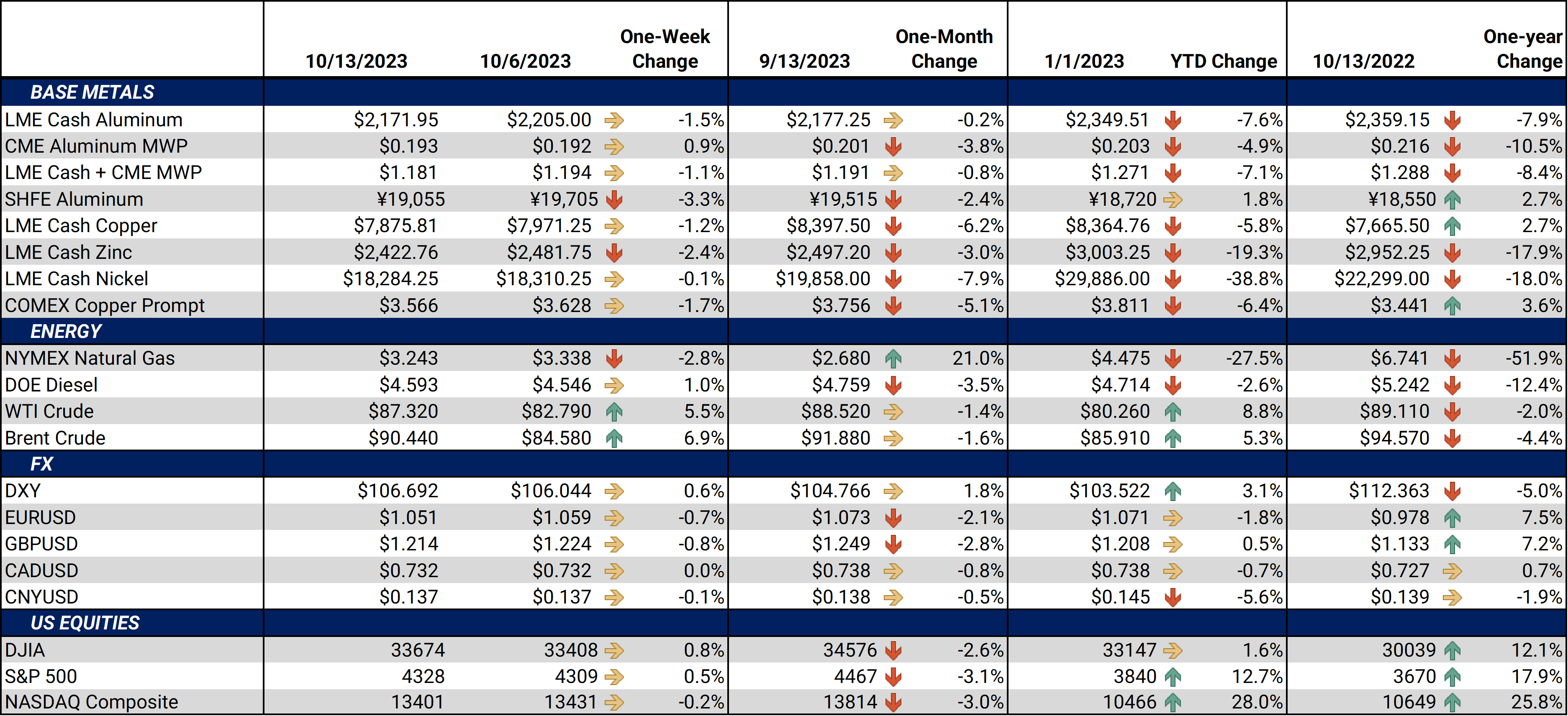

|

Aluminum LME aluminum prices fell 1.8% this week and have also taken away the significant gains of late September. Aluminum briefly broke out of the sideways trend in September but has since fallen back into the trading range between $2,100/mt and $2,300/mt. Subpar Chinese demand remains a concern, mainly due to slowing real-estate and manufacturing sectors. Meanwhile, Chinese aluminum production continues to make new all-time highs, with little demand on the other end. Poor demand amid high production will likely continue to burden the aluminum market. |

