|

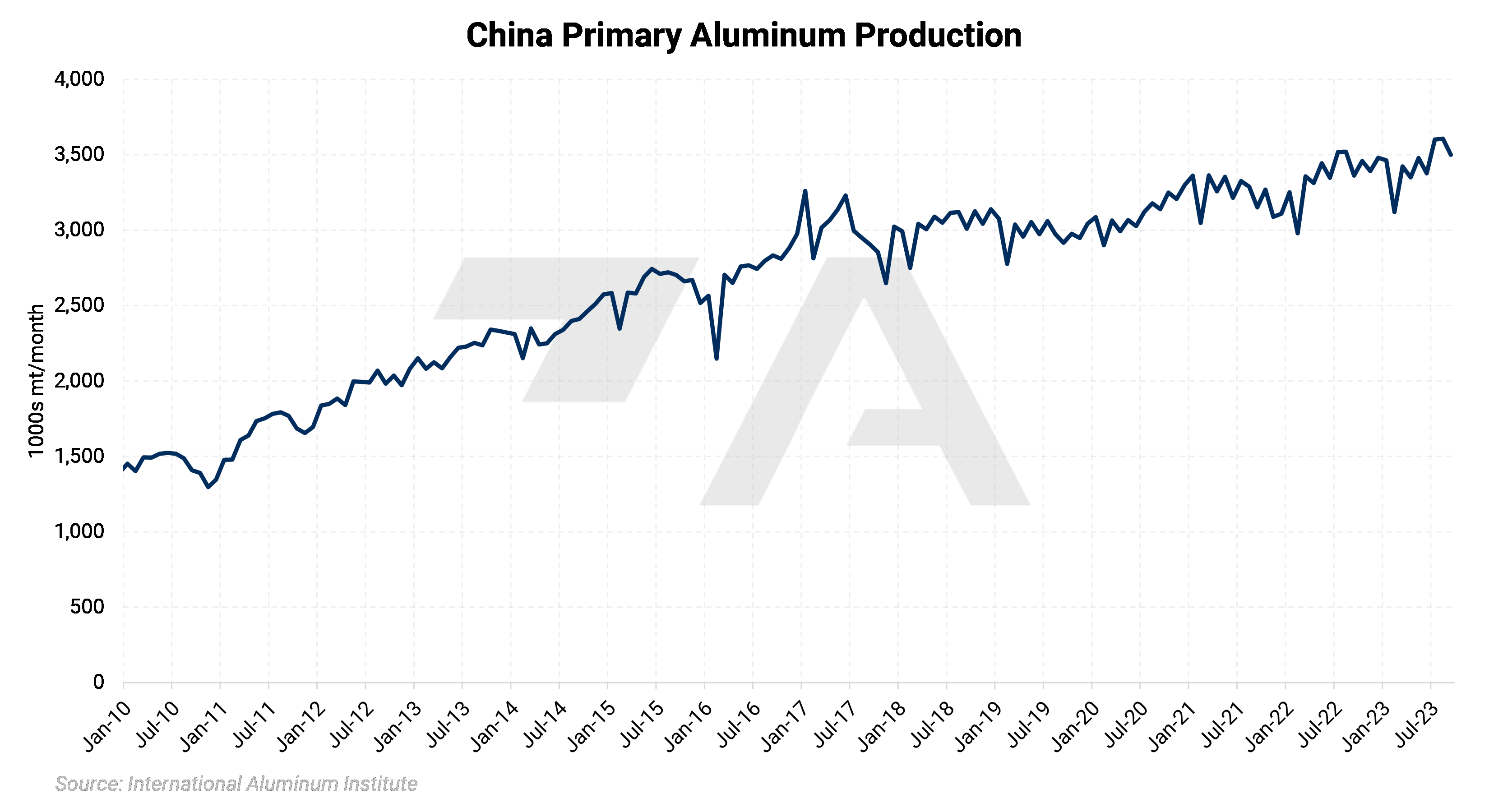

Aluminum Aluminum smelters in China’s Yunnan province, the country’s top production region, will soon curtail output by between 9% to 40%, according to recent reports. These production cuts are due to anticipated hydropower supply issues as the region enters its dry season. Based on calculations by Goldman Sachs, this will remove approximately 600,000 mt out of production from November through May. (Sources: Bloomberg, Reuters) |

