|

Aluminum This week, most LME metals fell alongside other risk assets as market participants assessed the US Federal Reserve’s next interest rate adjustment. In a note from earlier this week, Citigroup stated that “demand for metals could weaken further as the effects of tight credit conditions work their way through major economies.” Citigroup also proclaimed, “the impact of Chinese policy stimulus is unlikely to completely offset the drag from developed markets in 2024.” (Source: Bloomberg) |

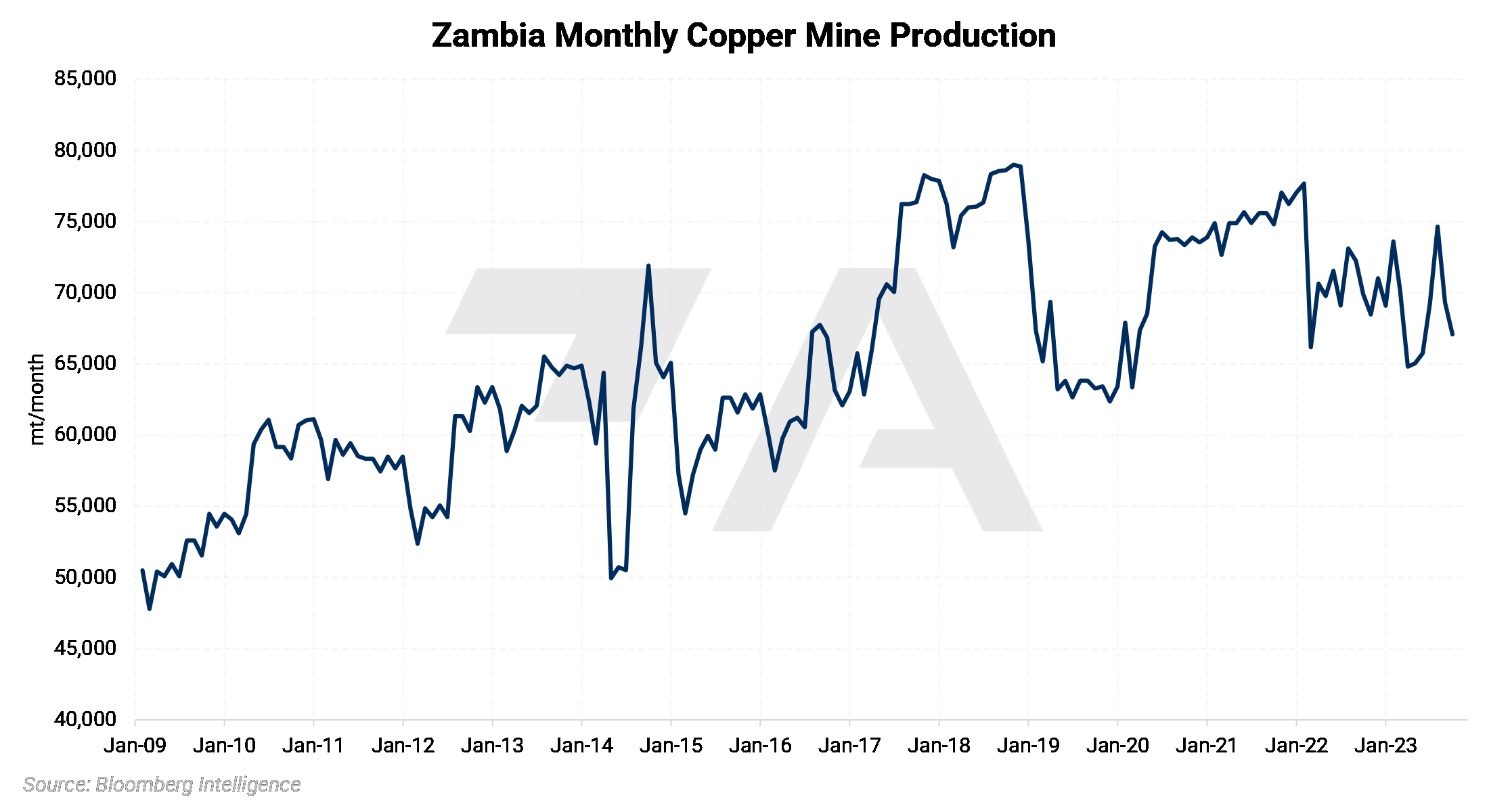

|

|

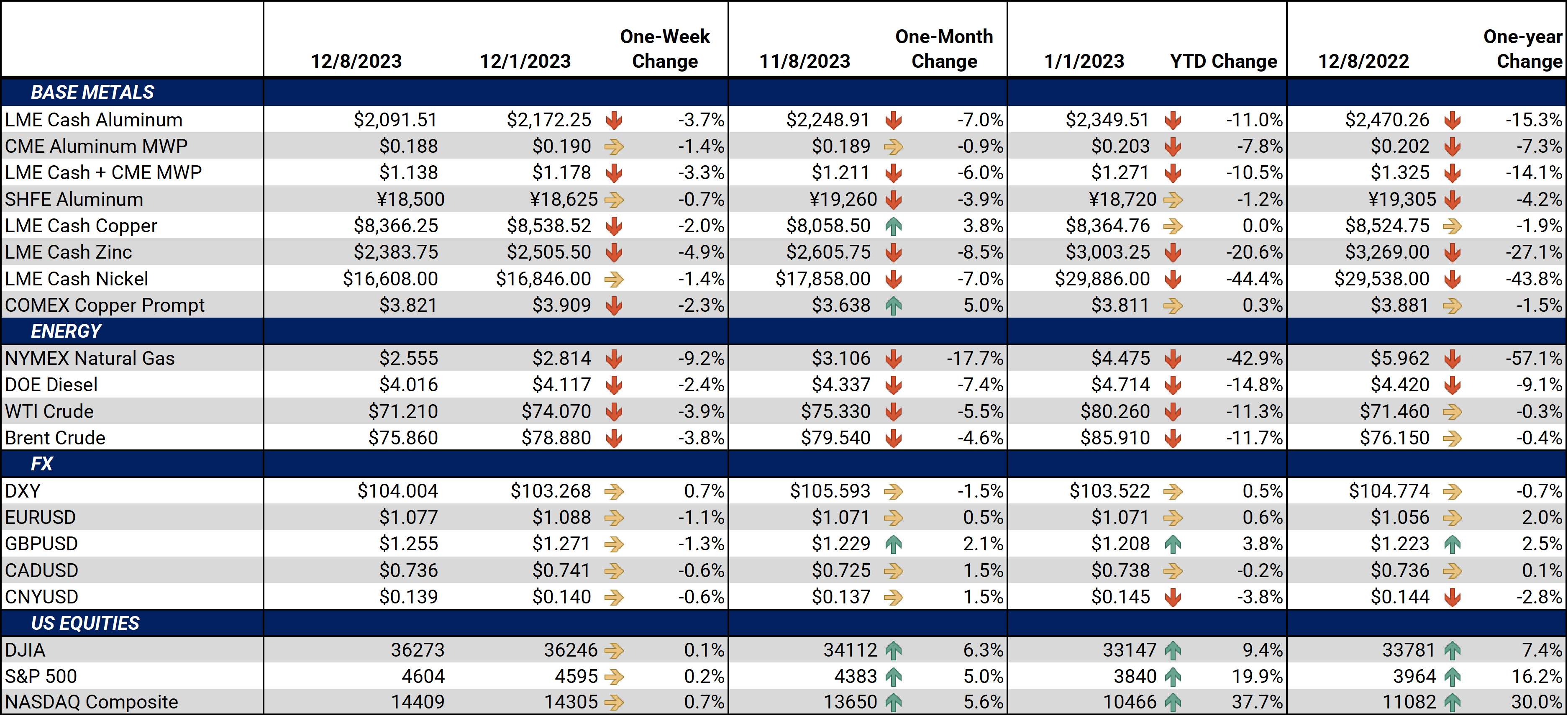

Similarly, Shanghai Metal Market (SMM) believes that aluminum will remain subdued, mainly because the market is entering the off-season for consumption. China's aluminum processing industry has been contracting for some time and will likely continue to contract into early 2024. A stellar import market, along with supply cuts in the country’s top production region (Yunnan province), remain supportive factors. (Source: SMM) Rusal, which is Russia’s top aluminum producer and a major global supplier, exported 2.8 million mt through November, down about 6% compared to last year. Meanwhile, domestic sales jumped by 23% to 526,000 mt. Alumina imports were up a meager 3.3% to 4.7 million mt, despite new relationships with China’s top alumina suppliers. (Source: Bloomberg) Rio Tinto, one of the world’s largest miners and metals producers, will increase its aluminum production in 2024, the company announced earlier this week. Next year’s production will be approximately 3.2 to 3.4 million mt, up from 3.1 to 3.3 million this year. Meanwhile, the production of bauxite, the ore from which aluminum is ultimately produced, will likely range from 53 and 56 million mt in 2024, down from 54 to 57 million mt this year. (Source: Bloomberg) Finally, traders continue to pull aluminum from LME warehouses. As of this writing, 453,325 mt of primary aluminum sits in LME warehouses, down over 32,000 mt since mid-November alone. Most of this recent drawdown has occurred in South Korean warehouses, which are known repositories of Russian-origin aluminum. The volume in these South Korea-based warehouses represents nearly 47% of the total primary aluminum inventories in the LME system. (Source: Reuters, LME) |

