|

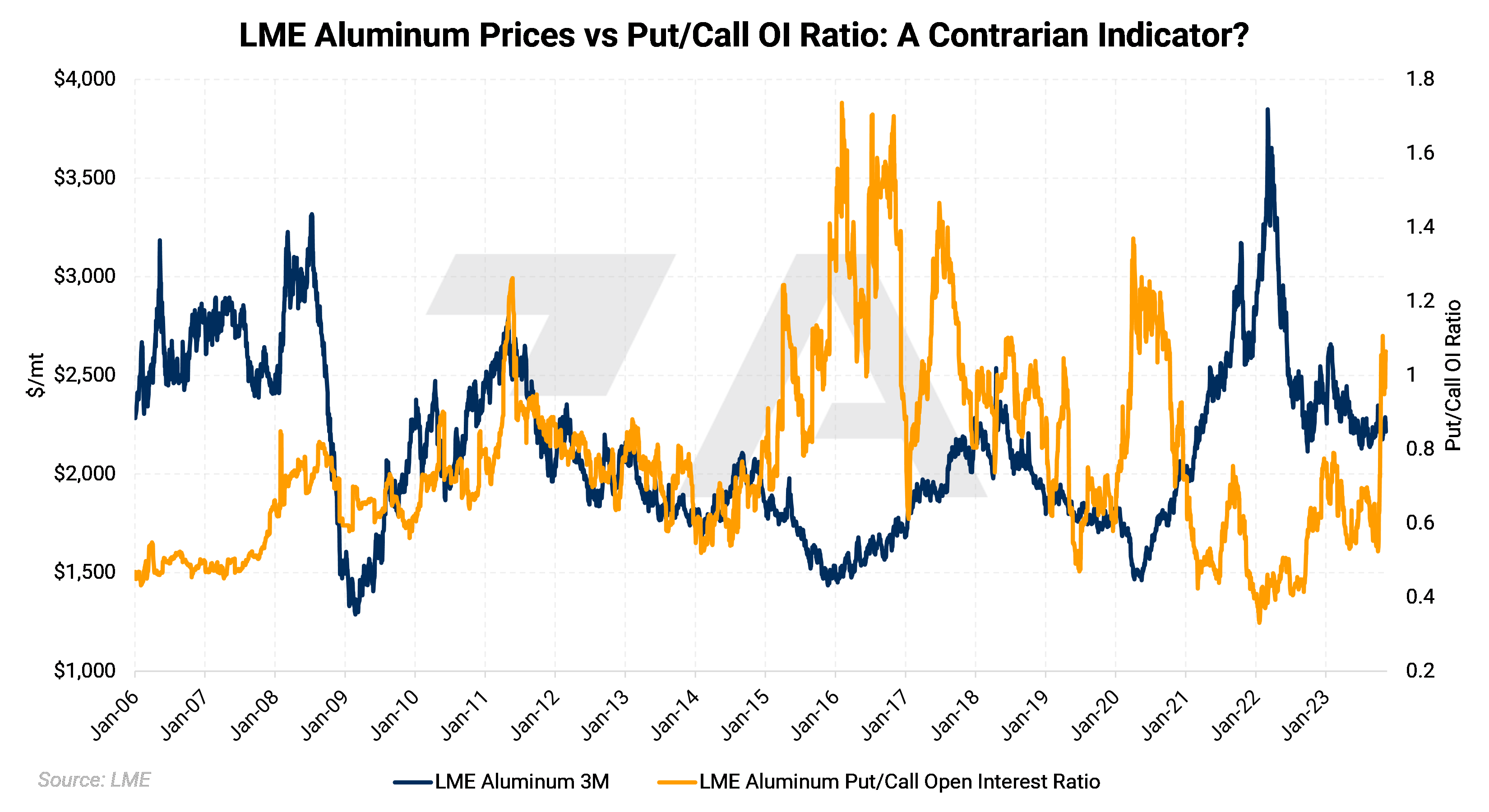

Aluminum The open interest in LME aluminum put options, a bearish position on the market, has surged in recent weeks. Open interest in call options, a bullish position on the market, has also increased, but not to the extent of put options. This has led to a surging Put/Call ratio, meaning that overall, market participants appear to be more bearish than bullish. AEGIS cautions that historically, this can be a contrarian indicator for LME aluminum prices. This means that despite bears piling into the market relative to bulls, prices rise rather than fall. Given that LME prices are still down about 6% on the year, this could be a good time for consumers to reevaluate or add to their hedging program. Please get in touch with us for more information on how to use LME aluminum options in your hedging program. |

