|

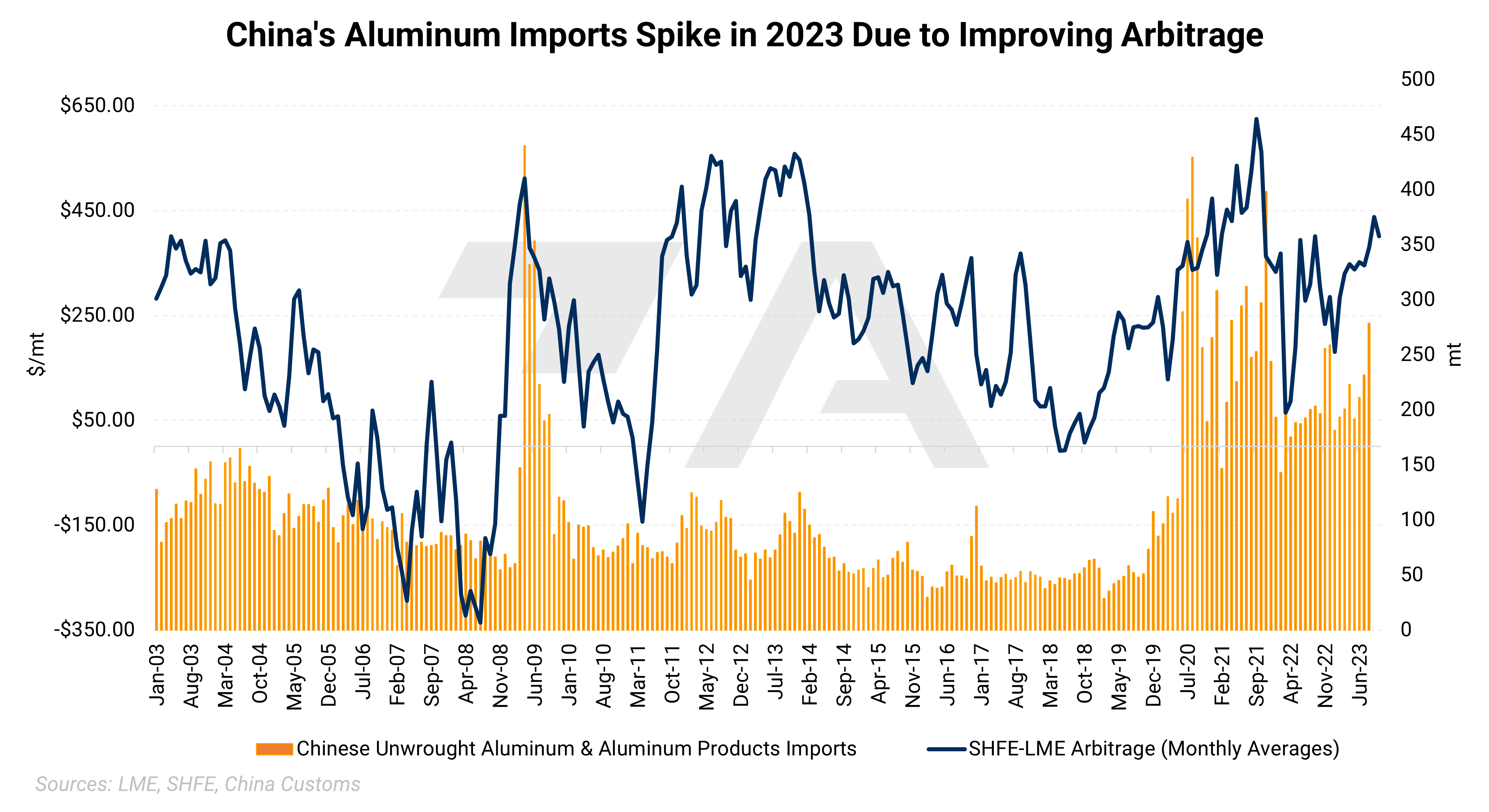

Aluminum Aluminum has been a tale of two markets this year, with SHFE prices holding steady while LME prices have fallen about 8.2% so far this year. The recent strength in China’s domestic (SHFE) prices is due to growing demand from the country’s automotive, new energy, air-conditioning, and power sectors, according to CRU. According to BloombergNEF, China is “adding more solar panels in 2023 than the US has ever built, and by the end of the year will have enough wind generation capacity to power Germany, France and the UK combined.” Meanwhile, the diverging markets have created China’s strongest import market since late 2022, leading to soaring imports. (Source: Bloomberg) |

