|

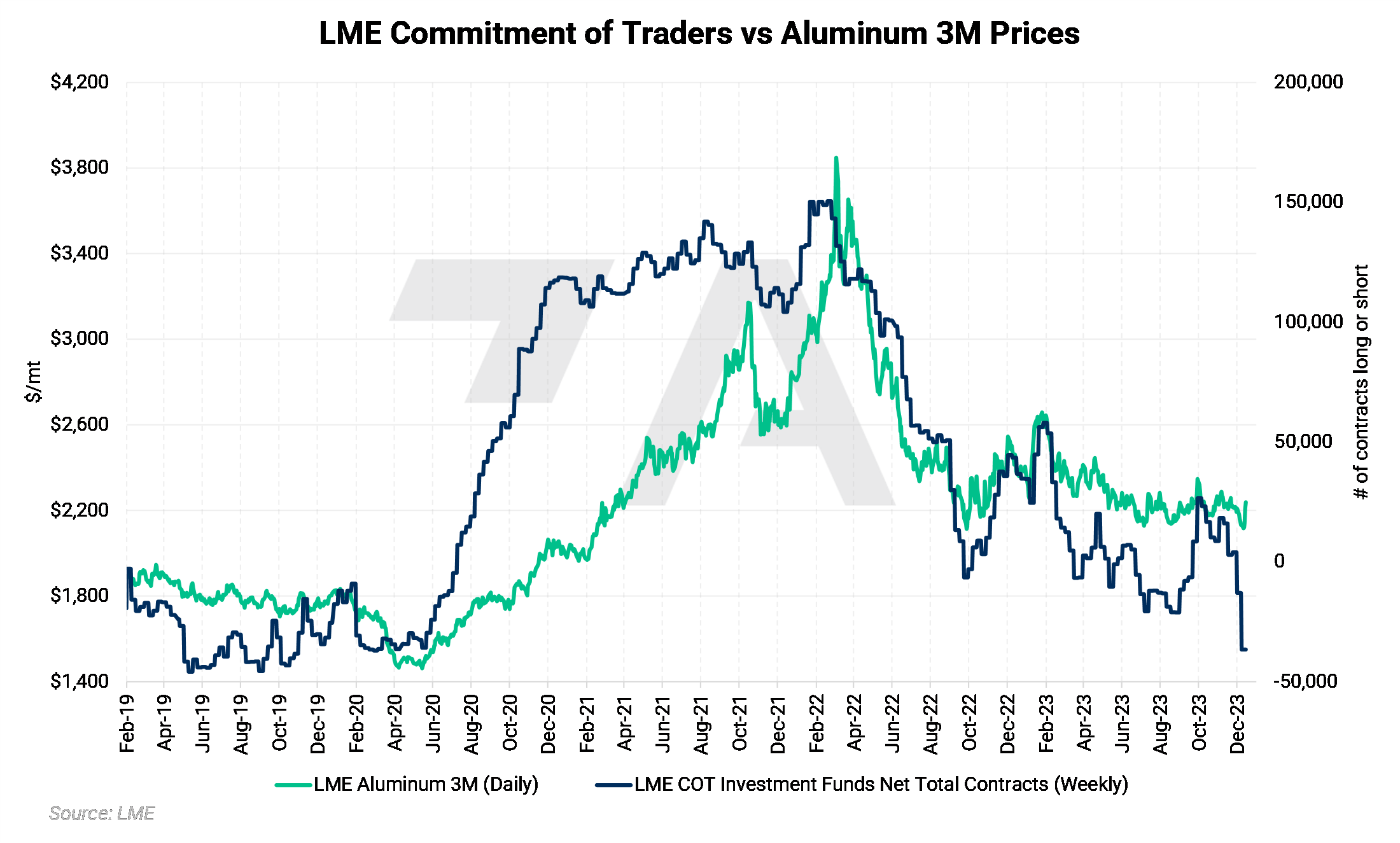

Aluminum Investment funds, purely speculators in metals markets, have dramatically increased their short position in LME aluminum. As of last Friday, these funds are now net short over 35,000 contracts, making this their largest short position since the early days of the pandemic. The aluminum market is extremely price-sensitive to actions by investment funds, which is likely why aluminum prices fell in early December. (Source: LME) |