|

|

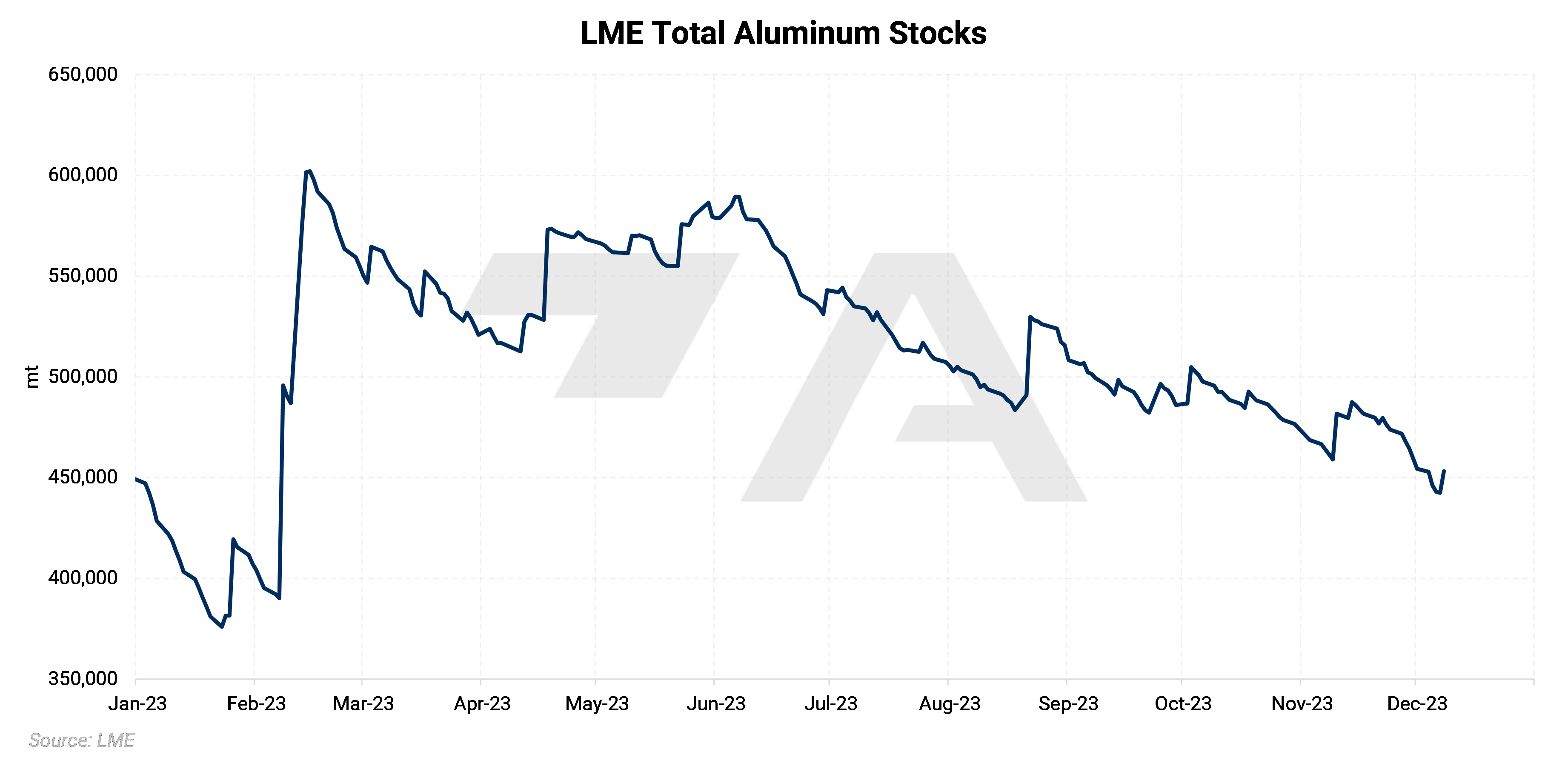

Copper Like aluminum, traders are pulling copper from LME warehouses. As of this morning, canceled warrants, meaning the metal is set for delivery, reached 49,325 mt, the highest level since early July. This could be directly tied to supply concerns that have sprung up in recent weeks. Last week, the Panamanian government closed First Quantum’s Cobre Panama copper mine, essentially shutting off nearly 1.5% of the globe’s annual output. (Sources: LME, Reuters) |