|

At 193,350 mt, LME on-warrant aluminum inventories, meaning the metal is available to trade, have slipped to nearly the lowest level since late January. This is mainly due to traders taking deliveries from Malaysian and South Korean warehouses. The LME’s South Korean warehouses are known repositories for Indian-origin metal, while South Korean warehouses house mainly Russian-origin metal. (Source: LME)

|

|

|

China’s aluminum smelters continue to pump out record volumes. Last month, daily production averaged 119,000 mt, up 3,000 mt from August, which was also a record. The recent uptick in production is mainly due to restarting previously curtailed output in China’s largest production region, Yunnan province. The province suffered a significant drought in 2023, leading to less hydropower-produced electricity. As hydropower generation increased, aluminum smelters were able to ramp up output. (Source: Bloomberg) Regarding other major producers, in Q3, Rio Tinto, the largest aluminum producer in the Western world, saw its aluminum production jump by 9.1% to 928,000 mt, the company announced yesterday. Production of bauxite and alumina also increased slightly. As for metals demand, the company stated, “China’s economic recovery has been uneven, as the property market continues to weigh on the economy and prompts further policy easing…. Consumer confidence in the US has started to wane while manufacturing activity in advanced economies decelerated further as recessionary risks remain.” (Source: Bloomberg) Finally, due to an ongoing glut of alumina, the raw material for aluminum production, Alcoa has begun cutting the workforce at its Kwinana refinery in Australia, the company announced this week. The company also stated that this move is part of a “restructuring program” at the refinery. The Kwinana facility is the oldest of Alcoa’s three Australian alumina smelters and has an annual nameplate capacity of 2.2 million mt. (Sources: Alcoa, Bloomberg) |