|

|

|

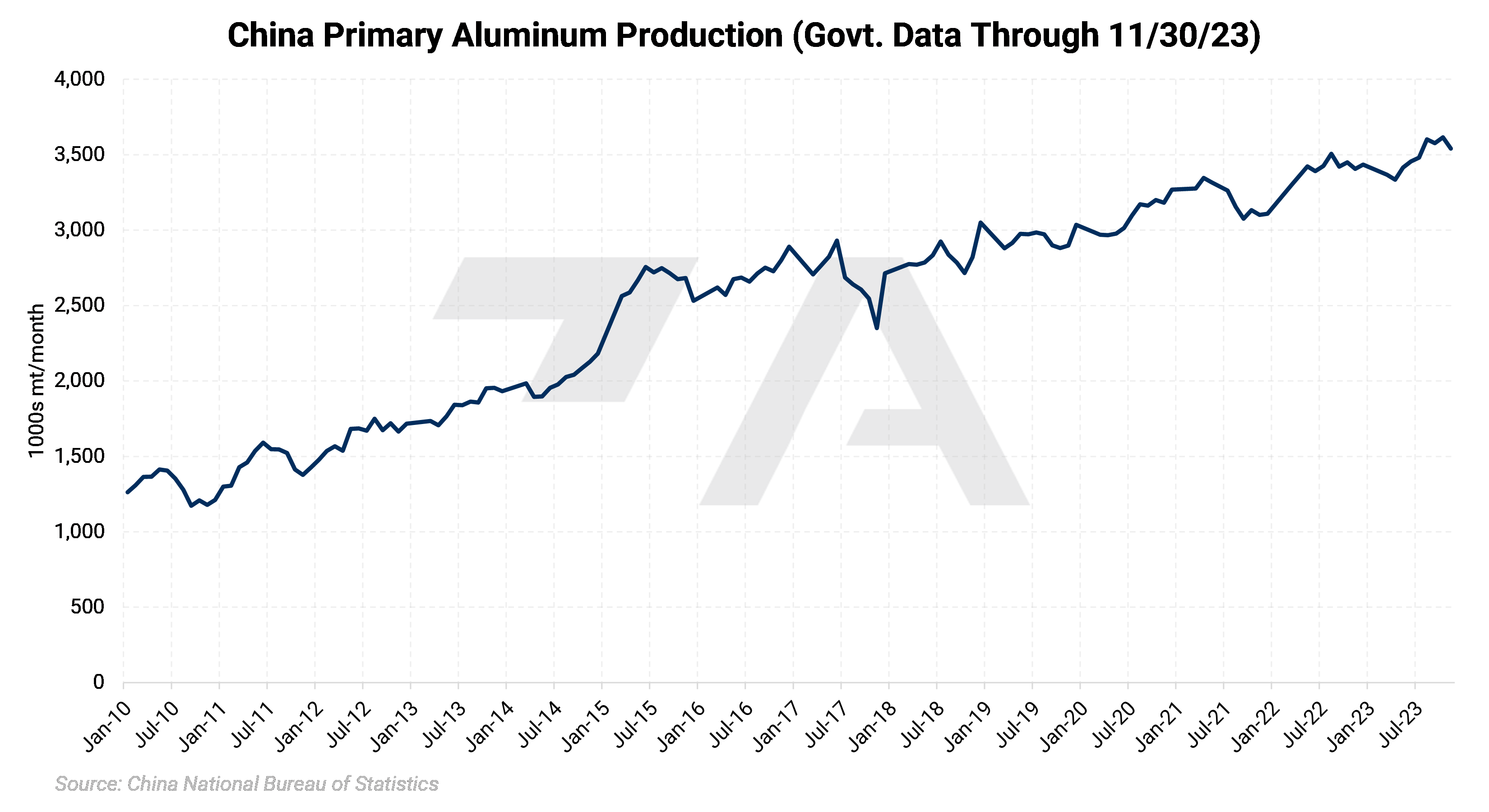

Government data released Friday morning showed that Chinese primary aluminum production ticked lower last month. The country’s primary aluminum smelters produced 3.54 million mt in November, down from 3.616 million mt in October. The October volume was a record, so last month’s production was barely off an all-time high. (Source: Bloomberg) |