Rusal, Russia’s top aluminum producer, exported 2.29 million mt of aluminum in the first nine months of 2023, according to Russian Railways, the country’s state-owned rail company. This is up about 4.8% compared to January through September 2022. At 3.82 million mt, Rusal’s alumina imports were up about 2% in January through September 2022. (Source: Bloomberg)

Approximately 33% of Rusal’s aluminum exports went to Asia this year, up from 22% in 2022, a spokesman for the company stated earlier this week. Nearly all of China’s recent primary aluminum imports have come from Russia, with Chinese importers spending almost $1.1 billion with Rusal this year. Rusal is currently building its sales portfolio for 2024, and China and other Asian countries will likely remain critical buyers. (Source: Bloomberg)

|

|

|

At 132,475 mt, Russian-origin aluminum represented about 76% of the total on-warrant stocks in LME warehouses at the end of September, down slightly from the 81% total on August 31. The total volume of Russian-origin aluminum continues to drop and is now at the lowest level since February. This is mainly due to traders pulling volumes from South Korean warehouses, known repositories of Russian-origin metal. (Source: LME) |

|

|

|

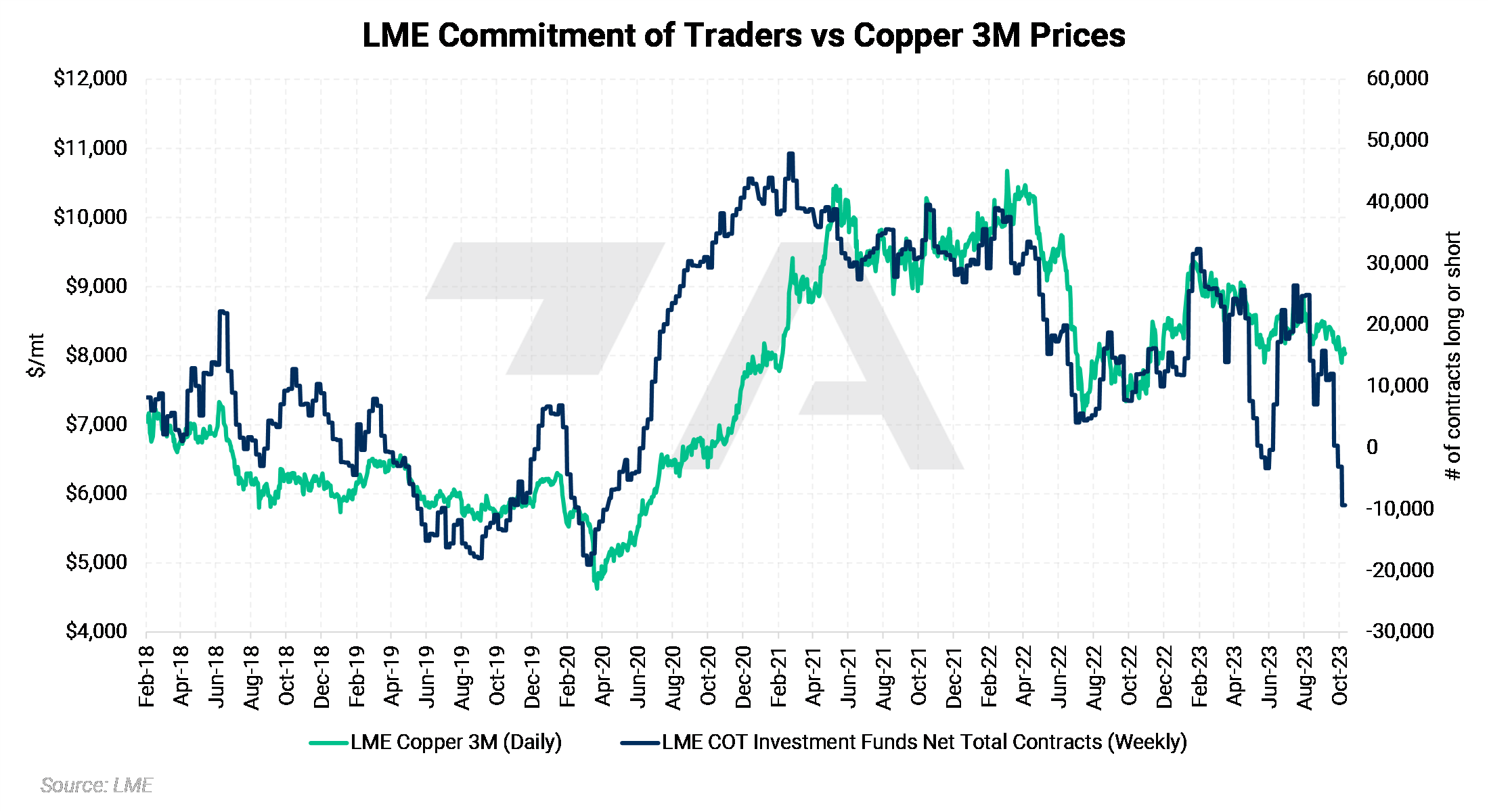

Finally, Rio Tinto, already the largest aluminum producer in the Western world, aims to boost its output even further, according to Chairman Dominic Barton. This is mainly due to increasing demand from the energy transition, while Chinese and Russian exports to Western buyers have decreased dramatically. Barton also stated that demand for "green" aluminum produced via renewable energy will increase in the coming years. These comments were made at last week's FT Mining Summit in London. (Source: Wall Street Journal) Copper Speculators have now built their largest short position since the early days of the COVID-19 pandemic. As of last Friday, investment funds, which are purely speculators in the LME copper market, are now net short 9,353 contracts, the largest such position since May 2020. This is likely why copper prices tumbled almost 3% last week. Fundamentally, copper demand remains poor, while China’s manufacturing and real estate sectors continue to stumble. (Source: LME) |