|

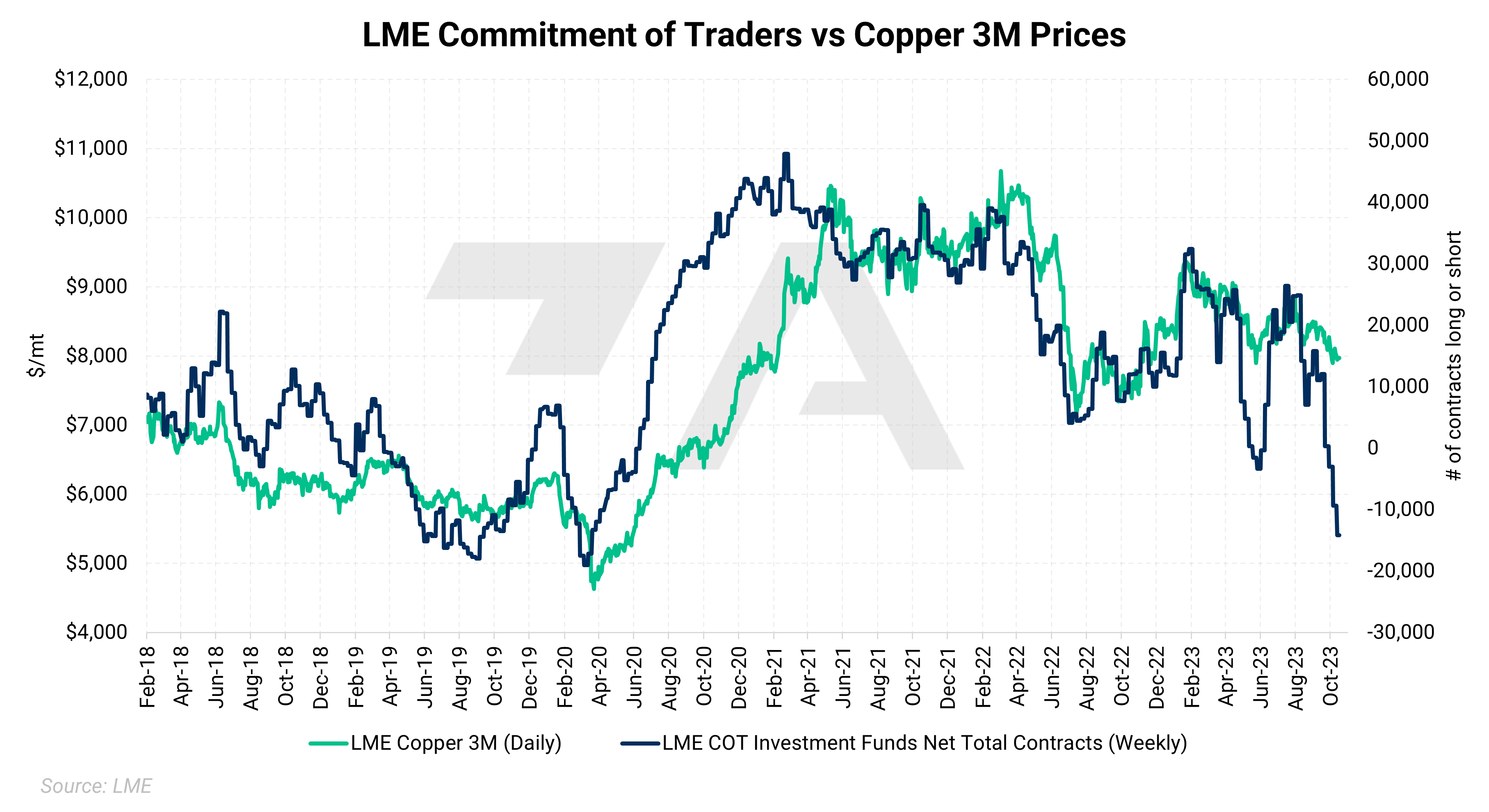

Copper Traders continue to pressure the LME copper market. As of last Friday, investment funds, which are purely speculators in metals markets, added 4,794 contracts to the net short position in LME copper last week. This brings the total net short position to 14,147 contracts, the largest since March 2020, and likely why LME Copper prices fell over 1% last week. (Source: LME) |