|

|

That said, Chinese aluminum production will be up slightly this month to 3.56 million mt, bringing the yearly total to 41.5 million mt, according to estimates by Shanghai Metal Market. Both figures would be records. This mainly depends on power issues in the southwest, specifically Yunnan province, the country’s top production region. Through November, China has produced 37.946 million mt of primary aluminum this year, up 3.6% compared to last year. (Source: Shanghai Metal Market) European Aluminum, the continent’s top aluminum association, is calling for stronger bans on Russian aluminum. Currently, only a small portion of Russian-made aluminum products are banned, including wire, tubes, and pipes. In a letter to the EU’s governing body, European Aluminum stated, "We regret the fact that the vast majority of Russian aluminum exports to the EU (more than 85% of the total), in particular primary metal, look set to remain outside of the scope of the measures." (Source: Reuters) Alcoa will soon meet with the Spanish government to discuss the future of the San Ciprian aluminum smelter and alumina refinery, the company stated on Monday. The smelter was shuttered in early 2022, and the alumina refinery has been operating at 50% since then, but “the economics for both the smelter and the refinery have continued to worsen," according to Alcoa. The smelter was scheduled to restart in phases in January 2024 per an agreement with the Spanish government. (Source: Bloomberg) |

|

Copper Copper prices rallied in the latter half of the week after the US Federal Reserve signaled that the cycle of interest rate hikes could be over. Most Federal Reserve governors now expect three interest rate cuts in 2024, for a total of 0.75%. This amplified some analysts' expectations of copper demand and prices for next year. In a note earlier this morning, Morgan Stanley stated, “Copper remains our preferred base metal…. Copper supply disruptions are rising rapidly, driving an even tighter balance for 2024.” (Source: Bloomberg) Copper prices also rallied due to actions by the Chinese government. Late Thursday, Chinese authorities relaxed home-buying rules in Beijing and Shanghai. This was followed on Friday morning with new stimulus measures from China’s central bank, the People’s Bank of China. Both measures are aimed at boosting the country’s sagging real-estate sector. (Source: Bloomberg) As for global copper production, in a final blow to First Quantum’s Panamanian copper operation, last Friday, the government ordered that the Cobre Panama “end extraction, processing, refining, transportation, export, and sales activities," effectively shutting down the operation, according to a statement from First Quantum. The company also stated that it must secure the facility and take measures to stop environmental damage. This closure removes 1.5% of global production from the marketplace. (Source: Reuters, USGS) Other major copper producers are struggling as well. Anglo American, one the world’s largest copper miners, plans to drastically cut its copper production due to soaring costs as well as operational and logistical issues, the company announced late last week. Production in 2024 will likely total 730,000 to 790,000 mt, down from their prior estimate of 1 million mt. Production will also be down in 2025. “Given continuing elevated macro volatility, we are being deliberate in reducing our costs and prioritizing our capital to drive more profitable production on a sustainable basis,” the company stated. (Source: Bloomberg) Not all recent copper news has been bullish, though. Zambian copper production will soon increase, albeit from an unusual source. Jubilee Metals Group has signed an agreement with UAE-based International Resources Holdings to develop waste from a state copper mine. This project has access to 350 million mt of copper waste and will likely yield "in excess of 20,000 tons per annum of copper at a cost of below $4,000 per ton of copper." (Source: Reuters) |