|

After falling to a 15-year low in August, the spread between LME Aluminum and the 3M contracts has narrowed tremendously in the past three months. As of this writing, the LME aluminum cash is trading at a $10/mt discount to 3M, narrowing from a nearly $55/mt discount in mid-August. This is likely due to improving Chinese import demand while the government is trying to restrict or clamp down on both legal and illegal production. Although LME prices have rallied alongside that of SHFE, SHFE prices have rallied more than LME, leading to an improving import arbitrage. (Sources: SHFE, LME, China Customs, Bloomberg)

|

|

|

|

Despite poor spot demand, Novelis, one of the largest global aluminum product manufacturers, is bullish on overall aluminum demand for 2024, their CEO stated earlier this week. This growth will come from the automotive and aerospace industries and will help offset slumping demand from the real estate sector. “Things are helping us feel stable-to-strong from a growth standpoint going into 2024…. I think we’d see growth in 2024 across the majority of the business segments — the big ones — beverage packaging, automotive, and aerospace,” CEO Steve Fisher stated. (Source: Bloomberg) As for raw materials, the Aluminium Association of India, the country’s leading aluminum trade group, urges the government to quadruple the tax on aluminum scrap imports to 10%. According to Recycling Today, the current 2.5% tax has been a hot-debated issue for some time, putting secondary aluminum producers at a competitive advantage over primary producers. India is the largest market for US aluminum scrap, with 319,000 mt going there between January and August 2023, according to the USGS. (Source: Recycling Today) Global bauxite production, the ore from which aluminum is ultimately produced, could increase due to investment in Suriname. Companies from China, India, and the Middle East are contemplating investing billions in a bauxite mining project, which, according to one estimate, has approximately 324 million mt of ore reserves. Suriname, a small country in northeastern South America, has been mining bauxite for over 100 years, but compared to other major global players, current production is relatively small due to a lack of investment. (Source: eitisuriname.org, USGS, Reuters) |

|

|

Copper As of Friday’s close, copper prices are down approximately 1.7% this week while Chinese demand continues to disappoint. China’s official gauge of consumer prices, a key measure of the country’s inflation, fell into deflation last month. This signals that despite recent efforts, the government continues to struggle to create demand for raw materials like copper as well as consumer goods. As Bloomberg Economics suggested, this continuing lackluster demand could force the country’s central bank to do more stimulus measures. (Source: Bloomberg)

Even though the spot market for LME aluminum seems to be improving, the same cannot be said for LME copper. As of this writing, the LME cash contract is trading at an approximately $81/mt discount to the 3M contract, the largest discount since at least 1995. This is likely due to Chinese buyers pulling back on imports while refined production remains near record levels and continues to outpace demand. (Source: LME, China Customs, Bloomberg) |

|

|

|

|

|

Investment funds, purely speculators in metals markets, continue to cover their short position in LME copper. As of last Friday, these investment funds are net short approximately 6,700 contracts, down from a net short position of over 15,000 contracts two weeks ago. The prior position was their largest net short position since the early days of the pandemic. Given that the copper market is extremely price-sensitive to fund positioning, further short covering (if it occurs) could be bullish for LME copper prices. (Source: LME) |

|

|

|

|

|

Chile’s Codelco, the world's largest copper producer, has lowered its export premium for Chinese buyers to $89/mt (above LME) for 2024 shipments, down from $140/mt this year. This year’s premium was the highest since 2008 due to expectations that Chinese imports would surge while it recovers from the pandemic. These expectations fizzled, though, as copper imports slumped due to falling demand amid record Chinese production. Like Codelco’s premium, these factors have contributed to falling global copper prices in 2023. (Source: Bloomberg) Finally, Ivanhoe Mines, one of the largest “up-and-coming” global copper producers, stated that its Q3 profit quadrupled compared to last year due in part to growing production at its Kamoa-Kakula Copper operation in the Democratic Republic of Congo (DRC). Year-to-date production for the Kamoa-Kakula project stands at 301,336 mt, with a cash cost of $1.43/lb. “Kamoa-Kakula continues its industry-leading development and operating performance with copper production and costs remaining solidly within our annual guidance ranges … an increasing rarity in our business, where many of our peers are being plagued by cost over-runs and production shortfalls,” the company stated in its 3Q2023 earnings report. (Source: Ivanhoe Mines) |