|

|

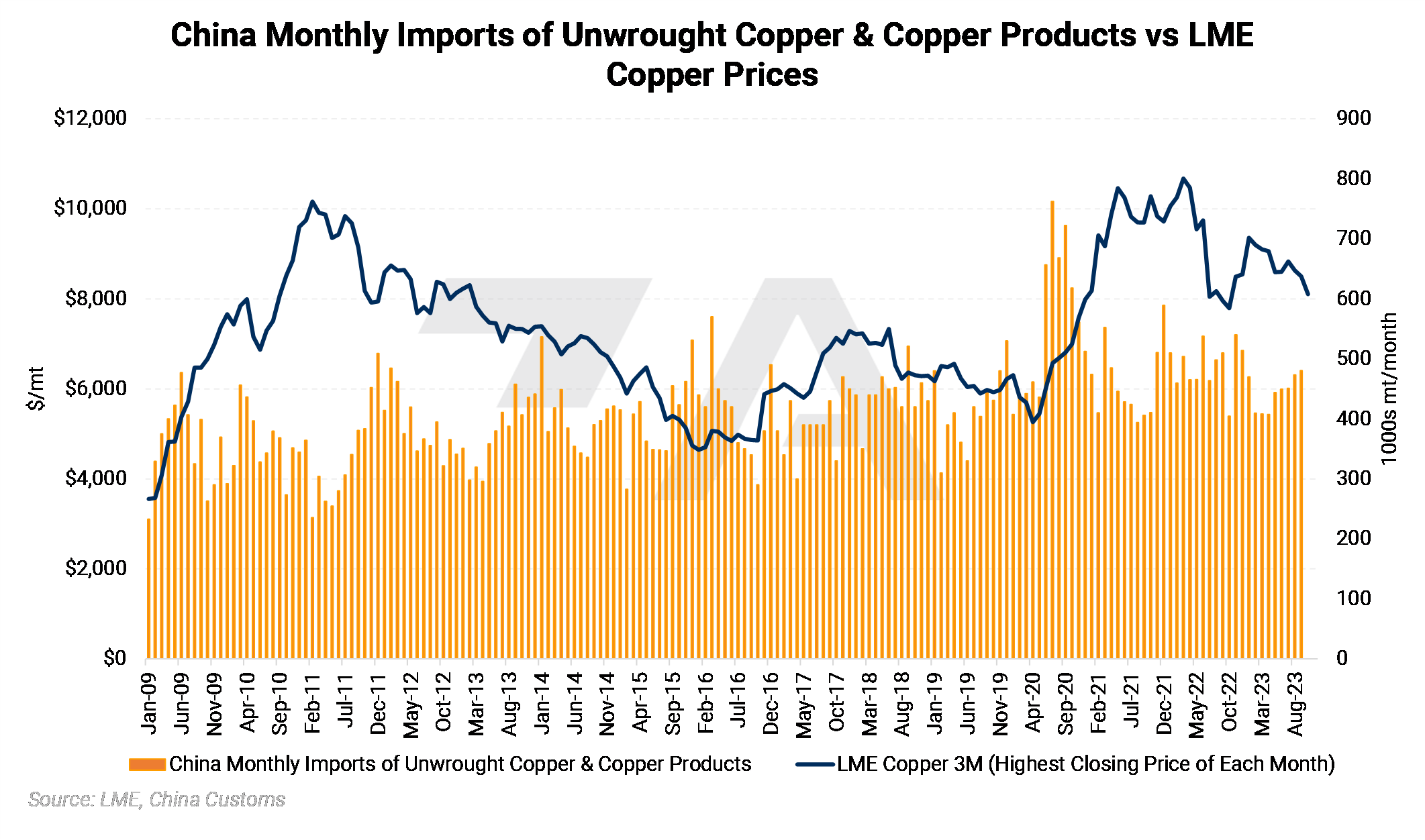

Although some analysts are bullish on metals demand, Citigroup remains bearish on global copper demand over the next six to twelve months as the macroeconomic environment remains weak. They also stated that prices remain skewed to the downside. These comments were reinforced by the reportedly downbeat mood at the recent LME Week conference. (Source: Bloomberg) Chinese demand continues to suffer. Through September, China’s imports of unwrought copper and copper products have fallen by about 9.5% compared to last year, customs data showed on Friday. The country has imported 3.99 million mt of unwrought copper and copper products, of which 480,426 mt came in September alone. Although Chinese copper demand has picked up recently, so has refined production, leading to fewer imports. (Source: China Customs, Reuters) |

|

|

In Q3, Freeport-McMoran, one of the world’s largest copper miners, reported a 4.2% increase in copper production compared to 3Q2022. Copper production totaled 1.1 billion lbs at a net cash cost of $1.73/lb. The net cash cost was down about 1.1% compared to last year, while the average realized price was $3.80/lb, up 8.6% compared to 3Q2022. The company estimates it will produce 4.06 billion lbs this year, up slightly from its prior forecast of 4 billion lbs. Net cash costs for copper production will be $1.63/lb, up from their previous estimate of $1.55/lb. (Source: Bloomberg) Lastly, Glencore is closing its Mount Isa copper mines in Australia by the end of 2025, citing declining ore grades and the fact that the mines have reached the end of their natural life. The copper smelter and refinery will remain open, as there is enough 3rd party business to make them operational. The zinc operations will remain unaffected. The Mount Isa mines are the second-largest copper producer in Australia. (Sources: Glencore, Bloomberg) |

