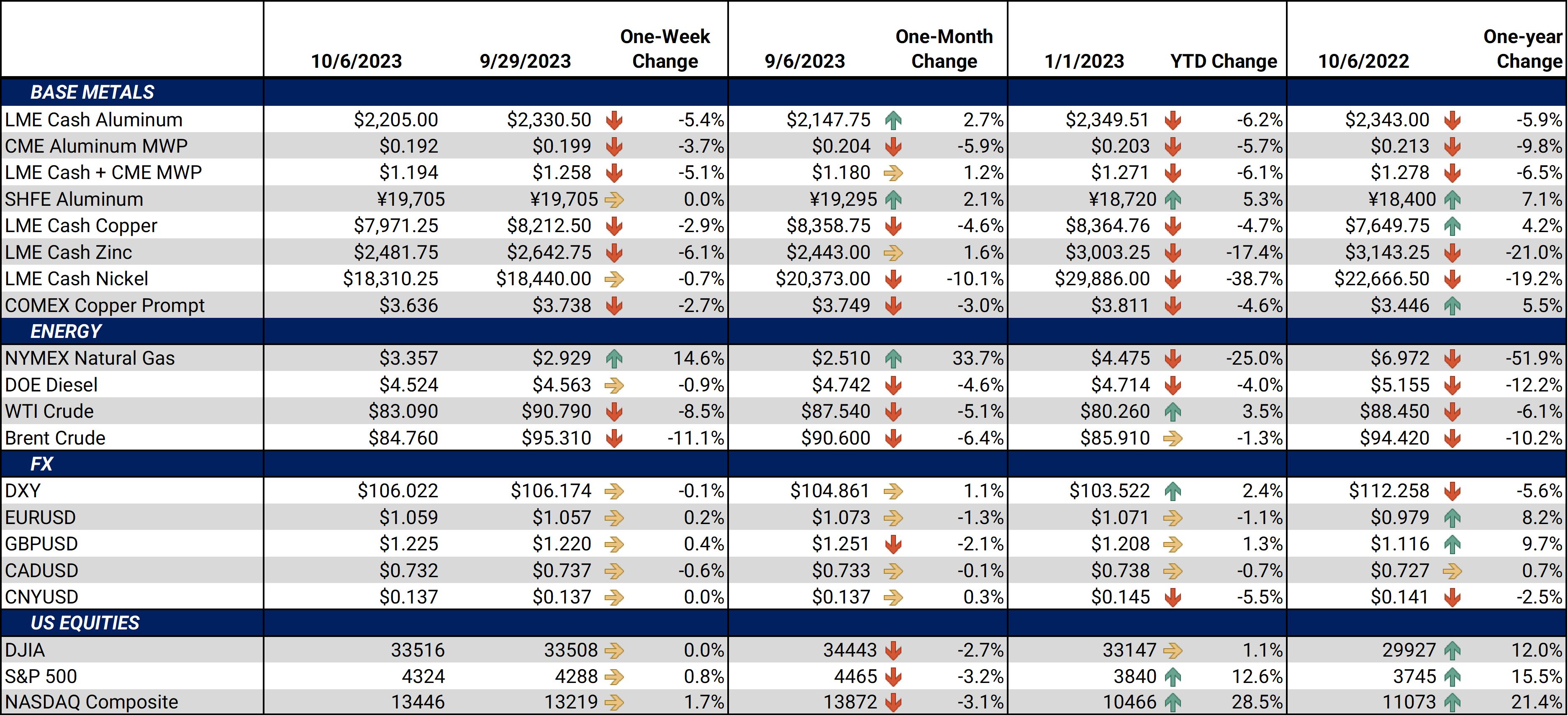

Copper The LME Copper 3M contract fell $224.5/mt, or 2.7%, this week, having given back last week’s gains. Similarly, prices are down about 3.9% on the year. Investment bank Citigroup remains bearish on copper demand into 2024, citing weakening global economic growth. Although China’s economic stimulus measures remain “piecemeal,” they could somewhat support the copper market, Citigroup also stated. (Source: Bloomberg) Unlike LME aluminum, investment funds have flipped to a net short position in LME copper. With a net short position of 3,051 contracts as of last Friday, these funds have their largest short since late May. Contrary to normal price action, copper prices rallied last week while investment funds were selling. (Source: LME) |

