|

Aluminum Norsk Hydro, one of the largest aluminum producers in the EU, said its earnings from bauxite & alumina sales fell by 85% last quarter, while earnings from aluminum sales fell by 79%. This is mainly due to lower volumes amid falling prices. The company stated that global industrial and real estate-related demand continued to fall in Q3. Specifically, regarding China, the country’s EV and renewable energy sectors remain robust aluminum demand sources. Norsk Hydro’s CEO also stated that margins in 2024 and 2025 will be supported by its “strategic hedging program.” The company has 440,000 mt currently hedged at an LME price of $2,500/mt in 2024 and 300,000 mt hedged at an LME price of $2,400/mt in 2025. (Sources: Bloomberg) |

Last quarter, Alcoa produced 532,000 mt of aluminum, up 7% compared to 3Q2022. Similarly, at 630,000 mt, aluminum shipments were also up slightly. The company’s average aluminum third-party sales price slumped to $2,647/mt, down 17% year-over-over. Meanwhile, alumina shipments were up despite lower production. (Source: Bloomberg)

Rusal, Russia’s top aluminum producer, might idle several unprofitable smelters, according to recent Bloomberg reports. This unprofitability stems from low global aluminum prices and Russia’s onerous export tax. Bloomberg noted that Rusal has not been at full capacity for some time. Last year, the company produced 3.8 million mt, even though its annual nameplate capacity is 4.2 million mt. (Source: Bloomberg)

The news on Rusal continues. In a rare move, Rusal has agreed to acquire a 30% stake in Chinese alumina producer Hebei Wenfeng New Materials. This will help Rusal fill an alumina supply gap that has flared up due to the Russia-Ukraine conflict. Since the conflict began in February 2022, Rusal has struggled to secure non-domestic supplies of the key raw material due to self-sanctioning efforts by foreign suppliers and other supply constraints. (Source: Bloomberg)

Russia’s primary aluminum shipments to China continue to surge. Last month, a record 152,877 mt of Russian aluminum went to China, bringing the year-to-date total to 806,253 mt. So far this year, approximately 84% of China’s total primary aluminum imports have come from Russia. (Source: Bloomberg, China Customs)