|

|

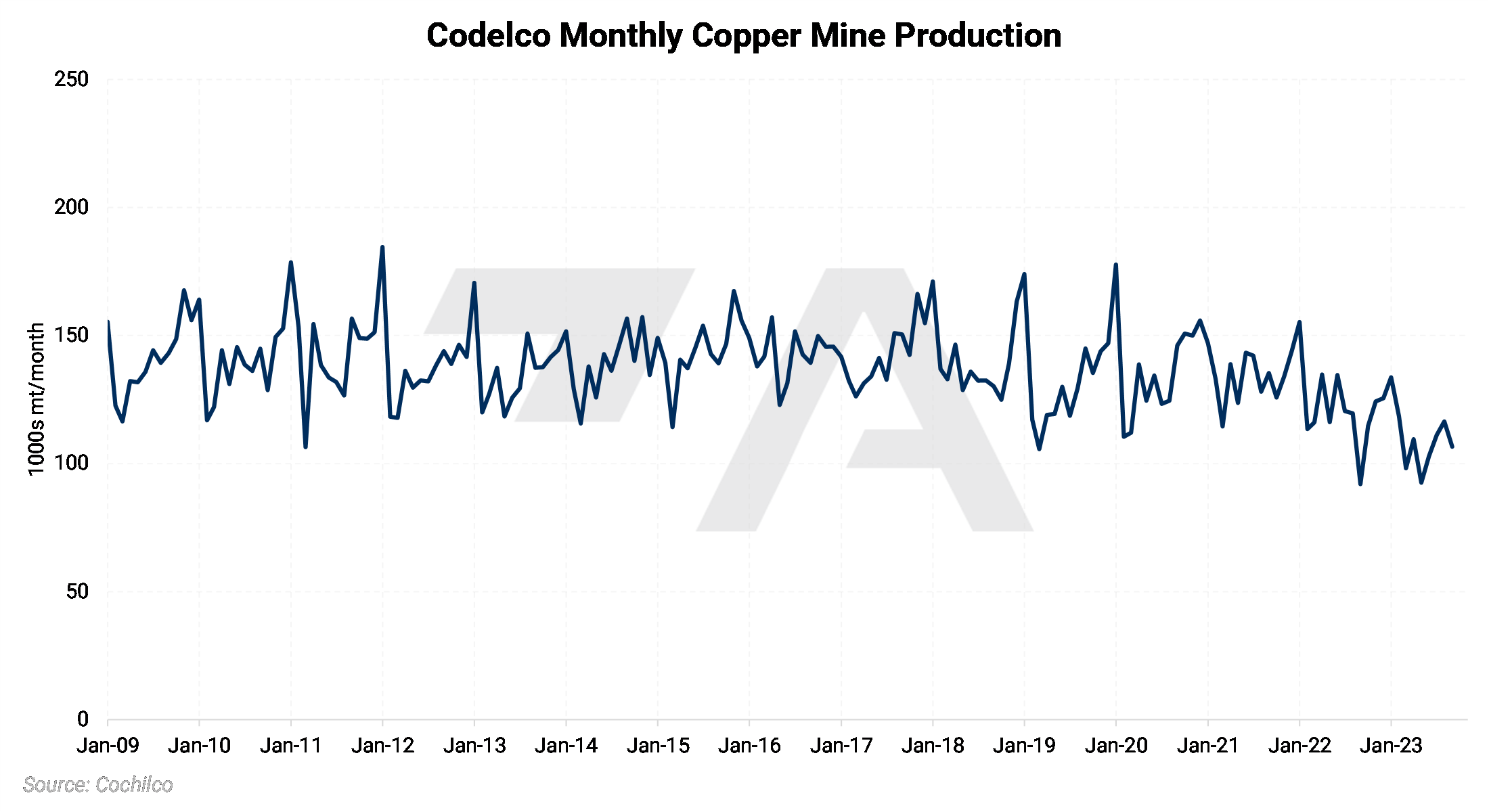

Copper demand was one of the hot-button issues discussed at the LME week conference. Chinese property demand remains a concern, with Laura Varriale of S&P Global Commodity Insights stating, "It is a worry if property construction isn't performing well." Other conference speakers proclaimed that today’s high interest rate environment remains a burden and that more interest rate hikes could fuel further bearishness. (Source: Bloomberg) Despite cost overruns and delays, Codelco, the world's largest copper miner, will raise more debt to fund its growth plans, CEO Maximo Pacheco recently reiterated. Pacheco proclaimed that production in 2023 will be low, with growth coming “gradually but consistently” as new projects start. Production in 2023 could be the lowest in 25 years due to poor weather, declining ore grades, political strife, and other issues. (Source: Bloomberg) |