|

China’s primary inventories have increased dramatically in October. Since the end of September, SHFE on-warrant inventories have increased by 35,545 mt, while social inventories (which include SHFE on-warrant inventories and aluminum held in private, off-exchange warehouses) have increased by 161,000 mt. Given the nearly 125,455 mt discrepancy, this suggests that non-SHFE inventories have increased more than SHFE inventories. This contra-seasonal inventory build suggests that Chinese aluminum demand could be slowing. (Source: SHFE, Shanghai Metal Market)

|

|

|

China’s alumina imports, a critical raw material for aluminum, have slumped this year, according to Shanghai Metal Market (SMM). Through September, China has imported 1.3306 million mt of alumina, down about 8% compared to last year. In September alone, imports totaled 191,400 mt, down year-over-year and month-over-month. SMM did not cite a specific reason for the drop in imports, but it could be due to ample port inventories. After falling to the lowest since at least 2015, alumina inventories have jumped significantly. This suggests that domestic alumina demand has fallen, leading to falling imports while inventories build. (Sources: Shanghai Metal Market, Mysteel) |

|

|

|

Finally, regarding Russian aluminum supply, Rusal is devoting more capital to its port project in Russia’s Far East, the company announced this week. The port, which will take about three years to complete, could be used for both alumina imports and aluminum exports, they also stated. Capacity is expected to be about 1.5 million mt/year. (Source: Bloomberg) |