|

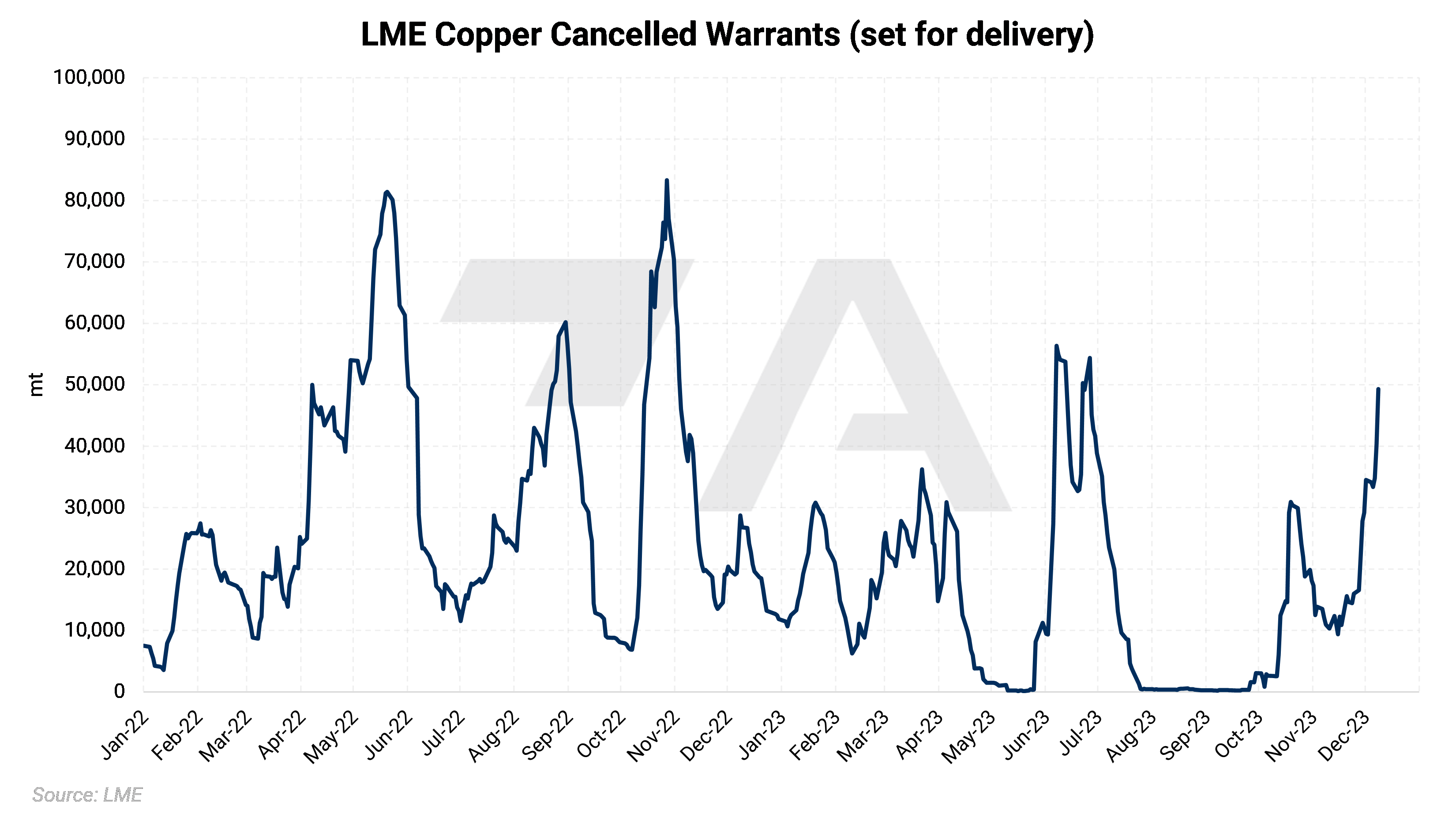

| Beleaguered copper miner First Quantum Minerals is trying to fast-track its Zambia-based project, the company announced yesterday. The new project, in which First Quantum will partner with Zambia’s Mimosa Resources, will start in 2026 and aims to slowly ramp up production to 30,000 mt/year by 2030, according to a joint statement. Zambia is currently the second-largest copper mining country in Africa. (Source: Reuters) |