|

|

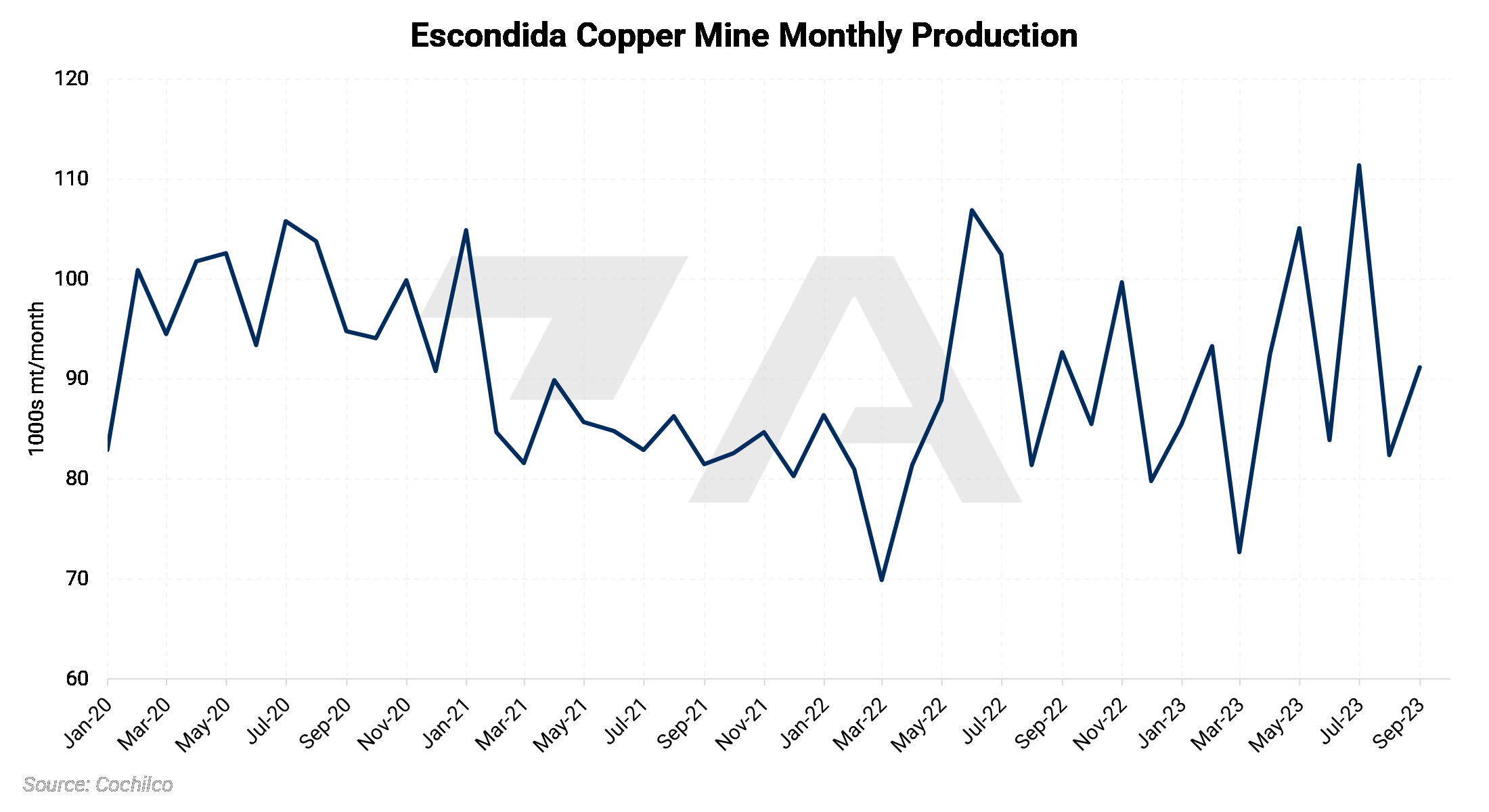

Codelco has negotiated a $90/mt premium over LME prices with China’s top copper importers for shipments in 2024. This is down from the $140/mt premium these importers paid in 2023. Approximately 40% to 45% of Codelco’s sales go to China. The premium that Codelco sets with its Chinese buyers is usually seen as a global benchmark. (Source: Reuters) As a final note regarding Chilean production, with a last-minute deal in place, BHP has averted a worker strike at Chile’s Escondida copper mine. The agreement still needs to be ratified by union members, BHP stated on Thursday. The Escondida mine is the world’s largest, responsible for about 5% of global production. (Source: Bloomberg) |

|

|

Steel The American physical steel market stabilized this past week, with Argus’s weekly domestic HRC assessment unchanged at $700/st. This is $40/st off the September lows. Buyers remain hesitant, mainly because most secured volumes are at prices lower than current market. The ongoing autoworkers strike remains a concern and a stumbling block for buyers, with end-users reluctant to purchase more than their spot needs. (Source: Argus) Metals prices reacted little to the fighting that Hamas, which is backed by Iran, initiated in Israel over the weekend. This is likely because Israel is not a significant metals producer. Iran, however, is the 10th largest steel producer in the world. Most of their steel gets exported to the UAE, which is right across the Persian Gulf, for use in the oil industry. Any further escalation or counterattacks on Iran’s infrastructure could impact their steel production. (Source: USGS) |