|

Steel Spot HRC steel prices continue to rise. Argus’s weekly HRC Midwest price assessment, out Tuesday, has topped $900/st, up $50/st from last week. This most recent assessment is up about $240/st from the September lows. This recent uptick in spot prices could be due to mills holding back on supply. Steel capacity utilization, a measurement of how much available production capacity the industry is using, has fallen to 73.9%, the lowest level since January. Some analysts had also predicted the prices would rise due to the resolution of United Auto Workers strikes. (Source: Argus) Other major production regions are experiencing production and demand issues as well. Due to slumping manufacturing demand, European steelmakers are pulling back on production. According to Morgan Stanley, about 7% of the continent’s steel capacity has gone offline recently. At €630/mt, North Europe HRC Spot Steel prices have fallen by 33% since April, dramatically reducing profitability amid continued high prices for raw materials. (Sources: Bloomberg, Kallanish) As for raw materials, prices for zinc, a key raw material for Hot Dipped Galvanized (HDG) Steel production, jumped this week while supply issues continue to take shape. Russia’s Ozerny zinc mining and processing plant, set to start full-scale operations next year and is attached to the country’s zinc deposit, briefly caught on fire this week. This will likely delay the project’s expected start date. Meanwhile, zinc stocks at LME warehouses continue to fall as traders grab the scant inventories. On-Warrant inventories, which means the metal is available to trade, have fallen by nearly 2/3 since late August. (Source: LME) Finally, iron ore futures in Singapore, a key benchmark for Southeast Asian trade, reached their highest level since March after the Chinese government stated it would issue more debt “to address the local funding constraints.” This is the second such announcement in recent weeks. The country announced a one trillion yuan ($137 billion) bond issue in late October to aid several key industries such as disaster relief and construction. (Source: Bloomberg) |

|||||

|

|

|||||

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,215/mt, down $39/mt on the week. Aluminum prices were down this week. This has caused the futures forward curve to shift vertically lower by approximately $40/mt. It remains in a steep contango, meaning nearby prices are lower than forward prices. Aluminum consumers concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

Midwest Premium |

|||||

|

Prompt month CME MWP last traded/settled at 18.9¢/lb this week. The CME Midwest Premium market is now in a contango from the November ‘23 contract on forward. The CME Midwest Premium swap market is thinly traded, with no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please get in touch with AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,035.5/mt, down $140/mt on the week. Compared to last Friday, LME Copper's forward curve has fallen vertically by approximately $140/mt and remains in contango for the remainder of 2023 and throughout 2024 and 2025. The copper market has sufficient liquidity to use swaps and options. Depending on their risk tolerance, consumers might consider strategies that use only swaps, options, or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $17,257/mt, down $966/mt on the week. As prices were down this week, nickel’s forward curve has also shifted vertically lower by about $965/mt. It remains in a steep contango, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Depending upon your risk tolerance, consumers might consider strategies that use only swaps or options or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded/settled at $893/T, up $20/T on the week. Steel mill profit margins have improved dramatically since early September. The CME HRC Steel – CME MW Busheling Fe Scrap spread, which is generally used as a gauge for steel mill profitability, is now approximately $496/st, up from about $320/st on September 1. Even though CME MW Busheling Fe Scrap prices have risen slightly, this improvement in steel mill profitability is because HRC steel has rallied more than busheling scrap. Since steel prices have significantly recently, mills should consider hedging production and raw material usage for late 2023 and early 2024. For most steel producers, this would consist of buying CME MW Busheling Scrap swaps and selling CME HRC swaps. Options are available for CME HRC, but they are relatively illiquid. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

11/8/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 10/17/2023: Important US Economic Data (AEGIS Reference) 09/28/2023: Aluminum Buyers Should Hedge Alongside Chinese Importers 09/08/2023: Despite Price Slump, Hedging is Still Feasible for Steel Producers 08/25/2023: Growing Secondary Aluminum Supply Could Further Weigh on Prices |

|||||

Notable News |

|||||

|

11/10/2023: Indian aluminium producer Hindalco misses Q2 profit view on lower prices, demand 11/9/2023: India's NALCO posts Q2 profit rise on strong aluminium demand 11/7/2023: Suriname bauxite project may attract interest from Indian, Chinese companies 11/6/2023: India’s primary aluminum producers propose scrap import fee hike 11/2/2023: US light vehicle sales edge down in October |

|||||