|

|

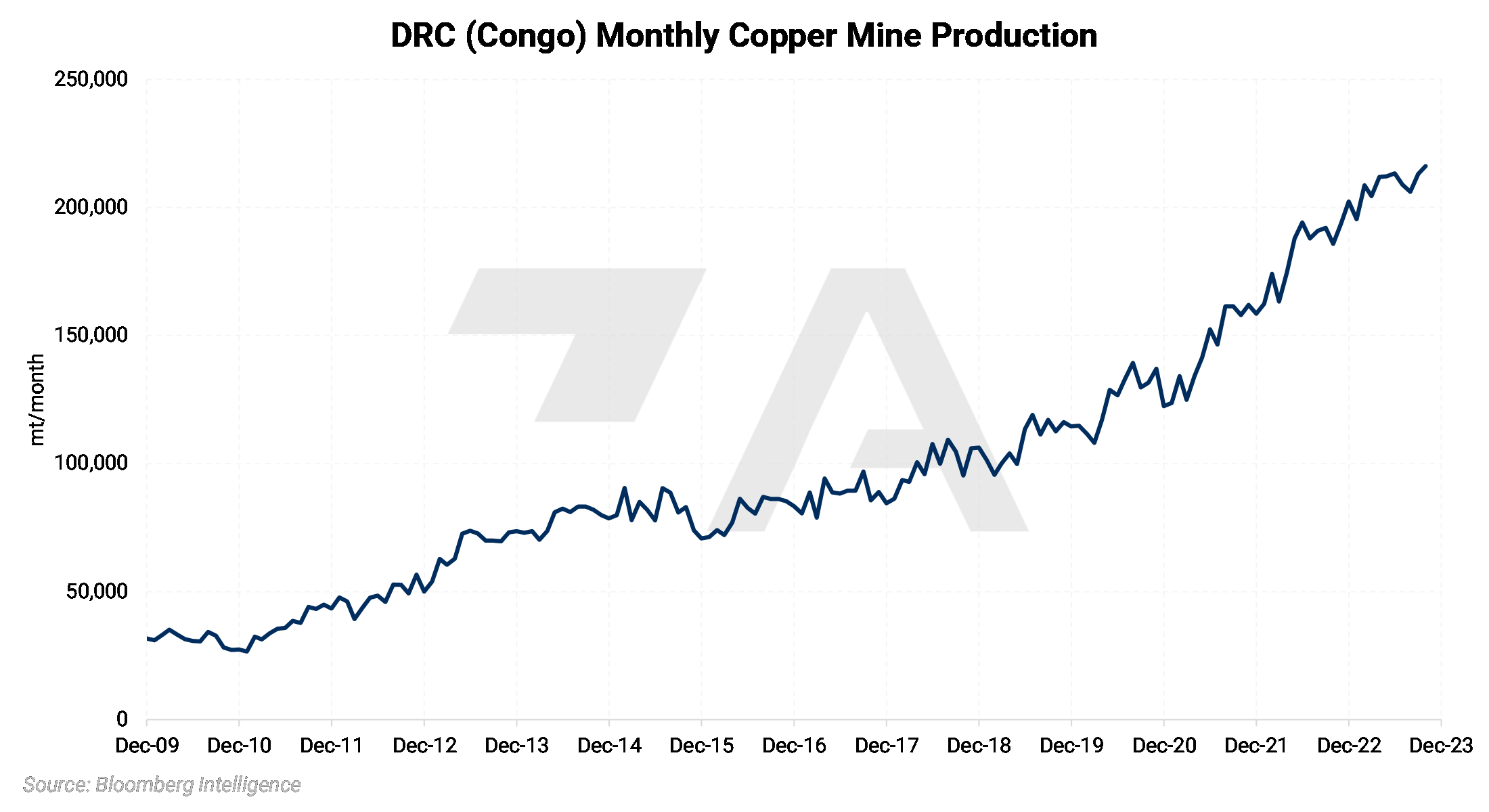

Zambia’s northern neighbor, the Democratic Republic of the Congo (DRC), which is already one of the world’s largest copper producers, could see further gains in 2024. Ivanhoe Mines, a Canadian copper mine with significant assets in the DRC, aims to quadruple its exploration budget to $90 million to further develop its most-promising DRC-based projects, the company announced this week. These funds will come from strategic investors, institutions, and sovereign wealth funds, Ivanhoe stated. “We are really accelerating our exploration drilling into 2024," Ivanhoe Mines' Founder and Executive Co-Chairman Robert Friedland proclaimed. (Source: Bloomberg) |