|

|

|

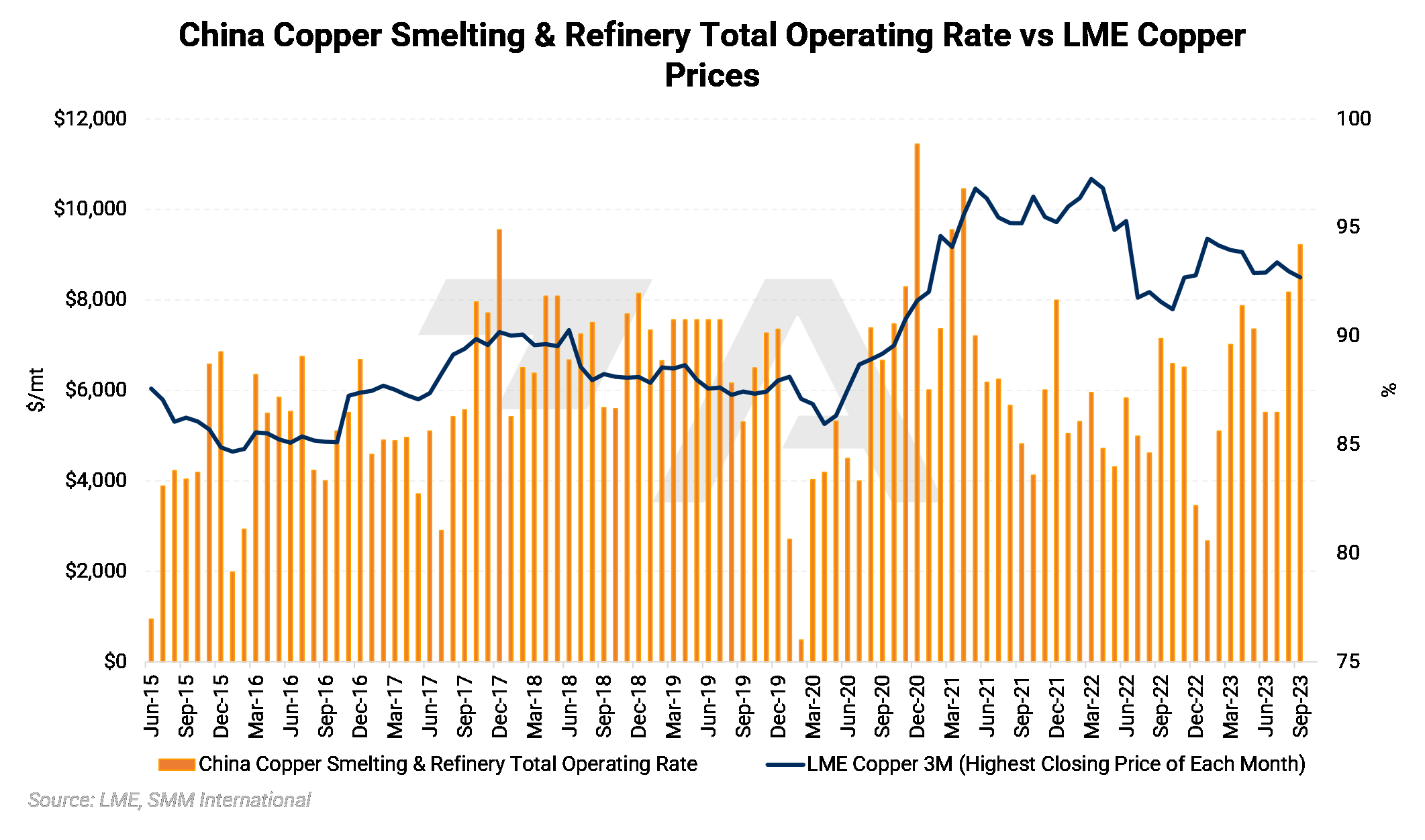

Copper Copper prices rallied only about 1.9% this week despite the Chinese government's new round of stimulus measures. Earlier this week, Beijing approved $137 billion in sovereign debt that will be used for disaster relief and the construction sector. Despite the copper market’s lackluster response, some analysts applauded the measures. “The additional fiscal support approved today is the intervention we had been expecting, and that was needed to prevent an abrupt fiscal tightening in China in the closing weeks of the year,” said Mark Williams, chief Asia economist at Capital Economics Ltd. (Source: Bloomberg) Traders could be pulling copper from LME warehouses. As of this morning, canceled warrants, meaning the metal is set for delivery, totaled 18,800 mt, up from a mere 3,050 mt at the beginning of the month. This could be a signal that demand is trying to stabilize. LME copper prices have fallen approximately 5.5% this year due to slumping global demand. (Source: Bloomberg) Last Friday, the Panamanian government passed a new contract with First Quantum, operator of Panama’s largest copper mines. The new contract stems from a years-long battle over royalties and averts a possible mine shutdown. The Cobra Panama mine is responsible for about 1.5% of global production and is First Quantum’s top revenue source. (Sources: Bloomberg, Reuters) Due to construction delays and other issues, Canadian copper producer Teck Resources now estimates its Quebrada Blanca 2 expansion in Chile will cost $600 million more than expected, the company stated earlier this week. Regulators recommended against approving the expansion, leading Teck to pull their environmental permit application. Meanwhile, submitting a new, revised environmental permit application will add 12 months to the regulatory process, Teck stated. Many other copper mining projects worldwide are experiencing project delays and spiraling costs. (Source: Bloomberg) China’s copper smelters continue to churn out record volumes. In September, the country’s refined copper production hit 1.14 million mt, a new record output for the second month in a row. Chinese refined copper production has been 1 million mt or higher for every month so far in 2023. This record production comes amid higher demand from the renewable energy sector despite a sagging real-estate sector. Smelter capacity utilization, which measures how much of the country’s capacity is being used, reached 94.21%, a new high for 2023. (Sources: Bloomberg, Shanghai Metal Market) |