||||

|

||||

|

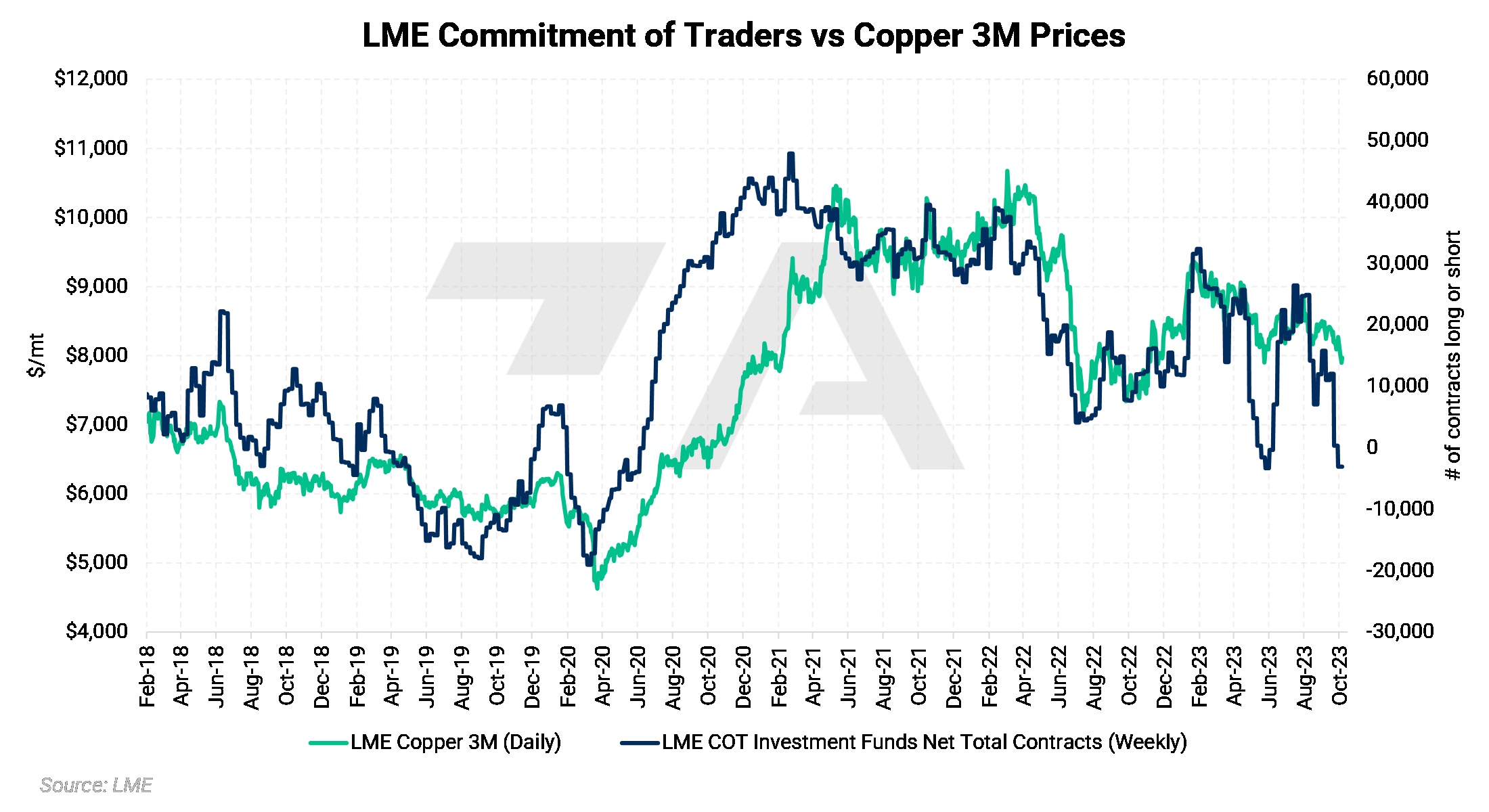

Moving onto production, Chile’s copper miners produced 434,206 mt of the red metal in August, up slightly compared to July. This is a slight increase from August 2022 as well. Until recently, Chilean copper miners had struggled with many production issues, including political protests near mines, poor weather, and declining ore grades. (Source: Instituto Nacional de Estadística Chile) |

||||

|

||||

|

Mitsubishi Materials, one of Japan’s top refined copper producers, expects higher production in the second half of FY23/24, the company announced on Monday. Between October 2023 and March 2024, they expect to produce about 217,000 mt of refined copper, up 34% compared to the same period in 22/23. The company’s refined copper is formed into copper products that supply the automotive and real estate industries. (Source: Reuters) |