|||||

|

|

|||||

|

Moving over to China, the country’s recently formed state-owned mineral buying agency, known as China Mineral Resources Group Co (CMRG), is negotiating iron ore purchase agreements for most of China’s largest steel mills, according to anonymous sources cited by Bloomberg. CMRG aims to get favorable terms on transport, grades, and delivery arrangements from the world’s top iron suppliers, such as Rio Tinto, BHP, Fortescue Metals, and Vale, the sources stated. If successful, CMRG could further increase China’s buying power in the global iron ore trade. China imports nearly 75% of the world’s iron ore. (Source: Bloomberg) In other raw materials, prices for nickel, a key raw material for stainless steel production, have essentially stalled in the first half of October. As of this writing, the last trade on the LME Nickel 3M Select contract was $18,580/mt, down $115/mt, or 0.6% on the month. This lackluster price action comes after a nearly 40% drop in global prices this year. According to Shanghai Metal Market, oversupply remains a concern, while demand has been and could remain subdued. (Source: Shanghai Metal Market) Finally, the EU is currently working with the US on a set of tariffs that would further restrict imports of Chinese-produced steel and aluminum. The new measure would be a provision to the Global Steel and Aluminum Arrangement (GSA) and would target non-market excess capacity and carbon emissions. An announcement is expected during an October 20 summit in Washington. If an agreement isn’t set by October 31, the tariffs would be reinstated on approximately $10 billion of exports between the US and the EU. (Source: Bloomberg) |

|||||

|

|

|||||

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,199.5/mt, down $40/mt on the week. Aluminum prices were down this week. This has caused the futures forward curve to shift vertically lower by approximately $40/mt. It remains in a steep contango, meaning nearby prices are lower than forward prices. Aluminum consumers concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

Midwest Premium |

|||||

|

Prompt month CME MWP last traded/settled at 19.3¢/lb this week. The CME Midwest Premium market is now in a slight contango from the October ‘23 contract on forward. The CME Midwest Premium swap market is thinly traded, with no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please get in touch with AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $7,949/mt, down $97/mt on the week. Compared to last Friday, LME Copper's forward curve has fallen vertically by approximately $100/mt and remains in contango for the remainder of 2023 and throughout 2024 and 2025. The copper market has sufficient liquidity to use swaps and options. Depending upon their risk tolerance, consumers might consider strategies that use only swaps or options or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $18,546/mt, down $36/mt on the week. As prices were down this week, nickel’s forward curve has also shifted vertically lower by about $35/mt. It remains in a steep contango, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Depending upon your risk tolerance, consumers might consider strategies that use only swaps or options or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded/settled at $695/T, down $10/T on the week. The spread between CME HRC Steel and CME MW Busheling Scrap is generally used as a proxy for steel mill profitability. This spread currently sits at about $315/st, falling over 50% since the mid-April high of $731/st. Despite this significant drop, steel mills should consider hedging production and raw material usage for late 2023 and early 2024. For most steel producers, this would consist of buying CME MW Busheling Scrap swaps and selling CME HRC swaps. Options are available for CME HRC, but they are relatively illiquid. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

10/11/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 10/02/2023: Important US Economic Data (AEGIS Reference) 09/28/2023: Aluminum Buyers Should Hedge Alongside Chinese Importers 09/08/2023: Despite Price Slump, Hedging is Still Feasible for Steel Producers 08/25/2023: Growing Secondary Aluminum Supply Could Further Weigh on Prices |

|||||

Notable News |

|||||

|

10/13/2023: UPDATE 2-China Sept copper imports slide amid strong domestic production 10/10/2023: LME WEEK-China's top copper buyers expect a 36% cut in Codelco premium -sources 10/10/2023: From Detroit Three to healthcare, US labor unions flex muscle 10/9/2023: Investors on guard for oil price spike amid Middle East turmoil |

|||||