|

|

|

Steel US and EU officials failed to reach an agreement this week on a trade dispute over Trump-era tariffs on steel and aluminum. Negotiations are set to continue, however. If the trade dispute is not resolved by year's end, the US will reinstate tariffs on steel and aluminum imports from the EU, and the EU will likely retaliate with similar tariffs. In 2017, due to national security risks, then-President Donald Trump slapped tariffs on steel and aluminum imports from the EU, leading the EU to respond with retaliatory tariffs on the US. (Source: Bloomberg) Thyssenkrupp, one of the world's largest steel producers, said the European steel market has “deteriorated markedly” due to high energy and raw material costs, as well as Germany’s slowing economy. Importing cheaper Chinese steel is also weighing on steel prices, they also proclaimed. (Source: Reuters) India’s steel demand continues to soar. Specifically regarding stainless steel, the country's top producer, Jindal Stainless, saw its Q2 profit nearly double compared to last year amid a government-led push for stainless steel usage. The company also stated they are worried about imports of Chinese stainless steel. "The unchecked inflow of subsidised and substandard foreign imports continued to distort the level playing field against Indian manufacturers,” Jindal proclaimed. (Source: Reuters) As for raw materials, anonymous sources have told Bloomberg that Tesla’s upcoming Cybertruck will use stainless steel from Finland’s Outokumpu Oyj. According to the sources, this stainless steel will come from Outokumpu Oyj’s facility in Calvert, Alabama. Outokumpu Oyj is Europe’s largest stainless-steel producer and the second-largest in the Americas. (Source: Bloomberg) In raw material-related markets, the prompt-month CME hot-dipped-galvanized (HDG) Premium contract has ticked slightly higher to $170/st in October. Before the recent rally, this premium had been flat at $150/mt for nearly three months. In 2023, the CME HDG premium has fallen alongside LME zinc. Prices for LME Zinc, the key raw material for HDG steel production, have fallen 19% this year, making it the second worst-performing LME metal. (Sources: LME, CME) |

|||||

|

|

|||||

|

|

|||||

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,181.5/mt, down $18/mt on the week. Aluminum prices were down this week. This has caused the futures forward curve to shift vertically lower by approximately $20/mt. It remains in a steep contango, meaning nearby prices are lower than forward prices. Aluminum consumers concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

Midwest Premium |

|||||

|

Prompt month CME MWP last traded/settled at 19.3¢/lb this week. The CME Midwest Premium market is now in a contango from the October ‘23 contract on forward. The CME Midwest Premium swap market is thinly traded, with no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please get in touch with AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $7,948.5/mt, down $0.5/mt on the week. Compared to last Friday, LME Copper's forward curve is essentially unchanged and remains in contango for the remainder of 2023 and throughout 2024 and 2025. The copper market has sufficient liquidity to use swaps and options. Depending upon their risk tolerance, consumers might consider strategies that use only swaps or options or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $18,588/mt, up $42/mt on the week. As prices were up this week, nickel’s forward curve has also shifted vertically higher by about $40/mt. It remains in a steep contango, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Depending upon your risk tolerance, consumers might consider strategies that use only swaps or options or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded/settled at $703/T, up $8/T on the week. The spread between CME HRC Steel and CME MW Busheling Scrap is generally used as a proxy for steel mill profitability. This spread currently sits at about $306/st, falling over 50% since the mid-April high of $731/st. Despite this significant drop, steel mills should consider hedging production and raw material usage for late 2023 and early 2024. For most steel producers, this would consist of buying CME MW Busheling Scrap swaps and selling CME HRC swaps. Options are available for CME HRC, but they are relatively illiquid. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

10/18/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 10/17/2023: Important US Economic Data (AEGIS Reference) 09/28/2023: Aluminum Buyers Should Hedge Alongside Chinese Importers 09/08/2023: Despite Price Slump, Hedging is Still Feasible for Steel Producers 08/25/2023: Growing Secondary Aluminum Supply Could Further Weigh on Prices |

|||||

Notable News |

|||||

|

10/20/2023: EU, US to keep talking about tariffs as war in Israel and Ukraine overshadow summit 10/20/2023: Panama congress signs off on contract with Canada's First Quantum 10/20/2023: China weighs options to blunt U.S. sanctions in a Taiwan conflict 10/20/2023: China's rare earths dominance in focus after it limits germanium and gallium exports 10/20/2023: Wall Street dips as benchmark US bond yields breach 5% 10/20/2023: Vietnam arrests rare earth industry officials, casting shadow over plans to rival China 10/19/2023: Rio Tinto flags return to record iron ore production 10/18/2023: Thyssenkrupp sees steel market deteriorating, M&A talks unaffected for now 10/17/2023: LME Week consensus is a bright future but short-term pain 10/17/2023: Glencore to shut Mount Isa copper mines by 2025, cut 1,000 jobs - AFR 10/16/2023: U.S, EU business groups push for steel deal, minerals drive at summit 10/13/2023: Large EU steelmakers shun OEM index requests |

|||||