|

Steel At 2,066,878 mt, steel imports into the US slumped to a new 2023 low in August. Import volumes seasonally fall in the late summer months, but import volumes in July and August 2023 are down roughly 10% compared to last year. Meanwhile, American steel production volumes have been rangebound in 2023, hovering between 1.5 and 1.8 million short tons per week. The slump in imports amid stagnant production could suggest that the American steel market is still slightly oversupplied. This fall in imports and stalled production comes while CME HRC Steel prices continue to fall and hover near 40% off the highs of mid-April. (Sources: AISI, US Census Bureau, CME) |

|||||

|

|

|||||

|

Regarding other top producers and imports, Salzgitter, one of Germany’s leading steelmakers, recently stated that some buyers are willing to pay a three-digit euro per metric ton premium for green steel produced using renewable resources. However, most of the electricity that will be used for green steel production will initially come from natural gas, as green hydrogen remains in short supply. Although natural gas is cleaner than coal, steel production via natural gas is not carbon-neutral, according to think tank Agora Industry comments. (Source: Bloomberg) As for raw materials, prices for iron ore, a key raw material for China’s steel producers, surged nearly 20% in September. According to recent Bloomberg comments, this rally in iron ore prices is underpinned by rising Chinese steel production. Regarding Chinese steel production, Australian Steel Association chief executive David Buchanan recently stated, “We can certainly see the demand signals there. We can certainly see production is definitely ramping up.” (Source: Bloomberg) Finally, according to Reuters, Quebec, one of Canada’s top mining provinces, is in talks with battery and car manufacturers to build out EV supply chains. These investments could total nearly C$15 billion over the next three years and be made through a government-owned investment fund and will aim to promote the region's critical minerals, such as lithium and nickel. Creating more EV batteries will, in turn, generate greater steel demand. (Source: Reuters) |

|||||

|

|

|||||

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,239.5/mt, down $107.5/mt on the week. Aluminum prices were down this week. This has caused the futures forward curve to shift vertically lower by approximately $100/mt. It remains in a steep contango, meaning nearby prices are lower than forward prices. Aluminum consumers concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

Midwest Premium |

|||||

|

Prompt month CME MWP last traded/settled at 19.2¢/lb this week. The CME Midwest Premium market is now in a slight contango from the October ‘23 contract on forward. The CME Midwest Premium swap market is thinly traded, with no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please get in touch with AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,046/mt, down $224.5/mt on the week. Compared to last Friday, LME Copper's forward curve has fallen vertically by approximately $220/mt and remains in contango for the remainder of 2023 and throughout 2024 and 2025. The copper market has sufficient liquidity to use swaps and options. Depending upon their risk tolerance, consumers might consider strategies that use only swaps or options or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $18,582/mt, down $112/mt on the week. As prices were down this week, nickel’s forward curve has also shifted vertically lower by about $100/mt. It remains in a steep contango, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Depending upon your risk tolerance, consumers might consider strategies that use only swaps or options or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded/settled at $705/T, up $1/T on the week. The spread between CME HRC Steel and CME MW Busheling Scrap is generally used as a proxy for steel mill profitability. This spread currently sits at about $345/st, falling nearly 50% since the mid-April high of $731/st. Despite this significant drop, steel mills should consider hedging production and raw material usage for late 2023 and early 2024. For most steel producers, this would consist of buying CME MW Busheling Scrap swaps and selling CME HRC swaps. Options are available for CME HRC, but they are relatively illiquid. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

10/02/2023: Important US Economic Data (AEGIS Reference) 09/28/2023: Aluminum Buyers Should Hedge Alongside Chinese Importers 09/27/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 09/08/2023: Despite Price Slump, Hedging is Still Feasible for Steel Producers 08/25/2023: Growing Secondary Aluminum Supply Could Further Weigh on Prices |

|||||

Notable News |

|||||

|

10/6/2023: LME WEEK-Resilient China demand supports copper prices, boosts local aluminium prices 10/5/2023: EU, US seek interim steel deal to avoid return of Trump tariffs - Bloomberg News 10/4/2023: LMEWEEK Hydro CEO sees rapid demand growth for low-carbon aluminium 10/4/2023: Rusal says production at Siberian aluminium smelter unaffected after fire 10/3/2023: US HRC: Prices rise despite strike headwinds 10/3/2023: Nucor keeps plate prices flat 10/2/2023: Japan's Mitsubishi Materials sees H2 copper output up 34% y/y 10/1/2023: Glencore may look elsewhere for recycling hub after Italy rejects fast-track approval 9/29/2023: Quebec in talks with battery, auto makers for C$15 billion in EV-related investments |

|||||