|

Steel US Steel, which remains a potential takeover target for several competitors, has received multiple offers of $40/share or higher, the company told CNBC this week. Cleveland Cliffs has reportedly upped its from $35/share to over $40/share in cash and stock. As CNBC suggested, the sales process appears to be coming to an end. (Source: CNBC) Nucor, one of the largest American steel producers, stated that its 4th quarter earnings will be down due to lower production and sliding steel prices. According to their press release from Thursday, they expect to be lower at sheet and plate mills. They also expect earnings from raw materials to be down due to lower prices and plant outages. (Source: Bloomberg) As for raw materials, iron ore prices, the key raw material for most of China’s steel production, have surged to a 10-month high while steelmakers rebuild inventories. The country’s real estate sector will soon enter a seasonal lull, but demand is expected to increase in the spring due to economic stimulus measures. “Market fundamentals are actually good, and mills had begun to restock imported ores in anticipation of post-Lunar New Year demand,” Wei Ying, an analyst at China Industrial Futures Co, reiterated late last week. (Source: Bloomberg) Last Friday, Anglo American Plc, one of the largest iron ore producers in the world, stated that it would cut South African production over the next three years due to continual problems with the country’s rail system. South Africa’s port and rail operator, Transnet, has struggled with cable theft, locomotive shortages, and infrastructure vandalism. Like Anglo American, South Africa is one of the world’s largest and most important iron ore producers. (Source: Reuters) Finally, European production of zinc, a key raw material for galvanized steel production, could jump next year. Boliden, a Swedish miner and metals producer, will resume negotiations with employees at its Ireland-based zinc operation next month, with an aim to restart production in 2Q2024. The potential restart is also dependent upon market conditions. The mine, known as “Tara,” is Europe’s largest zinc mine and produced 198,000 mt of concentrate in 2022. (Source: Reuters) |

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,247.5/mt, up $113.5/mt on the week. Aluminum prices were up this week. This has caused the futures forward curve to shift vertically higher by approximately $115/mt. It remains in a steep contango, meaning nearby prices are lower than forward prices. Aluminum consumers concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

Midwest Premium |

|||||

|

Prompt month CME MWP last traded/settled at 18.8¢/lb this week. The CME Midwest Premium market is now in a contango from the December ‘23 contract on forward. The CME Midwest Premium swap market is thinly traded, with no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please get in touch with AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,549/mt, up $100.5/mt on the week. Compared to last Friday, LME Copper's forward curve has risen vertically by approximately $100/mt and remains in contango for the remainder of 2023 and throughout 2024 and 2025. The copper market has sufficient liquidity to use swaps and options. Depending on their risk tolerance, consumers might consider strategies that use only swaps, options, or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $17,150/mt, up $344/mt on the week. As prices were up this week, nickel’s forward curve has also shifted vertically higher by about $340/mt. It remains in a steep contango, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Depending upon your risk tolerance, consumers might consider strategies that use only swaps or options or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded/settled at $1,068/T, down $2/T on the week. Steel mill profit margins have improved dramatically in Q3 and Q4. The CME HRC Steel – CME MW Busheling Fe Scrap spread, which is generally used as a gauge for steel mill profitability, is now approximately $570/st, up from about $320/st on September 1. This is mainly due to prompt month CME HRC steel futures rallying alongside prices in the physical market. Since steel prices have increased significantly recently, mills should consider hedging production and raw material usage for late 2023 and early 2024. For most steel producers, this would consist of buying CME MW Busheling Scrap swaps and selling CME HRC swaps. Options are available for CME HRC, but they are relatively illiquid. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

12/13/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 12/8/2023: Aluminum and Copper Markets Diverge but Hedging Opportunities Persist for End-Users 12/06/2023: Important US Economic Data (AEGIS Reference) 11/17/2023: Aluminum and Copper End-Users Should Hedge As Inflation Eases |

|||||

Notable News |

|||||

|

12/14/2023: US Treasury unveils rules for clean energy manufacturing subsidy 12/14/2023: EU risks losing ground in EVs without strong industry strategy - ACEA 12/14/2023: Billionaire-backed KoBold Metals widens lithium hunt across four continents 12/13/2023: U.S. Steel received multiple bids in excess of $40 a share, sources say 12/12/2023: Jubilee Metals forms Zambian copper recovery venture with UAE's IRH 12/11/2023: China 2023 steel output set to rise despite property woes 12/8/2023: Anglo's S.African iron ore unit cuts production as rail woes persist 12/8/2023: Panama gov't orders First Quantum to end mining operations, country unit says |

|||||