|

|

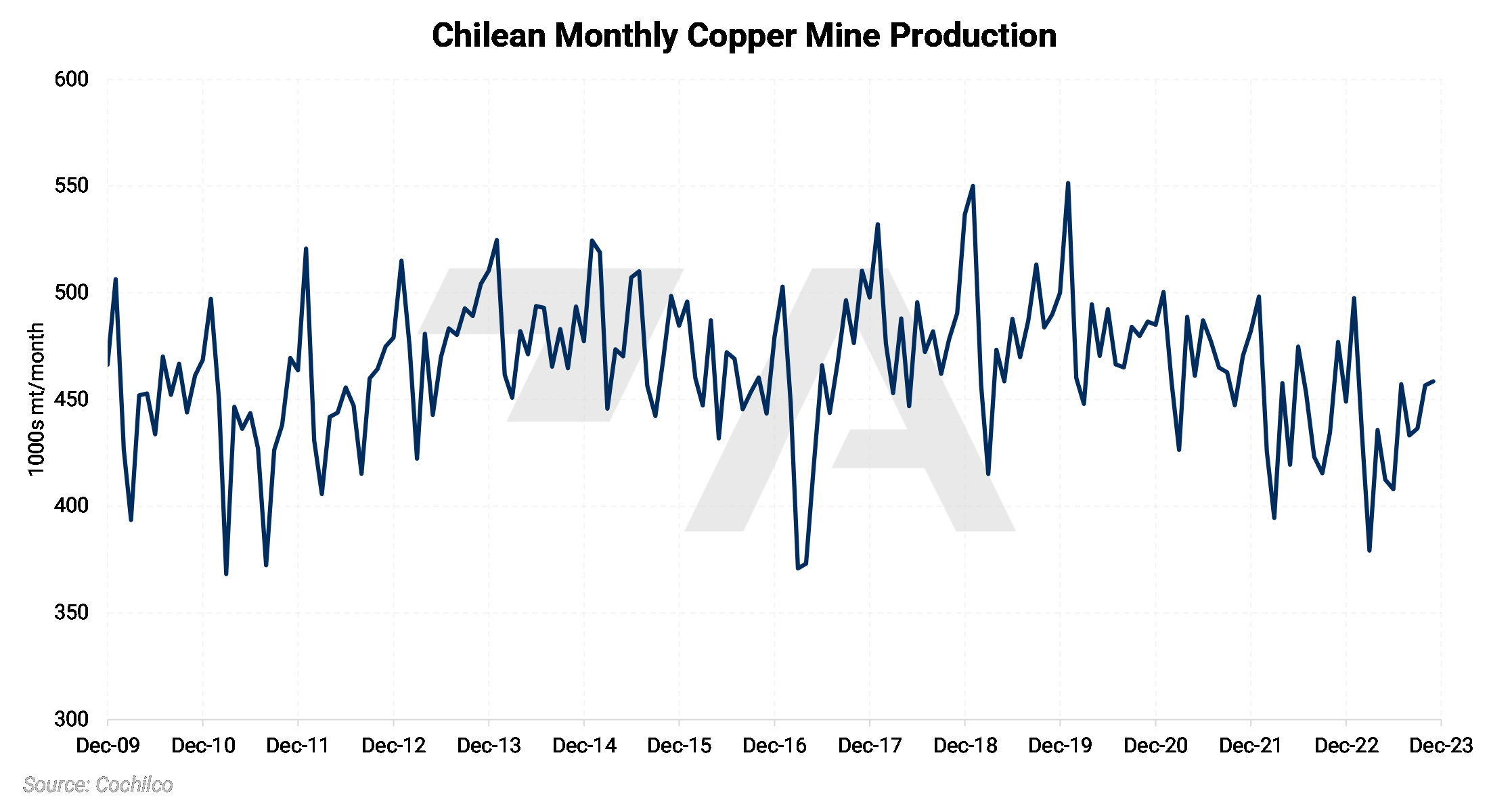

Chile aims to increase its copper production by 1.04 million mt by 2026, its finance minister announced on Wednesday. Based on last year’s production figures, this would be an increase of nearly 20%. The country’s copper agency, Codelco, is far less optimistic, predicting that production will increase by 1% to 5.4 million mt this year and by 4.3% to 5.6 million in 2024. In 2022, Chile produced 5.322 million mt. Through September, the country has produced 3.827 million mt this year. (Sources: Cochilco, Bloomberg) |

|

|

Steel American steel producers have been disciplined about holding down production. As of last Saturday, capacity utilization, which is a measurement of how much available production capacity the industry is using, stood at 74.1%, down from 78.1% in late June. Although capacity utilization has increased slightly since mid-November, it is still hovering near 11-month lows. (Source: American Iron and Steel Institute) |