|

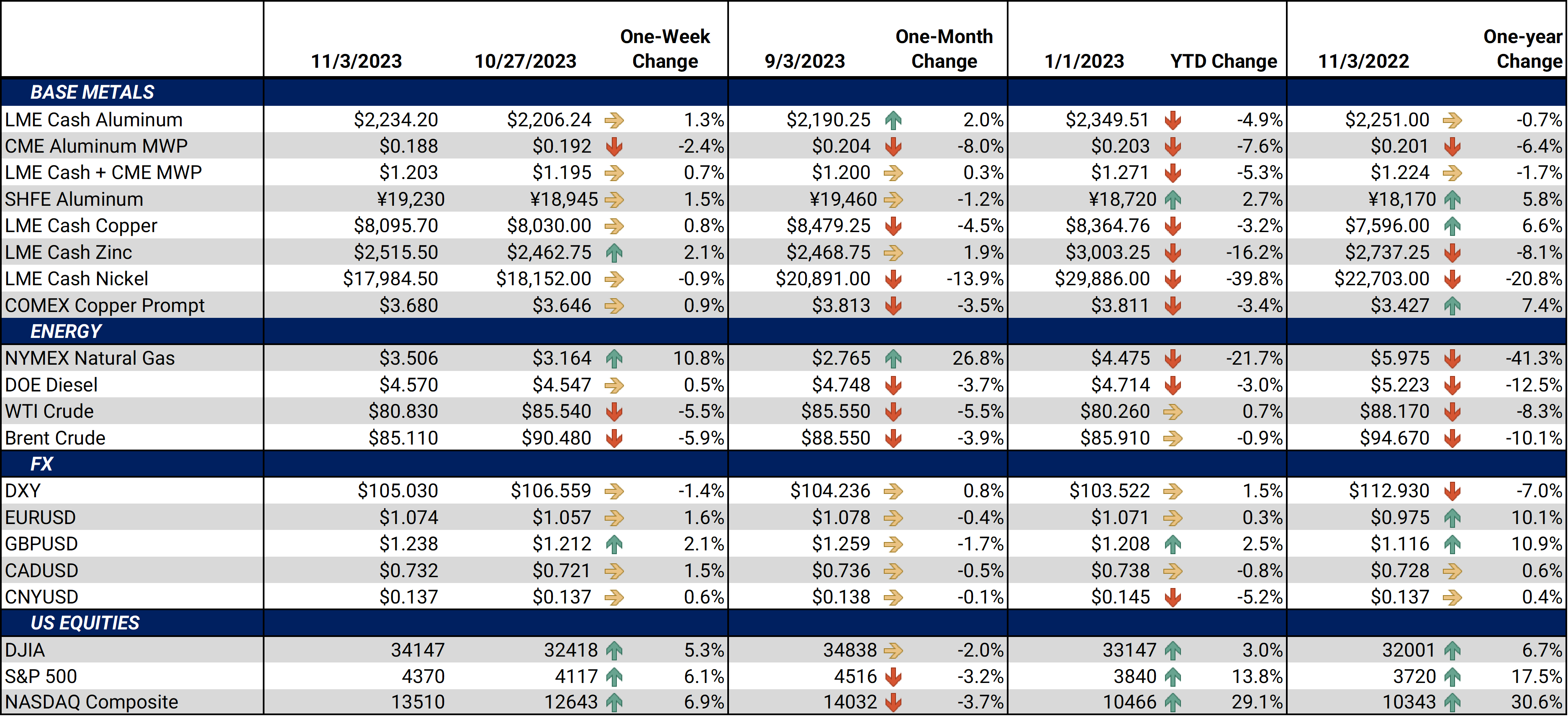

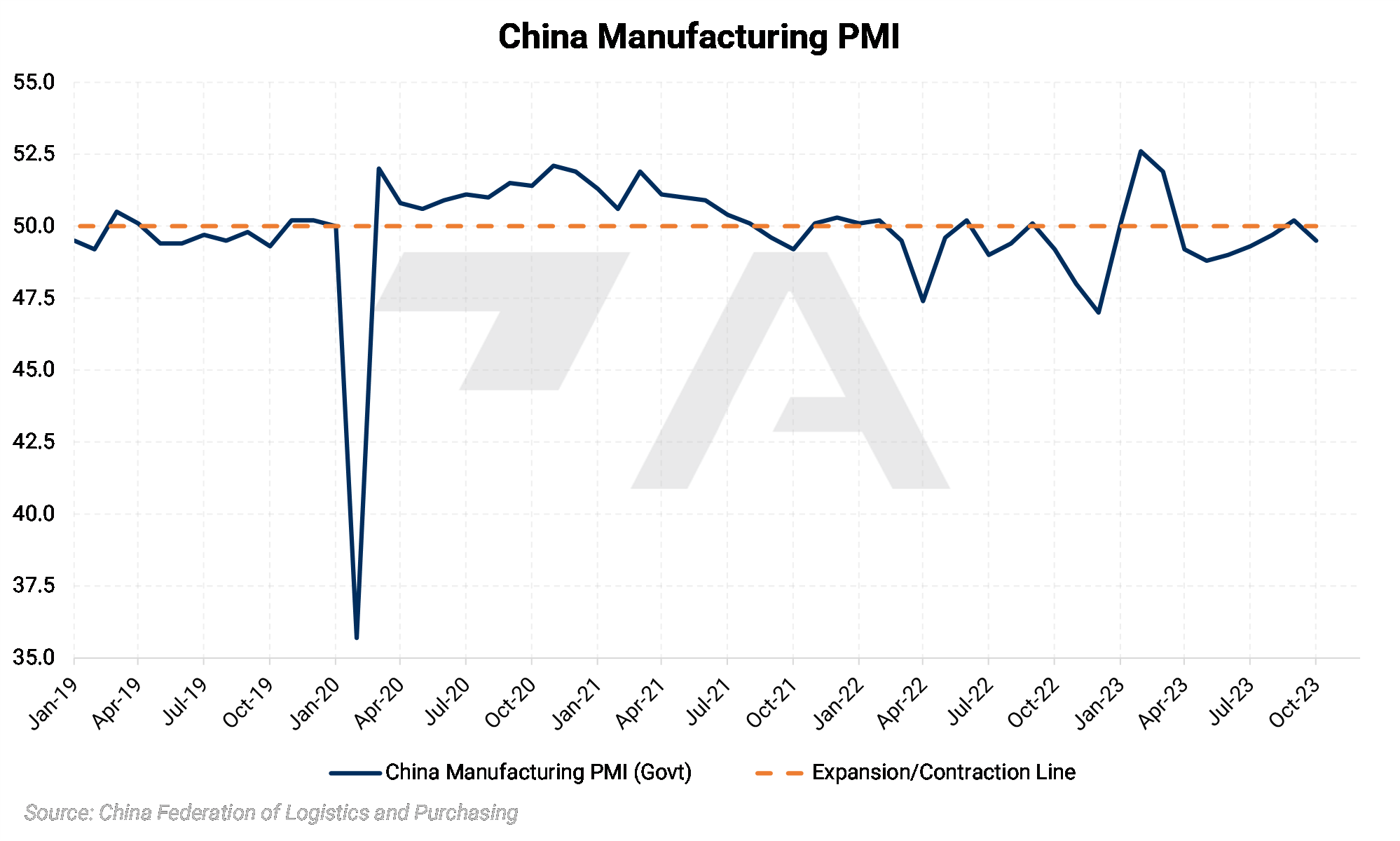

Copper Most LME metals, including copper, were up slightly this week even though Chinese economic data continues to disappoint. China’s official Manufacturing Purchasing Managers’ Index (PMI), a key gauge of the country’s manufacturing sector, fell in October, signaling that the sector continues to contract. Except for a brief spike in September, China’s manufacturing sector has been contracting since April. (Source: Bloomberg) |

|

|

Chile’s Codelco, the world’s largest copper miner, could be hit with an employee strike in the coming days, the workers’ union suggested late last week. Codelco is currently proposing job cuts to offset slumping production, prompting workers to threaten a strike. Amador Pantoja, president of the Federation of Copper Workers (FTC) - which represents Codelco’s worker unions, suggested that the company should focus on getting new projects online rather than job cuts. (Source: Reuters) |

|

|

|

The outlook for Antofagasta, one of Chile’s other major copper miners, is starting to improve. In a note earlier this week, RBC Capital Markets stated that Antofagasta will benefit from resilient Chinese demand, even though demand from Western economies continues to suffer. They added that the US Federal Reserve’s pausing of interest rate hikes could further help copper demand. (Source: Bloomberg) New mining projects in Panama could be in jeopardy. Despite backlash and protests that flared days after the Panamanian government approved a new contract with First Quantum Minerals, the government will not rescind the contract, they stated on Thursday. A new bill that was debated on Thursday issued a moratorium on only new mining projects. First Quantum’s Panamanian operation accounts for about 1.5% of global copper mine production. (Source: Reuters, USGS) |

|

Steel Late Monday night, the United Auto Workers (UAW) union struck a tentative deal with General Motors, ending a nearly six-week-long strike. This newest development essentially ends the UAW's strikes against Detroit’s “Big Three” automakers. Last week, the UAW had struck deals with Ford and Stellantis. The agreement with Stellantis still needs to be approved and ratified by union leaders and members. (Sources: CNBC, Reuters) Steel mill profit margins have improved dramatically since early September. The CME HRC Steel – CME MW Busheling Fe Scrap spread, which is generally used as a gauge for steel mill profitability, is now approximately $480/st, up from about $320/st on September 1. Even though CME MW Busheling Fe Scrap prices have risen slightly, this improvement in steel mill profitability is because HRC steel has rallied more than busheling scrap. (Source: CME) |