|

|

Steel The US could keep its current tariff suspension on imports of EU-origin steel and aluminum in place while negotiations continue, the US ambassador to the EU stated yesterday. The current tariff suspension is set to expire on December 31, 2023, unless the US and EU intervene. In 2017, the Trump administration implemented a 10% import tariff on EU-produced aluminum and 25% on EU steel, citing national security. The tariffs were suspended in January 2022 and replaced with a tariff rate quota system. (Source: Reuters) Nucor and Cleveland Cliffs are raising their minimum HRC steel sales price to $800/st; the companies announced last week Thursday. This is up slightly from the $750/st price minimum both companies set late last month and higher than Argus’s most recent weekly domestic HRC price assessment. Last Tuesday, Argus set its weekly domestic HRC assessment at $750/st, up $50/st from the previous week. (Source: Argus) Due to higher costs and lower volumes, Nucor’s sales last quarter were $883 million, well below one analyst’s estimate of $1 billion. In Q3, Nucor had an average scrap and scrap substitute of $415/gross ton, higher than their estimate of $391.37/gross ton. Given that the average 2024 CME Busheling Fe Scrap futures price is approximately $495/gross ton, unless prices drop significantly, Nucor could experience high raw material costs into 2024. (Source: Bloomberg, CME) Rio Tinto, the world's largest iron ore producer, plans to increase production capacity at its newest project in Western Australia to a record 50 million mt in the coming years. Rio Tinto did not give a timeline for this expansion, but analysts interviewed by Reuters believe it will occur by 2025. Due to urbanization, Rio Tinto believes that demand for the steelmaking ingredient will grow extensively over the next 20 or more years. (Source: Reuters) Continuing on raw materials, prices for nickel, a key raw material for stainless steel production, continue to plummet. Since September 1, prices have fallen nearly 10%, or $2,005/mt, to $18,345/mt as of this writing. This could be mainly due to investment funds, which are purely speculators in the metals markets, building a significant short position in LME Nickel. As of last Friday, these investment funds are net short 18,550 contracts, their largest short position since mid-2019. (Source: LME) |

|||||

|

|

|||||

|

|

|||||

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,220/mt, up $38.5/mt on the week. Aluminum prices were up this week. This has caused the futures forward curve to shift vertically higher by approximately $40/mt. It remains in a steep contango, meaning nearby prices are lower than forward prices. Aluminum consumers concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

Midwest Premium |

|||||

|

Prompt month CME MWP last traded/settled at 19.3¢/lb this week. The CME Midwest Premium market is now in a contango from the October ‘23 contract on forward. The CME Midwest Premium swap market is thinly traded, with no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please get in touch with AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,099/mt, up $150.5/mt on the week. Compared to last Friday, LME Copper's forward curve has risen vertically by approximately $150/mt and remains in contango for the remainder of 2023 and throughout 2024 and 2025. The copper market has sufficient liquidity to use swaps and options. Depending on their risk tolerance, consumers might consider strategies that use only swaps, options, or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $18,374/mt, down $214/mt on the week. As prices were down this week, nickel’s forward curve has also shifted vertically lower by about $210/mt. It remains in a steep contango, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Depending upon your risk tolerance, consumers might consider strategies that use only swaps or options or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded/settled at $860/T, up $56/T on the week. Steel mill profit margins have improved dramatically since early September. The CME HRC Steel – CME MW Busheling Fe Scrap spread, which is generally used as a gauge for steel mill profitability, is now approximately $472/st, up from about $320/st on September 1. Even though CME MW Busheling Fe Scrap prices have risen slightly, this improvement in steel mill profitability is because HRC steel has rallied more than busheling scrap. Since steel prices have significantly recently, mills should consider hedging production and raw material usage for late 2023 and early 2024. For most steel producers, this would consist of buying CME MW Busheling Scrap swaps and selling CME HRC swaps. Options are available for CME HRC, but they are relatively illiquid. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

10/25/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 10/17/2023: Important US Economic Data (AEGIS Reference) 09/28/2023: Aluminum Buyers Should Hedge Alongside Chinese Importers 09/08/2023: Despite Price Slump, Hedging is Still Feasible for Steel Producers 08/25/2023: Growing Secondary Aluminum Supply Could Further Weigh on Prices |

|||||

Notable News |

|||||

|

10/25/2023: U.S. will extend EU metals tariff exemption if needed -envoy 10/24/2023: Stellantis to enter JV with Orano to recycle electric car batteries 10/24/2023: Hydro gets boost from renewables deal as Q3 core profit lags 10/24/2023: Teck Resources misses quarterly profit estimates, trims copper output forecast |

|||||