|

|

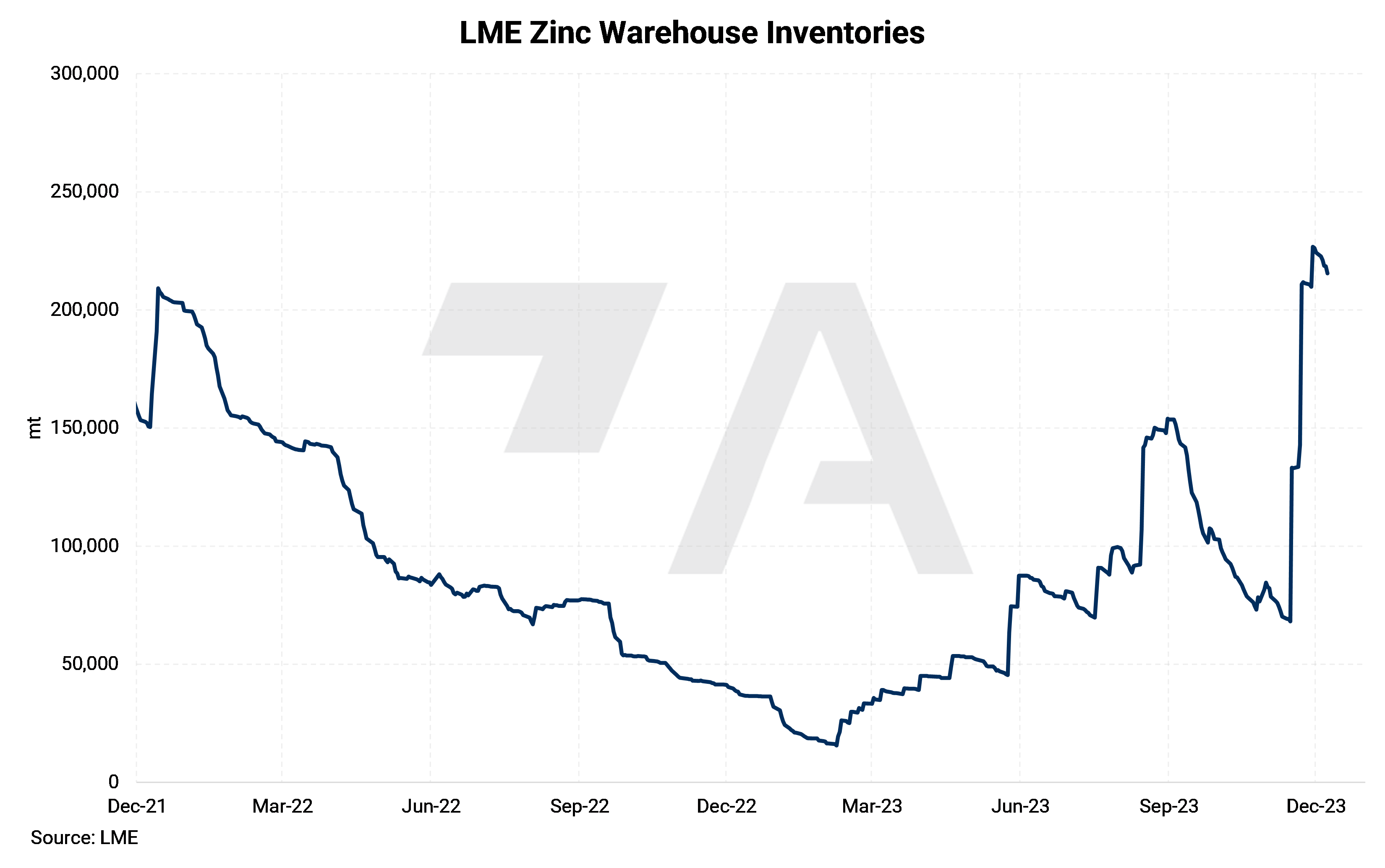

| Unlike copper and aluminum, stocks for zinc, a key raw material for hot-dipped galvanized (HDG) steel production, have soared in recent weeks. At 215,450 mt, total stocks are at nearly the highest level since September 2021, with approximately 147,000 mt being delivered into LME warehouses since mid-November alone. This is likely because the zinc market remains oversupplied amid subdued demand. (Sources: LME, Reuters) |