|||||

|

|

|||||

|

As for raw materials, BHP, one of Australia’s largest iron ore producers, could be hit with a worker strike in early November. Unless BHP negotiates for better pay and benefits, certain railroad workers for the company’s Western Australian Iron Ore unit will likely strike, the union announced earlier this week. Australia is responsible for nearly one-third of global iron ore production, according to the USGS. (Source: Argus, USGS) Due to low zinc prices amid high inflation, Nyrstar will close two Tennessee-based zinc mines at the end of November, the company announced earlier this week. Despite the closure, the zinc market appears to suffer from lackluster demand rather than oversupply. As Morgan Stanley recently stated, “most zinc [is] used to galvanize steel, which faces demand challenges from weak construction activity, we would still see surpluses. In our view, a stronger demand recovery is needed for a more sustained rally.” Zinc is the second-worst performing LME metal in 2023, down about 16% as of this writing. (Source: Reuters) |

|||||

|

|

|||||

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,254/mt, up $34/mt on the week. Aluminum prices were up this week. This has caused the futures forward curve to shift vertically higher by approximately $35/mt. It remains in a steep contango, meaning nearby prices are lower than forward prices. Aluminum consumers concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

Midwest Premium |

|||||

|

Prompt month CME MWP last traded/settled at 18.8¢/lb this week. The CME Midwest Premium market is now in a contango from the November ‘23 contract on forward. The CME Midwest Premium swap market is thinly traded, with no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please get in touch with AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,175.5/mt, up $76.5/mt on the week. Compared to last Friday, LME Copper's forward curve has risen vertically by approximately $75/mt and remains in contango for the remainder of 2023 and throughout 2024 and 2025. The copper market has sufficient liquidity to use swaps and options. Depending on their risk tolerance, consumers might consider strategies that use only swaps, options, or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $18,223/mt, down $151/mt on the week. As prices were down this week, nickel’s forward curve has also shifted vertically lower by about $150/mt. It remains in a steep contango, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Depending upon your risk tolerance, consumers might consider strategies that use only swaps or options or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded/settled at $879/T, up $13/T on the week. Steel mill profit margins have improved dramatically since early September. The CME HRC Steel – CME MW Busheling Fe Scrap spread, which is generally used as a gauge for steel mill profitability, is now approximately $480/st, up from about $320/st on September 1. Even though CME MW Busheling Fe Scrap prices have risen slightly, this improvement in steel mill profitability is because HRC steel has rallied more than busheling scrap. Since steel prices have significantly recently, mills should consider hedging production and raw material usage for late 2023 and early 2024. For most steel producers, this would consist of buying CME MW Busheling Scrap swaps and selling CME HRC swaps. Options are available for CME HRC, but they are relatively illiquid. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

11/1/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 10/17/2023: Important US Economic Data (AEGIS Reference) 09/28/2023: Aluminum Buyers Should Hedge Alongside Chinese Importers 09/08/2023: Despite Price Slump, Hedging is Still Feasible for Steel Producers 08/25/2023: Growing Secondary Aluminum Supply Could Further Weigh on Prices |

|||||

Notable News |

|||||

|

11/3/2023: Rainfall plays key role in capping Chinese aluminium capacity 11/2/2023: Panama lawmakers scrap plan to annul copper mine concession 11/1/2023: Nippon Steel lifts annual outlook on improved first-half margins 10/31/2023: Automakers oppose Cleveland-Cliffs push to buy U.S. Steel 10/31/2023: Chinese aluminium smelters to cut output as Yunnan enters dry season 10/30/2023: UAW reaches deal with GM, ending strike against Detroit automakers 10/30/2023: Glencore cuts 2023 nickel production guidance 10/28/2023: UAW in tentative deal to end labor strike with Stellantis but expands its strike at General Motors 10/28/2023: First Quantum's Panama unit says concerned over protests at port 10/27/2023: Panama orders halt to new mining projects as street protests grow |

|||||