|

|

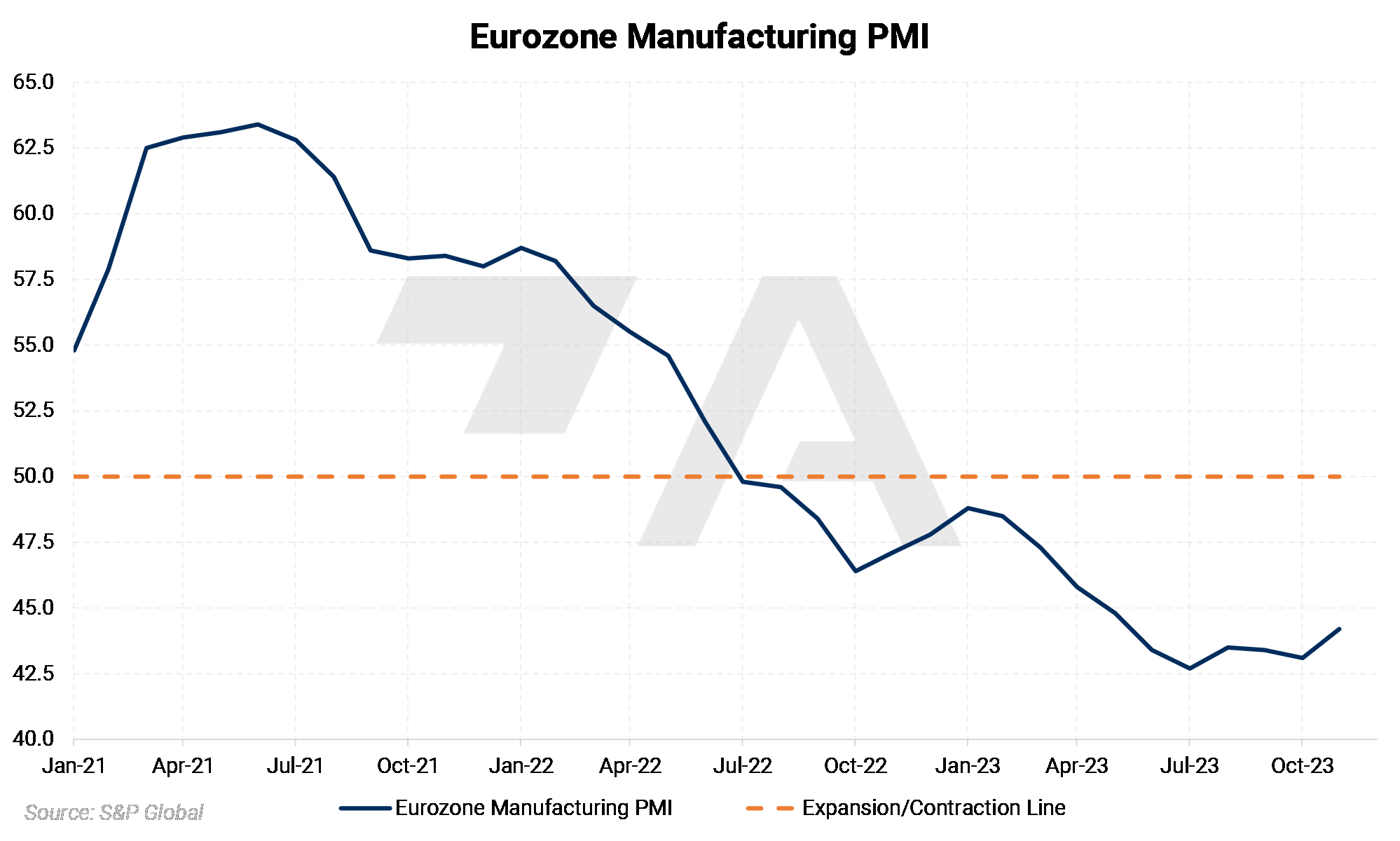

The US ferrous scrap market should improve in early 2024, according to researcher Kallanish. This is mainly due to an expected uptick in export demand to Turkey, the US’s top ferrous scrap buyer. Some supply constraints have also crept into the market, leading to higher freight costs, which are being passed along in the form of higher scrap prices, Kallanish also suggested. (Source: Bloomberg) Vale, one of the world's iron ore producers, estimates its production will total 310 to 320 million mt next year. This is essentially unchanged compared to 2023 production, which will likely total 315 million mt, according to company estimates. “We’ll bring our volumes exactly where we can put them… We’ll not be the ones to unbalance the market,” CEO Eduardo Bartolomeo stated yesterday. Most of Vale’s iron ore goes to China, the world’s largest steel producer. (Source: Bloomberg) Finally, the Eurozone’s manufacturing sector, a major source of steel demand, continues to slump. S&P Global’s Eurozone Manufacturing PMI, a key gauge of activity for the continent’s manufacturing sector, improved slightly last month to 44.2 but remains in contraction. Based on the most recent reading, the sector has been contracting for 17 consecutive months. A reading below 50 suggests that the sector is contracting, while a reading above 50 suggests expansion. (Source: Argus, S&P Global) |

|

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,134/mt, down $75/mt on the week. Aluminum prices were down this week. This has caused the futures forward curve to shift vertically lower by approximately $80/mt. It remains in a steep contango, meaning nearby prices are lower than forward prices. Aluminum consumers concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

Midwest Premium |

|||||

|

Prompt month CME MWP last traded/settled at 18.8¢/lb this week. The CME Midwest Premium market is now in a contango from the December ‘23 contract on forward. The CME Midwest Premium swap market is thinly traded, with no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please get in touch with AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,448.5/mt, down $162/mt on the week. Compared to last Friday, LME Copper's forward curve has fallen vertically by approximately $160/mt and remains in contango for the remainder of 2023 and throughout 2024 and 2025. The copper market has sufficient liquidity to use swaps and options. Depending on their risk tolerance, consumers might consider strategies that use only swaps, options, or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $16,802/mt, down $236/mt on the week. As prices were down this week, nickel’s forward curve has also shifted vertically lower by about $240/mt. It remains in a steep contango, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Depending upon your risk tolerance, consumers might consider strategies that use only swaps or options or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded/settled at $1,068/T, up $29/T on the week. Steel mill profit margins have improved dramatically in Q3 and Q4. The CME HRC Steel – CME MW Busheling Fe Scrap spread, which is generally used as a gauge for steel mill profitability, is now approximately $600/st, up from about $320/st on September 1. This is mainly due to prompt month CME HRC steel futures rallying alongside prices in the physical market. Since steel prices have increased significantly recently, mills should consider hedging production and raw material usage for late 2023 and early 2024. For most steel producers, this would consist of buying CME MW Busheling Scrap swaps and selling CME HRC swaps. Options are available for CME HRC, but they are relatively illiquid. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

12/8/2023: Aluminum and Copper Markets Diverge but Hedging Opportunities Persist for End-Users 12/06/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 12/06/2023: Important US Economic Data (AEGIS Reference) 11/17/2023: Aluminum and Copper End-Users Should Hedge As Inflation Eases 09/28/2023: Aluminum Buyers Should Hedge Alongside Chinese Importers |

|||||

Notable News |

|||||

|

12/8/2023: Aluminium group calls for EU to go much further on Russian bans 12/5/2023: Rio Tinto to fully move towards renewable diesel at Kennecott 12/4/2023: First Quantum agrees with Zambian firm to fast-track copper project 12/4/2023: Insight: Western start-ups seek to break China's grip on rare earths refining |

|||||